Updated July 24, 2023

Financing Formula (Table of Contents)

What is the Financing Formula?

The term “Financing” refers to the process of raising funds for the purpose of purchasing equipment or making the investment with the intent of setting up a business.

This financing can be either funded through banks or other lenders in the form of debt financing, or it can be funded internally through equity financing. The formula for financing is basically the formula for financing cost, which can be categorized into –

- Cost of Debt

- Cost of Equity

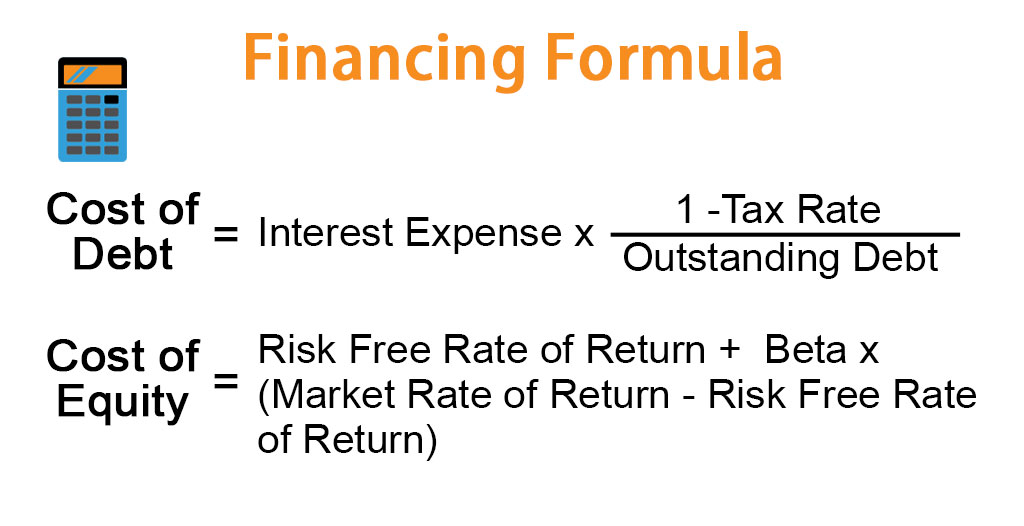

The formula for the cost of debt is expressed as the company’s tax-adjusted interest expense divided by its outstanding debt amount. Mathematically, it is represented as,

The formula for the cost of equity is expressed as the risk-free rate of return of the market added to the product of the stock’s beta, and it is market risk premium, i.e. difference of market rate of return and the risk-free rate of return. Mathematically, it is represented as,

Example of Financing Formula (With Excel Template)

Let’s take an example to understand the calculation of Financing in a better manner.

Financing Formula – Example #1

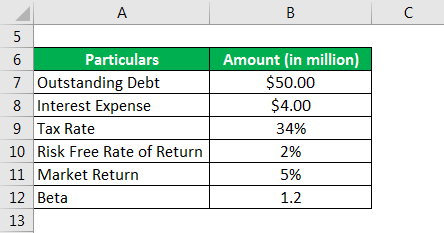

Let us take the example of a company to illustrate the concept of financing with debt and equity. According to the latest annual report, the company has an outstanding debt of $50 million, and it paid $4 million as interest expense. The applicable risk-free rate of return is 2%, while the relevant market gave a return of 5% during the last year. Calculate the cost of debt and cost of equity if the applicable tax rate is 34% and the stock’s beta is 1.2.

Solution:

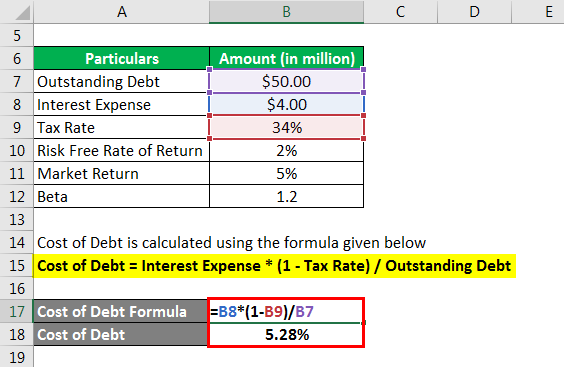

Cost of Debt is calculated using the formula given below

Cost of Debt = Interest Expense * (1 – Tax Rate) / Outstanding Debt

- Cost of Debt = $4 million * (1 – 34%) / $50 million

- Cost of Debt = 5.28%

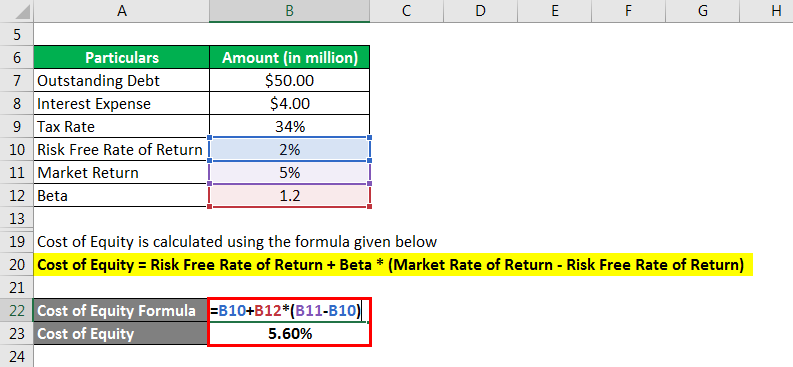

Cost of Equity is calculated using the formula given below

Cost of Equity = Risk Free Rate of Return + Beta * (Market Rate of Return – Risk Free Rate of Return)

- Cost of Equity = 2% + 1.2 * (5% – 2%)

- Cost of Equity = 5.60%

Therefore, the company’s cost of debt and cost of equity was 5.28% and 5.60%, respectively, for the year.

Financing Formula – Example #2

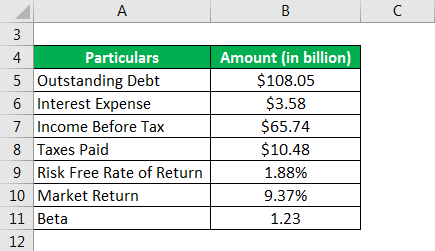

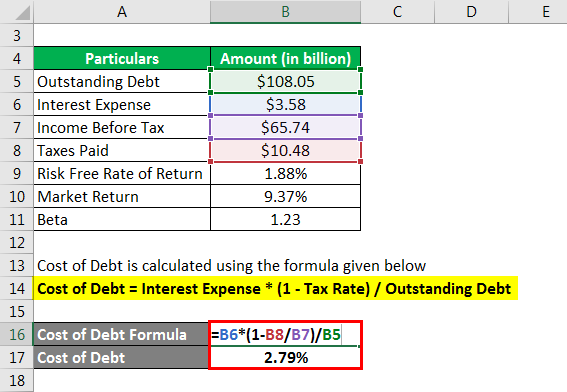

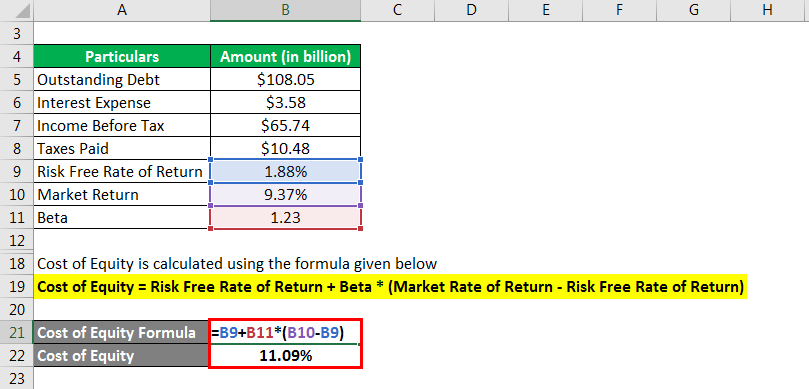

Let us take the example of Apple Inc.’s latest TTM financial performance to illustrate financing cost calculation. The is information available in the public domain:

Solution:

Cost of Debt is calculated using the formula given below

Cost of Debt = Interest Expense * (1 – Tax Rate) / Outstanding Debt

- Cost of Debt = $3.58 billion * (1 – $10.48 billion / $65.74 billion) / $108.05 billion

- Cost of Debt = 2.79%

Cost of Equity is calculated using the formula given below

Cost of Equity = Risk Free Rate of Return + Beta * (Market Rate of Return – Risk Free Rate of Return)

- Cost of Equity = 1.88% + 1.23 * (9.37% – 1.88%)

- Cost of Equity = 11.09%

Therefore, Apple Inc.’s cost of debt and cost of equity was 2.79% and 11.09%, respectively, for the latest TTM.

Explanation

The formula for Financing can be calculated by using the following steps:

Step 1: Firstly, note the interest expense of the company from its income statement.

Step 2: Next, determine the applicable tax rate, which is either available separately in the income statement or can be computed as taxes paid divided by income before taxes.

Tax Rate = Taxes Paid / Income Before Taxes

Step 3: Next, determine the outstanding value of the company’s debt from its balance sheet.

Step 4: Next, adjust the interest expense for the tax benefit that it enjoys due to debt funding. It is computed by multiplying the interest expense (step 1) and one minus the tax rate (step 2).

Tax Adjusted Interest Expense = Interest Expense * (1 – Tax Rate)

Step 5: Finally, the formula for the cost of debt can be derived by dividing the tax-adjusted interest expense (step 4) by the outstanding debt (step 3), as shown below.

Cost of Debt = Interest Expense * (1 – Tax Rate) / Outstanding Debt

The formula for the cost of equity can be derived by using the following steps:

Step 1: Firstly, determine the risk-free rate of return applicable to the company. The 10-year Treasury bond return is predominantly taken as the proxy for the risk-free rate of return in the US.

Step 2: Next, determine the beta of the stock, which is a measure of the stock’s volatility relative to the relevant market and can be sourced from various stock market research databases (e.g., Yahoo Finance).

Step 3: Next, determine the market rate of return based on the relevant market index movement such as S&P500.

Step 4: Next, compute the market risk premium of the company’s stock, which is the difference in the excess return generated by the market (step 3) relative to the risk-free return rate (step 1).

Market Risk Premium = Market Rate of Return – Risk Free Rate of Return

Step 5: Finally, the formula for the cost of equity can be derived by adding the risk-free rate of return (step 1) to the product of the stock’s beta (step 2), and it is market risk premium (step 4) as shown below.

Cost of Equity = Risk Free Rate of Return + Beta * (market Rate of Return – Risk Free Rate of Return)

Relevance and Use of Financing Formula

The concept of financing is very important as it helps in the assessment of the cost of funding from different sources. Based on the analysis of financing cost, a company’s management takes major decisions pertaining to its dividend policy, capital structure, financial leverage, and other financial decisions.

Financing Formula Calculator

You can use the following Financing Formula Calculator

| Interest Expense | |

| Tax Rate | |

| Outstanding Debt | |

| Cost of Debt | |

| Cost of Debt = | Interest Expense * (1 -Tax Rate) / Outstanding Debt |

| = | 0 * (1 -0) / 0 = 0 |

Recommended Articles

This is a guide to Financing Formula. Here we discuss how to calculate the Financing along with practical examples. We also provide a Financing calculator with a downloadable excel template. You may also look at the following articles to learn more –