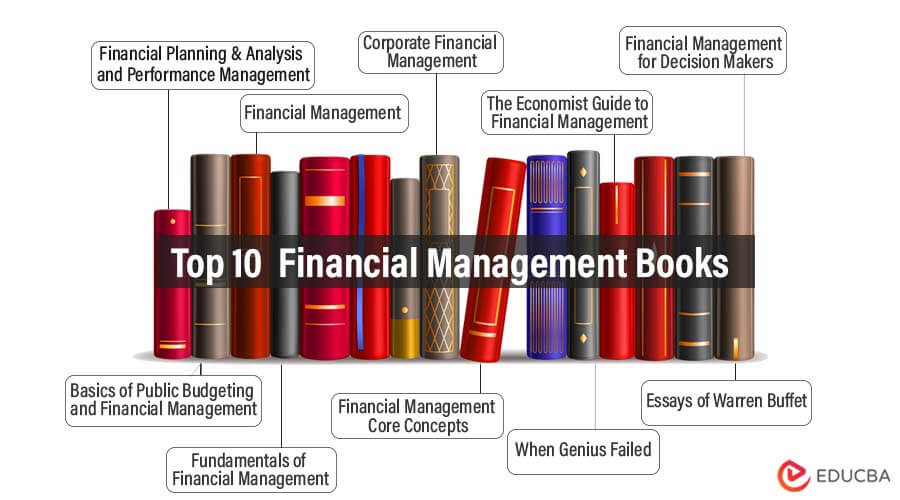

Best Books to Learn Financial Management

Financial Management is about planning, organizing, and managing an organization or individual’s financial resources to meet financial objectives. The list given below helps the readers grasp the concepts of financial management. The books have many practical and real-life examples to understand these concepts better.

Here is a list of the top 10 financial management books:

| # | Financial Management Books | Author | Published | Rating |

| 1 | Financial Planning & Analysis and Performance Management | Jack Alexander | 2018 | Amazon: 4.4

Goodreads: 4.41 |

| 2 | Financial Management: Theory and Practice | Michael Ehrhardt and Eugene Brigham | 2013 | Amazon: 4.3

Goodreads: 4.23 |

| 3 | Corporate Financial Management | Glen Arnold and Deborah Lewis | 2019 | Amazon: 4.2

Goodreads: 3.89 |

| 4 | The Economist Guide to Financial Management: Principles and Practice | John Tennent | 2014 | Amazon: 4.5

Goodreads: 4.03 |

| 5 | Financial Management for Decision Makers | Dr. Peter Atrill | 2019 | Amazon: 4.3

Goodreads: 4.00 |

| 6 | The Basics of Public Budgeting and Financial Management | Charles E. Menifield | 2020 | Amazon: 4.4

Goodreads: 3.00 |

| 7 | Fundamentals of Financial Management | Eugene Brigham and Joel Houston | 2018 | Amazon: 4.4

Goodreads: 3.54 |

| 8 | Financial Management: Core Concepts | Raymond Brooks | 2018 | Amazon: 4.5

Goodreads: 3.89 |

| 9 | When Genius Failed: The Rise and Fall of Long-Term Capital Management | Roger Lowenstein | 2001 | Amazon: 4.6

Goodreads: 4.20 |

| 10 | The Essays of Warren Buffett: Lessons for Corporate America | Warren Buffett and Lawrence Cunningham | 2019 | Amazon: 4.7

Goodreads: 4.29 |

Given below are the reviews and key points from the top 10 financial management books listed above:

Book #1: Financial Planning & Analysis and Performance Management

Author: Jack Alexander

Buy this book here.

Review:

The book provides a thought-provoking discussion on some critical areas of financial management. It also offers a fresh perspective on financial and operational areas impacting a company’s efficiency. The author uses various visual representation tools, like dashboards, graphs, etc., to illustrate complex financial concepts.

Key Points:

- This book covers financial communication, budgeting and forecasting, performance management, benchmarking, and analysis.

- It is an ideal reference book for CFOs, investment bankers, equity and debt research executives, and market analysts.

- This book provides critical insights into core segments associated with an organization’s financial efficiency.

Book #2: Financial Management: Theory and Practice

Author: Michael Ehrhardt and Eugene Brigham

Buy this book here.

Review:

This book should help readers grasp key concepts in financial management. It offers practical tools for better decision-making. The author also provides insights into the world’s financial crises and the importance of finance.

Key Points:

- The book covers various topics, like strategic finance and core fundamentals of financial management.

- This book has concepts that should help develop effective financial management strategies.

- The author also links real-world events with corporate financial decision-making.

Book #3: Corporate Financial Management

Author: Glen Arnold and Deborah Lewis

Buy this book here.

Review:

The author offers a detailed analysis of the theory and practice of financial management. Students or working professionals in finance, accounting, and business management can refer to this book for practical illustrations of the corporate financial management process.

Key Points:

- This book includes several topics such as risk management, returns, sourcing of finance, and appraisal of investments.

- This book provides real-world case studies to help you understand the intricacies of financial management.

- It focuses on corporate values to be mindful of when undertaking financial management.

Book #4: The Economist Guide to Financial Management: Principles and Practice

Author: John Tennent

Buy this book here.

Review:

It is a practical guide for managers to understand the basic principles of financial management. This book also covers complex topics such as the preparation of budgets, understanding variance reports, and preparing investment proposals for new ventures.

Key Points:

- This book provides finance managers with simple and efficient ways to understand financial jargon, management accounts, performance reports, statements of accounts, budgeting, and pricing.

- This book should help readers understand the basic principles of financial management.

Book #5: Financial Management for Decision Makers

Author: Dr. Peter Atrill

Buy this book here.

Review:

The author tries an innovative and open learning approach to explain the core principles of financial management. This book highlights the importance of prompt decision-making in corporate finance in a simple and non-technical manner.

Key Points:

- The author focuses on the practical application of financial management.

- Readers that do not have accounting or finance backgrounds can refer to this book for an introduction to financial management.

- The primary topics covered by the author are financial planning, financing a business, and capital investment decisions. These will be useful for professionals with a non-finance background to understand financial management.

Book #6: The Basics of Public Budgeting and Financial Management

Author: Charles E. Menifield

Buy this book here.

Review:

This book provides readers with the theoretical concept and the practice of budgeting and financial management. Readers of this book would get a strong foundation about budgeting and its impact on financial management across industries.

Key Points:

- The insights provided in this book indicate the author’s vast practical experience.

- This book offers critical insights into financial management and budgeting.

- A unique feature of this book is that it contains an elaborate step-wise approach to understanding budgeting.

Book #7: Fundamentals of Financial Management

Author: Eugene Brigham and Joel Houston

Buy this book here.

Review:

This book contains updated trends and practices from corporate financial management. It adopts a simple approach to set out the fundamentals of financial management.

Key Points:

- The book covers topics such as federal debt and the current situation of financial markets.

- It is a good book for clearing fundamental concepts about managing financial resources.

- It also contains some of the most pressing issues plaguing the corporate world.

- The simple language and real-life examples used in this book should help readers develop a strong foundation of financial management concepts.

Book #8: Financial Management: Core Concepts

Author: Raymond Brooks

Buy this book here.

Review:

Raymond Brooks introduces various tools and fundamental concepts in the initial chapters. In the succeeding chapters, he teaches how to use those concepts and tools in financial management processes.

Key Points:

- The book contains interesting concepts such as spreadsheet issues, annual financial statements, and understanding and analyzing yield curves.

- Readers will get a comprehensive idea about financial operations by reading this book.

- It focuses on explaining the theoretical concepts of financial management and their application in the real world.

Book #9: When Genius Failed: The Rise and Fall of Long-Term Capital Management

Author: Roger Lowenstein

Buy this book here.

Review:

The author gives an insight into corporate finance by narrating the history of hedge funds. This book is an intriguing tale about the rise of capital investments and their eventual fall – leading to a stability crisis for financial institutions. It uses the hedge fund’s Long-Term Capital Management failure as a case study to understand the importance of proper financial management.

Key Points:

- The author creates a gripping story by referencing interviews with experts and confidential internal memos.

- This book provides some gripping details about the sudden rise and eventual fall of the American hedge fund Long-Term Capital Management.

- The book describes the factors that led to the fall of John Merriweather, the founder of the iconic hedge fund Long-Term Capital Management.

Book #10: The Essays of Warren Buffett: Lessons for Corporate America

Author: Warren Buffett and Lawrence Cunningham

Buy this book here.

Review:

The book guides financial management to new and experienced readers. In this book, veteran investor Warren Buffett shares his mantra about managing corporate finances.

Key Points:

- The collaboration between Cunningham and Buffett offers invaluable insights into corporate financial management from a real-world perspective.

- This book contains observations about the ideal financial management process.