Fiscal Year – Definition

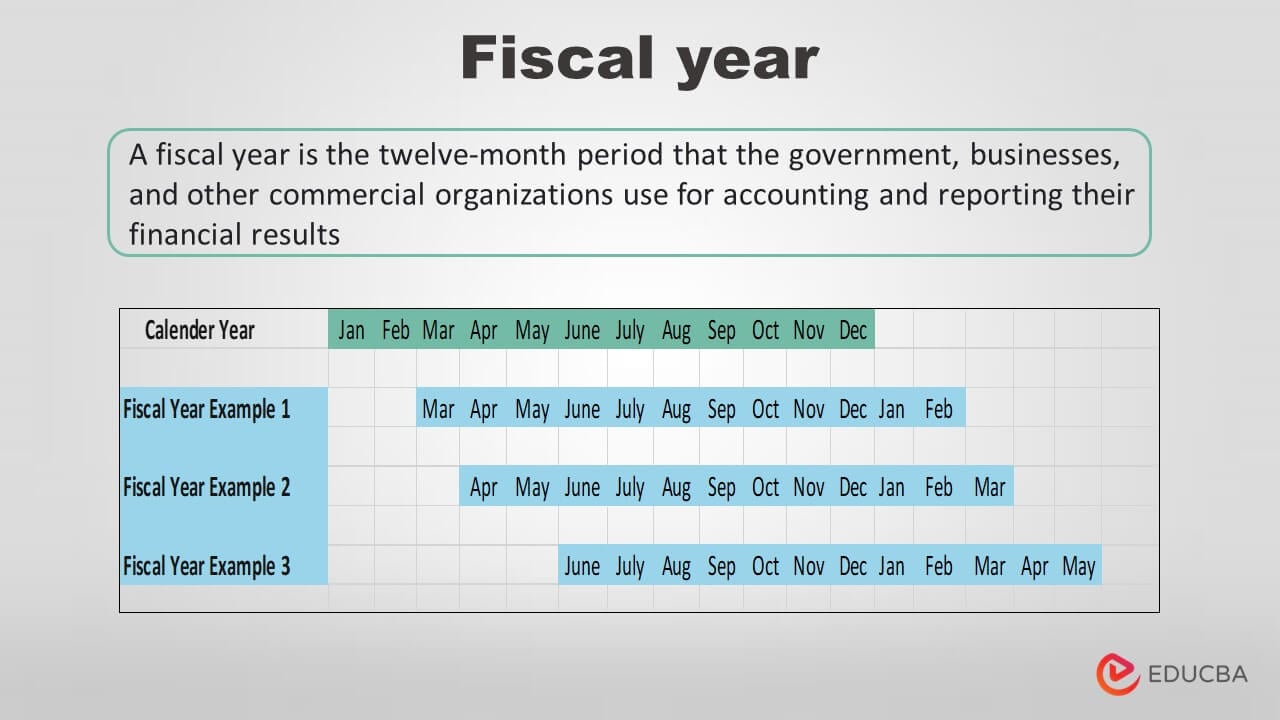

A fiscal year is twelve consecutive months or a year that the government and companies use for accounting for their financial statements. It usually varies from business to business.

Generally, it starts from the beginning of the quarter months, i.e., January, April, July, and October. Still, even the other months can mark its start.

Key Takeaways

- A corporation chooses a fiscal year, which is twelve months, to disclose its financial data.

- The company’s business cycle can help determine the period, allowing companies to close their books in a different month than usual.

- The reporting period is the basis for financial statements, external audits, and federal tax records.

- Understanding a company’s reporting period is crucial for businesses and their investors. It enables them to compare sales and earnings year over year precisely.

How Does it Work?

Every business organization must prepare its financial statements and calculate the profits at the end of a year. Many companies even require publishing these financial statements before the public. So, all the businesses, if allowed, need to choose 12 months for which they will prepare the financials. Otherwise, companies have to adopt the same period as the law authorizes.

It can start on the first day of any month but ends after completing 12 months from the starting date. For example, if a company chooses January 1st as the starting date, that financial year will end on December 31st.

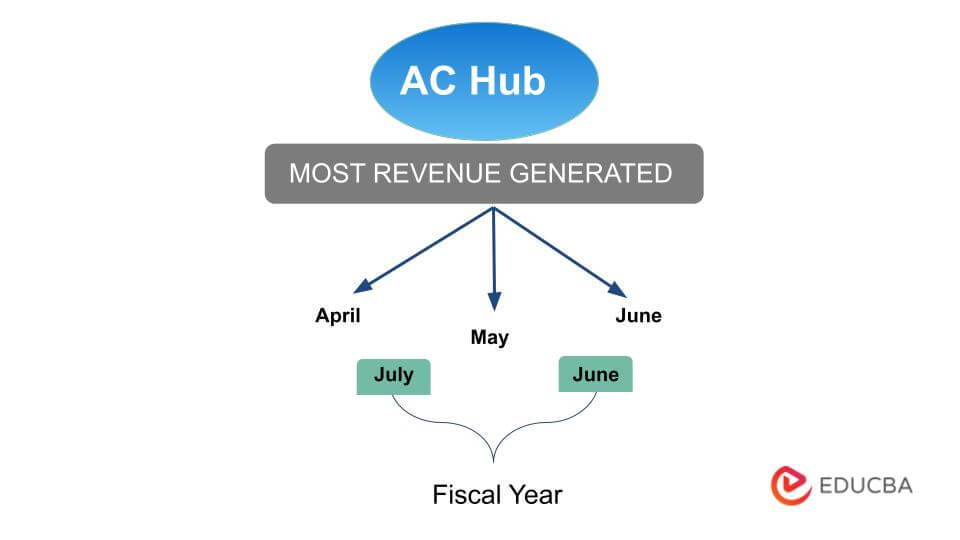

The organizations consider their type and functional operations while calculating a fiscal year. Every company has different busiest periods, and they make the most profit during such quarters. Therefore, they should first identify the peak month of a commercial operation. In that way, they should conclude the period immediately following the pinnacle of commercial enterprise. Excessive consultation and the company’s performance also facilitate the process.

Examples of Fiscal Year

- AC Hub is a business firm that deals with air conditioners. After thorough analysis, they noticed they generated the most revenue from Air conditioners in April, May, and June. Therefore, they are comfortable closing books after the completion of the June period. Along with time for account preparations at lower costs, they also benefit by reporting the last quarter’s sales as the highest. In such a case, the AC hub will opt for a year starting in July and ending in June the following year.

- Another example is a grocery shop that operates at a significantly lower level. The owner wants experts to do their accounting at a low cost. So choosing the calendar year is unfavorable because it’s the peak season for the experts. Therefore, the chances of getting an expert at minimal cost are almost nil. So the best choice for him is to choose a year apart from the calendar year. It can be a year from April 1st to March 31st or starting from any other month apart from January.

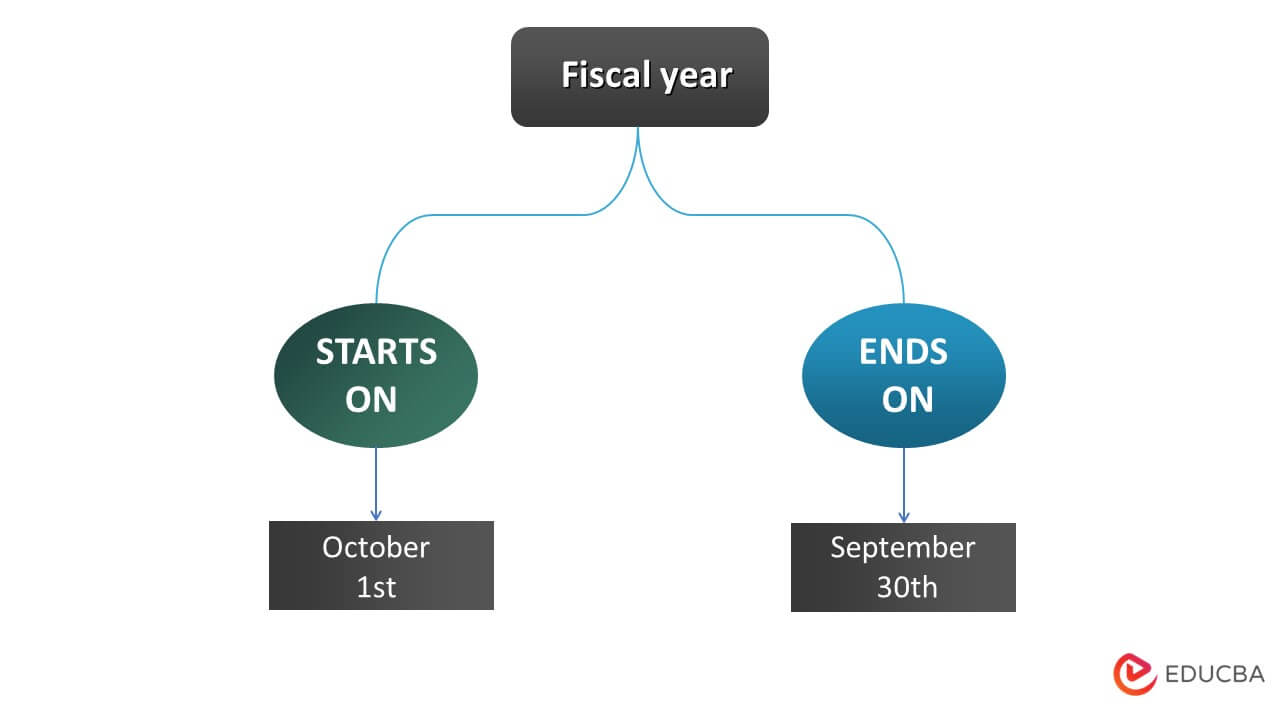

- The fiscal year for the U.S. federal government begins on October 1st and ends on September 30th.

Fiscal Year vs. Calendar Year

Fiscal Year

- It can be of any 12 months, i.e., starting from the 1st day of any month and ending after 12 consecutive months.

- For organizations following this, accounting and auditing become difficult.

- It can vary among countries or businesses depending upon their nature.

- It doesn’t bring uniformity as one may follow a different year than their clients, suppliers, or government agencies.

- Using this can ease hiring professionals like tax or accounting experts at a lower cost as that will be the off-season for those experts.

Calendar year

- The calendar year is a fixed period of 12 months that starts on January 1st and ends on December 31st.

- Choosing the calendar year can make understanding, recording, and auditing financial transactions accessible.

- It is the same worldwide.

- It brings uniformity as it is the same for all existing businesses.

- When enterprises commonly use the calendar year, hiring professionals at the end of the year can be expensive.

Benefits of Fiscal Year

- It benefits corporations as they can get various tax benefits and reduce their tax burdens.

- As the company’s business cycle is a deciding factor, it allows businesses to close their books in another month of the year, depending on their business.

- It allows easy negotiation with accounting and tax experts to convince them to provide services at a reduced cost.

- Usually, companies prefer to end financial results with the quarter that provides the best profits. Therefore, using a different year than the calendar year helps businesses choose accordingly.

- A wisely chosen FY paradigm can boost investor trust and interest. It can aid investors in appreciating a business’s worth through an organization’s simple trajectory.

IRS Guidelines

The IRS permits businesses to file taxes for either the fiscal or the calendar year. However, some organizations may start off using the calendar year approach. One can choose whatever year, provided it complies with one of the IRS standards.

However, according to the IRS, one must use the calendar year if:

- They don’t maintain any documents or books.

- They did not select an additional yearly reporting period.

- Their current tax year is ineligible to be a fiscal year.

IRS-acceptable tax years are,

- A 12-month period that starts on January 1st and ends on December 31st is known as a calendar year.

- A year of 12 consecutive months, concluding on the final day of any month except December.

- A year ranges between 52 and 53 weeks. It can end any day, not necessarily the last day of the month.

Conclusion

A consecutive twelve-month period organizations use for financial reporting is a fiscal year. Organizations have the right to choose the year as per their choice with no obligation to adopt the calendar year. The deciding factor can be the business’s operating cycle or its nature. However, it can make it difficult for investors to evaluate and compare companies with different reporting periods. Therefore, adopting the calendar year can unify the reporting periods of companies worldwide.

Frequently Asked Questions(FAQs)

Q1. Is the fiscal and calendar year the same?

Answer: No, they are not always the same. Companies need to choose either one of them as their financial reporting period. When companies choose the fiscal year as the calendar year, it is the same; otherwise, it is not.

For instance, ABC Ltd. uses the calendar year (January-December) for financial reporting. At the same time, XYZ Ltd. selects the fiscal year (beginning in April and ending in March of the following year). Therefore, the fiscal and calendar year are different in this case.

Q2. Why do companies use Fiscal years?

Answer: Since every business functions uniquely and has different peak operating seasons, fiscal years are crucial. They aid in coordinating the company’s commercial objectives with its financial needs.

Q3. What are the fiscal year quarters?

Answer: The fiscal year has four quarters. Many people use the terms Q1, Q2, Q3, and Q4 to refer to these quarters. How a corporation divides a calendar year into these four quarters is up to them.

The first quarter, or Q1, begins on January 1st and ends on March 31st. Similarly, Q2, Q3, and Q4 range from April to June, July to September, and October to December, respectively.

Q4. Fiscal year vs. financial year. Are they the same?

Answer: The terms “fiscal year” and “financial year” for businesses in the United States are interchangeable. Both of them refer to a 12-month accounting cycle. Although in other nations, they could have different meanings.

Q5. When does the fiscal year start and end?

Answer: A fiscal year typically runs from the first day of the first month to the end of the twelfth or from October 1st to September 30th. Depending on the time and date constraints, businesses may utilize a 53-week cycle.

Recommended Articles

This is a guide to the Fiscal Year. Here we discuss its meaning and explanation with examples and respective benefits. You can also go through our other related articles to learn more,