Updated July 25, 2023

Fiscal Deficit Formula (Table of Contents)

What is the Fiscal Deficit Formula?

The term “Fiscal Deficit” refers to the situation where the total income generated by the government during a specific period of time, through the collection of taxes and non-debt capital receipts, is lower than the total expenditure incurred by the government during the same period of time. In other words, a fiscal deficit happens when a government’s expenditure exceeds its income, indicating that the government will need external borrowing to meet the shortfall.

The formula for fiscal deficit can be derived by deducting the total income during a given period from the corresponding total expenditure. However, mathematically, it is represented as,

The formula for Fiscal Deficit –

As can be seen from the above equation, a fiscal deficit can occur either due to a loss of revenue or a major spike witnessed in capital expenditure, which is then funded through borrowing either from the central bank of the country or the capital markets by the issuance of treasury bills and bonds.

Example of Fiscal Deficit Formula (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Fiscal Deficit Formula – Example #1

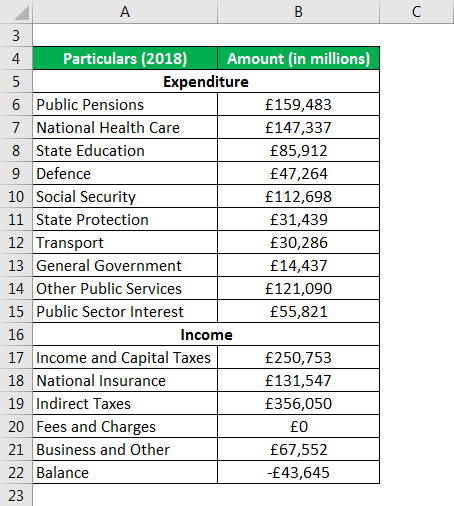

Let us take the example of the UK Government’s Fiscal result to Calculate the Fiscal Deficit. For the fiscal year 2018, the following information is available:

Solution:

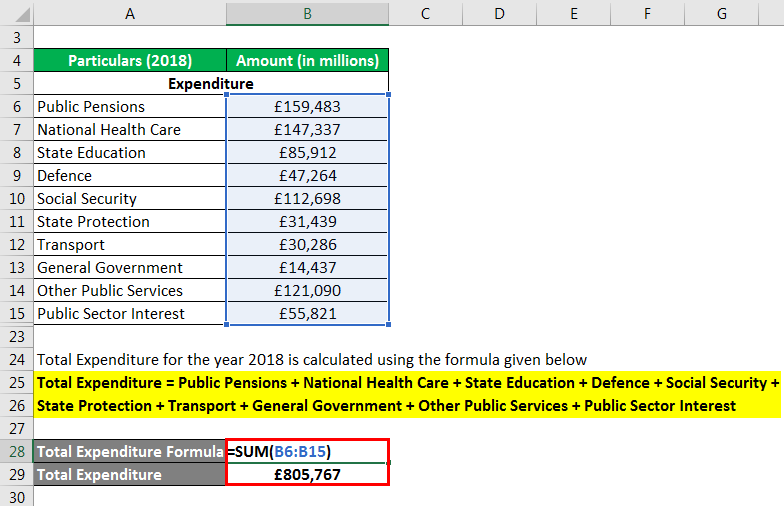

Total Expenditure calculates using the formula given below

Total Expenditure = Public Pensions + National Health Care + State Education + Defence + Social Security + State Protection + Transport + General Government + Other Public Services + Public Sector Interest

- Total Expenditure = £159,483 million + £147,337 million + £85,912 million + £47,264 million + £112,698 million + £31,439 million + £30,286 million + £14,437 million + £121,090 million + £55,821 million

- Total Expenditure = £805,767 million

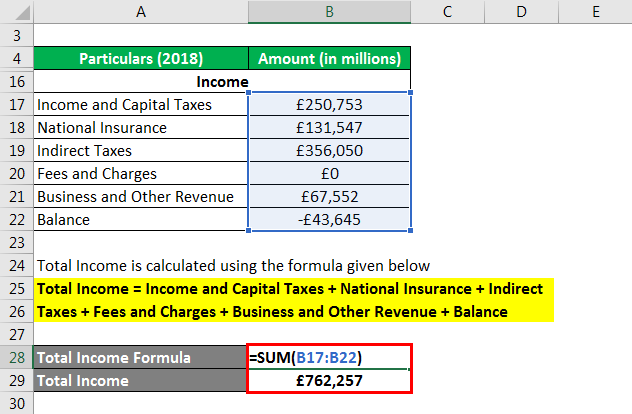

Total Income calculates using the formula given below

Total Income = Income and Capital Taxes + National Insurance + Indirect Taxes + Fees and Charges + Business and Other Revenue + Balance

- Total Income = £250,753 million + £131,547 million + £356,050 million + £0 million + £67,552 million – £43,645 million

- Total Income = £762,257 million

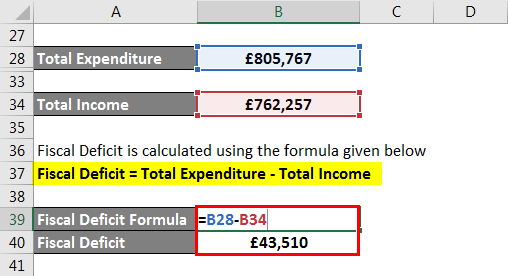

The fiscal Deficit calculates using the formula given below

Fiscal Deficit = Total Expenditure – Total Income

- Fiscal Deficit = £805,767 million – £762,257 million

- Fiscal Deficit = £43,510 million

Therefore, the UK’s fiscal deficit for 2018 stood at £43,510 million.

Fiscal Deficit Formula – Example #2

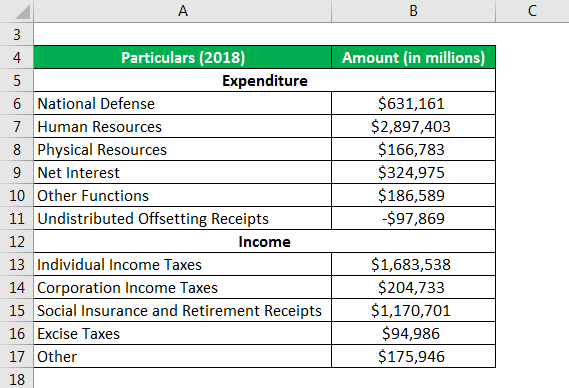

Let us also take the example of the US Government’s fiscal result for 2018 to illustrate the computation of fiscal deficit. For 2018, the following information is available:

Solution:

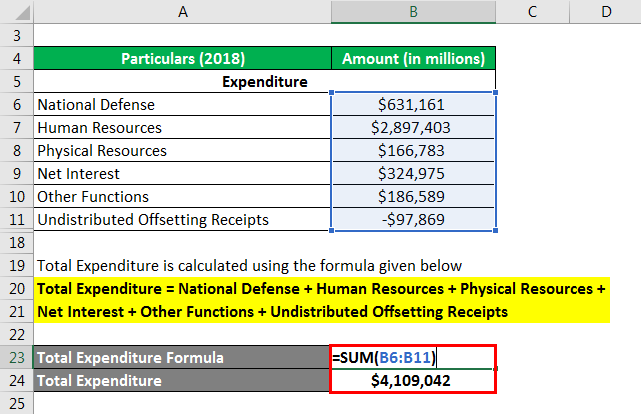

Total Expenditure calculates using the formula given below

Total Expenditure = National Defense + Human Resources + Physical Resources + Net Interest + Other Functions + Undistributed Offsetting Receipts

- Total Expenditure = $631,161 million + $2,897,403 million + $166,783 million + $324,975 million + $186,589 million – $97,869 million

- Total Expenditure = $4,109,042 million

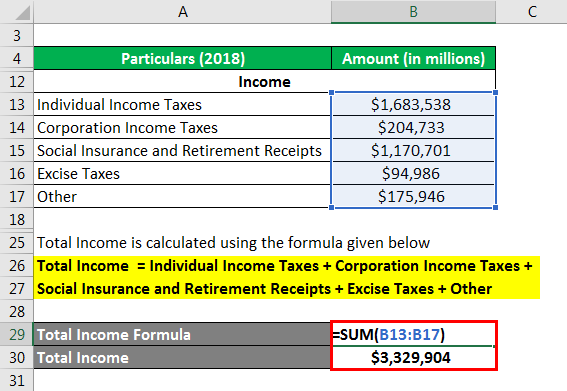

Total Income calculates using the formula given below

Total Income = Individual Income Taxes + Corporation Income Taxes + Social Insurance and Retirement Receipts + Excise Taxes + Other

- Total Income = $1,683,538 million + $204,733 million + $1,170,701 million + $94,986 million + $175,946 million

- Total Income = $3,329,904 million

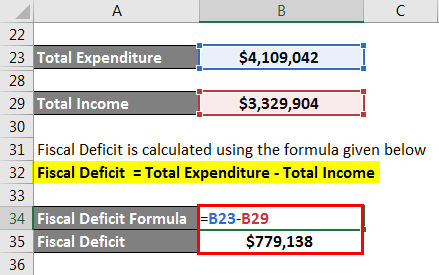

The fiscal Deficit calculates using the formula given below

Fiscal Deficit = Total Expenditure – Total Income

- Fiscal Deficit = $4,109,042 million – $3,329,904 million

- Fiscal Deficit = $779,138 million

Therefore, US’s Fiscal Deficit for 2018 stood at $779,138 million.

Explanation

The Formula can be computed by using the following steps:

Step 1: Firstly, determine the total expense incurred by the government during a specific period of time, usually a quarter or year. The expenditure includes major expenses such as social protection, health services, education, infrastructure, etc.

Step 2: Next, determine the total income generated by the government during the period, which includes collection through income tax, national insurance tax, excise duty, corporate tax, property tax, municipal tax, etc.

Step 3: Finally, the formula for fiscal deficit can be derived by deducting the total income (step 2) during a given period from the corresponding total expenditure (step 1) as shown below.

Fiscal Deficit = Total Expenditure – Total Income

Relevance and Use of Fiscal Deficit Formula

From a macroeconomic point of view, it is important to understand the concept of fiscal deficit as it can be a strong (although lagging) indicator of a nation’s financial health. A fiscal deficit, per se, is not considered a negative event because countries in the growing phase can run into fiscal deficit as they try to build income-generating resources for the future. As such, a nation with surplus income is always desirable, but a nation in fiscal deficit while growing can also be considered healthy.

Fiscal Deficit Formula Calculator

You can use the following Fiscal Deficit Formula Calculator

| Total Expenditure | |

| Total Income | |

| Fiscal Deficit | |

| Fiscal Deficit = | Total Expenditure – Total Income |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This is a guide to the Fiscal Deficit Formula. Moreover, here we discuss calculating the Fiscal Deficit along with practical examples. We also provide a Fiscal Deficit calculator with a downloadable Excel template. You may also look at the following articles to learn more –