Best Books to Learn About Fixed Income

Investing in fixed-income securities is an intelligent bet whether you are a professional looking to diversify your portfolio or contemplating an option to park your surplus funds for a short period. Fixed-income investment has given the highest yield even during unprecedented times like the pandemic and other global crises, making it a sound and popular investment option.

This list of fixed-income books will help you understand bonds, debt funds, ETFs, and Money Market funds as some of the common fixed-income sources. The fixed income books teach beginners and professionals how including these has created a balanced and robust portfolio.

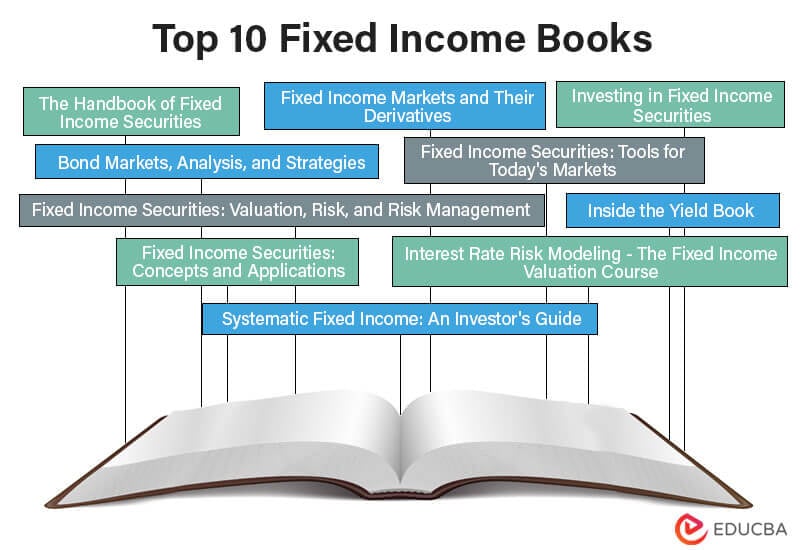

Here is the list of 10 books on fixed income that are equally ideal for students and professionals.

|

# |

Fixed Income Books | Author | Published |

Rating |

| 1 | The Handbook of Fixed Income Securities | Frank Fabozzi | 2005 | Amazon: 4.5

Goodreads: 4.25 |

| 2 | Fixed Income Securities: Tools for Today’s Markets | Bruce Tuckman | 2002 | Amazon: 5

Goodreads: 3.90 |

| 3 | Inside the Yield Book | Martin L. Leibowitz, Sidney Homer, Anthony Bova and Stanley Kogelman | 2013 | Amazon: 4.8

Goodreads: 4.00 |

| 4 | Fixed Income Securities: Valuation, Risk, and Risk Management | Pietro Veronesi | 2010 | Amazon: 4.2

Goodreads: 4.30 |

| 5 | Bond Markets, Analysis, and Strategies | Frank Fabozzi | 2009 | Amazon: 3.9

Goodreads: 3.89 |

| 6 | Investing in Fixed Income Securities: Understanding the Bond Market | Gary Strumeyer | 2005 | Amazon: 4.3

Goodreads: 5.00 |

| 7 | Fixed Income Markets and Their Derivatives | Suresh Sundaresan | 2009 | Amazon: 3.9

Goodreads: 3.80 |

| 8 | Fixed Income Securities: Concepts and Applications | Sunil Kumar Parameswaran | 2019 | Amazon: 5

Goodreads: 3.76 |

| 9 | Interest Rate Risk Modeling – The Fixed Income Valuation Course | Sanjay K. Nawalkha, Gloria Soto and Natalia Beliaeva | 2005 | Amazon: 3.8

Goodreads: 4.0 |

| 10 | Systematic Fixed Income: An Investor’s Guide | Scott A. Richardson | 2022 | Amazon: 5

Goodreads: 5.00 |

The following are the top 10 books, each discussed in detail.

Book #1: The Handbook of Fixed Income Securities

Author: Frank Fabozzi

Purchase this book here.

Review:

The book captures the basic ideas, tactics, and principles that help investors comprehend and assess fixed-income securities and their returns. The creators of this brilliant work lay out an exceptionally easy-to-follow strategy for investors to earn profit from these low-return category investments. With the help of the learnings of the book, both novices and experts can devise a profitable strategy in this complex industry by using the book’s simplified analytical tools and procedures.

Key Points:

- The fixed-income securities market is significant because of its ability to produce substantial returns, and the authors have given tactics highlighting this.

- The book includes chapters on managing portfolios of high-yield bonds, hedge fund fixed-income techniques, risk analysis, corporate bond market dynamics, and multifactor fixed-income models.

- The book is a reference to the potential rewards and potential hazards that the market for fixed-income securities offers to investors.

- It aims to make the fixed-income securities market’s complicated processes and inherent hazards more understandable to investors.

Book #2: Fixed Income Securities: Tools for Today’s Markets

Author: Bruce Tuckman

Purchase this book here.

Review:

Tuckman provides an excellent guide for examining and evaluating fixed-income securities using approaches, principles, and tactics. The book is the most effective way to learn quantitative techniques in an approachable fashion. The author includes insightful pictures to make it more instructive and useful in practice. It covers a variety of subjects, such as credit markets, interest rates, basis swaps, bond forwards and futures, repo rates, risk measurements, and arbitrage pricing.

Key Points:

- The current version is an excellent resource for finance professionals because it provides information on the crucial relevance of the current markets.

- It outlines pertinent and useful methods for using quantitative tools to evaluate and value fixed-income products.

- It also offers excellent insights into accurately valuing fixed-income assets using cutting-edge quantitative tools and approaches.

- This study helps readers comprehend how markets work by comprehensively depicting the world’s fixed-income markets.

Book #3: Inside the Yield Book: The Classic That Created the Science of Bond Analysis

Authors: Martin L. Leibowitz, Sidney Homer, Anthony Bova, and Stanley Kogelman

Purchase this book here.

Review:

The book’s primary goal is to change the perspective of bonds and other fixed-income assets by providing a historical perspective on bonds and valuation techniques. The concept of duration targeting is in the most recent edition (constantly replacing aging bonds with newer ones to maintain a stable overall portfolio duration). Instead of looking at individual bonds, it examines bond portfolios to see how they are impacted by shifting interest rates. It also demonstrates that a portfolio that maintains a constant maturity will, on average, provide returns consistent with YTM at the start of each such period for each period of a particular length of time.

Key Points:

- The book contains educational, significant, and helpful knowledge for understanding the critical ideas of value, time, and return.

- It gives straightforward insights of the fixed income from the first edition to assist you in navigating today’s changing market.

- The book aims to change the reader’s perception of bonds and other fixed-income assets by providing a historical perspective on bonds and valuation techniques.

Book #4: Fixed Income Securities: Valuation, Risk, and Risk Management

Author: Pietro Veronesi

Purchase this book here.

Review:

Pietro Veronesi has given us an instant classic in terms of fixed-income markets. This book approaches the topic entirely differently, combining a wide range of modeling challenges with incredible intuition and analysis of institutional elements. The author presents a new standard reference for fixed-income market specialists and students through various perceptive instances. The talks in the book incorporate straightforward ideas and prose, making it simple for students unfamiliar with these markets to understand.

Key Points:

- This book contains examples and techniques that have wide usage after understanding the fundamental concepts.

- It explains in detail these complicated assets, the factors influencing their prices, the hazards they pose, and the proper risk management techniques.

- Veronesi also offers a fantastic collection of illustrations based on information and circumstances from the actual world.

- These examples help readers understand the prices of fixed-income instruments and how the markets operate.

Book #5: Bond Markets, Analysis, and Strategies

Author: Frank Fabozzi

Purchase this book here.

Review:

Fabozzi’s Bond Markets prepares students to understand the bond market and manage bond portfolios in an applied approach without getting mired down in theory. It covers topics like the term structure of interest rates, measuring yield, measuring bond price volatility, and pricing of bonds; Just a few examples include stripped mortgage-backed securities, prime and subprime mortgage-backed securities, commercial loans and commercial mortgage-backed securities, interest rate models, and analyses of bonds with embedded options.

Key Points:

- The book has crisp explanations and mathematical analyses of bond finance, mortgage debt finance, securitized debt finance, and other topics.

- It comprehends the current understanding of the bond market and management tools for bond holdings.

- The book presents the analysts’ and fund managers’ current viewpoints on the fixed-income market.

- The newly added chapter on prime and subprime loans explains the 2008 financial crisis.

Book #6: Investing in Fixed Income Securities: Understanding the Bond Market

Author: Gary Strumeyer

Purchase this book here.

Review:

Through an approachable, analytical, but not excessively mathematical format, Gary Strumeyer deciphers the intimidating fixed-income market. This book aims to help you make the best possible investment decisions. Hence it covers a wide range of topics. These topics include the various types of fixed-income securities, their characteristics, and more.

Key Points:

- The author provides a technical and professional approach to looking into Fixed-Income Instruments.

- The book gives step-by-step guidance on the Bond market.

- The book also shares techniques required to manage a diversified portfolio and bond pricing concepts.

Book #7: Fixed Income Markets and Their Derivatives

Author: Suresh Sundaresan

Purchase this book here.

Review:

Sundaresan gives concise and understandable explanations of fixed-income markets, pricing, and securities. The book’s structure emphasizes institutions in the first section, analytics in the second, specific fixed-income market segments in the third, and fixed-income derivatives in the fourth. The author has also considered genuine market pricing and historical data from fixed-income markets; most examples are real-world situations. Credit default swaps and collateralized debt obligations are two recent developments in fixed-income markets that are examined and presented easily.

Key Points:

- It contains numerous real-life and worked-out examples using EXCEL to illustrate complex concepts with concrete examples.

- The book also includes an integrated discussion of the 2007 – 2008 credit crisis.

- It is a comprehensive financial glossary that explains the important terminology used in the book.

Book #8: Fixed Income Securities: Concepts and Applications

Author: Sunil Kumar Parameswaran

Purchase this book here.

Review:

Sunil Kumar Parameswaran’s Fixed Income Securities covers the full spectrum of fixed-income instruments, from standard bonds to interest rate derivatives and mortgage-backed securities. This book offers fundamental constructions and concepts with a parallel focus on practical applications and topics of importance to market professionals. It does so with helpful numerical demonstrations and explanations of using certain Excel functions. This book is a vital resource for professionals in brokerage, insurance, mutual funds, pension funds, hedge funds, commercial and investment banks, and finance students.

Key Points:

- The book simplifies and intuitively explains complicated concepts like Convexity, Immunization of a Bond Portfolio, and Mortgage-Backed Securities without sacrificing accuracy or depth.

- Sunil Kumar Parameswaran examines the time value of money, bonds, yield measurements, money markets, interest rate futures, and interest rate swaps.

- The author uses many helpful examples and demonstrations to explain these topics.

Book #9: Interest Rate Risk Modeling – The Fixed Income Valuation Course

Author: Sanjay K. Nawalkha, Gloria Soto, and Natalia Beliaeva

Purchase this book here.

Review:

It is the ultimate manual for valuing fixed income and assessing risk. The trilogy in Fixed Income Valuation and Risk Analysis covers the most thorough study on interest rate risk, term structure analysis, and credit risk. It is the first book on interest rate risk modeling. It explores almost all popular IRR models for valuing and analyzing the risks associated with various fixed-income assets and their derivatives.

Key Points:

- This book shows how to apply risk models to various fixed-income instruments.

- It discusses the virtual representation of the models that adds to the book’s value.

- This extensive resource gives readers the practical knowledge and tools they need to excel in the financial industry.

- It also includes many programming tools and algorithms that help readers better model risk and evaluate fixed-income instruments.

Book #10: Systematic Fixed Income: An Investor’s Guide

Author: Scott A. Richardson

Purchase this book here.

Review:

This book provides readers with a strong, practical, and reliable framework for investors and asset managers. This way, they can maintain the diversifying properties of a fixed income allocation and supplement that with special sources of excess returns through systematic security selection. Dr. Scott Richardson, a well-known financial expert, offers practical methods for locating the relevant sources of risk and return in the public fixed-income markets. He also explains fixed income’s tactical and strategic functions in standard portfolios.

Key Points:

- It focuses on the liquidity and risk arising from a systematic fixed-income portfolio.

- The author highlights the rate and credit-sensitive fixed-income assets’ systematic return sources in developed and emerging markets.

- This paradigm enables effective fixed-income alpha and beta capture.

Recommended Books

We hope this top 10 fixed income books article helps you. For more such books, EDUCBA recommends the following,