Introduction to Forex Brokers

The forex market accounts for trillions of dollars worth of traded value on average daily. It is easily the biggest financial market in the world.

While there is currently no central or major market for forex trading, traders must select based on how their desired trading outcomes can be met. There is numerous forex broker to compare choose from. But you must possess a bird’s eye perspective if you want profits to be sky-high. Soaring profits hinge on selecting the right broker in today’s competitive forex market trading centers. Forex brokers offering really low spreads attract traders by minimizing transaction costs, making it easier for them to maximize profits. Here are some criteria you need to consider before taking the plunge.

Best 14 Forex Brokers

Below are the best 14 forex brokers:

1. Questions About Regulatory Compliance

A reputed forex broker to compare needs to be registered with the regulatory authority. For example, a well-known forex broker in the United States will be registered with the US Commodity Futures Trading Commission. In the Indian context, SEBI would be an equivalent example. Such a forex broker aims to create and foster a healthy yet competitive environment for futures trading. Ensure the forex broker you choose has a membership or is registered with regulatory authorities. Critical concerns concerning the deposit’s safety and the forex broker’s integrity and reputation should be given priority. Accounts should be opened with well-regulated firms.

2. Complete Account Details

Forex brokers have different types of accounts on offer. This includes the following:

- Leverage and Margin

- Commissions and Spreads

- The ease with which Deposits and Withdrawals Are Made

Leverage refers to loans extended to brokers by margin account holders. Leverage and margin depend on the forex broker. Ratios can range from 50-200 to 1. Using the 50 is to 1 leverage, an account of INR 2000 can hold a position valued at INR 100,000. The trader uses leverage to score winning positions; the scope for profits rises due to this. The converse is also true. Therefore, leverage is a type of double-edged sword when it comes to forex brokers.

Initial deposit size is also a basis for selecting the forex broker. While many currency exchange trading accounts can be funded with small initial deposits, leverage ensures that purchasing power is far higher. This is why currency exchange trading is so attractive for beginners and forex brokers…after all, one can make more profits with less money in hand. Forex brokers in the currency exchange trading market initially offer standard, mini, and tiny-micro accounts with varied small deposit requirements.

Recommended courses

- Online Financial Modeling of Retail Sector Course

- Complete Financial Modeling of Automobile Sector Training

- Online Certification Training in Financial Modeling of the Cement Sector

- Online Course on Financial Modeling of Pharma Sector

Commissions and spreads are the means through which a forex broker earns money. Forex brokers using a commission can charge a certain percentage of the spread. So what is the spread? It is the difference between the bidding and asking price of the currency pair. Many forex brokers hold that no commissions will be charged, and instead, money is to be generated through wider spreads. For instance, a spread is fixed or variable about market volatility. For example, if the position has a 4 pip spread and a quote of 1.3843 to 1.3947 is mentioned, as soon as the market participant purchased at 1.3947, the position lost 4 pips of value as it could only be sold for 1.3943. Therefore, the bigger the spread, the harder it is to avoid losses. Popular trading pairs would have more tight spreads, including EUR/UK pounds (GBP).

Moreover, each forex broker has certain account withdrawal and funding principles. Some may allow account holders to transfer online cash through credit cards, Pay Pal, wire transfer ban, or business checks. Others may be strict about dealing with face-to-face transactions only. Forex brokers can charge fees for either service, depending on their policies.

3. Currency Pair On Offer: Match Made in Financial Paradise?

While many currency pairs are there for trading, only a few live “happily ever after.” Major currency pairs are GBP-USD, USD- Swiss France, Euro-USD, and USD-Japanese yen. These are not only the most common forex trader jobs but are offered in pairs across the globe. US forex brokers can have a wide or small selection of currency pairs, yet they offer pairs where the trader has a requirement or an interest. Therefore, choose the broker with care to get the right currency pair! This can vary.

4. Serving the Customers

Forex trading is a 24/7 job, not a 12/5 job. Forex Broker customer support needs to be there at almost any time. The ease with which one can interact with customer service professionals associated with a forex broker is important. One can speak with a person or an automated voice; each has its pitfalls and drawbacks. A 5-minute call provides a clue about a broker’s customer service. You can also assess the capacity of the rep to answer questions correctly. Subjects on which the rep should be grilled include spreads, leverages, regulations, as well as details of the company. Remember that in the markets, size does matter. A larger forex broker has access to better prices as well as operations.

5. Nature of the Trading Platform

A trading platform is the investor portal for the markets. Care should be taken that platforms and the software they use should be easy. It should also be easy on the eyes! Visually pleasing platforms are easier to observe. Apart from being user-friendly and visually appealing, well-designed trading platforms also have many tools. This includes technical as well as fundamental analysis.

Ease of entry and exit is another criterion for assessing the trading platform. A perfect trading platform will have distinct options for buying and selling. Some platforms even offer a “cancel all transactions” option.

What does a poorly designed interface mean?

- Costly to enter

- Tough to exit

- Accidental position add-ons, for example, going long when short, and much more.

- Customization types

- Order Entry options

- Automated Trading types

- Strategy growth

- Backtesting and trading notifications

Brokers often offer free demo mini accounts so forex traders’ jobs can find out on the trading platform much before the account is opened and funded. Little research can go a long way in selecting the right forex broker to do the job.

6. Medium of Trading

US forex broker provides investors in-depth data on market trends and analysis, making trading decisions easier. Some forex broker offers investors a chance to conduct online trading. Others offer only the offline option. Selecting the right us forex broker makes all the difference to a positive outcome while trading in the markets.

7. Understand the comparisons Between A Good Forex for a Broker and a Bad One

Each forex broker best offers differing services. All of them vary in competency, too. Selecting the right forex broker is important because your trading career and market success depend on this. Some research and analysis are critical before you choose forex for a broker. Remember that making the wrong choice can wipe out any chances of success in the market.

Approach forex broker selection in a methodical manner. Start with a list of us forex brokers suitable to meet your needs. Once you have found a broker who suits you in terms of trading style, check his or her position with respect to size and location in terms of your preferences.

8. Financial Backing: Checking Cash Power

Forex or currency exchange trading brokers must provide investors with high leverage. This is only possible if well-funded financiers or institutions back them.

9. Registration with Commission

Forex brokers need to register with the futures commission within their country. Investors must check if the forex brokers are registered by the US Commodity Futures Trading Commission/CFTC. In India, the Forward Markets Commission is the apex body for this purpose

10. Technical Details

This includes platform, account type, and spread. Different choices are available for the investor based on the nature of the spread and the platform. Forex traders’ jobs must also be clear whether they require a mini, macro, or standard account with the broker. The exact amount of capital investment dictates the account type opened with a brokerage firm.

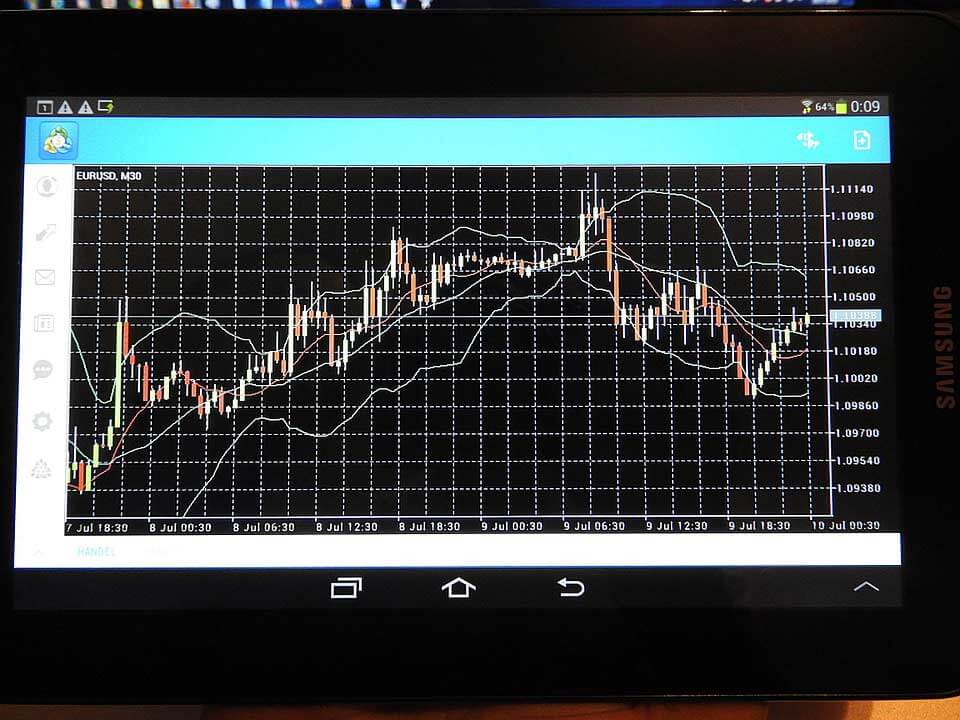

For mini firms, a minimum deposit to be placed with the broker will have a far lower value than required for a standard or macro account. Each broker offers a platform that enables traders to get data about graphs, charts, live quotes, open positions, present profit and loss status, and net exposure.

The technology offered should also be user-friendly. There should also be market research and tools to ensure the best possible action. You also need to talk with other investors about the reputation of the forex broker selected. Unethical trading practices like scalping, sniping, or hunting should mean you need to nip the idea of hiring such brokers in the bud.

11. Cost to You if You Go At It Alone!

Forex brokers are qualified to trade forex on a preliminary basis, and they should have the moral courage and determination they need to trade in volatile markets. Do you have to consider if you are emotionally qualified to trade forex because it is preliminary? Do you have intelligence, drive, and focus? Intelligence includes EQ and financial or market intelligence. The drive includes motivation and skill. Focus implies attention, concentration, and capability to deal with the vagaries of the market.

Forex is where you can excel if one has the drive to do it. But if you need an expert, trading forex requires opening an account with a broker online.

12. How Secure Are Your Funds?

There is no point in opening a Forex account if funds would be unsafe with the broker or stolen or taken by force. Currency fundamentals will not help you if profits are pilfered by crooks or those who lack money management skills. Before registering with a broker, a safe, clean, and reliable track record is necessary. Regulatory authorities in the nation are oriented toward screening brokers and making their legitimacy clear to the world. Large financial centers also have special rules and regulations to prevent investors from being defrauded.

13. Currency Range Offered And Your Goals

One must select a broker offering a wider array of tradable currencies. There are different classifications of currency pairs, and you need to be clear about whether you are getting your money’s worth. For example, if brokers offer 4 currencies with major economic powers, three for developing nations with floating currencies, three for pegged or fixed currencies, and three rare pairs (like the Chinese Yuan/RMB), this is a better idea. Thus, a broker who offers all currency pairs of major developed economies is not diversifying risk effectively for the investor.

14. Dealing Desk or Non-Dealing Broker?

Another important consideration is whether the broker offers to fix or nonfixed spreads and their width and who will likely make a quick buck on some pips. Large spreads or those that are variable can negatively impact performance. Always check if the broker is leveraging in a way that suits the trading style. In the markets, less is more when it comes to leverage. Trading micro lots initially is much better if you want to insulate yourself against losses.

Another important point is whether brokers credit or debit everyday rollover interest. Remember that some brokers do both if you think these are the only two possibilities. Premium services like charting, market comments, and news feeds are also important to consider. There are differences among brokers regarding slippage and execution, so think carefully before making a choice.

Conclusion – Forex Brokers

Selecting the right forex broker can make or break your future in the currency exchange trading markets. So, look before you leap; otherwise, it will be costly in terms of time, effort, and money.

Recommended Articles

This has been a guide to Forex Brokers. Here, we discuss the 14 best forex brokers for forex trader jobs. You may also look at the following articles-