What is Financial Literacy for Students?

Financial literacy is a key concept every college student must know. It helps them understand the importance of money and how to manage it wisely. Colleges bring new expenses and financial challenges, so budgeting and saving become essential for students. These financial skills help students control their spending, foster discipline, and prepare them for future financial challenges.

Learning to handle finances in the early days of adulthood sets a strong foundation for responsibly handling money. This article emphasizes the key importance of financial literacy for students, gives tips to control expenses, and shows how to save money in college.

Table of Contents

- What is Financial Literacy for Students?

- Why Financial Literacy is Important For Students?

- Tips for Reducing Expenses

- Practical Ways for Students to Save Money

- Financial Literacy Tools for College Students

- Importance of Credit and Debt Management

- Why Should Students Seek Financial Guidance?

Why Financial Literacy is Important For Students?

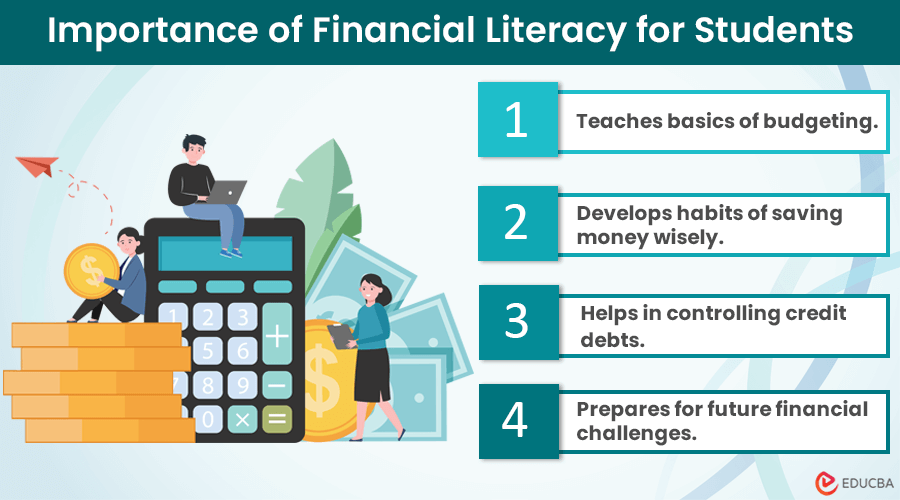

The importance of financial literacy to students is as follows.

1. Teaches Basics of Financial Control

Financial literacy helps you understand your financial situation and how to control it by assessing your income sources. This income might come from part-time jobs, scholarships, or parental support. It teaches you to be realistic about how much you earn monthly.

You can track everything from rent, tuition fees, study materials, and groceries to smaller costs like entertainment. Even occasional expenses, like hiring an online essay writer to write me an essay and free up time for budgeting, can be tracked. This helps you see where your money goes.

2. Develop Habits of Saving Money Wisely

Financial literacy for students helps calculate your budget to save more. Therefore, you must divide your expenses into different categories to save money wisely. For example, allocate rent, groceries, and utility expenses under the ‘needs’ category and dining out or entertainment costs under the “‘wants” category. This division or separation helps you decide on what to spend on first.

Then, list your monthly income and subtract your essential expenses. What remains is your discretionary income (extra money left for spending). You can use the extra money for your college activities and set at least a small portion of that income for savings.

3. Prepares for Future Financial Challenges

Remember, a budget is not static. Life changes, and so should your budget. Review and adjust it monthly to keep it real and manageable. Always plan for unexpected expenses and set aside money for car repairs or medical bills as an emergency fund. This helps you feel secure and reduces financial stress.

Finally, remember that understanding your financial status is not a one-time task. You need to keep a regular check on your income and spending. This way, you will spot patterns and areas where you can save or need to spend more and adjust as needed.

Tips for Reducing Expenses

Here are some practical tips for reducing college expenses:

1. Use Student Discounts

Many colleges and institutions offer student discounts and scholarships. It includes expenses from transportation to entertainment. You can always ask if there is a student discount available for you.

2. Buy Used Textbooks

Buying new textbooks can be expensive. You can buy used ones or rent them to cut costs. Also, check for digital versions, which can be cheaper.

3. Plan Cost-Effective Meals

Having frequent meals from restaurants can be costly. So, plan your meals wisely and cook at home if possible. Also, cooking in bulk quantity and using affordable ingredients can save a lot.

4. Limit Unnecessary Spending

You must track your spending habits, including small purchases like daily coffee cups. Try to find cheaper alternatives or skip them if they cost too much.

5. Use Public Transport or Carpool

If possible, use public transportation or share rides (carpool) with friends. This can reduce travel costs significantly.

6. Use Campus Resources

Many campuses offer free or discounted amenities like gyms, libraries, and other benefit. Make the most of these instead of spending on expensive gyms.

You can reduce and manage your budget expenses better by implementing these tips.

Practical Ways for Students to Save Money

As a student, you can follow the below tips to save money.

1. Start with Small Savings

Don’t underestimate small savings. Even if you save a few dollars a week, it will make more money over time. So, start with a saving goal you can achieve and later increase the saving target as you can.

2. Open a Savings Account

A savings account is not just for adults but also for students to save money. It is a safe and secure place. Choose a bank that has high interest and no service fees.

3. Set up Automate Savings

Set up an automatic transfer system where a fixed amount of money goes directly from your operational account to your savings account each month. Treat this transfer system like a mandatory expense you cannot negotiate or skip.

4. Set Long-Term Goals

Whether for a post-graduation trip or a major purchase, long-term savings goals can motivate you to stick to your savings plan.

Remember, the key to saving is consistency and patience. These financial strategies can help you build a solid financial foundation even on a limited budget.

Financial Literacy Tools for College Students

In today’s digital age, using technology to manage finances is a game-changer. Many apps and tools are available to help streamline budgets and monitor expenses. These tools provide a comprehensive view of financial status, including income, expenses, and savings objectives. Some examples of such tools are Mint, Zogo, and Money Skill.

In addition, these applications can effectively track your spending patterns, categorizing expenses and highlighting spending trends. They even send alert messages if you reach your budget limit, helping you spend finances accordingly. This information will help you simplify informed financial decisions, enhancing your overall financial wellness through technological support.

Importance of Credit and Debt Management for Students

Knowing the basics of credit and debt is important to maintain financial health. Credit means borrowing funds with a commitment to repay, often with added interest. A good credit score indicates that you are reliable in repaying debts. It is important for various aspects of life, including obtaining loans and credit cards and even renting options. To keep a healthy credit score, paying bills on time and responsibly managing credit card usage is essential.

Sometimes, as a student, you must submit a thesis or any other writing as part of the university curriculum. But if you are struggling with your coursework and considering services like the best paper writing service, make sure you budget for it so you don’t end up with unnecessary credit card debt. Understanding the terms of your student loans is also crucial. You must make repayment plans and know the due dates to avoid defaults, which can adversely affect your credit rating/score.

Why Should Students Seek Financial Guidance?

As a student, it’s wise to seek financial advice when needed. Don’t hesitate to consult financial advisors or use financial resources available on campus. These experts can provide personalized guidance tailored to your situation. Additionally, continuously educating yourself about personal finance is crucial.

Final Thoughts

In conclusion, there are many benefits of financial literacy for students. It equips them to handle money wisely, plan for the future, and avoid debt. By understanding their finances, they can create a budget, reduce expenses, save strategically, and use financial tools to set themselves up for success. The financial future lies in taking proper steps right now in managing money.

Recommended Articles

We hope this article on “Financial Literacy for Students” was informative. To learn more about related topics, refer to the articles below.