Build a Financial Plan for Your Marketing Strategy

Marketing is the heartbeat of any organization. A strong marketing strategy can drive brand awareness, generate leads, and increase sales. However, an effective marketing strategy is not just about creative ideas and clever campaigns. It also requires careful financial planning to allocate resources optimally and achieve goals within budget. A financial plan for marketing strategy helps tie your marketing efforts to business objectives, prioritize initiatives, and measure ROI effectively.

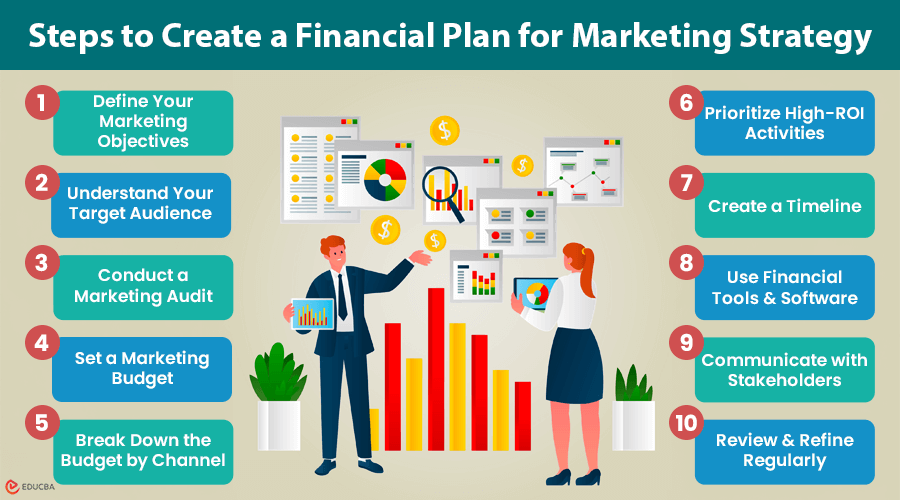

Steps to Create a Financial Plan for Marketing Strategy

Here is a step-by-step guide on how to build a financial plan for your marketing strategy:

#1. Define Your Marketing Objectives

It is important to establish clear marketing objectives before preparing a budget plan. Increasing brand awareness, fostering leads, achieving high sales volume, entering a new market, or increasing customer retention requires specific strategies and budgets. Therefore, having the financial plan aligned with those objectives would ensure proper resource allocations to achieve the desired outcomes.

#2. Understand Your Target Audience

It is essential to inform the audience before allocating a budget. Analyze the demographics, preferences, and behavior of the audience. Then, check which platforms they visit and what type of content they consume. All these will guide you in deciding where to spend the advertising budget for social media, influencer-based marketing, content marketing, or offline promotions.

#3. Conduct a Marketing Audit

A marketing audit is necessary to evaluate existing efforts and identify areas for improvement. Review past campaigns to understand their ROI, assess website traffic and conversion rates, and check customer acquisition costs (CAC). This will help you identify the most impactful aspects of your marketing strategy and prioritize them in your financial plan.

#4. Set a Marketing Budget

Set a realistic budget. The financial plan is not complete without this most basic step. Most businesses have 5–10% of their annual revenue going towards marketing, and startups will have an even higher percentage because of brand awareness. Both fixed costs, such as salaries, software subscriptions, and annual sponsorships, and variable costs, such as paid advertisements, freelance services, and campaign-specific expenses, must be included in your budget. Additionally, set aside a contingency fund to handle unexpected opportunities or challenges, such as a PR crisis or trending topics.

#5. Break Down the Budget by Channel

Distribute your marketing budget across different channels based on audience insights and objectives. Key areas include:

- Digital marketing (SEO, PPC, social media ads, email marketing)

- Content creation (blogs, videos, infographics)

- Offline marketing (print ads, TV, radio)

- Events and sponsorships (trade shows, local partnerships)

- Influencer marketing

Use data from past campaigns to estimate the costs and returns of each channel and invest in the most effective ones.

#6. Prioritize High-ROI Activities

Marketing is not the same in all cases. Check which actions are top-notch for that ROI and invest more. For example:

- If email marketing proves to be a profitable form of conversion, then invest a significant amount of money in the broader email database and more fine-tuned campaigns.

- If Facebook Ads produce a lower cost per lead than traditional ads, shift budgets to that avenue.

- If SEO generates high-quality organic traffic and boosts long-term visibility, allocate resources to optimize your website, produce valuable content, and build strong backlinks.

This data-driven approach ensures that you are focusing all your efforts and time on the best strategies for your budget.

#7. Create a Timeline

A good financial plan for marketing includes a timeline for when you will spend your marketing dollars. Schedule marketing activities to spread expenses evenly throughout the year:

- Allocate most of the budget for peak holiday seasons or special promotions.

- Reserve funds for product launches or limited-time offers.

- Set aside consistent spending for evergreen content, like blogs and SEO.

A timeline helps prevent overspending and ensures resources are available for ongoing initiatives. Meeting deadlines and maintaining organization are made easier using project management software.

#8. Use Financial Tools and Software

Tracking marketing expenses manually can be tedious and error-prone. Invest in financial tools that integrate with your marketing platforms to streamline the process. For example:

- Google Analytics to track website performance and measure campaign ROI.

- HubSpot to manage marketing activities and expenses.

- QuickBooks or FreshBooks to handle budgeting and accounting.

These tools offer real-time data, allowing you to make informed financial choices and manage your budget efficiently. Additionally, investing in SaaS application development can automate processes, enhance reporting, and provide better insights for your financial plan.

#9. Communicate with Stakeholders

Transparency is crucial when presenting financial plans to stakeholders. Use pie charts or bar graphs clearly defined to demonstrate the allocation of funds across channels. Highlight the projected outcomes and ROI to justify the spending.

Regular updates on performance and changes keep stakeholders at arm’s length and in the loop.

#10. Review and Refine Regularly

Financial plans are not just one document. They are regularly adapted and adjusted as budgets and performance metrics indicate how to improve. This iterative process sustains the marketing strategy, business goals, and market context.

- Monthly Reviews: See the current campaigns and their expenses.

- Quarterly Adjustments: Reallocate funds according to performance.

- Annual Audits: Trends Long-term analysis in the overall results and established objectives.

Final Thoughts

Creating a financial plan for marketing strategy is crucial to achieving your business objectives efficiently. You can spend every marketing dollar wisely by setting clear goals, understanding your audience, focusing on high-ROI activities, and frequently evaluating your plan. A well-executed financial plan for marketing helps businesses compete effectively in the market and drives sustainable growth.

Author’s Bio

Mayur Bhatasana, Co-Founder and CEO of Jeenam Infotech LLP, is passionate about driving B2B and SaaS startups to new heights by mastering the art of strategic link-building.

Recommended Articles

We hope this guide on creating a financial plan for marketing strategy helps you understand how to allocate resources effectively. Check out these recommended articles for more insights on budgeting and planning for successful marketing campaigns.