What is a Financial Intermediary?

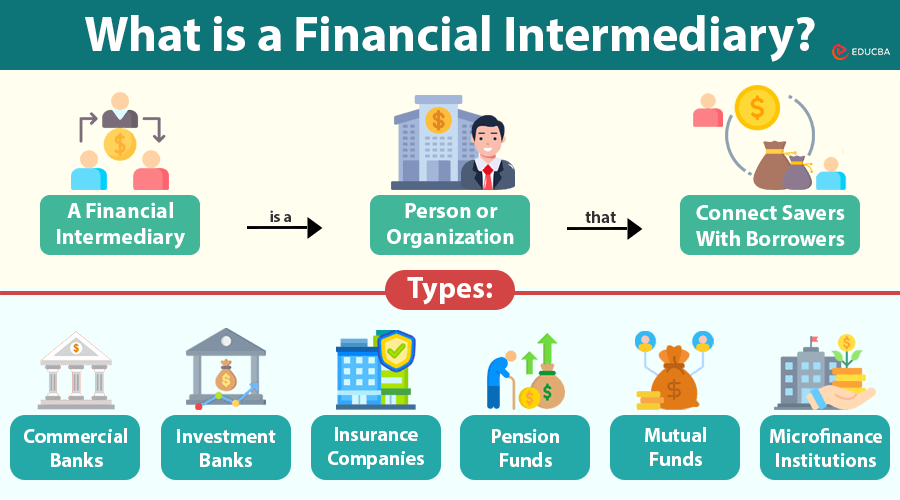

A financial intermediary is a person or organization that helps connect two parties in a financial deal, making the transaction easier for both sides. Their main job is to connect people who have money (investors or savers) with those who need money (borrowers, businesses, or governments).

Instead of savers directly giving loans or money to borrowers, a financial intermediary helps transfer these funds efficiently, securely, and profitably.

For example, suppose you deposit money in a savings account at a bank. The bank does not just keep your money in a vault—it lends that money to someone else who needs a home loan or a car loan. You earn interest for keeping your money in the bank, and the bank earns more interest by lending it out. The bank, in this case, is the financial intermediary.

Types of Financial Intermediaries

There are different types of financial intermediaries, each with its own specific role. Below are the most common ones:

1. Commercial Banks

These are the most common financial intermediaries. They receive money from people and businesses and lend it to those who need it.

Key Functions:

- Savings and checking accounts

- Personal and business loans

- Credit cards

- Foreign exchange services.

2. Investment Banks

Investment banks help companies raise money through stock or bond markets. They also assist in mergers and acquisitions and provide financial advisory services.

Key Functions:

- Underwriting new debt and equity securities

- Assisting in IPOs

- Managing investment portfolios

3. Insurance Companies

These companies gather premiums from policyholders and invest them in the market. In return, they provide financial protection against risks such as accidents, death, or property damage.

Key Functions:

- Risk management

- Long-term investment of funds

- Providing life, health, and property insurance

4. Pension Funds

Pension funds collect and invest contributions from employees and employers to provide retirement income.

Key Functions:

- Long-term investment

- Retirement income security

- Portfolio diversification

5. Mutual Funds

Mutual funds gather money from many people and invest it in stocks, bonds, or other assets. Professional fund managers manage them.

Key Functions:

- Diversification of investments

- Easy access to capital markets for small investors

- Liquidity and risk management

6. Microfinance Institutions (MFIs)

MFIs offer small loans to low-income individuals or groups who can’t access traditional banks.

Key Functions:

- Promote financial inclusion

- Encourage entrepreneurship

- Support rural development

Functions of Financial Intermediaries

Financial intermediaries are essential to the financial system. Here is how:

- Pooling of funds: They collect money from many savers and pool it to provide larger loans to borrowers. This increases access to capital and reduces individual risk.

- Risk management: By spreading investments across various sectors and borrowers, intermediaries help reduce risk for individual investors.

- Maturity transformation: They convert short-term deposits into long-term loans. For example, while your savings account may be withdrawn at any time, the bank may use the funds for a 10-year home loan.

- Reducing transaction costs: Financial intermediary reduces the time, effort, and cost of connecting borrowers and lenders directly.

- Providing liquidity: They make it easier for investors to convert their investments into cash when needed. For instance, you can withdraw money from a mutual fund or bank account fairly quickly.

- Information processing: They collect and analyze data about borrowers and the market, helping in better decision-making and reducing information asymmetry.

Importance of Financial Intermediaries

Financial intermediaries are vital for a healthy and growing economy. Here is why:

- Capital allocation: They direct money to the most productive investments, ensuring efficient use of funds in the economy.

- Encouraging savings and investments: They encourage people to save and invest by offering safe and rewarding options like savings accounts, mutual funds, or pension plans.

- Credit availability: They help individuals and businesses get credit for spending, growing their business, or handling emergencies.

- Economic stability: Managing risk and providing liquidity help stabilize financial systems during economic fluctuations.

- Boosting employment and growth: They create job opportunities and promote economic development by funding businesses and infrastructure projects.

Advantages of Financial Intermediaries

- Expertise: Professionals manage funds better than individual investors might.

- Convenience: Easier to invest, borrow, or manage money.

- Lower risk: Risk is spread across many investments and borrowers.

- Regulation: Most intermediaries are regulated by governments, which increases trust and security.

Disadvantages and Challenges

- Fees and charges: Some intermediaries charge high fees that reduce returns.

- Moral hazard: Institutions might take more risks knowing government bailouts back them.

- Over-reliance: Too much dependence on intermediaries can limit individual financial literacy.

- Frauds and scams: Poor regulation can lead to the misuse of funds.

Role of Technology in Financial Intermediation

The digital revolution has transformed how financial intermediaries operate. Many services are available online, making them faster and more accessible.

FinTech Innovations:

- Digital Wallets like Paytm or Google Pay

- Peer-to-Peer (P2P) Lending Platforms like LendingClub

- Robo-Advisors that provide automated investment advice

- Blockchain for secure, decentralized transactions

These innovations redefine financial intermediation by making it more transparent, inclusive, and efficient.

Regulatory Bodies That Oversee Financial Intermediaries

To ensure safe and fair practices, most countries have regulatory bodies:

- RBI (Reserve Bank of India): Regulates banks and NBFCs in India

- SEBI (Securities and Exchange Board of India): Oversees mutual funds, stock markets

- FDIC (Federal Deposit Insurance Corporation): Protects deposits in the U.S.

- FCA (Financial Conduct Authority): Regulates UK financial markets

These regulators ensure that intermediaries operate transparently, maintain fair practices, and protect customer interests.

Final Thoughts

A financial intermediary is more than just a middleman—it is a crucial financial system pillar. By efficiently channeling money between savers and borrowers, these institutions support economic growth, maintain financial stability, and promote inclusivity.

In an increasingly digital world, the role of financial intermediaries is evolving rapidly. With the right regulations and ethical practices, they will remain essential in building a safe financial future for both individuals and countries.

Frequently Asked Questions (FAQs)

Q1. What is the main function of a financial intermediary?

Answer: The main role is to link people who save money with those who need to borrow it, helping money move smoothly through the economy.

Q2. Are all banks financial intermediaries?

Answer: Yes, most banks are financial intermediaries because they accept deposits and offer loans.

Q3. What is an example of a non-bank financial intermediary?

Answer: Mutual funds, insurance companies, and pension funds are non-bank financial intermediaries.

Q4. Is a stockbroker a financial intermediary?

Answer: Technically, stockbrokers act as agents, not intermediaries, since they do not pool or lend money.

Q5. How do financial intermediaries make money?

Answer: They earn through interest rate spreads, service fees, commissions, and investment returns.

Recommended Articles

We hope this guide helps you understand the concept of financial intermediary in the economy. Explore these recommended articles for more insights into personal finance and investment strategies.