Updated July 12, 2023

Definition of Financial Statements

Financial statements are written records that reflect the financial results and performance of the business activities carried out by an entity during the reporting period. They reflect the accounting transactions and events carried out in any entity.

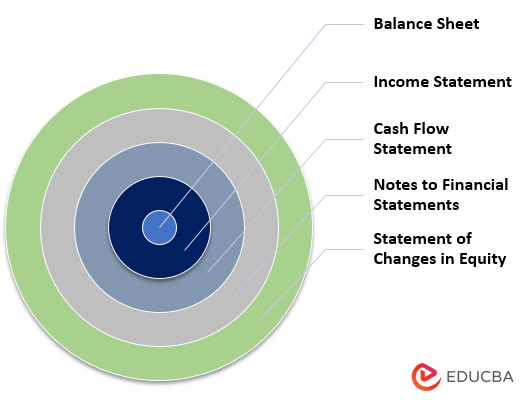

It contains five components: the Balance Sheet, Income Statement, Cash Flow Statement, Notes to Financial Statements, and Statement of Changes in Equity.

Explanation

Every entity’s transactions are recorded daily by way of accounting entries. At the end of the reporting period, the result of all the transactions and entries is compiled as financial statements. They reflect the position of profits or losses, assets, liabilities, and equity. It reflects the entity’s financial position, strength, and liquidity during reporting.

Example of Financial Statements

Here is a draft format for the Balance Sheet per IFRS (International Financial Reporting Standards).

Balance Sheet as At

| Particulars | Notes | Year ended 20XX | Year ended 20XX |

| Non-Current Assets | |||

| Property, plant and equipment, and Investment Property | |||

| Goodwill | |||

| Advances for Capital Assets | |||

| Intangible assets | |||

| Investments | |||

| Investments in associates | |||

| Available for sale investments | |||

| Receivables and other non-current Assets | |||

| Deferred tax assets | |||

| Total Non-Current Assets | – | – | |

| Current Assets | |||

| Inventories | |||

| Trade receivables | |||

| Other current assets | |||

| Income tax assets | |||

| Investments and financial receivables | |||

| Cash and cash equivalents | |||

| Total Current Assets | – | – | |

| Total Assets | – | – | |

| Shareholders’ Equity | |||

| Share capital | |||

| Reserves | |||

| Retained earnings | |||

| Total Shareholders’ Equity | – | – | |

| Non-Current Liabilities | |||

| Interest-bearing loans and short-term borrowings | |||

| Employee benefits liabilities | |||

| Provisions | |||

| Deferred tax liabilities | |||

| Total Non-Current Liabilities | – | – | |

| Current Liabilities | |||

| Banks’ overdrafts and short-term borrowings | |||

| Interest-bearing loans and short-term borrowings | |||

| Trade payables | |||

| Provisions | |||

| Income tax liabilities | |||

| Other liabilities | |||

| Total Current Liabilities | – | – | |

| Total Liabilities | – | – | |

| Total Shareholders’ Equity and Liabilities | – | – |

Source: https://www.caclubindia.com/share_files/files_download.asp?cat_id=1&files_id=21900

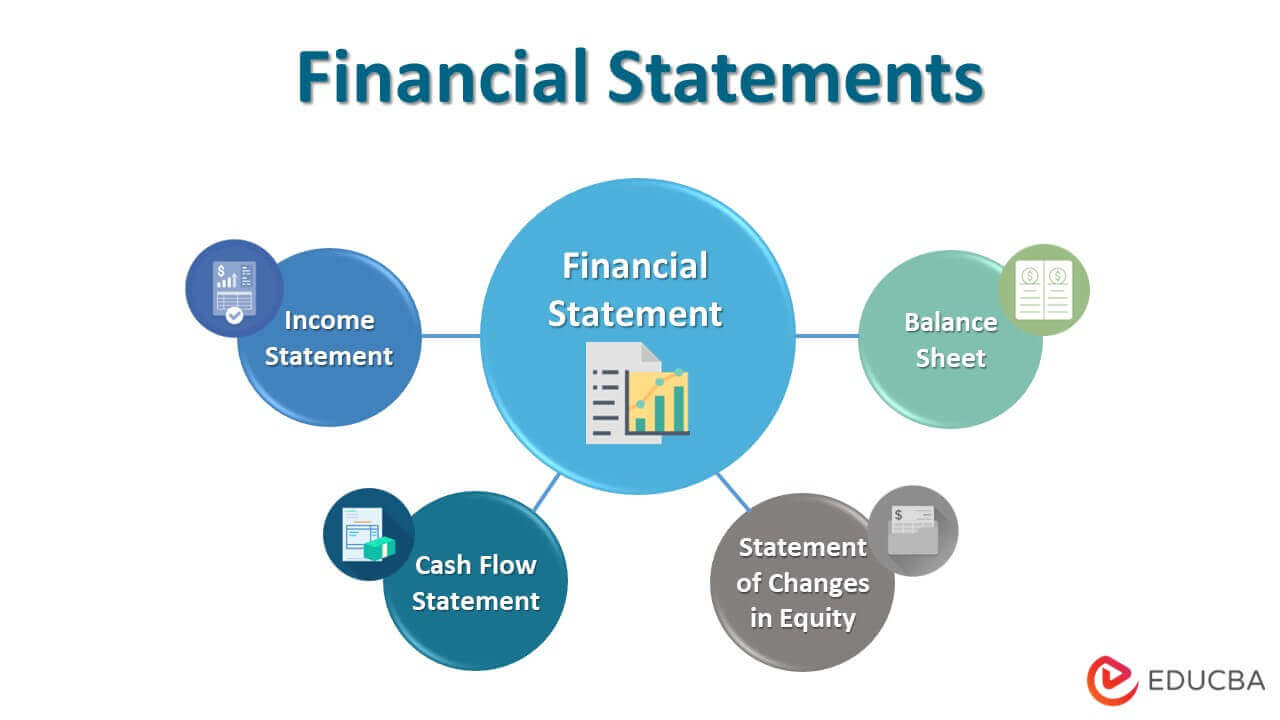

Types of Financial Statements

All entities generally prepare five types of financial statements by the generally accepted accounting principles prevailing in the jurisdiction of which the entity is a part.

1. Balance Sheet

It indicates the position of the entity’s assets, liabilities, and equity as of the last date of any reporting period. It measures the financial position and strength of the entity on a particular date. Assets and liabilities are further classified as current and non-current. Sometimes the assets and liabilities items are presented in the order of their liquidity when the accounting standards require the same.

2. Income Statement

The income statement reflects the financial results of an entity over a particular reporting period by way of profits or losses. The net profits or losses after tax are calculated after subtracting all expenses and taxes incurred from the revenues and other income earned for a particular period. Further, it shows the income attributable to each stockholder through EPS.

3. Cash Flow Statement

This statement indicates the sources of cash inflows and the application of such cash inflows by way of cash outflows by the entity over the reporting period. It shows the cash flows from operating, investing, and financing activities. The statement helps to track the movement of cash and cash equivalents over the reporting period.

4. Notes to Financial Statements

Notes to financial statements contain additional relevant information not in other financial statements. It includes the bifurcation of items that are presented in the other statements and also such information that could not be recorded in such other statements since they could not be quantified or did not qualify for reporting there.

5. Statement of Changes in Equity

It represents the movement in shareholders’ equity over the reporting period during various events. Apart from showing the net profit or loss attributable to the shareholders, it also accounts for changes in capital reserves, distributions to the shareholders, items directly recognized in equity, and the effect of changes in accounting policies or prior period items.

Analysis

The stakeholders can analyze financial statements to make investment-related decisions. Investors and market analysts use it to understand the financial health of a company, its financial performance, and capability. On the other hand, the management analyzes the statements to monitor the company’s financial affairs.

The statements of the current reporting period can be compared against the statements of the past periods and forecasts to understand the company’s performance. The techniques used for analyzing financial statements include horizontal, vertical, and ratio analysis. They help a user understand the profitability and liquidity of the company, based on which the investors can decide whether the company is worth investing in.

Financial Statements vs Financial Reporting

Financial reporting is a process through which information is provided to the company’s stakeholders to make decisions accordingly. The various stakeholders regularly present financial information concerning the company through financial reporting.

On the other hand, it is financial records prepared and issued by the company as a part of the financial reporting requirements. They represent the company’s financial health and are prepared per the prescribed accounting standards.

Advantages

It offers the following advantages.

- It contains valuable information about the earnings and financial position of the company. This information helps the users of the financial statement understand the company’s financial performance and trends compared to last year. This allows them to forecast the company’s future profitability and accordingly make investing decisions.

- They help to understand the position of debts and assets in a company and how it manages its debt.

- It helps in ratio analysis which is an essential tool for the analysis of financial statements and allows the users to draw meaningful information.

Limitations

There are some limitations attached to it.

- Forecasting based on the present financial statements can be risky. This is because a company’s financial performance is subject to fluctuations in the industry.

- It does not account for the effect of inflation.

- The statements are usually prepared for a specific period, like one year. Due to this, they do not reflect the individual seasonal impact on the business.

- It sometimes becomes difficult to compare the statements of two companies in the same industry if they adopt different accounting policies.

Conclusion

It is usually prepared every year. However, sometimes companies also prepare half-yearly financial statements. They help the stakeholders understand the company’s performance based on which they form their decisions.

Recommended Articles

This is a guide to Financial Statements. Here we also discuss the definition and types of financial statements and their advantages and limitations. You may also have a look at the following articles to learn more –