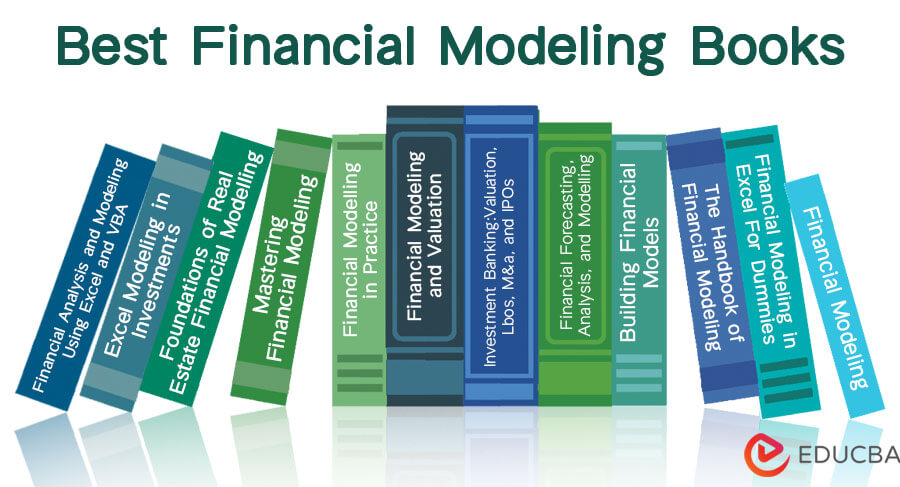

Financial Modeling Books – Introduction

Financial modeling books offer practical guidance and tools for building effective financial models, analyzing financial data, and making smart business decisions. They teach various techniques, valuation methods, Excel functions, and VBA programming. These books are valuable resources for business owners, entrepreneurs, financial analysts, and professionals seeking to enhance their financial modeling skills.

Here is a list of the best books to help readers understand financial modeling. Whether you want to expand your knowledge or improve your career opportunities, these top 13 financial modeling books are a great way to learn financial modeling for beginners and experts.

| # | Financial Modeling Books | Author | Publishing Year | Rating |

| 1. | Financial Modeling | Simon Benninga | 2014 | Amazon: 4.5 Goodreads: 4.02 |

| 2. | Foundations of Real Estate Financial Modelling | Roger Staiger | 2015 | Amazon: 3.4

Goodreads: 4.28 |

| 3. | Mastering Financial Modeling: A Professional’s Guide to Building Financial Models in Excel | Eric Soubeiga | 2013 | Amazon: 4.0

Goodreads: 3.71 |

| 4. | Financial Modelling in Practice: A Concise Guide for Intermediate and Advanced Level | Michael Rees | 2011 | Amazon: 3.2

Goodreads: 3.91 |

| 5. | Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private Equity | Paul Pignataro | 2013 | Amazon: 4.6

Goodreads: 4.28 |

| 6. | Investment Banking: Valuation, Lbos, M&a, and IPOs | Joshua Rosenbaum, Joshua Pearl, Joseph R. Perella, Joshua Harris | 2021 | Amazon: 4.3

Goodreads: 4.65 |

| 7. | Financial Forecasting, Analysis, and Modelling: A Framework for Long-Term Forecasting | Michael Samonas | 2015 | Amazon: 4.2

Goodreads: 4.00 |

| 8. | Building Financial Models | John Tjia | 2009 | Amazon: 4.4

Goodreads: 3.82 |

| 9. | Financial Modeling for Business Owners and Entrepreneurs | Tom Y. Sawyer | 2014 | Amazon: 4.5

Goodreads: 4.18 |

| 10. | The Handbook of Financial Modeling | Jack Avon | 2013 | Amazon: 4.2

Goodreads: 3.75 |

| 11. | Financial Modeling in Excel For Dummies | Danielle Stein Fairhurst | 2017 | Amazon: 4.4

Goodreads: 3.92 |

| 12. | Excel Modeling in Investments | Craig W. Holden | 2014 | Amazon: 4.0

Goodreads: 4.40 |

| 13. | Financial Analysis and Modeling Using Excel and VBA | Chandan Sengupta | 2009 | Amazon: 4.0

Goodreads: 3.94 |

Now, let us review each book to help you select the right one for your financial modeling requirement.

Book #1: Financial Modeling

Author: Simon Benninga

Get the book here.

Review

The book is an extensive guide to financial modeling covering various topics, including accounting principles, financial statement analysis, forecasting, and valuation, offering readers a deep understanding of finance tools and techniques. This book also explores major subject areas such as Finance for Corporations, Portfolio administration, and Spreadsheets in Excel.

This book shows how to create basic and advanced models in corporate finance, portfolio management, etc., with the help of Excel templates.

Key Points

- The book introduces financial modeling and analysis, starting from basic accounting principles and advancing to topics like M&A and financial restructuring. It provides useful tools like financial ratios and teaches techniques for forecasting and valuation.

- In the latest edition, the author has included new features like the fundamentals of Monte Carlo methods and their application in portfolio management and exotic option valuation.

- Additionally, a new chapter focuses on term structure modeling, particularly the Nelson-Siegel model.

- It also emphasizes data collection and modeling assumptions to create accurate financial models step-by-step.

Book #2: Foundations of Real Estate Financial Modeling

Author: Roger Staiger

Get the book here.

Review

The book offers a simple yet comprehensive guide to financial modeling for real estate projects. It covers essential topics such as amortization, equity division, financial statements, and different asset classes. The book emphasizes key investment principles like Return on Capital and Return on Capital. It gives special attention to a crucial investment metric – the net present value.

Key Points

- The book helps readers connect theory with practical application in building financial models.

- It shows how to create scalable, reusable, and portable financial models. The focus is establishing a consistent model development process rather than creating individual models from scratch.

Book #3: Mastering Financial Modeling: A Professional’s Guide to Building Financial Models in Excel

Author: Eric Soubeiga

Get the book here.

Review

In this book, you will find real-life examples that connect the formula and approach used in balance sheets. You will learn how to create your own cash flow model using income statements and a balance sheet, even if you only have basic knowledge of finance and accounting.

Key Points

- The book teaches you how to build financial models from scratch and utilize Excel features like pivot tables and macros to automate tasks and improve efficiency.

- It covers advanced financial modeling techniques like scenario analysis, Monte Carlo simulation, and sensitivity analysis.

- You will also get practical guidance on using financial models for forecasting, budgeting, and valuation purposes.

- The book includes numerous real-world examples and case studies demonstrating how to apply these techniques to business situations.

Book #4: Financial Modeling in Practice: A Concise Guide for Intermediate and Advanced Level

Author: Michael Rees

Get the book here.

Review

The author explains financial modeling at intermediate and advanced levels in this book. It emphasizes the significance of a structured approach to financial modeling and guides on building accurate Excel models. The book covers crucial topics such as Financial statement modeling, Cash flow analysis, Risk assessment, and Options. The author shares Excel functions commonly used in more advanced models, drawing from their extensive experience.

Key Points

- The author emphasizes the importance of a structured approach to financial modeling.

- The book teaches techniques for forecasting and budgeting, including sensitivity analysis and scenario analysis.

- It uses data analysis tools like regression and correlation analysis in financial modeling.

Book #5: Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private Equity

Author: Paul Pignataro

Get the book here.

Review

In this book, you will find a detailed case study of Walmart, which showcases the company’s financial situation and the process of creating a sophisticated financial model, similar to what professional Wall Street analysts do. It serves as a comprehensive guide for those aspiring to work in investment banking and private equity industries.

The book explores valuation techniques, including calculating LTM data, smoothing EBITDA, and determining Net Income. Each chapter ends with questions, practice models, additional case studies, and common interview questions designed to help readers progress in financial modeling.

Key Points

- It provides a step-by-step approach to financial modeling using Wall Street models as a guide.

- Even Excel beginners can benefit from the book, as it offers hotkeys and clear instructions for Excel usage.

- The book covers important financial statements like Income statements, Cash Flow statements, and Balance sheets, along with techniques for balancing them.

- It also covers Depreciation Schedules (including accelerating depreciation and deferring taxes), working capital schedules, debt schedules, and handling circular references.

Book #6: Investment Banking: Valuation, LBOs, M&A, and IPOs

Authors: Joshua Rosenbaum, Joshua Pearl, Joseph R. Perella, Joshua Harris

Get the book here.

Review

This book teaches readers how to value businesses and make deals, which are fundamental aspects of Wall Street activities. It explains vital financial concepts like DCF, M&A, LBO, and IPO and provides insights into how competitive companies operate and conduct transactions. The book uses a step-by-step approach to help readers understand finance, build their financial knowledge, and grasp important concepts effectively. It is suitable for those pursuing careers in finance or students studying finance.

Key Points

- Important features of the book include up-to-date information on IPOs and valuable insights into the US exchange NASDAQ and the global law firm Latham & Watkins LLP.

- Additionally, the book offers downloadable templates for valuation models, analysis of top transactions, and Discounted Cash Flow analysis.

- Readers can access downloadable resources for Leveraged Buyout Analysis, IPO Valuation, and M&A Analysis, along with free online access to Wiley Investment Banking Valuation for six months.

Book #7: Financial Forecasting, Analysis, and Modeling: A Framework for Long-Term Forecasting

Author: Michael Samonas

Get the book here.

Review

Financial professionals benefit from Financial Forecasting, Analysis, and Modeling as it provides a comprehensive framework for making long-term financial forecasts. This book helps in planning and budgeting effectively. It teaches readers to utilize Excel for creating these long-term projections and emphasizes the importance of Sensitivity and Monte Carlo Simulation in modern financial planning.

Key Points

- Readers can learn to use Excel and create long-term projection plans.

- The book guides the development of a more proactive strategy by using appropriate models and applying risk and uncertainty projections.

- Topics include Excel Scenario Manager, Sensitivity Analysis, Monte Carlo Simulation, and other tools.

Book #8: Building Financial Models: The Complete Guide to Designing, Building, and Applying Projection Models

Author: John S. Tjia

Get this book here.

Review

This book explains how to design, build, and implement valuation projection models to keep accounting and finance professionals competitive in today’s market. It includes topics of Building Financial Modeling like Modeling of Discounted Cash Flows, Model mechanics of projection, Cash sweepstakes, etc. It teaches one of the most valuable skills in corporate finance, as in Wall Street, to effectively create and interpret financial models.

Key Points

- The book offers the new discounted cash flow (DCF) modeling coverage.

- It shows how to use Excel formulas to perform complex calculations within a spreadsheet.

- It includes extensive explanations of projection model principles and mechanics.

Book #9: Financial Modeling for Business Owners and Entrepreneurs

Author: Tom Y. Sawyer

Get this book here.

Review

Financial Modeling for Business Owners and Entrepreneurs shows how to create financial models to raise capital, make informed decisions, predict sales, hire and invest wisely, plan projects, increase ROI, and enhance overall operations. The book guides on developing organizational concepts, staffing, and forecasting related costs. It also covers the critical aspect of evaluating the life cycle cost of sales and marketing functions and modeling fixed and variable costs for the company’s products and services.

Key Points

- The book teaches how to use Excel for financial modeling to plan and predict business finances.

- It explains how to make forecasts and budgets for revenue, expenses, and cash flow.

- You’ll learn how to create models to raise capital for startups or any business stage and how to plan projects and new ideas.

- The book also demonstrates using financial models to make intelligent business choices with real-life examples and case studies, including scenario and sensitivity analysis.

- Lastly, it emphasizes the importance of determining a company’s worth for analysts during a sale or merger.

Book #10: The Handbook of Financial Modeling: A Practical Approach to Creating and Implementing Valuation Projection Models

Author: Jack Avon

Get the book here.

Review

The book helps readers understand how to measure a company’s activities using financial models and make predictions about future earnings. The author’s experience in finance and business model building makes this book a valuable step-by-step guide for creating models from the ground up. It also provides a brief history of financial modeling and insights into building models in Excel.

Key Points

- Readers learn about finance and accounting concepts and how to build models.

- The book provides valuable insights for target users while constructing financial models.

- It teaches readers to plan, design, and create models to solve everyday problems using spreadsheets.

Book #11: Financial Modeling in Excel For Dummies

Author: Danielle Stein Fairhurst

Get this book here.

Review

This book is a practical guide to financial modeling in Excel, providing readers with a solid understanding of the tools and techniques used in financial analysis and modeling. The book guides the reader in building financial models in Excel, including data collection, modeling assumptions, and basic Excel functions such as conditional formatting, data validation, and charting.

Key Points

- The book covers forecasting techniques like time series analysis, regression analysis, and Monte Carlo simulation, as well as various valuation methods, including DCF analysis, relative valuation, and option pricing models.

- It includes sensitivity analysis techniques like scenario analysis and data tables and covers advanced Excel functions like pivot tables, array formulas, and VBA.

- This also includes real-world examples of financial models, such as business valuation and project finance models. It also covers data visualization techniques like charts, graphs, dashboards, and financial statement analysis techniques, including ratio and trend analysis.

- It covers best practices for financial modeling, including documentation, error checking, and auditing techniques.

Book #12: Excel Modeling in Investments

Author: Craig W. Holden

Get this book here.

Review

This book takes a practical approach to financial modeling in Excel, specifically focusing on investments. It explores crucial topics like portfolio management, asset pricing, and risk management. Starting with an introduction to fundamental Excel functions used in financial modeling, the book also includes comprehensive coverage of financial statement creation and analysis, encompassing balance sheets, income statements, and cash flow statements.

Key Points

- This book covers essential valuation techniques, including DCF analysis, comparable company analysis, and precedent transactions analysis. Additionally, it delves into risk considerations with sensitivity analysis, scenario analysis, and Monte Carlo simulation in financial modeling.

- Readers will also learn portfolio optimization techniques like the efficient frontier and CAPM. The book provides practical insights through real-world examples and case studies, illustrating how to apply financial modeling techniques to investment situations.

- This book is a must-read for anyone keen on financial modeling and investment analysis using Excel. It caters to finance professionals, students, and investors, offering valuable industry techniques and concepts.

Book #13: Financial Analysis and Modeling Using Excel and VBA

Author: Chandan Sengupta

Get this book here.

Review

This book is a practical and indispensable guide to utilizing Microsoft Excel and VBA for financial modeling and analysis. It enables readers to grasp crucial Excel functions for financial analysis and provides step-by-step instructions on analyzing financial statements, including balance sheets, income statements, and cash flow statements.

Key Points

- This book is a must-read for anyone interested in financial modeling and analysis using Excel and VBA. It offers a comprehensive overview of industry techniques and concepts, enabling readers to excel in their financial endeavors actively.

- Readers can learn valuable skills, such as discounted net present value, cash flow, internal rate of return for valuation, sensitivity, scenario, and Monte Carlo simulation for risk analysis. Moreover, the book covers finance-related topics like valuation, risk analysis, and portfolio optimization techniques.

- In addition, readers will be taught how to leverage VBA for task automation and creating complex models with real-world examples and case studies.

Recommended Books

We hope this EDUCBA guide on the top 13 financial modeling books was helpful. For further information, EDUCBA recommends these articles,