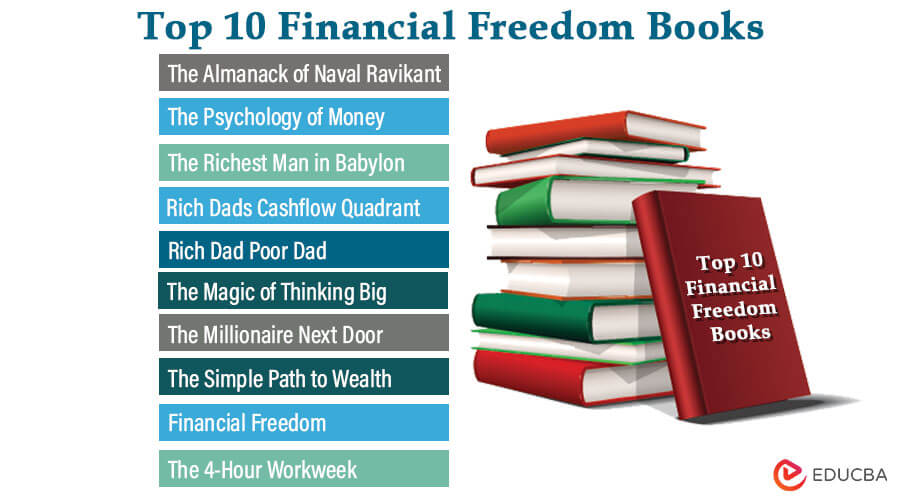

Best Financial Freedom Books

Financial freedom is the idea of changing into a financial freelance and being able to pay cash for things one enjoys. The idea stems from retiring early and reaching some extent wherever a person has no monetary obligations. They can live a free and prosperous life doing work they relish instead of work needed to support a way of life.

The book list can help readers from different walks of life. Everyone can use these as guides to becoming wealthy. These deal with investing correctly and earning money from these investments.

You can review the list of the top 10 financial freedom books below.

|

# |

Financial Freedom Books | Author | Published |

Rating |

| 1 | The Almanack of Naval Ravikant: A Guide to Wealth and Happiness | Eric Jorgenson | 2020 | Amazon: 4.7

Goodreads: 4.50 |

| 2 | The Psychology of Money | Morgan Housel | 2020 | Amazon: 4.6

Goodreads: 4.38 |

| 3 | The Richest Man in Babylon | George S Clason | 2015 | Amazon: 4.5

Goodreads: 4.21 |

| 4 | Rich Dad’s Cashflow Quadrant | Robert T Kiyosaki | 2011 | Amazon: 4.6

Goodreads: 4.73 |

| 5 | Rich Dad Poor Dad | Robert T. Kiyosaki | 2022 | Amazon: 4.6

Goodreads: 4.32 |

| 6 | The Magic of Thinking Big | David J Schwartz | 2018 | Amazon: 4.6

Goodreads: 4.25 |

| 7 | The Millionaire Next Door | Thomas J. Stanley PhD, William D. Danko PhD | 2020 | Amazon: 4.6

Goodreads: 4.06 |

| 8 | The Simple Path to Wealth | Money Mustache,

J. L. Collins |

2016 | Amazon: 4.7

Goodreads: 4.45 |

| 9 | Financial Freedom | Grant Sabatier | 2020 | Amazon: 4.6

Goodreads: 3.96 |

| 10 | The 4-Hour Workweek | Timothy Ferriss | 2011 | Amazon: 4.4

Goodreads: 3.92 |

Let us discuss each financial freedom book in detail, reviewing them and their key points:

Book #1: The Almanack of Naval Ravi Kant

Author: Eric Jorgenson

Get this book here.

Book Review

According to the author, people must care for themselves to be happy with money, health, meditation, and life goals. The book is divided into two sections: wealth and happiness, and thus it discusses earning money, working the right way, becoming wealthy, and remaining wealthy.

Key Points

- Money, according to the book, is a tool for becoming wealthy.

- People must work hard the right way to become wealthy. Otherwise, contentment will always be lacking.

- The author encourages individuals to use interest with cash, temperament, and character.

Book #2: The Psychology of Money

Author: Morgan Housel

Get this book here.

Book Review

The author demonstrates that wealthy people make the most irrational financial decisions, and the goalpost moves as we earn more. As a result, knowing when to spend enough and still be satisfied is critical.

Key Points

- The author uses the author’s relationship and perspective on money to explain why people fear investing and reinvesting.

- The book uses the example of businessman Warren Buffet to demonstrate the power of compounding.

- The author advises readers not to be misled by people’s visible wealth.

Book #3: Richest Man in Babylon

Author: George S Clason

Get this book here.

Book Review

Along with seven money rules, the book teaches three lessons to begin building wealth: living below your means, learning to be lucky by working hard, and never going into debt. According to the author, anyone who follows these three lessons is already ahead of most people.

Key Points

- The book lays out seven money rules.

- It provides a solid idea for money and is a must-read for newcomers.

- The book recommends investing 10% of your income in the appropriate assets.

Book #4: Rich Dad’s Cashflow Quadrant

Author: Robert T Kiyosaki

Get this book here.

Book Review

The book discusses how some people work less and earn more, encouraging readers to do the same. The book is significant because it describes how few people make much money while others struggle financially. Robert Kiyosaki created four quadrants: employee, business owner, self-employed, and investor.

Key Points

- The author created a quadrant in the book to explain where and how people fall and what they should do.

- It explains the issue of poor mindset and people’s struggles to overcome it.

- The author condemns poor mentality and claims that for people to become wealthy, they must change their perspective.

Book #5: Rich Dad Poor Dad

Author: Robert T. Kiyosaki

Get this book here.

Book Review

This book is divisive, but it gets you to do something. It is based partly on Kiyosaki’s life, in which he learned two approaches to money from his father and best friend.

Key Points

- The book tells you to use your money to buy assets rather than liabilities.

- It says that instead of avoiding risks, manage them.

- One should work to learn rather than to earn.

Book #6: The Magic of Thinking Big

Author: David J Schwartz

Get this book here.

Book Review

According to The Magic of Thinking Big, creative thinking is the driving force behind success. It is an idea you can find in several books recently. One will appreciate how this book combines many other now-popular ideas into a single purpose.

Key Points

- You are 100% capable of accomplishing whatever you set out to do.

- Your brain will spark the creativity required to achieve your goal.

- It ensures that you persevere in the face of failure and adversity.

Book #7: The Millionaire Next Door

Author: Thomas J. Stanley, Ph.D. and William D. Danko, Ph.D.

Get this book here.

Book Review

The co-authors, Stanley, and William Danko, studied people with high net worth but average income for years. The book will help you to avoid becoming someone under-accumulating wealth.

Key Points

- The book advises saving responsibly from the instant you begin earning over what you want to measure.

- It asks you to use a simple formula for net worth to determine if you are falling short of your financial potential.

- It also talks about avoiding economic healthcare to achieve your goal.

Book #8: The Simple Path to Wealth

Author: Money Mustache and J. L. Collins

Get this book here.

Book Review

It is the book to read to get your finances in order. Collins shares fundamental knowledge you need to make money work for you instead of against you in a straightforward, engaging manner.

Key Points

- The book tells you to avoid making complex investments.

- It explains why you must spend less than you earn and invest the excess in avoiding debt.

- It shows how money can buy many things, but nothing beats freedom.

Book #9: Financial Freedom

Author: Grant Sabatier

Get this book here.

Book Review

Grant Sabatier guarantees people can rewrite their retirement plans by following these simple steps. He also claims that financial freedom comes from being true to your work and the goal of acquiring your amount.

Key Points

- According to the author, the impulse is the enemy of freedom.

- The author lays out seven steps to financial independence.

- The book explains why money is synonymous with freedom.

Book #10: The 4-Hour Workweek

Author: Timothy Ferriss

Get this book here.

Book Review

The 4-Hour Workweek focuses on one central idea: teaching readers how to break free from the 9-to-5 workday. You can increase your income and escape the rat race with the right mindset.

Key Points

- The book guides you to increase your investments.

- It also demonstrates increased output offsite.

- The book also teaches you to create a quantifiable business benefit.

Recommended Books

Hopefully, our top 10 financial freedom books article helps you. For more such articles, EDUCBA recommends the following,