Updated July 17, 2023

Who is Fixed Income Trader?

A fixed-income trader is a finance professional (an individual) who works for a person (an individual, a firm, or a corporate entity) to trade specifically in fixed-income securities such as bonds, debentures, treasury bills, etc.

He ensures that such investments are safe to provide a fixed return for a longer period, either for himself or the clients or an asset management company.

How Do Fixed Income Traders Do?

- It is a finance professional who executes trades of fixed-income investments. He will trade such investments for big institutions and retail sector clients.

- Institutions, brokers, dealers, and bankers engage him. Even big broker-hubs, who receive contributions from investors, hire such fixed-income traders.

- He develops a trading strategy based on current market scenarios to pick the right instruments for the buy and sell sides. Market participants trade for fixed-income instruments such as loans and bonds.

- A firm for which the fixed-income trader is working may already have a separate department responsible for picking up the trading strategies. In such a scenario, his responsibilities are to execute the trade, manage the portfolio, and report the plus and negative points to the management.

- The fixed-income trader may execute the trade for the primary market as well as the secondary market. Primary market means initial public offer and further public offer. A secondary market means trading in listed bonds and debt instruments.

Career Path of Fixed Income Trader

- A fixed-income trader goes through a high level of stress for management of the portfolios, and the working hours are long enough on an average workday. All these are compensated with high financial rewards.

- High work pressure comes with high levels of compensation. Hence, only if a person has that high intensity to work under stress yet remains cool for long working hours can they become a successful fixed-income trader.

- The overall employment in the United States expects to grow by 6 million jobs from 2019 to 2029, per the latest news release by the US Bureau of Labor Statistics. Even if such a growth percentage is lower than the earlier estimate of 2009 to 2019, there is scope for financial professionals to take share in the next decade.

Education and Skills of Fixed Income Trader

Below are the Education and Skills :

Education of Fixed Income Trader

- The individual who aspires to become a fixed-income trader must have at least one degree in the finance domain. There is no hard and fast rule for a finance-oriented student to pursue only high-end degrees.

- Degrees can be within the range of becoming a BBA (Bachelor in Business Administration) with a finance specialization to an MBA (Master of Business Administration) with a specialization in finance.

- If a person has a spark for the finance world, he can expand his knowledge base by taking up CFA (Chartered Financial Analyst) course. CFA is a global standard for the finance sector. A CFA’s level of technical understanding is exceptional compared to a person with an MBA degree in finance. Still, it depends on the interests of respective individuals.

- The student should learn finance, statistics, probability theories, mathematics, and economics. Together with these, sufficient knowledge of behavioral finance is an added advantage. Now why behavioral finance? It would help an individual accommodate the situational and psychological profiling of the clients for whom the portfolio will be managed. Behavioral finance covers in level 3 of the CFA curriculum.

- However, at the time of actual trading in real life, experience counts more than the degree at the back end. It’s not a game of attaining knowledge first and then going forward for a job. The student is suggested to start at the early stage of gaining knowledge. Because over some time, experience matters a lot more than the knowledge base. In the starting phase, a person may start with the position of an analyst.

Skill Sets

- The skill set is about how you display yourself to the outside world. The knowledge is of lower importance in front of skill set. The skill set is the art of selling things.

- This is why finance professionals, even if they have a little perfect knowledge about a few things, can present things diligently to the prospective client. The information from a fixed-income trader is used to promote decision-making for the firm he works with.

- Good communication skill is like the blood required for finance professionals to survive in the competitive world. They got to explain a few concepts and methodologies to prospective clients in an easy-to-understand manner. Even after the first assignment, communication with clients is essential to keep the relations going.

- The fixed-income trader is required to face the client directly to understand the client’s financial goals and demographic profile and to maintain the desired level of fixed income from the investments he suggested.

- Finance professionals cannot afford the dissatisfaction of clients. In such cases, communication skills will help the fixed-income trader to present his ideas and the risk assumed by the trader for the portfolio of the dissatisfied client.

- The fixed-income trader needs to have a key eye for details. He should be able to multitask himself in a fast-paced world. He won’t be handling only one assignment at a time and may be doing additional research for a company, analyzing another company’s profits, or evaluating a share’s intrinsic value.

- Another important skill required by a trader is to stay from emotions. He cannot choose a bond because of any emotional connection with the issuer company.

- A working knowledge of Microsoft Excel is essential for a finance professional. The fixed-income trader needs to play around with the rows and columns of Excel. Any person in the commerce field should attain the basic skill set.

Experience

- The fixed-income trader starts his working knowledge by being an analyst. As his experience increases in the future, he gets a higher position.

- With the increase in experience, he can capture more successful trades resulting in high revenue for clients.

- In the US, a major workforce is moving towards retirement. Thus, fixed-income investments are increasing daily. This requires the fixed-income trader to manage the show.

Salary

- The pay scale of a fixed-income trader ranges widely depending on the firm in which he is working, the firm’s geographic location, experience, etc.

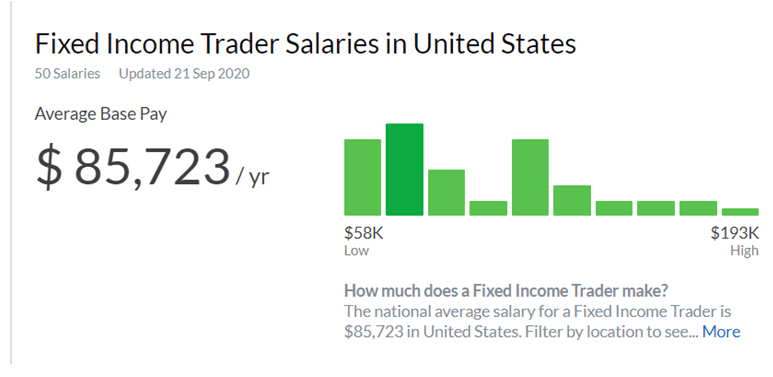

- As per an estimate by Glassdoor, the average salary of a fixed-income trader is around $ 85,723 per annum, with a low scale of $ 58,000 to a high scale salary of $ 193,000 per annum.

Image Source: https://www.glassdoor.co.in/Salaries/us-fixed-income-trader-salary-SRCH_IL.0,2_IN1_KO3,22.htm

- The bonus for a fixed-income trader depends on the performance. The normal compensation is around $ 32000 on an average basis.

A fixed-income trader is a finance professional investment firm executing trades in fixed-income instruments. The fixed-income instruments include trading in bonds, debentures, etc. The Western population is now moving towards a fixed-income source, and thus the demand for fixed-income traders is rising.

Recommended Articles

This is a guide to Fixed Income Trader. Here we also discuss the definition and how does a fixed-income trader do. Along with the education and skills of fixed income trader. You may also have a look at the following articles to learn more –