Updated July 21, 2023

What is Financial Risk?

Financial risk is a term applied to the individual, business, and government; risk means the probability of losing money in investment or in case of government and business inability to pay off its debt from various financial institutions.

Risk includes various factors that may affect desired results or provide unwanted effects affecting operations, eventually involving business, investors, and the entire market. Financial risk for an individual is the loss of investment and the ability to pay off loans. Business financial risk may occur due to problems in business operations, credit risk, i.e., inability to pay off debt, and market risk, i.e., when the business loses its customers due to upgrades, innovations by competitors, and changes in consumption patterns. For the government, financial risk means the inability to control inflation, defaulting bonds, and other debt instruments.

Example of Financial Risk

Examples of financial risk are given in detail:

Great Recession in 2008

- Subprime mortgage crisis.

- It started in December 2007 with a fall in GDP by 4.3% and a rise in unemployment by 10%.

- Reasons:

- Lenders grant high-risk loans to borrowers with lower credit scores and poor credit histories.

- From 2000-2005 due to the housing boom in the United States, many lenders wanted to capitalize on rising home prices.

- As a result, many financial institutions took risky mortgages in bulk from buyers with poor credit histories, known as mortgage-backed securities.

- In the US, in early 2007, New Century Financial declared bankruptcy.

- Freddie Mac(Federal Home Loan and mortgage corporation) declared its inability to buy other Mortgage-backed securities.

- As a result, there is no market available for a mortgage to sell and recover the investment in such high-risk loans; many firms started on a path to bankruptcy, resulting in a price decline in the real estate market and no way to recover the investment.

- Because of the fall in housing prices, many borrowers realized that their homes had much less value than the loan amount.

- Many homeowners started to default on their loans. Since there is a lack of buyers in such a market, prices continue to fall further, resulting in a rise in the number of defaults from homeowners and no way to recover such loans for financial institutions.

- Like a snowball effect on the economy, even when Dow Jones crossed 14000 for the first time, it could not maintain that level. Over the next 18 months, it fell more than 6500 points, which resulted in a loss of investment for many Americans who invested a large portion of their life savings in the stock market; as a result, the credit market started to decline.

- To take action against a fall in the economy, Federal Reserve in the US reduced the target for interest rates to promote borrowing and unfreeze the credit market.

- In February 2008, the US President signed the Economic Stimulus Act to encourage a certain amount of rebates to taxpayers to increase spending and loan limits to promote home sales and boost the economy.

- Investment banking giants like Bear Sterns and Lehman Brothers collapsed, declaring bankruptcy due to the subprime mortgage crisis of 2008.

- Insurance giant American Insurance Group(AIG), which insured many such Mortgage-backed loans from various financial institutions, also faced trouble. But because of its asset qualities, the Fed agreed to lend additional 85 billion dollars to AIG to manage its business.

- TARP(Troubled Asset Relief Program) allowed the US government $700 billion to buy such assets from companies in trouble. Such assets can be slowly sold in a market as the economy recovers.

- Tarp Funds were also used to bail out General Motors and Bank of America.

- The US government announced the second stimulus package in 2009 to promote spending on infrastructure, health care, energy, etc.

- The Great Recession also impacted European countries resulting in the default of bonds by Greece, Portugal, and Ireland with an expectation of a bailout.

- To avoid further defaults in debt, countries were compelled to implement specific measures such as increasing taxes and reducing social programs.

- The great recession of 2008 describes Financial Risk and its impact on individuals, the government, and the Global economy. If not appropriately managed, such risk creates a catastrophic result, which makes it hard for the economy to recover and forces the government to take specific measures through policy to avoid further downfall.

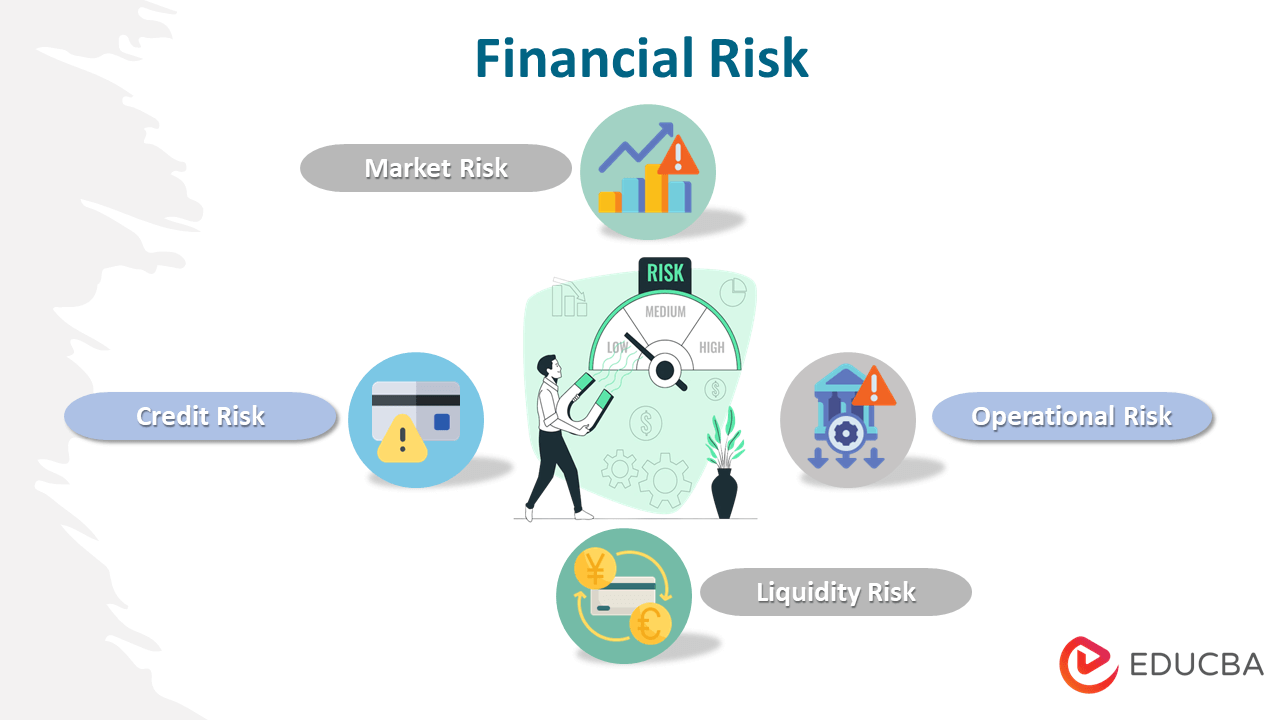

Types of Financial Risk

Various types of financial risk are given below:

1. Market Risk

Market risk arises from upgrades or innovations in technology, changes in prices, or changes in consumption patterns of customers affecting business revenues.

Market risk includes systematic and unsystematic risks resulting in a loss of investment. Systematic risk consists of recession, interest rate changes, and natural disasters, which cannot be avoided. Unsystematic risk refers to risks that can be avoided or managed through operations, strategy, and planning changes.

2. Credit Risk

The inability of a borrower to repay the debt according to contractual obligations. Defaulting in debt repayment will affect business’s reputation in the market, the ability to borrow funds from other financial institutions, and the loss of investor confidence. While in the case of government, credit risk can have vast effects on the entire economy and world since defaulting bonds and the inability to control inflation will affect countries’ reputation, business transactions, social stability, and relations with other countries.

3. Operational Risk

Operational risk can result from management decisions affecting business output or providing unwanted results. Generally, Operational risk does not mean complete failure but the reduction in output capacity, which a change in the decision can manage, upgrade, and maintain technology.

4. Liquidity Risk

The ability of an individual or business to pay out its short-term financial obligations due to failure to sell its assets quickly in a market without loss. The inability to sell assets or investments for cash can result from market conditions, lack of buyers, etc. Maintaining diversified investments in short-term assets and ensuring sufficient funds are available within the business to meet short-term obligations help manage liquidity risk.

Difference Between Financial Risk vs. Business Risk

|

Basis of Comparison |

Financial Risk |

Business Risk |

| Definition | Financial risk means the probability of loss in investment or an inability to pay off debt. | Business Risk means business inefficiency in generating enough revenue to meet operational expenses. |

| Why | In the case of business and government, financial risk is the inability to pay off its debt. | Business risk is generally related to inefficiency in operations. |

| Reasons | The high debt burden instead of equity can cause financial risk in generating better returns. | Business Risk is inevitable as long as the business continues to operate, as the business needs growth and expansion, which includes risk. |

| Risk Management | Financial risk can be managed by balancing equity and debt and using debt for business growth for better returns. | Business risk can be managed by managing the operation process, reduction in the cost of production, technical upgrades, and new strategies. |

| How to calculate | Debt to Asset ratio, debt to equity ratio, the interest coverage ratio. | Change in Revenue and EBIT. |

Advantages and Disadvantages of Financial Risk

Following are the advantages and disadvantages below:

Advantages

- Growth: Risk is an integral part of the business, and for growth and expansion in a new market, companies might need to raise finance through debt. Financial risk, although it looks like a burden for the company, if a company can perform and generate better revenues through growth and expansion, such risk needs to be taken.

- Tax Planning: Many companies use losses for a tax deduction, which can be spread over multiple years. Reduction in a company’s tax liability and risk management can turn financial risk into a long-term advantage.

- Alert for investors and management: Financial risk is an alarm for investors and management to take specific measures to avoid further damage.

- Valuation assessment: Financial risk in specific businesses or projects helps evaluate income through the risk-reward ratio, which tells whether such a company or project is worth it.

- Various ratios can help analyze financial risk, facilitating a clear understanding of the role of risk in the business.

Disadvantages

- Can Create Catastrophic Result: In the case of government, Financial Risk leads to defaulting bonds and other debt from financial institutions, which can cause long-lasting damage to the country and the global economy. E.g. the Greece crisis impacted countries in the European Union, which invested in Greece through bonds.

- Cannot be Control: Financial risk arising out of global factors, natural disasters, wars, changes in interest rates, and changes in government policies that cannot be controlled by a business operating in a particular market.

- Long-Term Effects: Financial Risk, if not managed at the right time with the right strategies, can cause damage to financials and reputation, affecting the entire business and causing loss of confidence of investors and lenders. It can be challenging for a company to overcome such setbacks.

- Impact: Financial risk can impact the entire sector, market, and economy.

Conclusion

Financial risk is integral to Individual finances, business, and government. Such risk is not necessarily a negative sign but can be a sign of growth if utilized and managed correctly. In the business case, financial leverage ratios such as interest coverage ratios, debt-asset ratios, and debt-equity ratios are utilized to assess the company’s level of debt within the market. Financial risk can be helpful if tackled with revenue growth and business expansion. Still, if not managed properly, it can cause the company’s bankruptcy and loss for investors and lenders.

In the case of Government, Financial Risk needs to be monitored continuously to avoid catastrophic effects on the country and economy in the future. Individual Financial risk can be lost in investment, or increasing financial debt can be a concern for their future. Such risk can be reduced and diverted with proper management techniques.

Recommended Articles

This is a guide to Financial Risk. Here we discuss the introduction and types of financial risk with advantages and disadvantages. You may also have a look at the following articles to learn more –