Updated July 24, 2023

Difference Between Finance vs Lease

Finance vs Lease in this, Finance can be defined as an option or a mechanism that a buyer avails of when he or she chooses to purchase a high-priced product and settles the total amount by paying in periodical instalments. On the other hand, a lease can be defined as an option or a mechanism in which a leasing company chooses to buy a financial asset on behalf of others. In a finance option, the customer is deemed the owner of the product, whereas, in a lease option, the leasing company or the dealer is regarded as the owner of the financial asset.

The financing option may or may not require the buyer to make down payments, whereas, in the case of a leasing option, down payments are just not required. Finance is a sort of capital expenditure, whereas the lease option is regarded as an operating expense. In a finance option, the hirer can actually claim depreciation, whereas, in the case of a leasing option, it is the lessor who is eligible to claim depreciation.

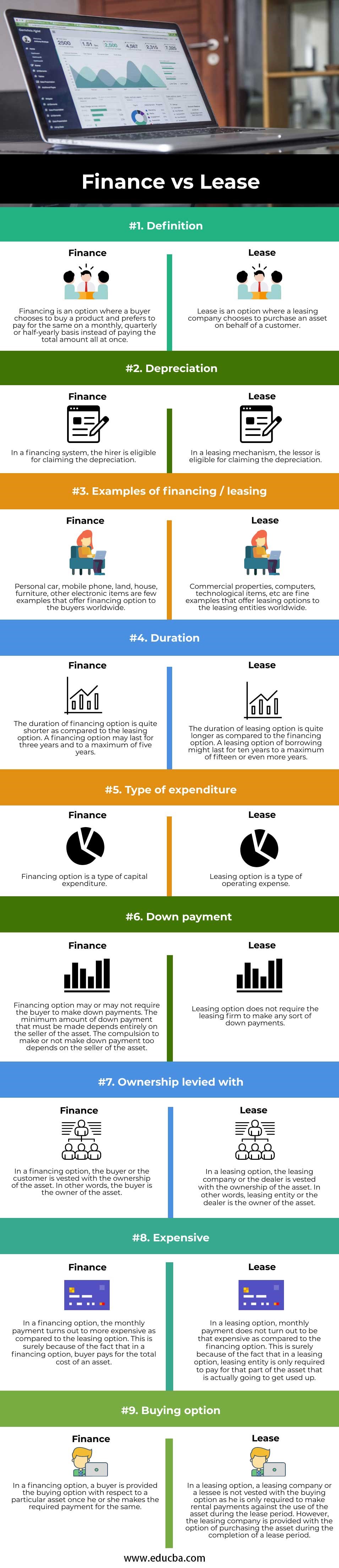

Head To Head Comparison Between Finance vs Lease (Infographics)

Below are the top 9 differences between Finance vs Lease:

Key Differences Between Finance vs Lease

The key differences between finance and lease are provided and discussed as follows:

- In financing option, the hirer can claim the depreciation, and the repairs and maintenance of an asset are entirely the responsibility of the buyer. On the other hand, in a leasing option, the lessor can claim depreciation. In an operating lease, the lessor will have to take care of the repairs and maintenance of the leased property. However, in the case of a financial lease, the lessee is solely responsible for the repairs and maintenance of the asset.

- A financing option might not always require the buyer to make down payments. This totally depends on the seller to seller, assets to assets, and offers to offers. The amount of down payment might not always be quoted the same by all the sellers of a particular asset. On the other hand, the down payment option is not available in the case of a leasing option.

- The duration of a financing option might be shorter as compared to the duration of a leasing option.

- The type of expenditure involved in financing is capital expenditure, whereas the type of expenditure involved in leasing is an operating expense.

- Financing takes place between a buyer and a seller of an asset, whereas leasing takes place between a lessor and a lessee of an asset.

Comparison Table of Finance vs Lease

Let us discuss the top comparison between Finance vs Lease:

| Basis of Comparison |

Finance |

Lease |

| Definition | Financing is an option where a buyer chooses to buy a product and prefers to pay for the same on a monthly, quarterly or half-yearly basis instead of paying the total amount all at once. | A lease is an option where a leasing company chooses to purchase an asset on behalf of a customer. |

| Depreciation | In a financing system, the hirer is eligible for claiming the depreciation. | In a leasing mechanism, the lessor is eligible for claiming the depreciation. |

| Examples of financing/leasing | Personal cars, mobile phones, land, house, furniture, other electronic items are a few examples that offer a financing option to buyers worldwide. | Commercial properties, computers, technological items, etc., are fine examples that offer leasing options to leasing entities worldwide. |

| Duration | The duration of the financing option is quite shorter as compared to the leasing option. A financing option may last for three years and to a maximum of five years. | The duration of the leasing option is quite long as compared to the financing option. A leasing option of borrowing might last for ten years to a maximum of fifteen or even more years. |

| Type of expenditure | The financing option is a type of capital expenditure. | The leasing option is a type of operating expense. |

| Down payment | Financing options may or may not require the buyer to make down payments. The minimum amount of down payment that must be made depends entirely on the seller of the asset. The compulsion to make or not make a down payment too depends on the seller of the asset. | The leasing option does not require the leasing firm to make any sort of down payments. |

| Ownership levied with | In a financing option, the buyer or the customer is vested with the ownership of the asset. In other words, the buyer is the owner of the asset. | In a leasing option, the leasing company or the dealer is vested with the ownership of the asset. In other words, the leasing entity or the dealer is the owner of the asset. |

| Expensive | In a financing option, the monthly payment turns out to be more expensive compared to the leasing option. This is sure because of the fact that in a financing option, the buyer pays for the total cost of an asset. | In a leasing option, the monthly payment does not turn out to be that expensive as compared to the financing option. This is sure because of the fact that in a leasing option, the leasing entity is only required to pay for that part of the asset that is actually going to get used up. |

| Buying option | In a financing option, a buyer is provided with the buying option with respect to a particular asset once he or she makes the required payment for the same. | In a leasing option, a leasing company or a lessee is not vested with the buying option as he is only required to make rental payments against the use of the asset during the lease period. However, the leasing company is provided with the option of purchasing the asset during the completion of a lease period. |

Conclusion

A financing option is a mechanism in which a buyer purchases an asset of his or her choice and avails of the instalment option for clearing off the payments of the same. In this way, the buyer will not be required to make the total payment all at once, and he or she can clear the total amount by making timely instalments. On the other hand, the leasing option is a mechanism of borrowing whereby a lessee chooses to lease a property of a lessor on behalf of a third party or a customer in return for a monthly rent amount that is supposed to be paid for a fixed period of time as defined in the contract made between both the parties.

Recommended Articles

This is a guide to Finance vs Lease. Here we discuss the difference between Finance vs Lease, along with key differences, infographics, & a comparison table. You can also go through our other related articles to learn more–