Updated October 11, 2023

Introduction to Financial Modeling Techniques

A financial model represents a company’s financial performance for both the past and future. Models are very cohesive; building a financial model in Excel is also advisable.

Knowledge of Excel, accounting and financial modeling techniques, corporate finance, and understanding the company’s operations are some of the financial modeling skill sets required in an individual to build a model.

Financial Modeling Techniques

Mr. Raj, a research analyst, prepared a financial model for company ABC and unfortunately got sick and went on leave. During his absence, the market moved precisely opposite to his expectations, and the financial model of company ABC required changes as per the current situation. Due to Mr. Raj’s Absence, his assistant, Mr. Saurabh, is asked to incorporate the necessary changes in the financial model of company ABC.Mr. Raj knew how to prepare a financial model but lacked knowledge of crucial financial modeling techniques.

Mr. Saurabh opens the model and gets confused looking at the model as he is not able to find out which one is the suitable cell in which changes need to be incorporated. In some cells, due to interlinkages, no value can be seen.

What do you think? Why did Mr. Saurabh face a lot of problems with the financial model? Do you think a model another person cannot understand is a good model?? In my opinion, the answer to this question is No.

A good financial model should always be:-

- It is realistically based on reasonable and defensible assumptions and projections.

- Flexible and adaptable to dynamic working schedules (or modules)

- Easy to follow, should not intimidate the reader

I was wondering how a model can have these features. So, let’s learn some essential financial modeling techniques and make a model flexible and easily understood.

Financial Modeling Techniques are as Follows

Financial Modeling Techniques 1 – Historical Data

Your assumption for the future years is based on your history. So, gathering the correct data from the right source is essential. While collecting data, remember that you are an analyst, not an auditor. So if the annual reports published by the company do not tally, don’t panic and sit to tally them.

Financial Modeling Techniques 2- Assumption

Financial models need to have clear and well-defined assumptions, referred to as ‘drivers’ or ‘inputs’; these are based on a thorough understanding of the business.

Assumptions should reflect business realities and expectations

To come up with an assumption, analyzing history plays a vital role. To explore the history, one should do a ratio analysis of the company financials and come up with answers to specific questions like

- Whether a certain ratio has declined or is growing

- What are the reasons behind this declining or growing percentage

- How would it affect the future

The other criteria that one should consider while making an assumption are

- No bias should get into the assumptions of the business

- Understanding the expected changes in future performance

- Understand Management expectations

- Check out what other analysts think about the company

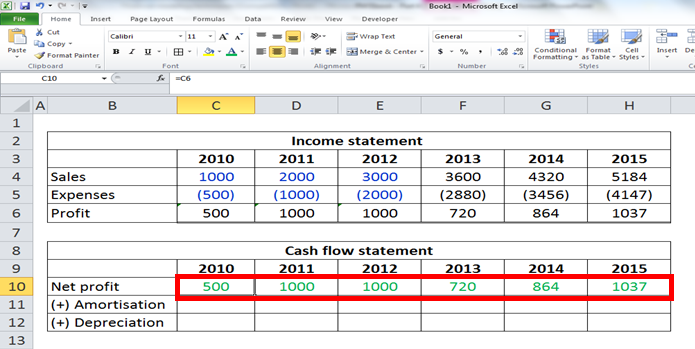

Financial Modeling Techniques 3 – Color Coding /Linkages

Formatting is essential in anything you prepare. In financial modeling, color coding is one formatting one needs to take care of.

Consider an example and try to understand why color coding is so necessary.

You have prepared a financial model, but the color of all the numbers is the same, and you are on leave. Some essential news has been published that would change your assumptions about that particular company, and your colleague wants to come up with the target price. Your colleague has to change certain things in the model to create a target price. Since it is the same color throughout, your colleague finds it challenging to find a suitable cell for changes.

What can be done to overcome this situation?

The correct color coding would solve this problem. So, there should always be different color coding for Historical inputs, formulas, and linkages. This would help your colleague to understand the financial model and make the necessary changes in the correct cell.

We have used specific color coding.

Historical Inputs in Blue

Formulas in Black Linkages in green

Financial Modeling Techniques 4 – A Circular Reference

A circular reference is a series of references where the last object references the first, resulting in a closed loop.

I got confused; let’s understand this with the help of an example.

We need to calculate the net income from the income statement. While calculating the net income, interest income is one item that needs to be calculated. We are calculating net income as a percentage of the ending cash and cash balances calculated in the cash flow statement. Over here, we assume the entire cash balance we deposited in a bank.

| Income Sheet (Rs m) | Year 1 |

|---|---|

| Net Sales | |

| (-)Direct Costs | |

| Gross Profit | |

| (-)Selling, General & Admin Costs | |

| EBITDA | |

| (-)Depreciation/Amortisation | |

| EBIT | |

| (-)Interest Expense | |

| (+)Interest Income | |

| Pretax Income | |

| (-)Income Taxes | |

| Net Income |

Here, to calculate the correct net income, we need to calculate interest income. Interest income will not be calculated unless we prepare a cash flow statement. So, let’s see what is required to prepare the cash flow statement.

| Cash Flow Statement | Year 1 |

|---|---|

| Operating Activities | |

| Net Income | |

| Depreciation/Amortization | |

| Change in Working Capital | |

| Cash Flow from Operating Activities | |

| Investment Activities | |

| Capital Expenditures | |

| Additions to Intangibles | |

| Cash Flow from Investing Activities | |

| Financing Activities | |

| Issuance/ (Repayment) of Long-Term Debt | |

| Issuance/ (Repurchase of) Equity | |

| Cash Flow from Financing Activities | |

| Net Change in Cash | |

| Beginning Cash Balance | |

| Ending Cash Balance |

So we can see here we need net income to calculate the ending cash balance, which will be used in calculating interest income.

| Cash balances | Year 1 |

|---|---|

| Average Cash Balance | |

| Interest Rate | |

| Interest Income |

So, let’s see how well we do this.

First, we will calculate net income by considering interest income as 0.

This net income will be linked to the cash flow statement to find the ending cash balance.

Then, this ending cash balance will be linked to average cash balances, which will help us calculate the interest income.

Later, we will link this interest income to the income statement and find the right net income balance.

So, you must wonder whether the new net income figure will be reflected in the cash flow statement.

Yes, through circular reference, this entire process will be done automatically, and accordingly, the other figures in the income statement, balance sheet, and cash flow statement will also be changed.

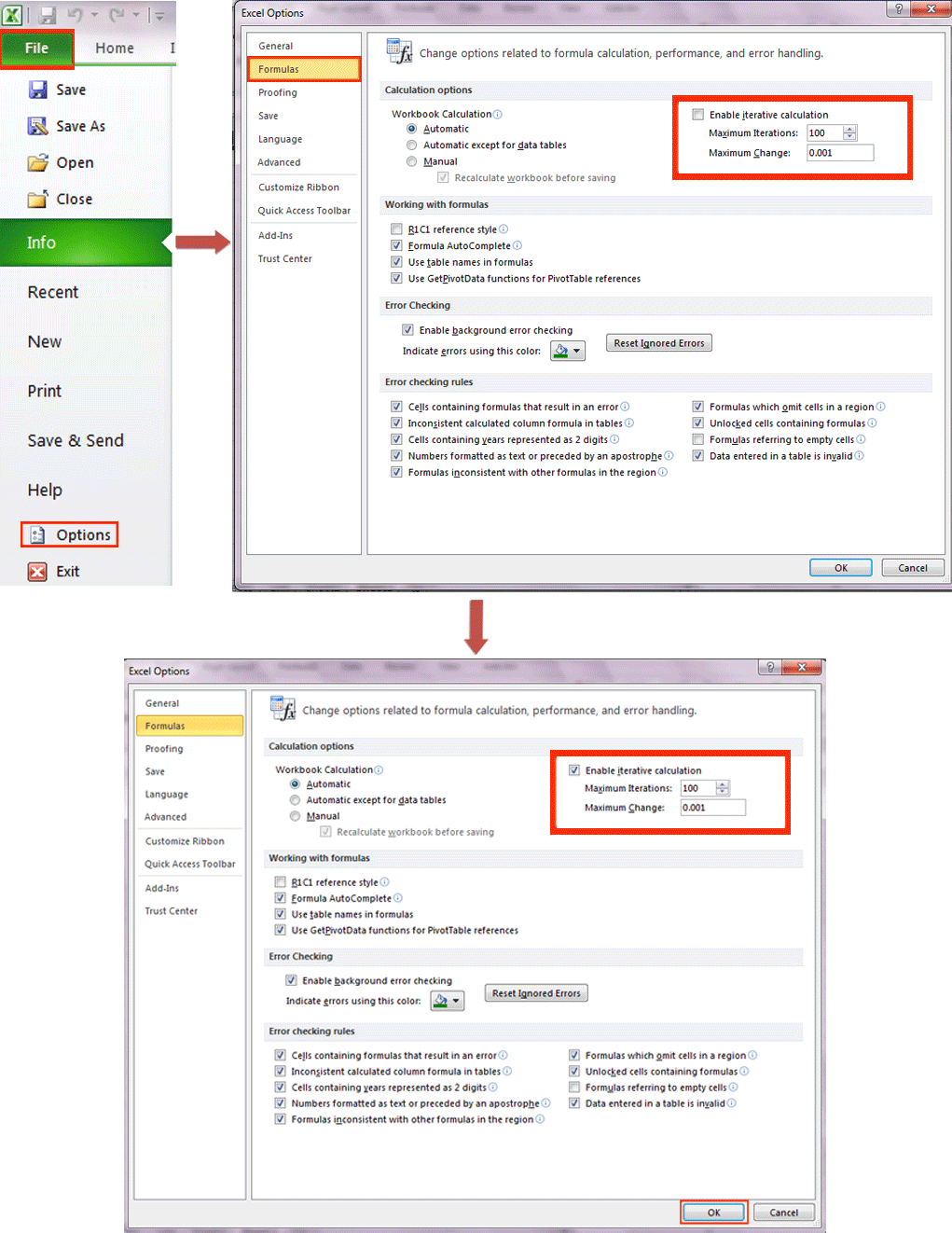

But remember that excel cannot calculate automatically when the model contains a circular reference.

We need to Turn ON “Iterations” to resolve the situation

Let’s see how you do that

Go to

File >>>Options >>>> Formulas >>>>> Enable iterative calculation >>>> OK

You can refer to our Financial Modeling Training course for in-depth knowledge of financial modeling techniques.

Infographic

Learn the juice of this article in just a single minute: Financial Modeling Techniques Infographic.

Recommended Articles

This has been a guide to the Financial Modeling Techniques, which are easy to remember. This post is a complete heads-up on Financial Modeling Techniques to make a financial model easy to understand.

Here are some articles that will help you get more details about Financial Modeling Techniques, so go through the link.