Financial Expert in Toronto: Overview

Managing a business means handling finances, from bookkeeping and taxes to planning and forecasting. Doing it all alone can be overwhelming and costly. Hiring a financial expert in Toronto helps keep your business financially stable and compliant.

This guide will help you find the right financial professional by outlining the key factors to consider.

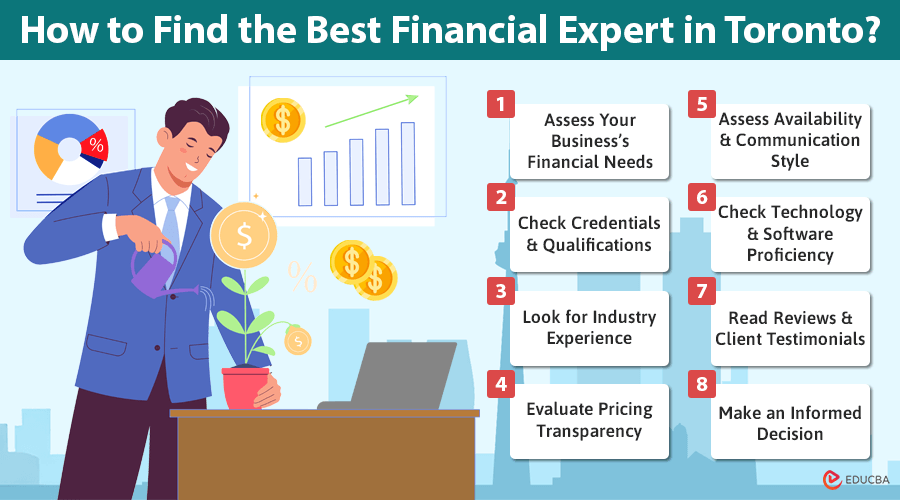

How to Find the Best Financial Expert in Toronto?

Here are the key factors:

#1. Assess Your Business’s Financial Needs

Before beginning your search, take a step back and evaluate what financial services your business requires. Do you need bookkeeping, tax planning, or full financial management? Knowing your needs will help you find the right financial expert.

Examples:

- A startup might need help with structuring its finances and securing funding.

- An established business may require advanced tax strategies to optimize profits.

- A retail business might need expertise in inventory management and sales tax compliance.

Knowing your needs will help you find a professional with the right expertise.

#2. Check Credentials and Qualifications

Not all financial professionals have the same level of expertise. Look for professionals with recognized certifications to ensure credibility and reliability. In Canada, common designations include:

- Chartered Professional Accountant (CPA): A highly respected certification covering auditing, taxation, and financial management.

- Certified Management Accountant (CMA): Specializes in strategic financial planning and management.

- Certified General Accountant (CGA): Offers broad accounting expertise across various industries.

Hiring a financial expert in Toronto with the right qualifications ensures compliance with Canadian tax laws and financial regulations, giving you peace of mind.

#3. Look for Industry Experience

Different industries have unique financial challenges. A financial expert with experience in your industry will understand sector-specific tax benefits, compliance requirements, and financial strategies.

Example Specializations:

- Tech Startups: Guidance on R&D tax credits and investor reporting.

- Healthcare: Knowledge of medical practice tax deductions and compliance.

- Real Estate: Expertise in property taxes and investment strategies.

Ask candidates about their industry experience and request case studies or client testimonials.

#4. Ensure Local Knowledge of Toronto’s Financial Landscape

Hiring a financial expert with knowledge of provincial tax regulations, business grants, and incentives can be beneficial. Ontario offers various tax credits and funding programs that a local professional can help you navigate.

Key areas of local expertise:

- Ontario business tax laws

- Toronto-based grants and funding options

- Local compliance regulations

A professional accountant in Toronto with in-depth knowledge of the financial ecosystem can help you maximize tax savings and business incentives.

#5. Evaluate Pricing Transparency

Cost is a crucial factor when hiring financial services. A professional financial expert in Toronto should provide clear and upfront pricing. When discussing fees, consider the following:

- Do they charge hourly, monthly, or per service?

- What services does the quoted price cover?

- Are there any hidden fees?

A trusted professional will clearly explain the costs so you can avoid surprises and budget easily.

#6. Assess Availability and Communication Style

Financial matters are time-sensitive, and delayed responses can lead to missed deadlines and penalties. When selecting a financial expert, ensure they are responsive and proactive.

Questions to Ask:

- How quickly do they respond to emails and calls?

- Do they provide regular financial updates and recommendations?

- Are they available during tax season or financial audits?

Clear and open communication is essential for maintaining smooth financial operations and reducing stress.

#7. Check Technology and Software Proficiency

Modern businesses rely on digital tools for efficient financial management. A financial expert who is proficient in accounting software can streamline your financial processes.

Popular Accounting Software:

- QuickBooks

- Xero

- Sage

If your business operates remotely or has multiple stakeholders, it is beneficial to choose a financial expert who offers digital solutions like cloud accounting and real-time financial reporting.

#8. Read Reviews and Client Testimonials

Before finalizing your decision, research online reviews and client testimonials to ensure you are hiring a trustworthy professional.

Where to Look:

- Google Reviews

- LinkedIn Recommendations

- Industry-specific directories

Additionally, ask fellow business owners for referrals. Word-of-mouth recommendations often lead to finding reliable professionals with proven track records.

#9. Make an Informed Decision

Finding the right financial expert in Toronto requires careful consideration of their qualifications, industry experience, and communication style. Taking the time to vet candidates ensures you find a professional who aligns with your business goals.

Final Thoughts

Hiring a financial expert in Toronto can greatly benefit your business by ensuring compliance, optimizing financial strategies, and reducing workload. By carefully evaluating your needs, researching candidates, and prioritizing industry expertise, you can find the right professional to support your business’s growth. Take the time to make an informed decision, and you will set your company up for long-term financial stability and success.

Recommended Articles

We hope this guide has been helpful. Check out these recommended articles for more tips on financial planning, tax optimization, and choosing the right financial expert for your business.