How to File ITR Without Form 16?

Form 16 is a document given by your employer. It shows your income details and the tax deducted (TDS) from your salary. You can think of it as a certificate that helps you file your Income Tax Return (ITR). However, what if you do not get it from your employer? Can you still file your ITR? Yes, you can still file ITR without Form 16 by following a systematic approach. In this article, we will see how you can do it.

Understanding Form 16

Form 16 is a certificate that employers give to salaried employees. It contains details about:

- Total salary earned

- TDS deducted by the employer

- Salary components such as:

- Basic Salary

- Dearness Allowance (DA)

- House Rent Allowance (HRA)

- Tax deductions claimed under sections like:

- 80C (e.g., PPF, ELSS)

- 80D (Medical Insurance)

- 80G (Donations)

Although this document is helpful, filing an ITR is not mandatory. You can still file your ITR using Form 26AS and other financial documents.

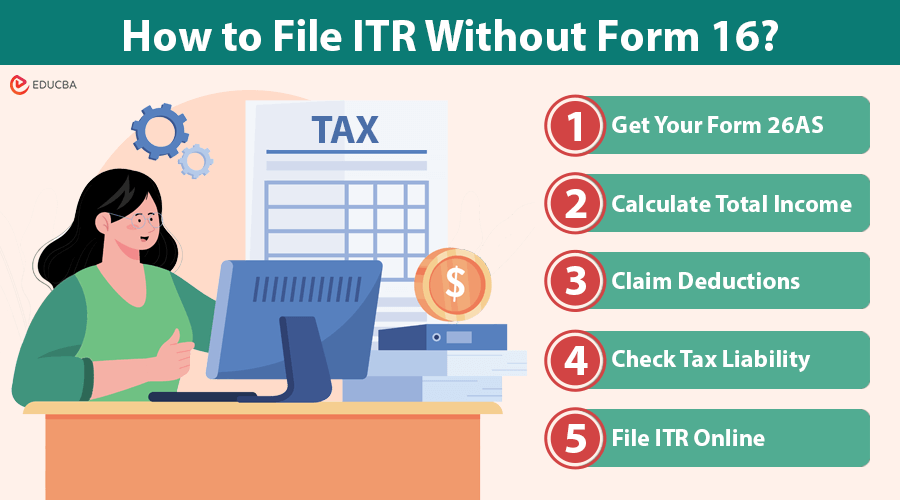

How to File ITR Without Form 16?

Firstly, become aware that Form 16 is not compulsory to file an ITR. It is just a document that can help you fill in the accurate details. However, you can also rely on documents like Form 26AS to obtain those figures. It can help you to calculate your income and taxes accurately.

Follow these steps to file ITR without Form 16:

Step 1: Get Your Form 26AS

Form 26AS is a tax statement. It is available on the income tax website without charge. This statement shows all the TDS deducted and deposited by your employer, banks, or others. Download Form 26AS after logging in to the official income tax department website.

Step 2: Calculate Total Income

After downloading Form 26AS, gather your salary slips. Now, calculate your total annual income. While doing so, include all income sources like:

- Salary income

- Rent received

- Interest earned from fixed deposits with NBFCs and banks

- Dividends received from shares

- Capital gains from selling investments and more.

Step 3: Claim Deductions

This step applies only if you are following the old income tax regime. Here, identify deductions you are eligible for, such as investments under:

- Section 80C (e.g., ELSS, PPF)

- Medical insurance premiums (Section 80D)

- Donations (Section 80G), and more.

Do not forget to keep proof of these deductions. Sometimes, the income tax department requires you to submit proof for verification purposes. Also, keep the high-ticket purchase invoices from online marketplaces or offline stores.

Step 4: Check Tax Liability

Use the income tax slabs for the applicable financial year and calculate your total tax liability. Be aware that slabs differ for both old and new regimes.

Step 5: File ITR Online

Now that you have all your income and tax details follow these steps to file ITR without Form 16:

- Log in to the Income Tax website.

- Choose the correct ITR form based on your income sources (e.g., ITR-1 for salaried individuals).

- Enter all the details manually, referring to your salary slips and Form 26AS.

- Verify and submit your return.

- E-verify within 30 days to complete the process.

Final Thoughts

Filing your ITR without Form 16 is straightforward if you use alternative sources like Form 26AS, salary slips, and other financial documents. Since Form 16 is not mandatory, you can still file ITR without Form 16 by gathering all income details, claiming applicable deductions, and computing your tax liability based on the correct tax regime. Follow these steps to file your ITR online and e-verify it within 30 days for a smooth and easy tax process.

Recommended Articles

We hope this guide on how to file ITR without form 16 has been helpful. Check out these recommended articles for more insights on tax filing, deductions, and compliance.