Updated July 26, 2023

Fixed Cost Formula (Table of Contents)

What is a Fixed Cost Formula?

The term “fixed cost” refers to the incurred expense that does not change with the change in the production level or sales volume over a certain period of time.

In other words, fixed cost is that kind of a cost which is independent of the level of business activity because it is more of a periodic cost. The formula for fixed cost can be derived by first multiplying the variable cost of production per unit and the number of units produced and then subtract the result from the total cost of production. Mathematically, it is represented as,

Examples of Fixed Cost Formula (With Excel Template)

Let’s take an example to understand the calculation of the Fixed Cost Formula in a better manner.

Fixed Cost Formula – Example #1

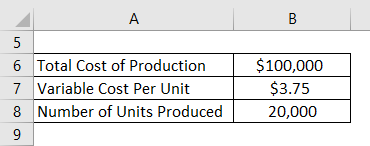

Let us take the example of a company which is the business of manufacturing plastic bottles. Recently the year-end production reports have been prepared and the production manager confirmed that 20,000 bottles have been produced during the year. On the other hand, the accounts department has confirmed that the company has incurred total production costs of $100,000 during the year. Calculate the fixed cost of production if the reported variable cost per unit was $3.75.

Solution:

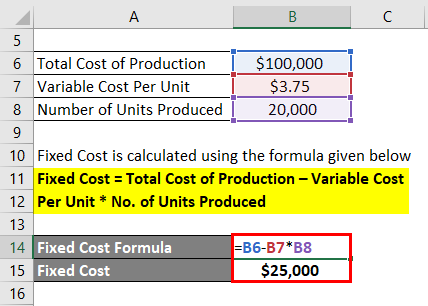

Fixed Cost is calculated using the formula given below

Fixed Cost = Total Cost of Production – Variable Cost Per Unit * No. of Units Produced

- Fixed Cost = $100,000 – $3.75 * 20,000

- Fixed Cost = $25,000

Therefore, the fixed cost of production for the company during the year was $25,000.

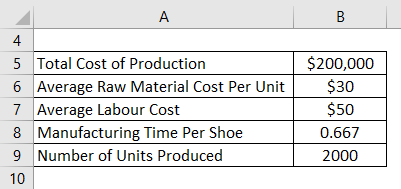

Fixed Cost Formula – Example #2

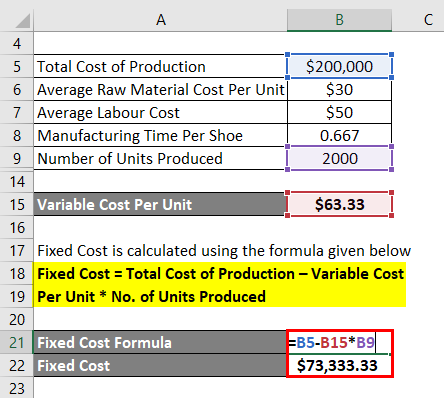

Let us take another example to understand the concept of fixed cost in further detail. PQR Ltd is a shoe manufacturing company and it reported the following production and cost data for the month of May 2019:

Solution:

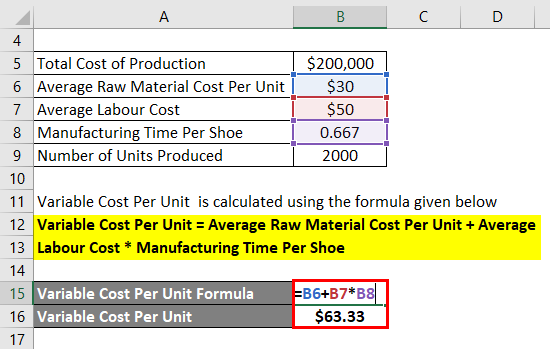

Variable Cost Per Unit is calculated using the formula given below

Variable Cost Per Unit = Average Raw Material Cost Per Unit + Average Labour Cost * Manufacturing Time Per Shoe

- Variable Cost Per Unit = $30 + $50 * 0.667

- Variable Cost Per Unit = $63.33

Fixed Cost is calculated using the formula given below

Fixed Cost = Total Cost of Production – Variable Cost Per Unit * No. of Units Produced

- Fixed Cost = $200,000 – $63.33 * 2,000

- Fixed Cost = $73,333.33

Therefore, the fixed cost of production for PQR Ltd for the month of May 2019 is $73,333.33.

Explanation

The formula for fixed cost can be calculated by using the following steps:

Step 1: Firstly, determine the variable cost of production per unit which can be the aggregate of various cost of production, such as labor cost, raw material cost, commissions, etc. As the name suggests, these costs are variable in nature and changes with the increase or decrease in the production level or sales volume.

Step 2: Next, determine the number of units produced during the period of time. The production is carried out according to a predetermined production schedule.

Step 3: Next, calculate the total variable cost of production by multiplying the variable cost per unit (step 1) and the number of units production (step 2) as shown below.

Total Variable Cost of Production = Variable Cost Per Unit * No. of Units Produced

Step 4: Next, determine the total cost of production of the company during the period of time which is the total of all costs incurred during the course of the production.

Step 5: Finally, the formula for a total fixed cost of production can be calculated by deducting the total variable cost (step 3) from the total cost of production (step 4) as shown below.

or

Relevance and Uses of Fixed Cost Formula

It is important to understand the concept of fixed cost because it is one of the two major components of the overall cost of production, the other one being the variable cost. Inherently, fixed costs are seen as that type of expense which hardly changes irrespective of the level of business activity of the company. However, it is should keep in mind that fixed cost is not perpetually fixed and it changes over the period of time during capacity expansion or unit hive off. In fact, fixed cost acts as a barrier to new entrants in capital intensive industries that eventually eliminates the risk of competition from smaller or newer players. Some of the major examples of fixed costs are depreciation expense, employee salary, lease rental, insurance fee, etc.

Fixed Cost Formula Calculator

You can use the following Calculator

| Total Cost of Production | |

| Variable Cost Per Unit | |

| No. of Units Produced | |

| Fixed Cost | |

| Fixed Cost = | Total Cost of Production - Variable Cost Per Unit * No. of Units Produced | |

| 0 - 0 * 0 = | 0 |

Recommended Articles

This is a guide to Fixed Cost Formula. Here we discuss how to calculate Fixed Cost along with practical examples. We also provide a Fixed Cost calculator with a downloadable excel template. You may also look at the following articles to learn more –