Best Books for Reading about Financial Advisors

Financial Advisor books will teach you how to create a personal budget, save money, invest it, and plan for insurance, estate planning, retirement, taxes, and all other financial obligations. Reading these Financial Advisor books helps you become more aware of the harsh truths of life and teaches you about the advantages of managing your money correctly. It also reflects on the drawbacks of squandering money and the consequences that might jeopardize your survival and future.

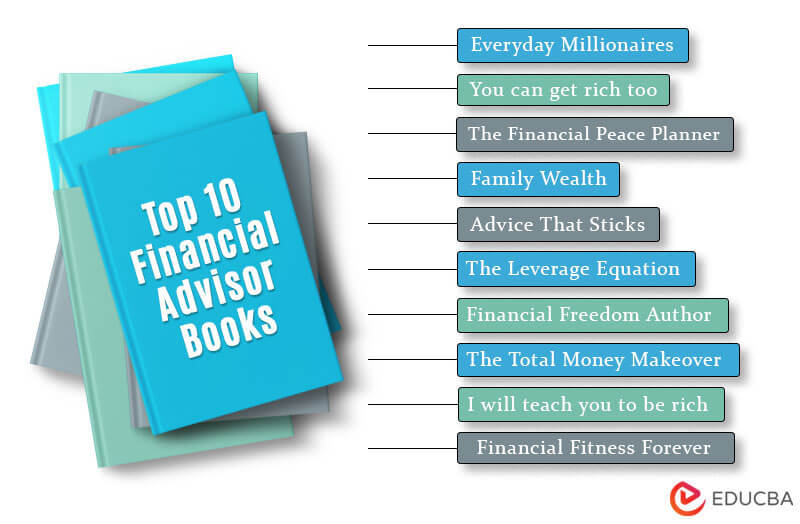

We have provided a list of Financial Advisor books offering the best financial plans from the most experienced or renowned financial advisors for readers wanting to improve their financial situation. Below is a list of books for professionals and beginners to enhance their understanding of sound financial planning practices.

|

# |

Financial Advisor Books | Author Name | Publishing Year | Ratings |

| 1. | Everyday Millionaires | Chris Hogan | 2019 | Amazon: 4.6

Goodreads: 4.08 |

| 2. | You can get rich too: With Goal Based Investing | PV Subramanyam and M Pattabiraman | 2016 | Amazon: 4.2

Goodreads: 3.69 |

| 3. | The Financial Peace Planner | Dave Ramsey | 1998 | Amazon: 4.6

Goodreads: |

| 4. | Family Wealth: Keep it in the Family | James E. Hughes | 2004 | Amazon: 4.5

Goodreads: 4.28 |

| 5. | Advice That Sticks | Moira Somers | 2018 | Amazon: 4.4

Goodreads: 4.21 |

| 6. | The Leverage Equation | Todd Tresidder | 2018 | Amazon: 4.4

Goodreads: 3.85 |

| 7. | Financial Freedom | Grant Sabatier, Vicki Robin | 2020 | Amazon: 4.6

Goodreads: 3.96 |

| 8. | The Total Money Makeover | Dave Ramsey | 2021 | Amazon: 4.7

Goodreads: 4.29 |

| 9. | I will teach you to be rich | Ramit Sethi | 2019 | Amazon: 4.6

Goodreads: 4.14 |

| 10. | Financial Fitness Forever | Paul Merriman | 2012 | Amazon: 4.6

Goodreads: 4.38 |

Let us go through Financial Advisor books review and key points in detail.

#1: Everyday Millionaires

Author: Chris Hogan

Get this book here.

Review:

This financial advisor book breaks the myth that ordinary struggling people with a few hundred dollars in their wallets cannot achieve a sound income status. It further dispels the idea that a person’s income or history has no bearing on accumulating money. It draws on studies and data from conversations with more than 10,000 billionaires. The author attempts to dispel the widespread belief that becoming a millionaire takes remarkable skill or good fortune by using instances of regular people.

Key Points:

- The book is an eye-opener on how ordinary people with less-paying jobs can become millionaires.

- It reflects on the qualities that millionaires possess that set them apart; they are disciplined and prudent, avoid taking on debt, and invest.

- Avoiding excessive risk in investments is one of its central tenets.

#2: You Can Get Rich Too: With Goal-Based Investing

Author: PV Subramanyam and M Pattabiraman

Get this book here.

Review:

The author helps a non-financial thinker to make goal-oriented investments and improve the standard of life. This goal-based investment” demystifies vital ideas on how one can be rich. In addition, the book assists readers in creating attainable financial objectives.

Key Points:

- The book enables readers to estimate their net worth and further assists them in visualizing and planning for the next two to three decades.

- The next step is to assist readers in choosing a strategy and the appropriate tools while guiding them away from novice investment blunders.

- With the help of this book, you may start working toward your financial objectives right away.

#3: The Financial Peace Planner

Author: Dave Ramsey

Get this book here.

Review:

Using his personal experience, the author lucidly shows how to escape a debt scenario when one is severely affected by it. The author had restored his financial life entirely before declaring bankruptcy. When you have debt, you must read this book. For those who are drowning in debt, this book will change their lives.

Key Points:

- The book gives step-by-step methods on how to pay off debts.

- It further helps an individual develop the insight to determine how urgent the matter is.

- It enables individuals to create a realistic budget per the current situation and recognize how money flows.

#4: Family Wealth: Keep it In the Family

Author: James E. Hughes

Get this book here.

Review:

The author wrote this book for wealthy customers so that they may add a new perspective about their heritage, wealth, and prestigious legacy as they hand it down to future generations. It is a core tool for financial advisors who want to build long-term relationships with clients’ families. The book defines terms like business, family, and wealth in the book’s three sections. It also includes information on the essential members of the family, managing its wealth, and the actions they can take to increase family assets.

Key Points:

- It is a top-notch manual on handling riches passed down through generations and how to perpetuate family affluence across generations.

- There is little mention of the structural inequality that has led to the racial wealth divide in the United States.

- The reader learns about the challenges many Americans experience in building and maintaining family wealth.

#5: Best for Advising Clients: Advice That Sticks

Author: Moira Somers

Get this book here.

Review:

This book enables financial experts to deal with individuals with all habits and beliefs that interfere with sound spending habits. As an expert in neuropsychology and financial change as an executive coach, Moira Somers writes in Advice That Sticks, “Most people are at least moderately nuts when it comes to money.” Given this, it’s reasonable to imagine that financial experts face formidable obstacles when working with customers. The fact that most people in finance lack training in good customer communication and could unintentionally turn off clients does not help.

Key Points:

- The author enables professionals to understand the psychology of clients and the socio-economic and cultural influences that may cause non-adherence.

- The book aids financial professionals and their teams in overcoming mistakes that can cause non-adherence.

- It enables professionals to communicate effectively and listen carefully, establish a personal connection, and ensure the client is on the same page.

#6: The Leverage Equation

Author: Todd Tresidder

Get this book here.

Review:

The leverage Equation helps individuals to recognize the hidden opportunities that help to multiply money. The former hedge fund manager author emphasizes the ideas, tactics, and resources required to build wealth and make the most of it. The book also demonstrates how to employ various forms of leverage to lower risk and speed up outcomes.

Key Points:

- The book helps individuals avoid the trap of regular paychecks and working long hours.

- It discloses that the nine leverage concepts will enhance a person’s financial gains.

- The author discusses the different ways to change the 10 USD to 100 USD. He further explains how an individual can make money without money.

#7: Financial Freedom

Author: Grant Sabatier

Get this book here.

Review:

The author emphasizes that while one’s capacity to generate income is endless, time is not. He offers a method to create more income in less time so that one may use the time saved to enjoy life. He also talks about the endless possibilities of making money and retiring early. There is a cap on how much you can save but not how much money you can make.

Key Points:

- The author offers ways to manage money and cut costs without sacrificing happiness.

- It enables an individual to plan and make a straightforward, profitable portfolio requiring minor tweaks.

- It further empowers an individual to succeed financially and generate income creatively.

#8:The Total Money Makeover

Author: Dave Ramsey

Get this book here.

Review:

This New York Times Best Seller financial advisor book outlines the methodical seven stages for effectively managing money, turning those unwanted expenses into a finely toned budget. Additionally, the author does a fantastic job of presenting the fundamentals of altering destructive money behaviors.

Key Points:

- The author explains the straightforward strategy for developing good saving habits by tweaking your spending habits.

- The book enables an individual to create a thorough repayment strategy for all debts, including mortgage, automobile, and installment payments.

- The book further guides an individual in overcoming the ten most harmful beliefs about money.

- It gears a person to establish a sizable retirement and emergency fund and retirement.

#9: I Will Teach You To Be Rich

Author: Ramit Sethi

Get this book here.

Review:

I Will Teach You To Be Rich is a 6-week personal finance education that will help you organize your finances for the rest of your life. Even though they are not financial gurus, Ramit Sethi concentrates on 20 to 35-year-olds to assist them in managing their finances.

This book differs from other financial planning publications by Indian authors currently on the market. It does not solely concentrate on stock market investment, saving, and other related topics. Sethi also focuses on credit cards and the best ways to use them. The book also advises setting objectives, making budgets, and managing debt.

Key Points:

- The author offers techniques to crush debt and loans quickly, including student loans.

- The book imparts valuable financial know-how, like how to set high-interest and no-fee bank accounts to help struggling students and young professionals handle their money better.

- The book enables a novice to automate finances and other investment strategies one can set and be free of worry.

#10: Financial Fitness Forever

Author: Paul Merriman

Get this book here.

Review:

Paul Merriman is Nationally recognized in the financial world, managing over 2000 American households and $1.5 billion in investments. In this book, the author explains investing techniques to readers in today’s turbulent investment climate, supporting them with data and facts rather than conjecture. The author helps to enable the most struggling portfolios to prime health, providing techniques to combat the following dilemmas.

Key Points:

- The book answers real-life dilemmas on situation-based money matters like mutual funds, asset allocation, index investing, and both buy-and-hold and active management strategies.

- This book answers the most crucial question in detail that the author has responded to in his 1000 workshops and weekly radio program.

- The author elaborates on the strategies that help control risk and how an individual can protect finances from personal feelings.

Recommended Books

Our top 10 financial advisor books article aims to help you. For more such books, EDUCBA recommends the following,