Introduction to Feasibility Study Examples

When companies want to start a new project or activity, they need to think and plan before they can begin. They want to ensure the new project or activity will be successful and not waste their time, money, or resources. To do this, they can use a “feasibility study.” A feasibility study helps companies determine their idea’s risks, benefits, and costs. Then they can decide if it’s a good idea to go ahead with it or not. Feasibility study examples include evaluating new business opportunities to see how much return the business may generate.

A feasibility study analyzes a proposed project or idea to determine if it is viable, practical, and economically feasible. It involves examining the project’s technical, operational, financial, and legal aspects.

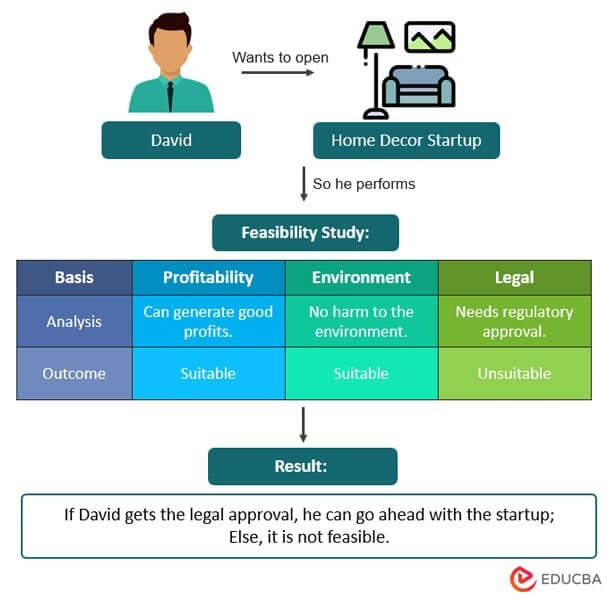

For example, David wants to launch a new home decor business. So, he evaluates factors like potential profitability, effect on the environment, legal requirements, etc. It is his feasibility study, and based on the findings, he can decide whether or not to move forward with the project.

Feasibility Study Examples (With Excel Template)

There are three types of feasibility studies, namely, economic feasibility, technical feasibility, and operational feasibility. We will discuss each of these with suitable feasibility study examples below:

1. Economic Feasibility

Economic feasibility determines if a project can make enough money to be worthwhile. It looks at the project’s costs and compares them to potential profits to see if they are suitable investments. It’s about figuring out whether a project will succeed financially.

Economic Feasibility Study Example #1: Opening of a New Restaurant

A restaurant chain owner, Oliver, wants to open the restaurant in a new location, a popular area with a lot of foot traffic. As he needs to know whether the property would give better returns on investment, he determines the economic feasibility of the venture. We have the following data to conclude the feasibility study:

|

Information |

Value |

| The daily customer estimate is |

150 |

| The average bill each customer will pay is |

$40 |

| The monthly rent for the property is |

$8,500 |

| The additional monthly expenses (utilities, insurance, and maintenance) are |

$3,500 |

| The estimated cost of obtaining permits and licenses is |

$5,000 |

| The total investment required for equipment and supplies (which will last for 5 years) is |

$125,000 |

| The owner plans to hire | 7 employees with an average monthly salary of $15,000, making the total monthly staffing cost $105,000 |

| The cost of goods sold (COGS) for each dish will be | 30% of the menu price, which is $12 per customer |

| The budget allocated for marketing and advertising is |

$25,000 |

Solution:

Given,

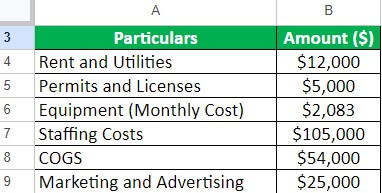

Rent and Utilities = $8,500 + $3,500 = $12,000

Permits and Licenses = $5,000

Equipment (Monthly Cost) = $125,000/ (5 years x 12 months) = $2,083

Staffing = 7 x $15,000 = $105,000

COGS = $12 x 150 customers x 30 days = $54,000

Marketing and Advertising = $25,000

Average Bill per Customer = $40

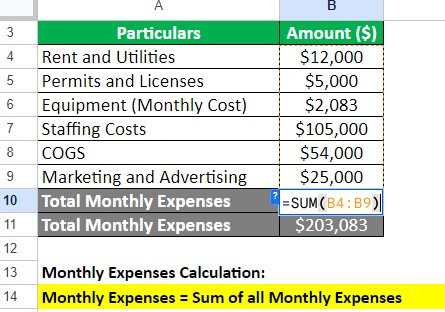

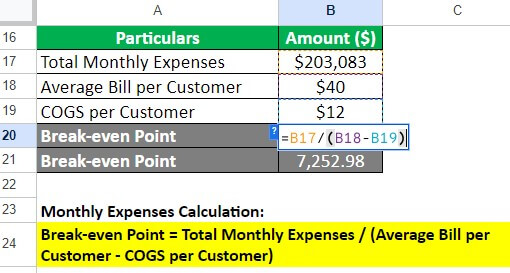

Step #1: Let us calculate the monthly expenses for the new business.

= $12,000 + $5,000 + $2,083 + $105,000 + $54,000 + $25,000 = $203,083

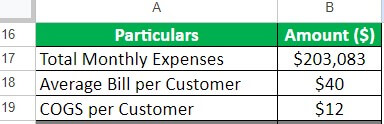

Step #2: Calculate the Break-even point (daily required customer count):

The owner must calculate the break-even point to determine the minimum revenue needed to cover these expenses. It is the point at which the revenue equals the total costs. We will determine the total number of customers the restaurant must bring in monthly to earn enough revenue.

= $203,083 / ($40 – $12) = 7,252.98 customers per month or 242 customers per day.

Result Analysis:

Assuming the restaurant is open 30 days per month, the owner must attract 242 customers daily to break even.

If the owner estimates they can attract at least this number of customers, the project is economically feasible. However, if the owner estimates they can attract 150 customers daily (less than the break-even point), he may need to adjust the business plan to improve its economic feasibility.

Feasibility Study Example #2: Solar Electricity Product

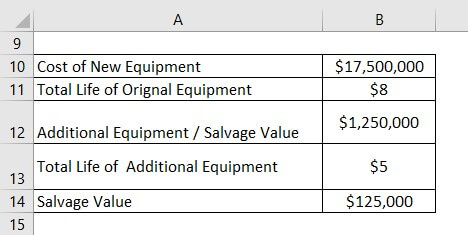

Weasley Ltd wants to invest in a new portable solar electricity product with a life of 8 years. Mr. Smith, the project manager, has to perform an economic feasibility study and submit a report. Mr. Smith collects the following data about the project to conduct the feasibility analysis:-

|

Information |

Value |

| The State Government provides a tax-free subsidy on initial capital investment to promote solar energy: | $1.25 million |

| Original equipment: | Cost = $17.5 million Lifetime = 8 years Salvage Value = 0 |

| Additional equipment: | Cost = $1.25 million Lifetime = 5 years Salvage Value = $125,000 |

| The working capital requirement at the initiation of the project: | $2 million |

| Expected Sales price: | $120 per unit |

| Variable expenses: | 60% of sales revenue |

| The fixed operating cost: | 1.8 million per year |

| Subjected to a tax rate: | 30% |

| Depreciation Method: | Straight line |

| The loss of any year will be set- off from the profits of the subsequent two years. | Allowed to adjust losses for 2 years for tax purposes. |

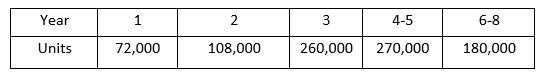

The estimated sales volume over the 8 years is:-

Mr. Smith calculates the project’s net present value (NPV) by discounting the cash flows at 12%. If NPV is positive, then the project is feasible, and the company can consider undertaking the project.

Solution:

We will use the concept of the time value of money to solve this example. It suggests that the amount available now is worth more than that amount of money will be in the future. So, to calculate the NPV of this project, we must consider the time value of money. We will first estimate the project’s future cash inflows and outflows. Then we will use a discount rate to return those cash flows to their present value.

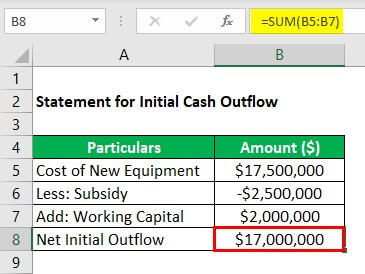

Step #1: Calculate the initial cash outflow

The statement of Initial Cash Outflow is given below:

= $17,500,000 + $2,000,000 – $2,500,000 = $17,000,000

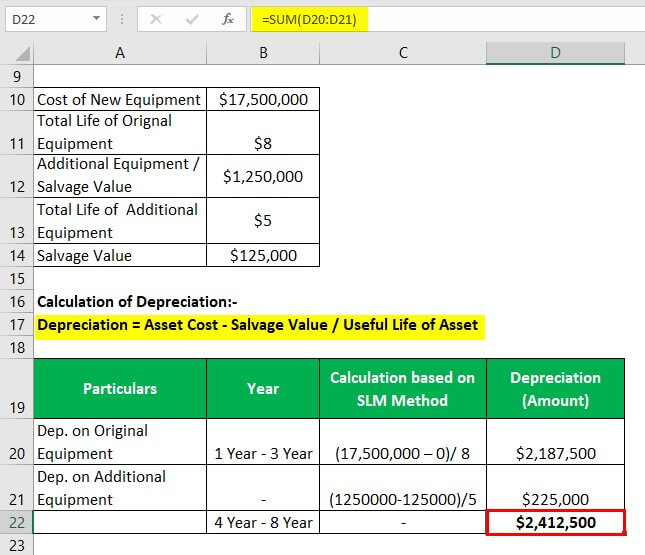

Step #2: Calculate the Depreciation

Given,

For Original Equipment = $17,500,000 – 0 / 8 = $2,187,500

For Additional Equipment = $1,250,000 – $125,000 / 5 = $225,000

Total Depreciation = $2,187,500 + $225,000 = $2,412,500

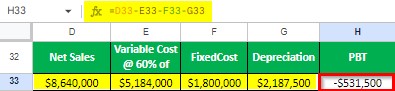

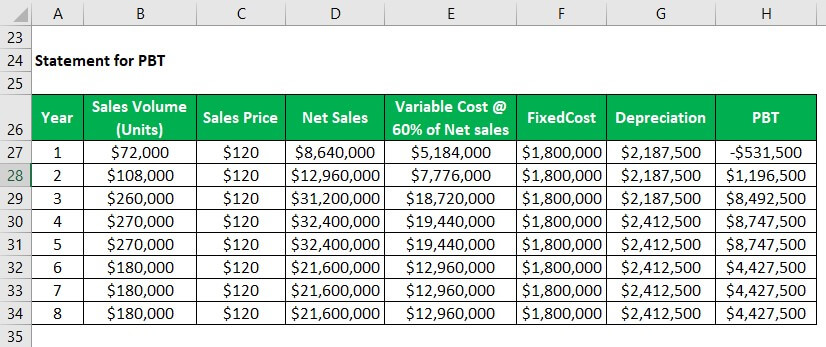

Step #3: Build a Statement of Profit Before Tax (PBT)

Let us calculate the profit before taxes for the company using the following formula:

- Net Sales = Sales volume x Sales Price = $72,000 x $120 = $8,640,000

- Variable Cost = Fixed Cost x 60% = $8,640,000 x 60% = $5,184,000

PBT (Year 1) = $8,640,000 – $5,184,000 – $1,800,000 – $2,187,000 = -$531,500

Similarly, calculate the PBT for the years 2 to 8.

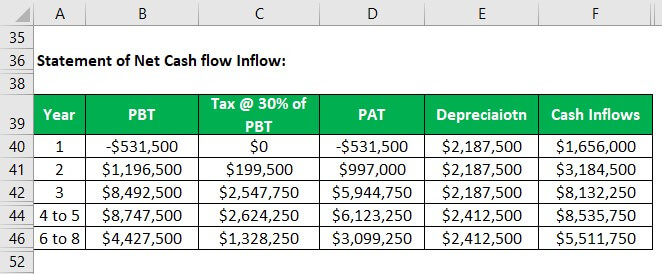

Step #4: Build a Statement of Net Cash Inflow

Here we will calculate the cash inflow using the following formula:

Thus, we need to calculate taxes and then profit after taxes. (Given: The tax rate is 30%)

1. Taxes = PBT x Tax rate

Year 1: As the company incurs a loss in the first year (PBT as calculated in step 3), it is liable to pay zero taxes for the first year.

Year 2: The company can adjust its losses for 2 subsequent years for tax purposes. Hence, PBT for the 2nd year will be reduced by losses of the first year.

$1,197,000 – 532,000 = 665,000.

Taxes (Year 2) = 665,000 x 30% = $199,500

Similarly, we calculate the taxes for the rest of the years (3-8).

2. Profit after taxes = PBT – Taxes

Year 1 = -$531,500 – 0 = -$531,500

Year 2 = $1,196,500 – $199,500 = $997,000

Similarly, we calculate the profit after taxes for the rest of the years (3-8).

3. Cash inflow = Profit After tax + Depreciation

Year 1 = -$531,500 + $2,187,500 = $1,656,000

Year 2 = $997,000 + $2,187,500 = $3,184,500

Similarly, we calculate the cash inflow for the remaining years (3-8).

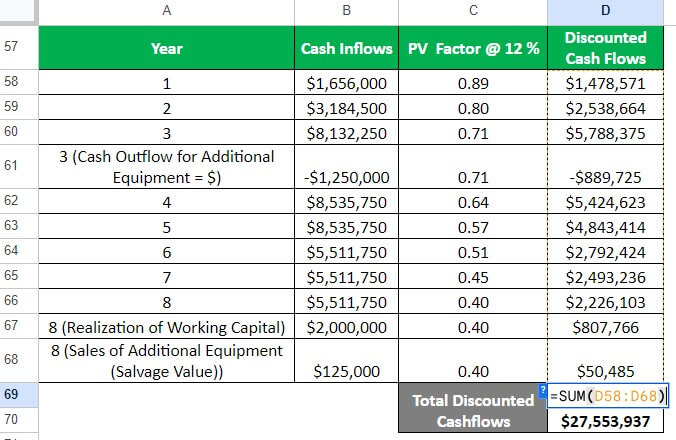

Step #5: Calculate the Discounted Cash Flows

In this step, we will calculate the discounted cash flows using the following formula:

Thus, we need to calculate the PV factor (Given: PV factor @ 12%)

1. Additional Cash inflows and outflows:

At the end of year 3, the company purchases additional equipment, which leads to a cash outflow of $1,250,000.

At the end of year 8, the company realizes the initially invested working capital of $2,000,000.

At the end of year 8, the company sells the additional equipment at its salvage value of $125,000.

2. PV Factor Calculation:

PV Factor = 1 / (1+ Discount Rate) ^ n

Year 1 = 1/(1+12%)^1 = 0.89

Year 2 = 1/(1+12%)^2 = 0.80

Similarly, we calculate the PV Factor for the remaining cash inflows and outflows.

3. Calculate the DCF:

DCF = Cash inflow x PV Factor

Year 1 = $1,656,000 x 0.89 = $1,478,571

Year 2 = $3,184,000 x 0.80 = $2,538,664

Similarly, we calculate the DCF for the remaining cash inflows and outflows.

Finally, we total the discounted cash flows for all the years.

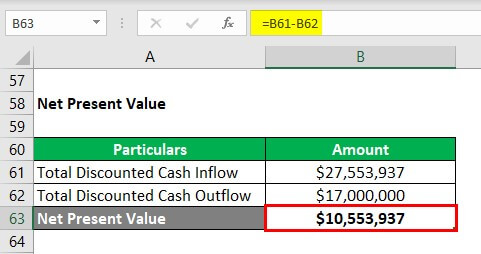

Step #6: NPV Calculation

= $27,553,937 – $17,000,000) = $10,553,937

Result Analysis:

After studying the costs and benefits of the project, Project Manager Will Smith concludes that the NPV (Net Present Value) is positive and high. Thus, the company can accept the project based on Economic Feasibility Analysis.

However, if the NPV of the project had come out to be negative (-ve), Mr. Smith’s final verdict would be to drop the project and not produce the solar products. This way, the company can limit its losses to the project manager’s salary and other essential costs. So they can save time and resources.

2. Technical Feasibility

Technical feasibility analyzes the ability to successfully develop, implement, and maintain a proposed project using current or available technology, skills, and resources.

Technical Feasibility Study Example #1: Developing a Mobile Application

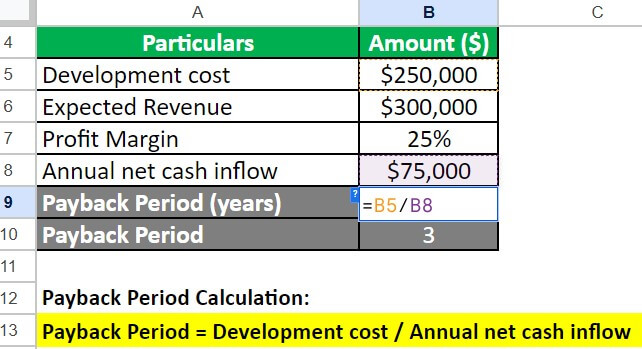

Suppose we plan to develop a mobile application that will cost $250,000. The estimated lifespan of the app is four years. To determine if this project is feasible, we need to conduct a feasibility study by analyzing the following factors:

- We must determine if the technology exists to develop the app and if we have the required skills. We conclude that the technology exists and we have the skills to create the app.

- Next, we must determine if the development cost is justifiable by analyzing the expected revenue and profit margins. Let’s say that the app will generate a revenue of $300,000 annually, and we expect a profit margin of 25%.

- Finally, we need to determine if we can integrate the app with existing systems and if there are any regulatory requirements. Let’s say that the integration is possible and there are no regulatory requirements.

Based on this analysis, we can calculate the feasibility of the project in two ways:

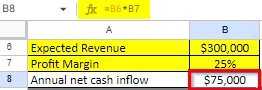

1. Payback Period:

The payback period is the time required for the project to generate revenue that equals the development cost. In this case, we calculate the payback period as follows:

Annual Net cash inflow = Expected Revenue x Profit Margin

= $300,000 x 25% = $75,000

Payback period = Development cost / Annual net cash inflow

= $250,000 / $75,000 = 3 years

Since the payback period is less than the estimated lifespan of the app, which is 3 years, the project is economically feasible.

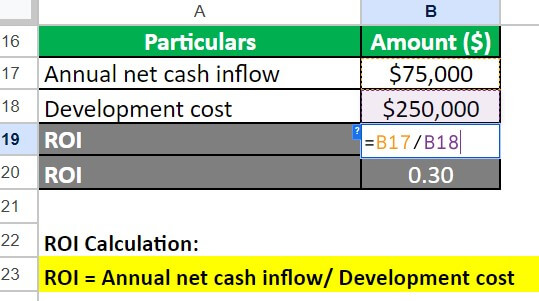

2. Return on Investment (ROI):

To determine the ROI of a project, we divide the profit it generates by its development cost. Here is the formula for calculating ROI:

ROI = Annual net cash inflow / Development cost

= ($300,000 x 0.35) / $250,000 = 0.30 or 30%

Since the ROI is greater than the minimum required rate of return, which is 10%, the project is economically feasible.

Result Analysis:

Based on both feasibility studies, we can conclude that developing a mobile application is feasible, and we can pursue it.

3. Operational Feasibility

Operational feasibility refers to the ability of a proposed project or venture to be successfully implemented and integrated into existing business processes, systems, and practices.

Operational Feasibility Study Example #1: Introducing a New Product Line

Let’s assume that a company is considering introducing a new product line of eco-friendly kitchen cleaning products. We have the following data for the feasibility study:

- Production capacity: The company can produce up to 12,500 units of the new product line per month without affecting existing product production.

- Supply chain management: The company has identified reliable suppliers for all necessary raw materials, components, and finished goods. The estimated cost of raw materials and components is $2.5 per unit.

- Marketing and distribution: The company plans to use social media advertising and targeted email marketing to promote the new product line to the target market. The estimated cost of marketing and distribution is $1.2 per unit.

- Cost and profitability: The company has estimated the cost of producing each unit of the new product line to be $7. They plan to sell each unit for $12, generating a profit margin of $5 per unit.

- Regulatory compliance: The company has confirmed that the new product line complies with all applicable regulations and standards.

Solution:

Based on the above information, we can conclude that the new product line is feasible to introduce. Here’s a breakdown of the costs and profits:

Cost per unit = $2.5 for raw materials and components + $1.2 for marketing and distribution + $3.3 for manufacturing cost = $7

Selling price per unit = $12

Profit per unit = Selling price per unit – Cost per unit = $12 – $7 = $5

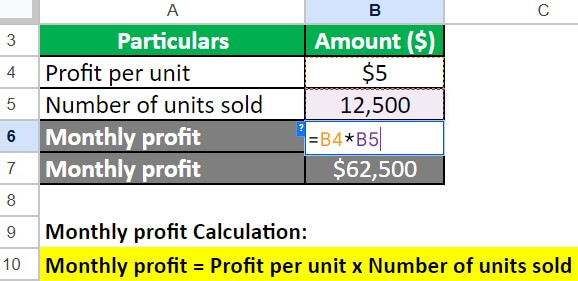

Let us calculate the monthly profit, assuming the company sells 12,500 units per month:

Monthly profit = Profit per unit x Number of units sold

= $5 x 12,500 = $62,500

Therefore, based on this feasibility study, the company can expect to generate a monthly profit of $62,500 by introducing the new product line.

Day-To-Day Life Feasibility Study Examples

Here are some daily life feasibility study examples:

|

Example |

Application in day-to-day life |

| Product Quality | Homemakers inspect product quality when purchasing from a grocery store to ensure it meets desired standards. |

| Organic Farming | Farmers study the feasibility of organic farming methods to eliminate pesticides and analyze the impact on crop output, quality, and cost. |

| Electric Vehicle | Entrepreneurs conduct feasibility studies to launch electric vehicles, considering technical, resource, and economic viability. |

Benefits of Feasibility Study

Here are some benefits of conducting a feasibility study with feasibility study examples:

|

Benefits |

Scenario |

Feasibility Study Identifies |

| Identification of potential problems during project implementation | Launch of a new restaurant |

|

| Determination of the financial viability of the project | Development of a new custom software application |

|

| Supports informed decision-making by assessing risks and benefits | Implementation of a new manufacturing process |

|

| Provides a clear roadmap for project implementation | Construction of a new building |

|

| Builds confidence among stakeholders | Launch of a new product |

|

Final Thoughts

The feasibility study is an essential test every entity should perform in advance while undertaking a new project. It gives a clear picture of the proposed project. It helps the management choose the best of various alternatives by providing valid reasons to accept and reject the other(s). As discussed in the article, a feasibility study is not limited to businesses but has broad dynamics and can be helpful in various fields.

For example, an automobile prototype is a tool for the feasibility study, and an experiment on rats to develop a new medicine is a procedure of feasibility analysis. Checking the configuration and features before purchasing a laptop resembles feasibility tests. Similarly, preparing for certification exams using Microsoft AZ-900: Practice Test Dumps serves as a feasibility check, helping candidates assess their knowledge and readiness before taking the actual exam.

Frequently Asked Questions (FAQs)

Q1. What is the feasibility study format?

Answer: A feasibility study includes an in-depth analysis of the factors necessary for the planned project. The report typically includes a description of the new endeavor or product, a market study, the technological and labor requirements, and the sources of funding and capital.

Q2. What is the most important part of a feasibility study?

Answer: Financial feasibility analysis is a crucial part of a feasibility study. It determines whether the proposed project is financially viable and can generate sufficient revenue to cover all the costs associated with the project, including initial investment, operational expenses, and maintenance costs.

Q3. What is the purpose of a feasibility study?

Answer: The sole purpose of conducting a feasibility study is to determine the success rate of a business, startup, new product or service, etc. The investigation concerns every factor that will contribute to its success or failure.

Recommended Articles

It is a guide to the Feasibility Study Examples. Here we discussed the practical feasibility study examples along with a detailed explanation. You can also go through our other suggested articles to learn more –