Updated July 24, 2023

Difference Between For Profit vs Non Profit

The for-profit organization can be defined as a company, partnership or a sole proprietorship firm whose primary purpose is to earn profits whereas a non-profit organization can be defined as a club, trust, society, etc formed for the purpose of serving the community. It is no denying that both For-profit and the non-profit organization intend to make profits but the difference is that the former earns profits for personal fulfillment reasons whereas the latter earns profits for serving a social cause or the society at large.

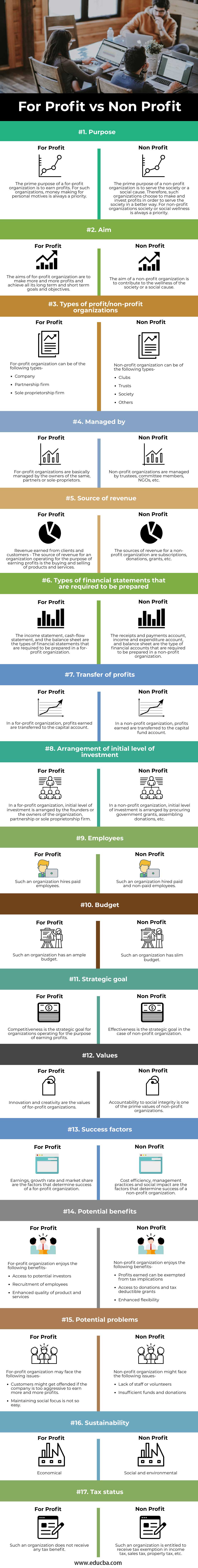

Head To Head Comparison Between For Profit vs Non Profit (Infographics)

Below are the top 17 differences between For Profit vs Non Profit:

Key Differences Between For Profit vs Non Profit

The key differences between a For Profit vs Non Profit contract are provided and discussed as follows-

- A for-profit organization is required to pay all its tax liabilities whereas non-profit organization is entitled to receive tax exemption in sales tax, income tax, property tax, etc.

- A for-profit organization is managed by its proprietors, partners, or sole proprietors whereas non-profit organization is managed by committee members, trustees, etc.

- The source of revenue in a for-profit organization is revenue that is earned from clients and customers i.e. by trading in the purchase and sale of goods and services whereas in the case of a non-profit organization is grants, donations, subscriptions, etc.

- The profits earned by for-profit and non-profit organizations are transferred to the capital account and the capital fund account respectively.

- For-profit organizations have ample budgets whereas non-profit organizations are budget constraints.

- The for-profit organization focuses on economic factors whereas non-profit organizations focus on social and environmental factors.

For Profit vs Non Profit Comparison Table

Let’s discuss the top comparison between For Profit vs Non Profit:

|

Basis of Comparison |

For Profit Organization |

Non Profit Organization |

| Purpose | The prime purpose of a for-profit organization is to earn profits. For such organizations, money-making for personal motives is always a priority. | The prime purpose of a non-profit organization is to serve society or a social cause. Therefore, such organizations choose to make and invest profits in order to serve society in a better way. For non-profit organizations society or social wellness is always a priority. |

| Aim | The aims of for-profit organizations are to make more and more profits and achieve all their long-term and short-term goals and objectives. | The aim of a non-profit organization is to contribute to the wellness of society or a social cause. |

| Types of for-Profit/non-Profit Organizations | A for-profit organization can be of the following types-

|

A non-profit organization can be of the following types-

|

| Managed by | For-profit organizations are basically managed by the owners of the same, partners or sole-proprietors. | Non-profit organizations are managed by trustees, committee members, NGOs, etc. |

| Source of Revenue | Revenue earned from clients and customers – The source of revenue for an organization operating for the purpose of earning profits is the buying and selling of products and services. | The sources of revenue for a non-profit organization are subscriptions, donations, grants, etc. |

| Types of Financial Statements that Are Required to be Prepared | The income statement, cash-flow statement, and balance sheet are the types of financial statements that are required to be prepared in a for-profit organization. | The receipts and payments account, income and expenditure account, and balance sheet are the type of financial accounts that are required to be prepared in a non-profit organization. |

| Transfer of Profits | In a for-profit organization, profits earned are transferred to the capital account. | In a non-profit organization, profits earned are transferred to the capital fund account. |

| Arrangement Of the Initial Level of Investment | In a for-profit organization, the initial level of investment is arranged by the founders of the owners of organization, partnership or sole proprietorship firm. | In a non-profit organization, the initial level of investment is arranged by procuring government grants, assembling donations, etc. |

| Employees | Such an organization hires paid employees. | Such an organization hired paid and non-paid employees. |

| Budget | Such an organization has an ample budget. | Such an organization has a slim budget. |

| Strategic Goal | Competitiveness is the strategic goal for organizations operating for the purpose of earning profits. | Effectiveness is the strategic goal in the case of a non-profit organization. |

| Values | Innovation and creativity are the values of for-profit organizations. | Accountability to social integrity is one of the prime values of non-profit organizations. |

| Success Factors | Earnings, growth rate and market share are the factors that determine the success of a for-profit organization. | Cost efficiency, management practices, and social impact are the factors that determine the success of a non-profit organization. |

| Potential Benefits | The for-profit organization enjoys the following benefits-

|

The non-profit organization enjoys the following benefits-

|

| Potential Problems | A for-profit organization may face the following issues-

|

A non-profit organization might face the following issues-

|

| Sustainability | Economical | Social and environmental |

| Tax Status | Such an organization does not receive any tax benefit. | Such an organization is entitled to receive tax exemption in income tax, sales tax, property tax, etc. |

Conclusion

As the name implies, for-profit organizations work in order to earn profit figures. On the other hand, non-profit organizations work for the wellness of society. The profits earned by non-profit organizations are used towards the fulfillment of a social cause while the profits earned by for-profit organizations are used for personal fulfillment. The types of financial statements that are required to be prepared in a for-profit organization are the income statement, cash-flow statement, and balance sheet. On the other hand, the types of financial statements that are required to be prepared in a non-profit organization are the receipts and payments account, income and expenditure account, and balance sheet. The employees employed in a for-profit organization are paid whereas the employees of a non-profit organization can either be paid or unpaid.

Recommended Articles

This is a guide to the top difference between For Profit vs Non-Profit. Here we also discuss the For Profit vs Non Profit key differences with infographics and comparison table. You may also have a look at the following articles to learn more –