Updated November 6, 2023

Difference Between Financial Lease vs Operating Lease

A financial lease is a lease where rewards and risk associated with the leased asset get transferred to the lessee with a transfer of the asset, while in operating, risk, risk, and return remain with the lessor. Here, the lessor refers to the original asset owner, while the lessee relates to the party using the asset in place of lease payments. An operating lease does not meet any of the above conditions. A capital lease agreement is like buying a property through A lending deal that requires installment payments, which is the same as an operating lease.

Let us study much more about Financial Lease vs Operating Lease in detail:

For a lease to be classified as a capital lease, any one of the four conditions has to be met:

- Ownership transfer of an asset to the lessee by the end of the lease term

- An option is given to the lessee to purchase the asset at a discounted rate relative to its fair value at the end of the lease term. Deciding on this discount purchase option is typical at the start of the lease.

- The lease term exceeds 75% of the asset’s useful life.

- The net present value of the lease payments is at least 90% of the leased asset’s fair market value.

However, for a lease of Land, only ownership transfer or the existence of a bargain purchase option (conditions 1 or 2) would qualify the lease as a capital lease.

Suppose you have rented an asset through an operating lease. In that case, you have no option to purchase the asset at the end of its life term, you use the asset for less than 75% of its effective life, and likewise, the present value of your lease payments will be less than 90% of the asset’s market value. The accounting treatment of your operating lease will differ from that of a capital lease. In an operating lease, the leased asset will stay off the balance sheet, and you will treat lease payments as operating expenses in the Income statement. Effectively, it is like you have taken a property on rent when you enter into an operating lease, while a capital lease agreement is like buying a property through a loan agreement with payment made through installments.

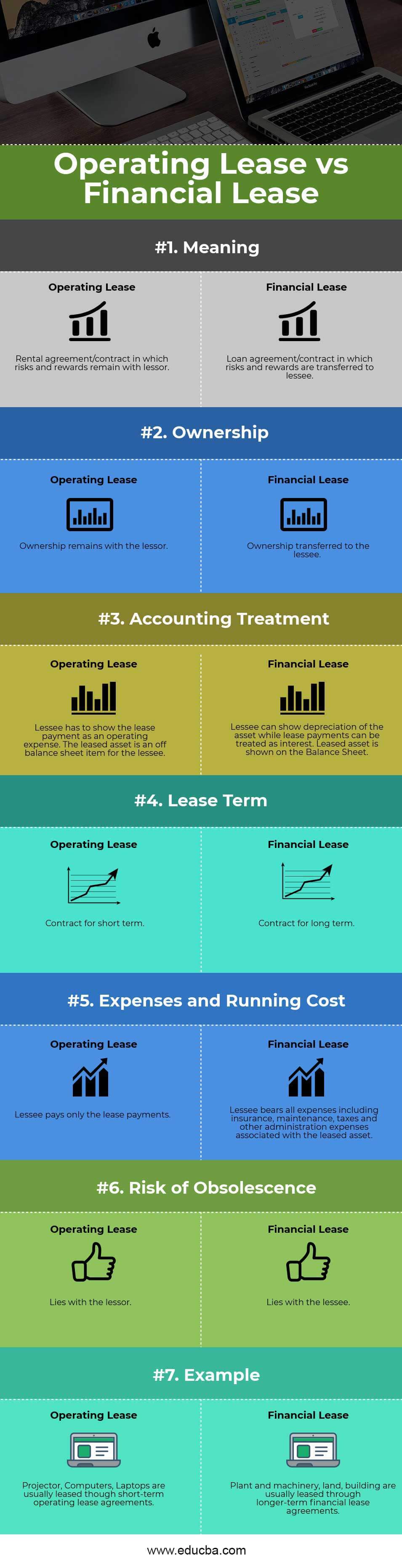

Head To Head Comparison Between Financial Lease vs Operating Lease (Infographics)

Below is the Top 7 difference between a Financial Lease and vs Operating Lease

Key Difference Between Financial Lease vs Operating Lease

The primary differences between Financial Lease and Operating Lease are discussed below:

- A financial lease is a loan agreement where the lessor transfers the risk and rewards of his asset to the lessee in exchange for periodic payments. However, an operating lease is a rental agreement where the lessor gives the lessee only the right to use the asset without transferring the risks and rewards of the ownership of the asset.

- Since a financial lease considers a transfer of ownership, the lessee must show the asset on the balance sheet. You can treat the depreciation of the asset as an operating cost. Similarly, you can treat lease payments as financial interest expenses, like a loan agreement. In an operating lease, the lessee shows lease payments as an operating expense, similar to a loan agreement. In contrast, the lessor shows the asset and depreciation in his accounts. Thus, the lessee can keep his balance sheet ‘light’ in an operating lease through the agreement.

- In the case of a financial lease, the lessee gets the right to use the asset for more than 75% of the asset’s estimated economic life, while in an operating lease, the asset is used for a much shorter term.

- A financial lease offers a tax deduction for depreciation and lease payments as finance charges to the lessee. In contrast, an Operating lease offers a tax deduction for the lease payments only to the lessee.

- Under a financial lease, the lessee can purchase the asset at a discounted price at the end of the contractual period, while in an operating lease, no such option is provided to the lessee.

- The lessee cannot cancel a financial Lease during the primary period of the lease, while the lessee can cancel the operating lease during the primary period.

Financial Lease vs Operating Lease Comparison Table

Below is the topmost comparison between Financial Lease vs Operating Lease

| Basis Of Comparison | Operating Lease | Financial Lease |

| Meaning | Rental agreement/contract in which risks and rewards remain with the lessor | Loan agreement/contract in which risks and rewards are transferred to the lessee |

| Ownership | Operating Lease ownership remains with the lessor | Ownership transferred to the lessee |

| Accounting Treatment | Lessee has to show the lease payment as an operating expense. The leased asset is an off-balance sheet item for the lessee. | A lessee can show asset depreciation, while lease payments can be treated as interest. The leased asset is shown on the Balance Sheet. |

| Lease Term | Contract for short-term | Contract for long-term |

| Expenses and running cost | The Lessee pays only the lease payments. | The lessee bears all expenses, including insurance, maintenance, taxes, and other administrative expenses associated with the leased asset. |

| Risk of obsolescence | Lies with the lesser | Lies with the lessee |

| Example | Projectors, Computers, and Laptops are usually leased through short-term operating lease agreements. |

Companies typically lease plants, machinery, land, and buildings through longer-term financial lease agreements. |

Conclusion

Therefore, Operating leases provide greater flexibility to companies since they can replace or update the leased equipment more frequently. Accounting treatments are also simpler in an operating lease, while administration and maintenance hassles are much less. Further, no transfer of ownership means no risk of obsolescence.

On the other hand, Capital Lease provides greater tax benefits to the lessee by including depreciation and interest expense in their books. Firms in the higher tax bracket are more likely to enter capital lease agreements than operating leases. The disadvantage of a capital lease over an operating lease is the higher administrative and maintenance costs.

The resale risk involved in a capital lease is also higher since the lessee has to make sure that the balloon payment for purchasing the asset is available at the end of the lease term. Financial leases are usually more prevalent in the case of bigger assets like plants and machinery, buildings, and land. Hence, depending on the requirement and tax situation, a company may choose between a Financial Lease vs Operating Lease.

Recommended Articles

Though this has been a guide to the top differences between financial and operating leases, here we also discuss the differences with infographics and a comparison table. You may also have a look at the following articles –