Updated November 2, 2023

Difference Between FIFO and LIFO

At the end of the accounting period, the company must report transactions such as stock repurchases and the cost of goods sold to determine the value of unsold inventory. A few accounting methods are FIFO (First In, First Out) and LIFO (Last In, First Out).

Both FIFO vs. LIFO are ways to manage inventory. While FIFO means using or selling the oldest or previously-produced products first, LIFO means selling the newest or more current stock first, especially if they are popular or trending.

The Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) allow the use of the First In, First Out (FIFO) accounting method, which is why it is more popular.

On the other hand, the IFRS standard does not permit Last in, First out, so it is less popular to be lower in inflationary times; however, it allows inventory valuation.

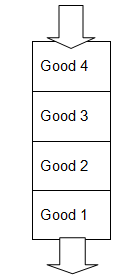

First in, First out, on the one hand, is when the goods enter (inventory) and leave (sold) the inventory as the latest entry from the bottom side of the below inventory box.

FIFO: Good 1 enters first and leaves the inventory first.

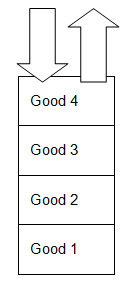

Last in, First out, however, is when the well-entered first leaves (sold) the previous inventory box.

LIFO: Good 4 enters last and leaves the inventory first.

LIFO: Good 4 enters last and leaves the inventory first. In this FIFO vs LIFO article, we will understand both FIFO and LIFO methods in detail. We will also look at the comparative analysis between them.

Without any ado, let’s start with the head-to-head difference between FIFO vs LIFO first. Then, we will talk about each of the methods separately.

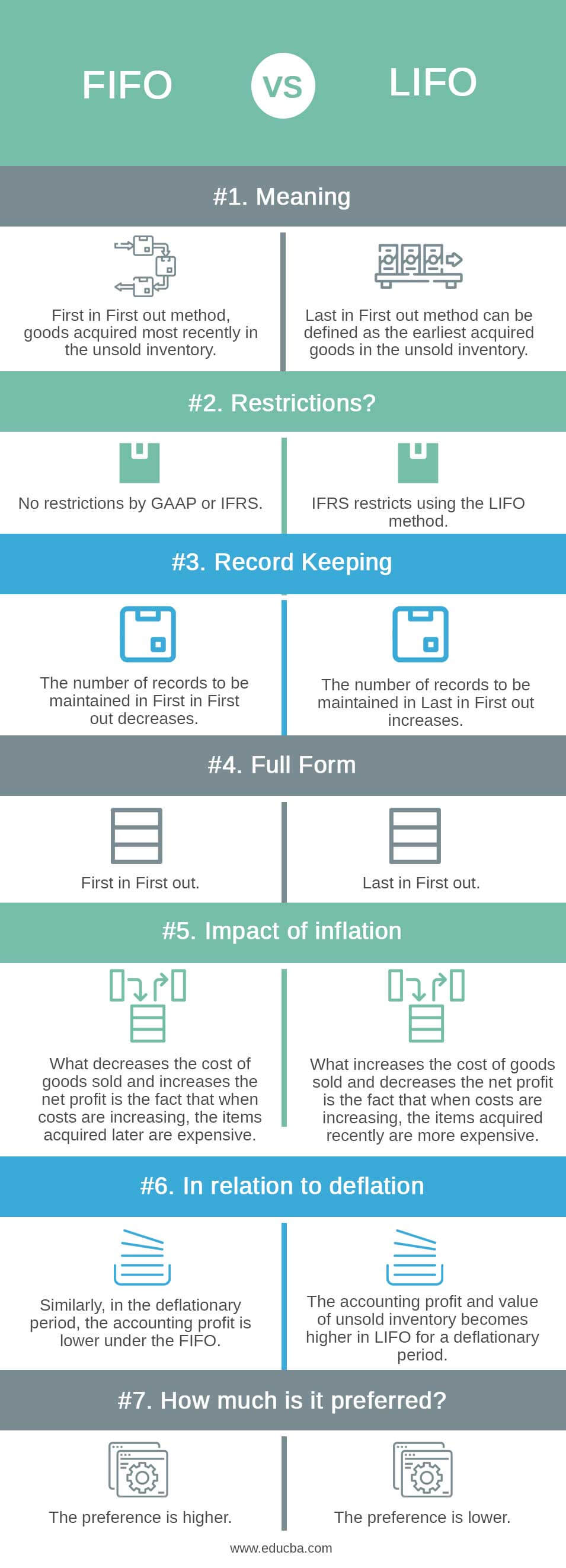

FIFO vs. LIFO Infographics

Below are the top 7 differences between (FIFO (First In, First Out) and LIFO (Last In, First Out))

Key Differences Between FIFO vs LIFO

As you can see, there are many differences between FIFO and LIFO. Let’s look at the top differences as follows:

- First in, First out is the method used in most businesses. Last in and First off, however, are a few businesses where the oldest items are kept in stock.

- First in, First out has fewer inventory layers to track, reducing the record-keeping. Last in, First out, have more inventory layers to track comparatively, which increases the record-keeping.

- First in, First out increases the profit, and income tax is larger. Last in, First out helps defer the payment of income taxes.

- First in, First out implies the inventory added first will be removed from the stock. Last in, First out (LIFO) means that the list of goods added last to the stock will be the first to be sold off.

- First in, First out gets a much higher preference. Last in, First out gets a much lower preference on the balance sheet.

FIFO vs LIFO Table

Below is the difference table between FIFO vs LIFO. Let’s have a look at them –

| The basis of comparison | FIFO- First in, First out | LIFO- Last in, First out |

| Meaning | First, in the First out method, goods acquired most recently in the unsold inventory. | Last, the First out method can be defined as the earliest acquired goods in the unsold inventory. |

| Restrictions? | No restrictions by GAAP or IFRS. | IFRS restricts using the LIFO method. |

| Record Keeping | The number of records to be maintained in First In, First Out decreases. | The number of records to be maintained in Last in First Out increases. |

| Full Form | First in, First out. | Last in, First out. |

| Impact of inflation | What decreases the cost of goods sold and increases the net profit is the fact that, when costs rise, the items acquired later become more expensive. |

Increasing costs raise the prices of recently acquired items, thereby increasing the cost of goods sold and reducing the net profit. |

| About deflation | Similarly, the accounting profit is lower under the FIFO in the deflationary period. | The accounting profit and value of unsold inventory become higher in LIFO for a deflationary period. |

| Preference level | The preference is higher. | The preference is lower. |

Conclusion

FIFO and LIFO are both important on their terms. And they both help in reporting the value of inventory. Can a firm use both as an accounting method? The answer is yes.

It’s inflation, raising the need for more than one accounting method. If the cost of materials or goods purchased remains the same between today and last year, then the cost of materials purchased in the previous year equals what is purchased today. So, the inventory cost added to the stock today will equal the one year ago. Hence, the value of the inventory, whether in LIFO or FIFO, will come out to be the same.

That’s why FIFO and LIFO are different methods of inventory accounting for the convenience and benefits both offers in other conditions.

Recommended Articles

This has been a guide to the top difference between FIFO and LIFO. Here, we also discuss the Key differences between infographics and comparison tables. You may also have a look at the following articles –