Updated November 4, 2023

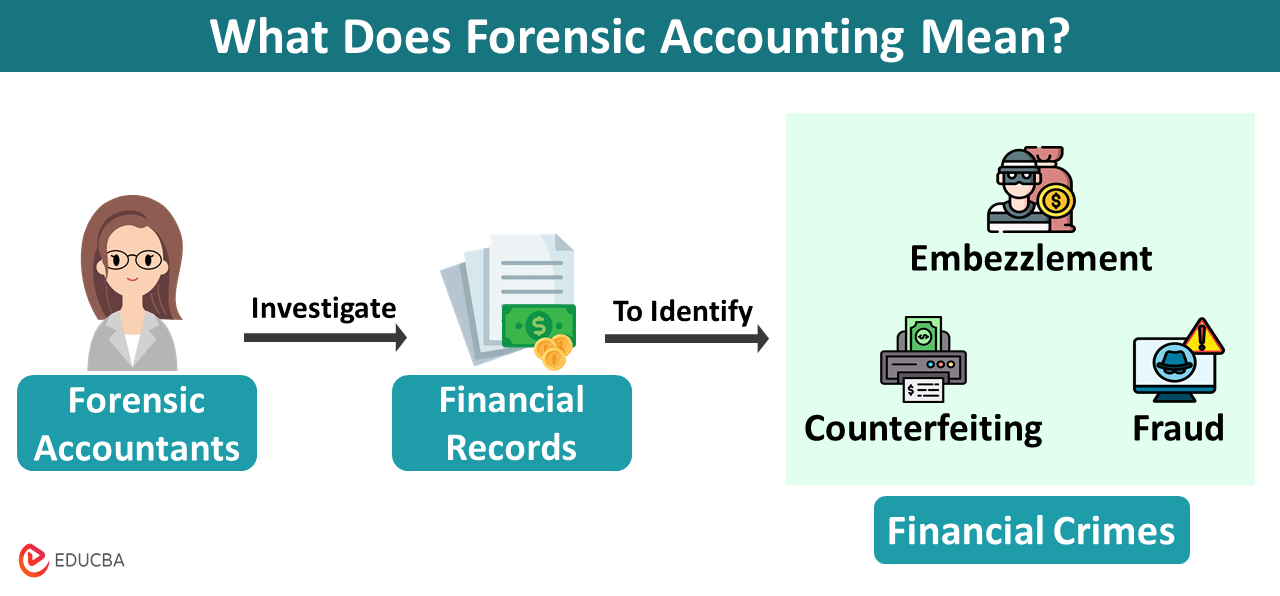

Forensic Accounting Definition

Forensic accounting is when accountants carefully study financial records and transactions to find any clues or evidence of financial wrongdoings like tax evasion, theft, money laundering, etc.

It is a unique combination of accounting and investigative skills. While regular accounting focuses on record keeping and providing financial information, forensic accounting focuses on revealing financial crimes. Detectives investigating financial crimes often take the help of forensic accountants to provide credible evidence. They can also serve as expert witnesses in court.

Table of Contents

- Meaning

- How Does it Work?

- Objectives

- Types

- Examples

- Services

- Techniques

- Forensic Accounting Vs. Auditing

Key Highlights

- Forensic accounting refers to finding evidence of financial crimes to assist investigators and courts in making informed decisions.

- Its types and applications include corporate fraud cases, tax evasion, divorce cases, insurance claims, money laundering, and more.

- Its two service branches are litigation and investigation.

- The main difference between auditing and forensic accounting is that while auditing focuses on finding financial mistakes, forensic accounting focuses more on uncovering fraud and identifying its source.

How Does It Work?

Forensic accounting is essentially like being a financial detective. Once a forensic accountant gets a case from a client, government agencies, or a lawyer, the process starts as follows:

- Gathering Information: First, they collect the financial documents and data related to the case, like bank statements and tax records.

- Examining the Numbers: Then, they carefully study the numbers to see if anything seems fishy or unusual, like hidden transactions, fake invoices, etc.

- Tracing Transactions: They follow the money trail and track where the money came from and where it went.

- Interviews and Interrogations: They also talk to people involved to get more information. This could be employees, managers, or anyone who might know something important.

- Creating Reports: They then make reports to explain their findings. These reports are used in legal proceedings to help make decisions.

- Testifying in Court: In some cases, they might need to go to court and explain their findings to the judge and jury.

Objectives

The major objectives of the forensic accounting are:

- Identifying financial misconduct and fraud.

- Proving financial crimes in court by offering concrete evidence and expert testimony.

- Implementing measures and recommendations to prevent future fraud and misconduct.

- Calculating the extent of financial losses resulting from the financial irregularities.

- Assisting in resolving financial disputes, including shareholder disagreements, contract disputes, or divorce settlements, by providing financial clarity and evidence.

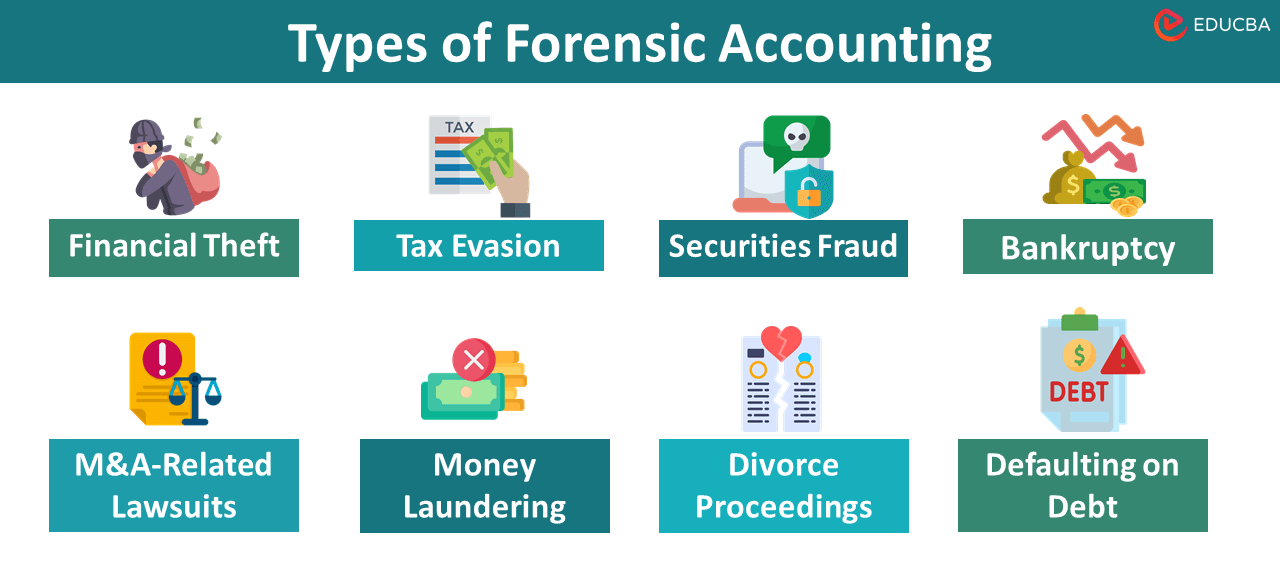

Types of Forensic Accounting

Following are some common applications of forensic accounting under various types of situations.

1. Bankruptcy

If businesses declare bankruptcy when they are incapable of paying back loans, forensic accountants assist creditors in recovering what they are owed. They do this by investigating activities like the secrecy of assets, confidentially exchanging and transferring property under the market value, and others.

2. Economic Damages

Economic damages are financial losses that arise from events like wrongful actions, breach of contract, etc. Forensic accountants help affected parties recover their financial losses by quantifying these damages accurately. This is crucial in legal cases, insurance claims, or settlement negotiations.

3. Tax Evasion

Businesses or individuals sometimes intentionally falsify their expenses or income statements to escape paying taxes. In such cases, government agencies can employ forensic accountants to uncover these tax frauds.

4. Securities Fraud

Also known as investment fraud, securities fraud is when businesses hide important information from investors. Thus, a forensic accountant investigates companies to ensure they are not misleading their investors.

5. M&A-Related Lawsuits

Sometimes, companies can file lawsuits against each other during M&A procedures. Thus, a forensic accountant is hired to investigate contract breaches and financial misrepresentations in such cases.

6. Financial Theft

Sometimes, outside parties, employees, or customers can steal the business’s money through fraudulent means. Here, a forensic accountant’s job is to discover such thefts, identify the person responsible, and present the evidence in court.

7. Money Laundering

Money launderers are people who hide their illegal sources of income, like trafficking and terrorist funding, and present their income as legal. Thus, it’s the forensic accountant’s job to find the true money sources.

8. Professional Negligence Claims

It is when clients file a case against professionals like CAs, lawyers, and accountants for losses caused by their alleged negligence. Here, Forensic accountants assess the actual credibility and value of the losses.

9. Privacy Information

If the private accounting information of a business leaks, it breaches the privacy of a company. Forensic accountants can investigate those privacy breaches to facilitate catching the culprits.

10. Divorce Proceedings

During divorce proceedings, a person might hide the true value of their assets from their spouse. Here, a forensic accountant can find the true value of the assets to ensure a fair distribution of wealth.

11. Defaulting on Debt

It involves investigating situations where individuals or businesses fail to repay their debts as agreed. Forensic accountants examine financial records, loan agreements, and other relevant documents to determine the causes of default.

12. Corporate Valuation Disputes

When there is a disagreement regarding the true worth of a company or its assets, it can lead to legal cases or shareholder disputes. To sort out the issue, forensic accountants evaluate the value of the business or its components, providing an accurate assessment of the company’s financial standing and worth.

Examples

Here are some simple examples of forensic accounting.

Example #1

A retail store found that there were clear discrepancies between recorded transactions and collected finances. To resolve this issue, they hired a forensic accountant. After thoroughly analyzing the store’s as well as each employee’s records and conducting detailed interviews, they found that one of the employees was embezzling money from the company’s cash registers.

Example #2

During a merger between two pharmaceutical companies, Company A and B, Company A believed that Company B had misreported one of its drug patents’ value. So, they hired a forensic accountant to assess the financial records, and the accounts found no financial misrepresentation in the deal.

Example #3

During a forensic accounting investigation, it was found that a publicly traded company was hiding crucial financial information from its investors. It was because they wanted to maintain high stock prices in the market. After uncovering the misleading practices, the stock market regulations filed a securities fraud case against the company.

Services

We can categorize forensic accounting services as follows:

- Investigative Service: The main focus of investigative services is to help find evidence of financial misconduct or fraud.

- Litigation Support: The main purpose of litigation support services is to aid legal cases by providing witness testimony, quantifying damages, calculating lost profits, tracing & recovering assets, resolving shareholder partnership disputes, and more.

Forensic Accounting Techniques

Here are some of the techniques forensic accountants use to identify financial crimes.

- Data Analysis: They use data mining and analysis tools to identify irregular patterns in a business’s financial records.

- Interviews: Conducting in-depth interviews with the key individuals involved in a case can help gather the required evidence.

- Document Examination: Scrutinizing the financial documents of an individual or business for inconsistencies, forgeries, or alterations is another crucial technique forensic accountants use.

- Digital Forensics: In the age of technology, experts must recover and analyze electronic data, such as emails or digital financial records.

- Conducting Surveillance: Forensic accounting also allows secret recording and monitoring of all the activities and financial transactions of the suspected individual or business to gain substantial evidence of financial irregularities.

- Going Undercover: Sometimes, forensic accountants may even need to assume a fake identity and pose as employees, clients, or business partners to gain access to sensitive information or observe financial activities.

Forensic Accounting Vs. Auditing

The following are the main differences between forensic accounting and audit.

| Basis | Forensic Accounting | Auditing |

| Aim | To disclose the financial crimes and identify the perpetrators. | To find and prevent errors and irregularities in financial statements. |

| Time frame | Depends on the case. | Periodic – Quarterly or Annually. |

| Approach | Analyzing financial documents, conducting interviews, and investigations. | Verifying and reviewing financial documents to ensure regulatory compliance. |

| Skills required | Accounting, investigation, and data analytics. | Accounting |

| Reporting | The accountants report to law enforcement agencies or courts. | The accountants report to the management of the company and other stakeholders. |

| Scope | Applicable in specific situations like embezzlement, financial fraud, insurance fraud, etc. | Required for analyzing the financial status of an entire organization. |

Final Thoughts

Forensic accounting investigates the finances of a business or an individual to ensure there is no mismanagement or misrepresentation of finances. Along with investigating financial crimes, forensic accountants can also work to prevent and predict financial inconsistencies.

Frequently Asked Questions (FAQs)

Q1. How do I become a forensic accountant?

Answer: A bachelor’s degree in accounting or a related field is the first step to becoming a forensic accountant. You can also pursue a Certified Public Accountant (CPA) or Certified Fraud Examiner (CFE) to enhance your qualifications. Moreover, taking specialized courses like Certified in Financial Forensics (CFF), Certified Forensic Accountant (Cr. FA), and working on forensic accounting cases can help build your accounting skills and knowledge.

Q2. How much does forensic accounting cost?

Answer: The cost of forensic accounting varies on different factors like case complexity and scope, the services needed, location, the forensic accountant’s expertise, and duration. Typically, the hourly rates can range anywhere between $100 to $500. However, if the case is too complex and requires more extensive investigation, the hourly rate could be significantly higher.

Q3. Are a CPA and a forensic accountant the same?

Answer: A CPA (Certified Public Accountant) is simply a qualified accountant who can perform general accounting, auditing, and tax-related tasks. On the other hand, a forensic accountant is someone who investigates and reports financial crimes. A CPA can be a forensic accountant, but they need additional skills and expertise in forensic techniques, data analysis, and investigation.

Q4. Which are the top forensic accounting firms?

Answer: Some of the big names in the forensic accounting field are PricewaterhouseCoopers (PwC), Deloitte, EY (Ernst & Young), and BDO USA.

Q5. What are the limitations of forensic accounting?

The following are the limitations of forensic accounting:

- Going through every document and detail of a business can be extremely time-consuming.

- It requires a lot of money to investigate financial crimes.

- It can affect employee morale and distract them from their work.

Recommended Articles

EDUCBA presents this article on Forensic accounting. If you find this article interesting, please feel free to read the following articles as well: