Updated October 5, 2023

Questions for Finance Interview

During any finance interview, interviewers ask a variety of finance questions, including defining the DCF approach, why financial planning is important, and ways to explain the company’s cash flow statement.

EDUCBA has compiled a list of basic questions a fresher should know to crack the technical round at various finance interviews.

Key Takeaways

- Before appearing for a finance interview, review different interview questions and practice your responses with a friend or in front of a mirror.

- Dress appropriately, smile genuinely, and take your time to understand the question and then answer.

- Know the basics of finance. Learning the fundamentals like financial statements, debt & equity, and microeconomic theories will boost your confidence.

How To Prepare For A Finance Interview

Before appearing for a finance interview, it is great to prepare oneself with all the necessary knowledge, both theoretical and practical. One should also pay attention to soft skills in addition to technical subjects. Moreover, the most crucial thing is to take your time. When you conclude, make a note of your calculations and assumptions.

You can also practice in front of a mirror or do a simulated interview with a friend. It would be best to learn the answers to fundamental financial questions. Here are a few questions to consider for your finance interview.

Finance Interview Questions and Answers

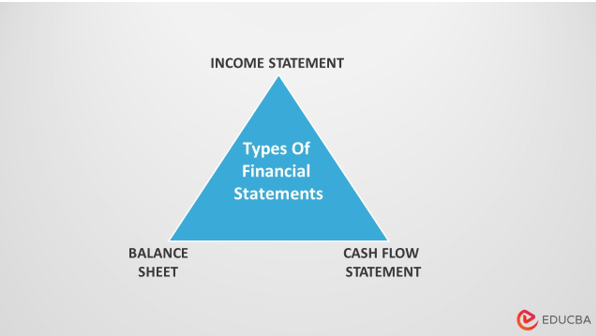

1. What are Financial Statements, and what are the 3 primary types of Financial Statements?

Financial statements are documents that describe a company’s operations and financial performance. Government organizations, accounting companies, etc., frequently audit financial statements to guarantee accuracy and for tax, financing, or investing purposes.

The primary financial statements are of 3 types. These statements are:

- Income statement: It is a statement that shows the income calculation for a specific period. It comprises financial information regarding three main components: revenues, profit or loss, and costs spent during the accounting period. It is also known as the Profit and Loss Statement.

- Balance sheet: A balance sheet summarizes a company’s assets, liabilities, and shareholder’s equity at a specific time. For the balance sheet’s two sides to be equal, assets must equal the sum of liabilities and equity. Cash and equivalents should be listed first in the asset section and must match the balance obtained at the cash flow statement’s end.

Changes in retained profits represent the transfer of net income from the income statement into the balance sheet (adjusted for payment of dividends).

- Statement of cash flows: An essential financial statement that helps clients understand how well a company is managing its cash flow is the cash flow statement. It is often known as a statement of changes in financial position.

Users may determine whether a company is earning enough cash to cover its debt obligations and operating expenses using the information in a cash flow statement.

2. Explain Earnings Per Share (EPS). How is it calculated? What is its significance?

Earnings per share (EPS) is the monetary value of a company’s earnings per outstanding share of common stock. EPS is determined over the years and is independent of changes in the company’s earning ability. EPS is widely used and is an indicator for measuring corporate value since it shows how much money a firm produces for each share of stock it owns.

It is important to note that the following vital categories make up EPS:

- Trailing EPS: only based on data from the prior year

- Current EPS: based on recent estimates and data readily available

- and Forward EPS: based on forecasted future developments and expected figures

How is it calculated?

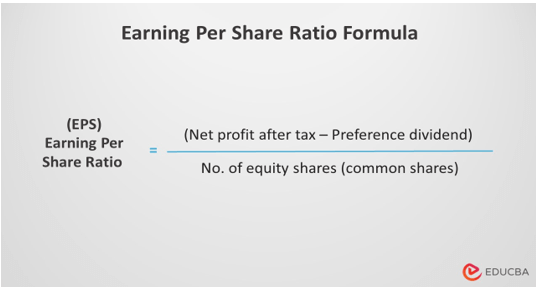

The earnings per share ratio (EPS Ratio) is the result of dividing the net profit after taxes and preference dividend by the total number of equity shares. There is a slight variance in the return on equity capital ratio.

The formula for the Earning per share ratio is:-

What is its significance?

Earnings per share is a measure of profitability and the comparative earning power of the respected firms. Since a higher EPS indicates greater profitability, the company will eventually increase dividend payments. Although often relying on the previous four quarters, EPS may also help to predict potential earnings in the upcoming quarters.

In addition to helping assess a company’s present financial situation, EPS also aids in tracing its past performances.

3. Why is financial planning necessary in an organization?

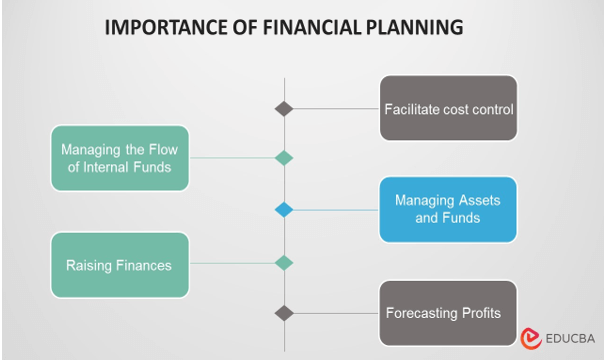

Financial planning entails selecting how much and what to spend based on available funds.

The primary goal of financial planning is to ensure that the organization has enough money to meet its needs. Therefore, it is crucial to ensure that the company does not raise resources unnecessarily.

Additionally, by foreseeing the financial requirements, financial planning helps businesses prevent the shock or surprises they may encounter in uncertain circumstances. It also establishes a link between current and future financial needs by accounting for the company’s projected sales and growth.

4. What is financial modeling? Why is it important?

It is a process of estimating the financial performance of a project or business using all pertinent variables, growth, and risk assumptions and analyzing their effects. It gives the user a concise understanding of all the variables involved in financial forecasting.

Financial modeling is crucial for a variety of reasons, mainly concerning deciding between mergers and acquisitions, generating capital, organizing and running a business, and making investments.

5. What is the DCF method, and why is it used?

DCF stands for Discounted cash flow. It is a business valuation method that allows you to assess the current value of a company and/or its assets.

Using a DCF model enables investors to assess the anticipated cash flows into and out of the organization at a risk-free rate over the anticipated holding period. It also helps to calculate the future worth of their cash flow forecasts. This data assists investors in making more informed investment decisions.

6. Explain the Types of Bonds

a) Floating Rate Bonds

Floating rate notes (FRNs) are bonds that have a comparable ratio with the money market reference rate and are also known as variable coupons.

It comprises the federal fund rate and the spread, which is the rate that remains constant. FRNs have quarterly coupons since they allow holders to pay interest once every three months.

Investors also prefer FRNs because they can benefit from rising interest rates. After all, the rate on the floater periodically adjusts to reflect current market rates.

b) Zero-Coupon Bonds

Zero-coupon bonds are sometimes known as discount or deep discount bonds since they are purchasable for less than their face value and repay when they reach maturity. This type of bond does not have periodic interest payments.

A deep discount allows an investor to invest a small amount of money that will grow over time. Since the bond repays when it matures, its holders benefit significantly by receiving a substantial amount of money equivalent to the initial investment.

An example would be U.S. Treasury bills. It is suitable for both short and long-term investments.

c) Deep Discount Bonds

This type of bond sells at a discount from par value. In this case, the bond sold below par value has a lower rate of fixed income and securities than other bonds. As a result, they also have a higher risk profile.

Moreover, they have a market price of at least 20%, although it is less than its face value and carries a bit more risk than other bonds of a similar nature.

Both institutional and individual investors can buy and sell discount bonds. These low-coupon bonds are long-term investments. A U.S. savings bond is a typical example of a discount bond.

7. What are Contingent Liabilities?

A contingent liability is an obligation linked to a past transaction, event, or condition that may arise due to a future event that is now considered possible but not probable. Thus, liabilities that may develop in the future are contingent liabilities.

For example, a bank guarantee for the loan advances to a third party, possible penalties, fines, and penalties payable to the government or income tax authorities, etc.

Contingency liabilities do not include potential damages from natural disasters. They do not maintain records in the Book of Records. On the liabilities side of the balance sheet, they are absent. A footnote at the bottom of the balance sheet is a means of reporting them.

8. Define Cost Accounting. How is it different from financial accounting?

A company’s expenditure on a procedure, good, or service is appropriately tracked, analyzed, summarized, and explained in cost accounting. It can assist a company in budget management and strategic planning to increase cost-effectiveness. Management uses cost accounting to determine where to increase expenditures and reduce costs.

Cost accounting indicates the cost per item and the profit or loss related to specific products, whereas financial accounting provides the value of the business’s overall profit and loss. While cost accounting’s primary goal is decreasing and controlling expenses, financial accounting’s main goal is maintaining accurate financial records.

9. What is Deferred Revenue Expenditure? Give some examples

Deferred Revenue Expenditure is a type of expenditure that does not result in acquiring any fixed asset, and such expenditures have benefits. Nonetheless, they do not actualize within the time limit specified.

It is necessary to consider the following points:

-The amount of revenue generated will encompass more than one fiscal year. -The financial statements should include a disclosure of deferred revenue expenditure.

Examples include Initial Advertisement Expenditure, Research and Development Expenditure, and Preliminary Expenses. They demand a substantial upfront investment, which results in future earnings.

10. Explain Explicit Cost and Implicit Cost

An explicit cost is a cost that is external to the business, like the wage, rent, and materials. This cost directly affects the revenue of the company. It gives a clear picture of a company’s cash outflow, ultimately decreasing profitability.

The value of the company’s sacrifice is the implicit cost. The cost associated with replacing an asset is a factor of production. Implicit costs can also explain underutilized resources and a company’s loss.

A firm’s opportunities, costs, and cash outlay relate to implicit and explicit costs. Unlike implicit costs, which are challenging to quantify, a firm may incur an explicit cost from various sources.

11. What are Adjusting Entries?

After the completion of an accounting cycle, journal entries, also known as Adjusting entries, are made to update specific revenue and expense accounts and ensure compliance with the matching principle. According to the matching principle, expenses must be incurred during the same accounting period as the revenue used to pay for them.

A financial report that corrects an error from a prior accounting quarter represents itself as adjusting journal entries.

12. What do you understand by Hedging, and why is it important?

Hedging is the process of understanding the risks of any investment and choosing to be safe from any unfortunate event that may affect one’s finances. Getting car insurance is a prime example of this.

A hedge can help traders and investors with a low-risk tolerance protect their money and find peace of mind. Hedge strategies allow traders and investors to profit while ensuring they are not taking undue risk consistently. A hedge can keep you in the business when things turn disastrous.

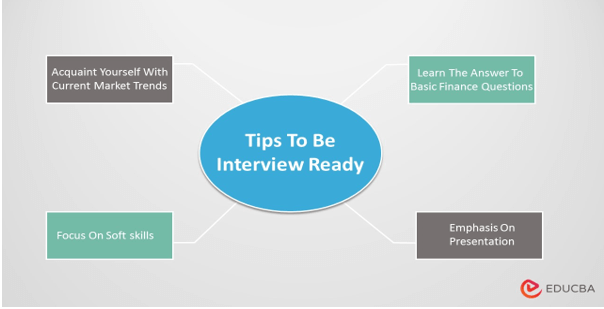

Tips To Be Interview Ready

Reading periodicals like The Wall Street Journal and Financial Times regularly or watching daily market coverage is one of the typical yet finest methods to prepare for a finance interview. This will help comprehend current market trends and allow the interviewer to determine the degree of a candidate’s passion.

When meeting new people, appearance is key; thus, appropriate dressing is essential. You should probably dress more formally for a financial interview and remember to smile when you go for an interview. A smile boosts your confidence and evens out your body language. Focusing on your words while avoiding interruptions and maintaining eye contact is also crucial.

At last, you can differentiate yourself in the interview and increase your chances of landing the job by emphasizing your analytical understanding and capacity for critical thinking. You might want to prepare simple questions like distinguishing between an audit and a review and learning the three primary financial statements.

Conclusion

These are a few finance interview questions and interview tips you can prepare. Although the entire procedure could initially appear intimidating, you will ace it if you have the right attitude and are well-prepared for the interview. Learn all the basic finance interview questions thoroughly. Ensure you are well-versed with the fundamentals and do not rush through the questions. Ultimately, the interviewer is more interested in how you respond to the question than the specifics of your response.

Recommended Articles

To read more articles related to finance interview questions, please refer to the links below.