Transformative Technological Trends in Finance

During the past 10 years, advanced technologies have reshaped the financial markets. We have seen traditional banking take a digital leap, peer-to-peer lending redefined how we borrow and lend, and blockchain brought transparency and security to the forefront. Investors now have a playground of sophisticated tools and platforms to analyze and predict digital asset prices. The past decade has been a thrilling roller coaster for finance, with no shortage of twists and turns.

Moreover, looking at the pace at which technology is evolving, investing in financial software development is crucial to staying competitive in the future.

Key Components of Financial Software Development

1. Online Banking and Mobile Applications

Many customers now prefer financial institutions that offer online banking app development services. They can create accounts and install mobile apps for managing transactions, such as deposits, withdrawals, and wire transfers. These apps also provide real-time notifications about account activities.

2. Cryptocurrency Trading

Cryptocurrency trading has surged in popularity. Customers can choose a broker to buy and trade digital currencies. With the increased interest in white-label crypto exchange software, platforms offer adaptable solutions for digital currency trading. These tools not only provide critical security features but also streamline processes, reduce initial development costs, and enhance time to market. These platforms offer tools to evaluate cryptocurrency prices, exchange assets, and access economic reports to inform their trading decisions.

3. Peer-to-Peer Lending for Loans

When in need of a loan, customers can visit peer-to-peer lending websites. Here, they can request loans and set terms, interest rates, and estimated monthly payments. Investors on these platforms can fund loans, providing a quick source of financing.

4. Data Analytics and Artificial Intelligence in Investment Strategies

Some companies have developed software programs that leverage AI to analyze economic reports, investment values, industry trends, and more. These programs can predict future investment values and provide informative graphs for investors.

Real-World Success Stories

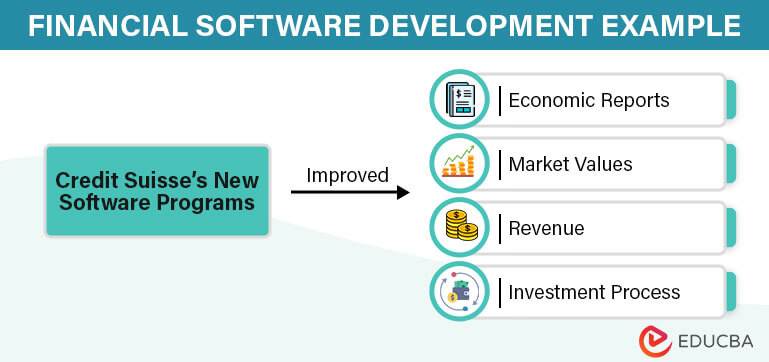

#1: Credit Suisse

Credit Suisse has introduced new software programs that significantly improve investment profitability. These programs rapidly evaluate economic reports, customer sentiments, and market values, ultimately increasing revenue, streamlining the investment process, and offering recommendations for financial advisers.

#2: Emerald Insight

In recent years, organizations like Emerald Insight have published reports highlighting how financial technology can boost profitability and enhance data management. Algorithm-driven software can identify trends, detect outliers, and assess investment risk, providing valuable insights for decision-makers.

Other Benefits of Financial Software Development

1. Blockchain Technology and Its Impact on Finance

Blockchain technology provides a decentralized network that enhances security and data protection. Advanced encryption systems in banks safeguard sensitive information, and user authentication and permission management further reduce security risks. These measures promote trustworthiness in financial institutions and enhance investment security.

2. Financial Technology and Solutions for Developing Economies

Many companies have introduced online banks in developing countries, reducing investment fees. Customers can receive direct deposits, manage investments, and purchase cryptocurrencies. Additionally, some banks offer remote financial advisers who guide customers in creating income-focused investment strategies.

3. Navigating Global Financial Regulations and Cybersecurity

Regulations, like those established by the Consumer Financial Protection Bureau, protect customers and data, promoting cybersecurity. Software programs encrypt data, authenticate users, monitor user activities, and provide comprehensive reports. Data is shared only with authorized entities, ensuring customer data remains confidential.

Final Thoughts

The financial tech revolution is reshaping the industry, from online banking to cryptocurrency trading and advanced analytics. Blockchain boosts security, regulations protect customers, and these changes improve the financial landscape for everyone involved. It’s an exciting time of positive transformation!

If you are interested in financial software development, contact Yalantis. They specialize in designing software programs to enhance online banking efficiency, increase investment profitability, and provide cutting-edge data management solutions. Yalantis can also create custom software for invoices, reports, notifications, and financial forecasts, benefiting investors, customers, and financial institutions alike.

Recommended Articles

We hope you found this article on financial software development useful. For similar articles, check out the following recommendations: