Power of Financial Literacy for Women

Nowadays, when gender equality in the entrepreneurial field is gradually becoming a reality, focusing on financial literacy and business ideas for women is more important than ever. Female entrepreneurs are breaking barriers and venturing into diverse industries, bringing fresh perspectives and innovative ideas. However, despite this progress, many still face significant challenges in navigating the financial aspects of starting and running a business. This is where the power of financial literacy for women comes into play, offering women the tools they need to succeed.

When empowered with the right knowledge, women entrepreneurs can develop business plans that are both sustainable and profitable, making them formidable players in the global economy.

Tips for Women to Improve Their Financial Literacy

Financial literacy for women is important in both business and personal finance. Here are some tips on how women can boost their financial knowledge to achieve greater independence and success.

#1. Use Online Learning as a Business Tool

Online learning has become a game-changer for entrepreneurs, especially for women. These platforms provide a wealth of resources covering everything from finance to technology, making it easier for women to access valuable knowledge. What’s great about online learning is its flexibility – learners can absorb information at their own speed and fit it into their busy schedules. It means women can keep improving their skills while managing other responsibilities without hassle.

#2. Enhance Financial Skills Through Online Courses

Improving your financial skills through online financial education is a smart move. First, pick one specific skill or area you want to improve and gain more knowledge on that concept. Whether you want to understand financial statements, get better at budgeting, or make sense of financial markets, there are numerous online courses that offer valuable insights. So, choose wisely and invest in a course that fits your needs and goals.

#3. Learn About Business Investments, Loans, and Debt Management

Besides learning the basics of finance, taking online courses on topics like business investments, loans, and managing debt is important. These courses teach us about different ways to invest, how to assess loan risks, and how to handle debt wisely. By taking these courses, women entrepreneurs can gain the skills they need to succeed financially.

#4. Learn About Taxes

Knowing the latest tax laws is vital to ensure compliance and optimize tax strategies. Online courses and resources (blogs, tutorials, videos) that focus on tax laws give you all the information you need about tax rules, deductions, credits, and what you need to do to follow the law. By keeping up with any changes in tax laws, you can minimize tax liabilities, maximize savings, and maintain financial health for your business.

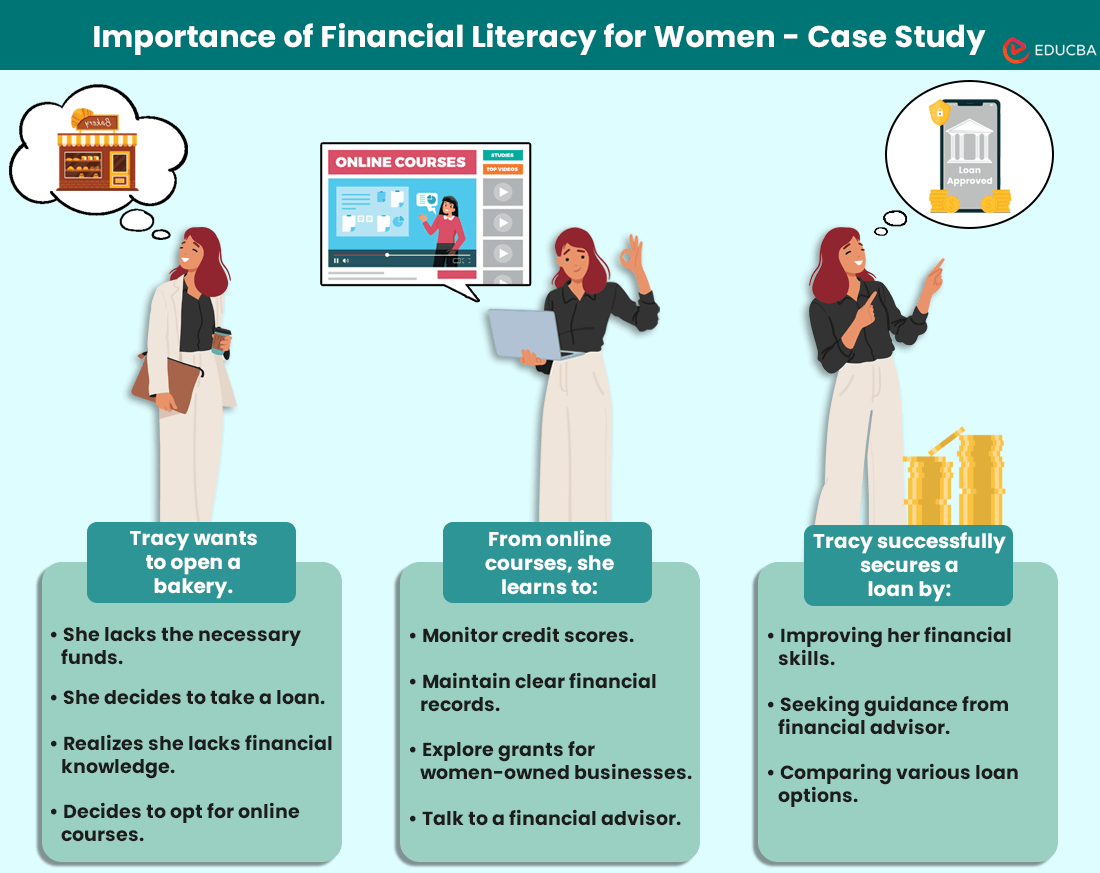

Importance of Financial Literacy for Women – Case Study

Let us look at an example of how women entrepreneurs can use online learning to enhance their financial literacy and apply it practically.

Consider Tracy, who dreams of opening a small bakery but lacks the necessary funds. After deciding to take a loan, Tracy realizes her lack of financial knowledge makes navigating loan options difficult.

Understanding your business’s financials is crucial when seeking funding. However, the array of financing options available, from traditional bank loans to newer peer-to-peer lending, can be overwhelming. Recognizing this, Tracy opts to enhance her financial skills through online finance courses.

Upon completing her courses, Tracy gains the following valuable insights:

- Monitoring credit scores is important as it can greatly impact the terms of a loan.

- Maintaining clear financial records boosts your credibility with lenders and offers better loan options.

- Explore grants designed for women-owned businesses can provide funding opportunities not typically available through traditional lenders.

- Compare different loan offers to determine which gives you the best interest rates and terms.

- Consult with financial advisors to tailor loan options to suit your business needs.

- Finally, before signing any loan agreement, it is crucial to carefully read all the details, terms, and conditions.

Using the newfound knowledge, Tracy was able to seek guidance from a financial advisor and secure a loan suitable for her bakery.

Future of Financial Education

The shift toward digital learning in finance is undeniable. Online platforms are not just alternative educational resources; they are becoming the go-to choice for entrepreneurs seeking to deepen their understanding of financial concepts and practices. Emerging trends suggest that interactive courses, real-time simulations, and AI-driven personalized learning paths enhance the online financial education experience. These innovations promise to make financial education even more accessible and impactful for women entrepreneurs worldwide.

Final Thoughts

While the entrepreneurial journey for women may be filled with challenges, especially with handling finances, having the right financial knowledge can be super helpful. By harnessing the potential of online learning platforms, women can build solid foundations for their businesses. Encouraging a culture of continuous learning and smart financial planning among women entrepreneurs will help create a more dynamic business world.

Recommended Articles

We hope this article on Financial literacy for women was informative and helpful. You can also refer to the articles below for more information.