Updated September 20, 2023

Financial Projections Definition

Financial projections forecast a company’s expected financial performance and position by presenting expected metrics such as projected revenue, expenses, capital expenditures, cash flows, etc.

Projections take the company’s data and financial statements into account, along with various external factors. It can project data over a specific period, typically lasting between a year, 5 years, or 10 years. An organization or individual puts together these projections to forecast future expenditures, earnings, assets, liabilities, profits, cash flows, capital spending requirements, etc.

Key Takeaways

- A financial projection predicts the business’s upcoming finances. They project future numbers, like costs, revenues, debt, cash flow, etc.

- It uses a balance sheet, cash flow, and income statement to make the projections.

- Projections are detail-oriented and conclude outcomes for hypothetical plans, while a financial forecast speculates an overall overview of the company’s future.

- It is an essential part of any business plan. It helps create budgets, identify potential risks & investment opportunities, and make decisions.

What is Financial Projection?

- Financial projections are a set of predictions about the Company’s financial future. Projections also use information like the company’s current and past data.

- The financial projection will also include assumptions made by management or other stakeholders.

- The assumptions mainly involve estimating changes in sales, prices, production costs, and taxes.

- Businesses use them for budgeting purposes, evaluating investment opportunities & risks, forecasting cash flow needs, and various business & financing decisions.

- Companies create it at the start of each year to understand their end-year financial situation.

- It is a valuable practice because it enables setting goals, identifying potential funding requirements, etc.

What Does Financial Projections Include?

Businesses can make projections to procure specific results. Thus, depending on the need, projections include specific financial metrics. Overall it takes into consideration the primary financial statements.

a) Balance Sheet

Organizations can assess their financial situation using a balance sheet. Equity firms must project their financial results three years in advance to calculate their break-even point. The three items that make up a balance sheet are,

- Assets – These are the company’s material possessions that have a monetary, material, or inventory value.

- Liabilities – A company’s liabilities are pending debts, accounts payable, or loans.

- Equity – It is the net difference between the company’s total assets and liabilities.

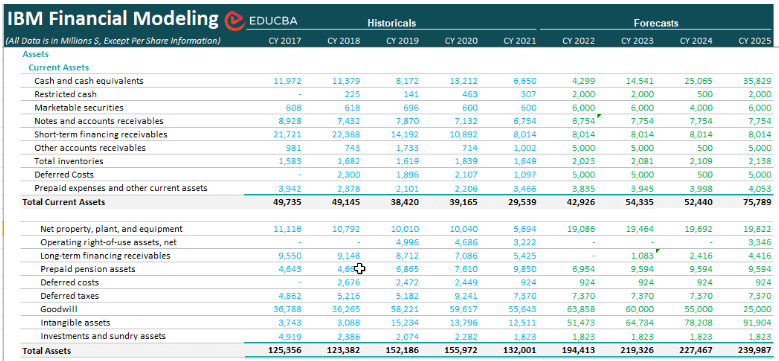

Here’s how a projected balance sheet looks like (Source: EDUCBA’s Financial Analyst Training):

b) Income Statement

The income statement summarizes how much money you’ve made, usually monthly or yearly. It is also known as the Profit and Loss statement and provides a quick snapshot of a company’s financial health. Some measures of the income statements are,

- Revenue: It is in line with the money earned from offered goods or services.

- Expense: You must be sure to account for all costs that the business will incur, including direct costs like equipment rental, materials, employee salaries, etc. Also include general and administrative expenses like advertising, bank fees, insurance, office leasing, legal and accounting fees, etc.

- Net Income: Net income is the final metric. We calculate it after subtracting all taxes, expenses, and interests from the revenue.

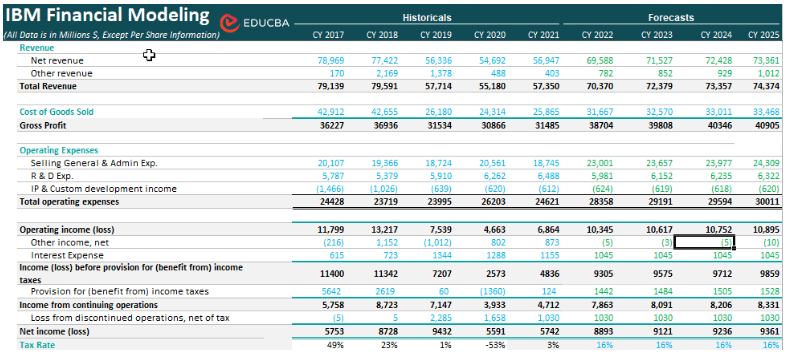

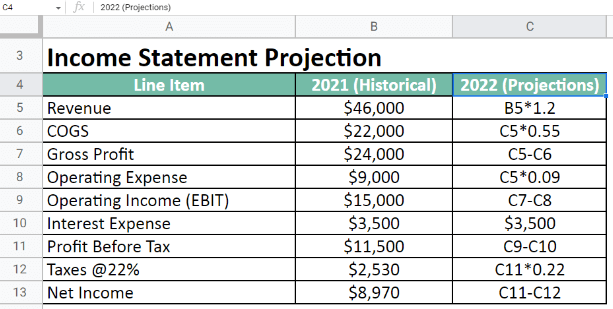

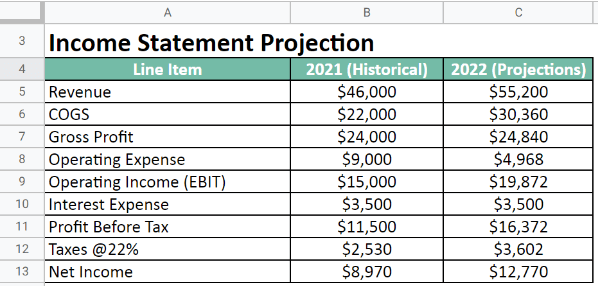

Here’s what a projected income statement looks like:

Cash Flow Projections

Cash flow projections help understand the company’s near-term cash needs. They show the amount of money coming in from operations and going out in expenses. Some measures of the cash flows are,

- Cash Revenue: This provides insight into whether the company has enough cash to meet expenses. It also identifies bottlenecks that need fixing. Therefore, the company can keep up with the business’s costs. The opposite of a cash flow bottleneck is an operating surplus. It means incoming revenue is more than outgoing expenditures.

- Cash Disbursements: It is a record of the company’s daily financial transactions. It can recognize negative and positive cash flows. It also helps determine the company’s solvency as well.

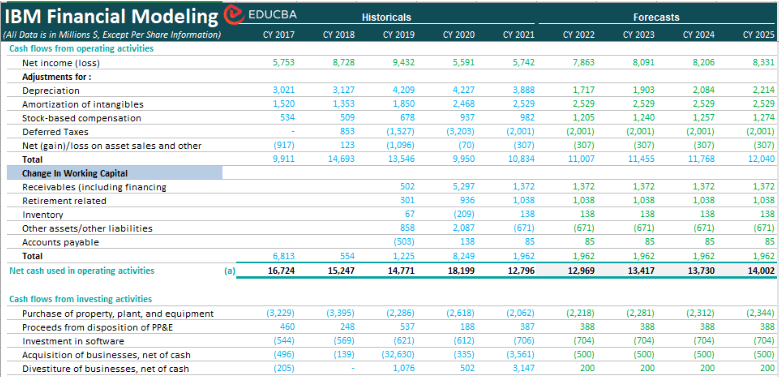

Here’s what a projected cash flow statement looks like:

How to Create Financial Projections?

1. Financial Projections for Business Plans

The primary method of projections is to project the various financial statements. First, we need to build the revenue and cost schedules. After this, we create projections for the balance sheet, income statement, and cash flow statements. Finally, we use those projections for business planning. However, during the process, we should keep in mind a few guidelines.

2. Make Assumptions & Identify Unpredictable Variables

- Assumptions are essential for effective projections. Thus, making appropriate and relevant assumptions is necessary.

- Make assumptions for cost, capital, and various metrics that act as crucial factors for the projection.

- We can estimate predictable variables using data from prior years, whereas we have to model unpredictable variables based on hypothetical scenarios.

3. Include Several Scenarios

- High-level financial projections take into account a variety of potential outcomes. They include different factors that influence the economic performance of the company. Growth rates, profit margins, and overheads are a few factors.

- While starting, one can suppose one of three possible outcomes: pessimistic, base, and optimistic. One can assess the variation in annual results based on these variables.

- In the pessimistic scenario, consider low sales growth, reduced profit margins, etc. Alternatively, we examine growth and profit margins above average in the optimistic scenario. Finally, the base scenario considers growth and profit margins in line with the historical average.

4. Use available Historical Data

- When a public company has been running for three years or longer, they have access to a sizable amount of historical data regarding revenue, debt, depreciation, interest expense, etc in its annual report.

- Analyze the data for patterns and use them to generate precise financial projections.

- For instance, if, historically, direct costs increase 1% for every 2% increase in sales, this trend may continue in the forthcoming years.

5. Think about your Financing Requirements

- Any projection that calls for a change in sales, positive or negative, will affect the company’s need for financing.

- For example, to increase sales, product-based businesses need to expand their inventory & capacity. At the same time, service-based companies must upgrade their infrastructure.

- For these investments, the company will need capital. Thus, they should factor potential capital requirements into the projections.

- They should also clearly state the company’s plans for ensuring additional liquidity, whether those plans involve bank loans, retained earnings, or capital contributions from partners.

6. Maintain Realism & Monitor

- It is preferable to be cautious rather than overly optimistic. The latter mindset may lead to poor investment and cost management decisions.

- Put the current year’s business projections into practice. Thus, companies can alter those suggestions in time if any problems arise.

- Create multi-year projections. Five-year projections are more beneficial for businesses. However, do monitor your forecasts and make adjustments as necessary.

Financial Projections for Startups/Small Businesses

Financial projections for startups and small businesses are no different than for other companies. However, these firms do not have historical or substantial data, so they need assistance. Here are a few suggestions for such businesses.

A) Benefit from Existing Businesses

- Some business owners already have the needed experience in related fields. That information aids them in creating accurate financial projections.

- Startups with no historical data can choose another similar-industry company of the same size. They can use the company’s available information to create projections for their own business.

B) Understand your Market

- Understanding the particular market for the business can help with accurate projections. Including the market trends over the years will give a glimpse of their business in the same market.

- An effective business plan must include information from market research, such as consumer data and demographics. It enables businesses to modify their models per their users.

C) Hire Experts

- Companies can hire industry experts to evaluate their small businesses and create projections. Apart from the analysts, they can also employ people with expertise in specific departments.

- The experts must align with the company’s future goals. For instance, an accountant with prior experience in the industry will help assess and ascertain advantages and costs.

Financial Projections Examples

Download the Excel template here – Financial Projection Excel Template

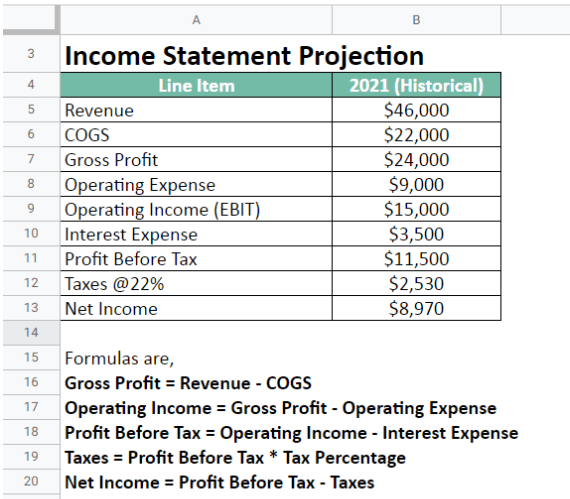

Let us project the income statement using an example.

Company A wants to forecast the next year’s performance, for which it needs to project the income statement.

- The particulars of this year’s income statement are,

Revenue = $46,000; COGS = $22,000; Operating Expense = $9,000; Interest Expense = $3,500;

- It states that Sales may increase by 20% next year.

- The COGS can increase upto 55%

- The operating expenses are subject to increasing by 9% while the interest expense stays the same.

- As the revenue falls between $40,525 and $86,375, the taxes are 22%.

Project the income statement for the next year.

Given,

Here, we calculated the other metrics using the formulas.

Let us project the income statement step by step.

- Project revenue by 20% (i.e. $46,000×1.20%)

- Project COGS by 55% of revenue (i.e. $55,200×0.55%)

- Calculate the gross profit (i.e. $55,200-$30,360)

- Project the operating expense with an increase of 9% (i.e. $55,200×0.09%)

- Calculate operating income (i.e. $24,840-$4,968)

- Calculate profit before tax (PBT) while interest expense stays the same (i.e. $19,872-$3,500)

- Apply 22% tax to PBT (i.e. $16,372×0.22%)

- Finally, calculate net income (i.e. $16,372-$3,602)

Here is the table with applied formulas.

This is the income statement projection for the year 2022.

Why are Financial Projections Important?

- Financial projections can help analyze the business and prepare adequate budgets.

- Companies can utilize them to raise capital by acquiring investments. It can also retain existing investors’ and creditors’ convictions in the business.

- A routine projection helps the business deal with change both inside and outside. Companies can use strategic planning to assess their current state and chart a clear course forward.

- Businesses can identify opportunities and problems by routinely reevaluating the company’s competitors, markets, and strengths. Variations in projections provide early warning of the issues.

- A projection also involves a commitment to achieving specific goals and establishing benchmarks to track development.

- When deviations occur, the projection can offer a framework for determining the costs and benefits of various corrective measures.

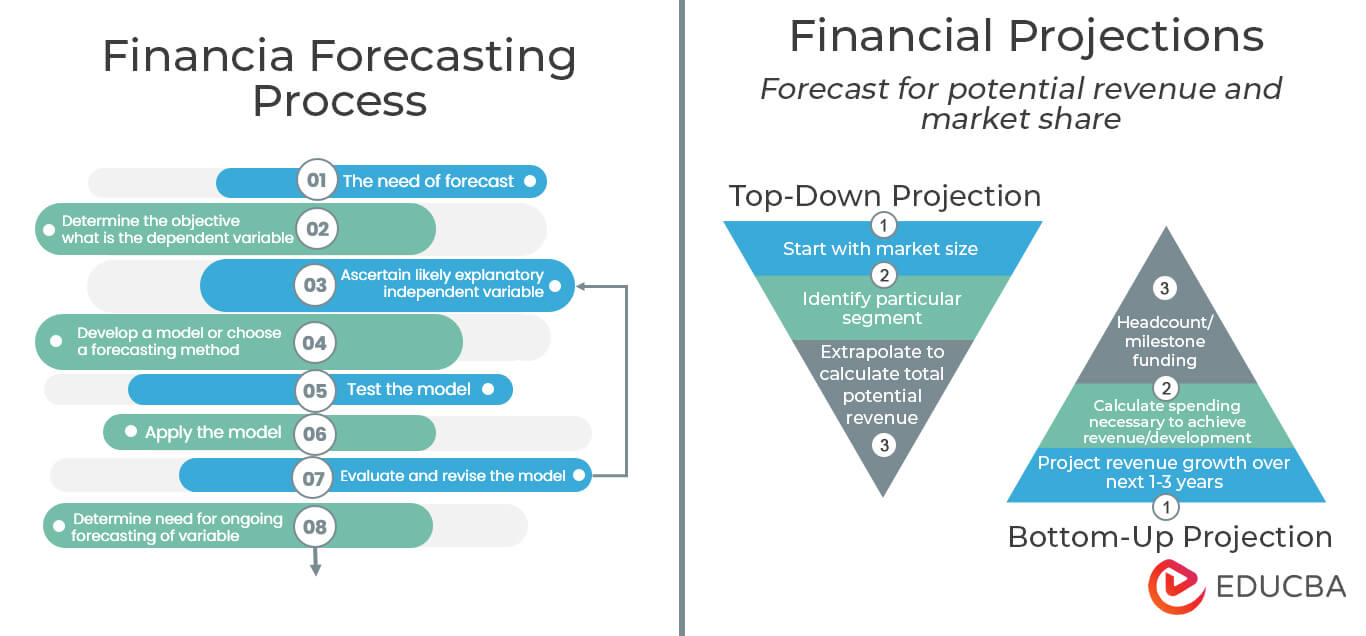

Financial Projections vs. Forecast

Forecasting and projections go hand in hand. Both project the future success of the business. However, they go about it in very different ways.

- Companies create forecasts to construe the company’s short-term finances. They usually predict the future for a one-year timespan. However, projections include both long-term and short-term goals. It can be helpful for five years.

- Forecasts are more accurate and give approximate financial figures. Alternatively, projections answer the what-if scenarios and not precise financial statistics.

- As businesses use forecasts as future suppositions, the assumptions for forecasts must be thorough. However, projections can be flexible as they do not predict the exact future but gauge results for different action plans.

- Businesses use forecasts to present their business value to the world. They use it to raise capital from investors and creditors. On the contrary, projections can be helpful for the company’s internal use. They conclude outcomes for various strategic plans.

- Forecasting is a general overview of the entire organization and doesn’t provide specifics. A projection goes in-depth because it includes outside factors, economic conditions, consumer sentiment, and competitor data.

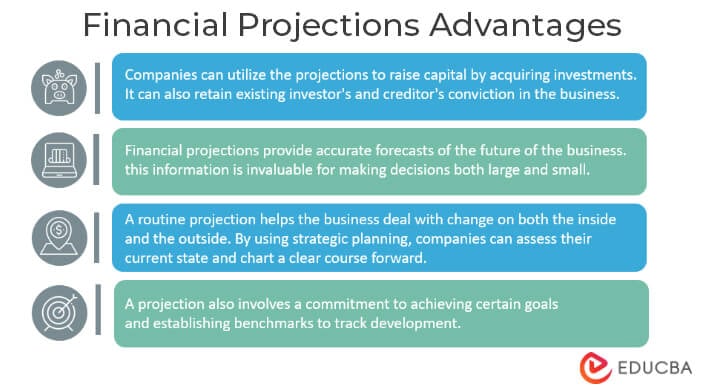

Financial Projections Advantages

- Financial projections provide accurate forecasts of the future of your business. This information is invaluable for making decisions, both large and small.

- These projections show whether the company has a steady source of income or if they rely heavily on only one client or project.

- They can predict company profits or losses over time. It can help plan an elaborate budget plan.

- It helps plan the future by setting objectives and preventing significant setbacks.

FAQs

1. What is Financial Projection?

Answer: Financial projections are the forecasts of future values such as sales, profits, taxes, and earnings. These projections provide a baseline for understanding your company’s financial health. It involves predicting when events like economic cycles will impact your business. They are also used to map out possible scenarios of how a company’s earnings will change over time.

2. Which Software is used to Create Financial Projections?

Answer: There are several software available in the market to create financial projections. Most of them charge for monthly and yearly packages. Some examples are Insight software, Cube Software, and Quickbooks. Therefore, you can also register for crucial Financial Modeling Courses to learn about financial forecasting from scratch.

3. What are the Assumptions in Financial Projections?

Answer: Assumptions are the most critical elements of financial projections. While projecting all the statements, the analysts make detailed assumptions. They base the predictions on hypothetical scenarios, what-if situations, and guesswork about the company’s future. Thus, t provides the business with financial and planning guidelines.

4. How do we Present Financial Projections?

Answer: First and foremost, the company makes accurate assumptions regarding its future goals. Afterward, they project the financial statements: cash flow, income statements, and balance sheets. Consequently, they create reports and establish planning guidelines accordingly. Finally, with time, they monitor the projections and make changes as necessary.

5. How to make a Financial Projection Report?

Answer: We include the primary financial statements to make a financial projection report. Finally, we add all the projected statements like cash flow, balance sheet, and income statement to the report.

Recommended Articles

This article explains everything about Financial Projections. To know more, read the following articles,