Top Books to Learn Forex Trading

Foreign exchange (FX) is an integral part of the global economy due to the absence of national boundaries and the advancement of technology and communication. This list is an aid for professionals and beginners to create a robust trading strategy. These books are up-to-date with all the latest trends in the industry.

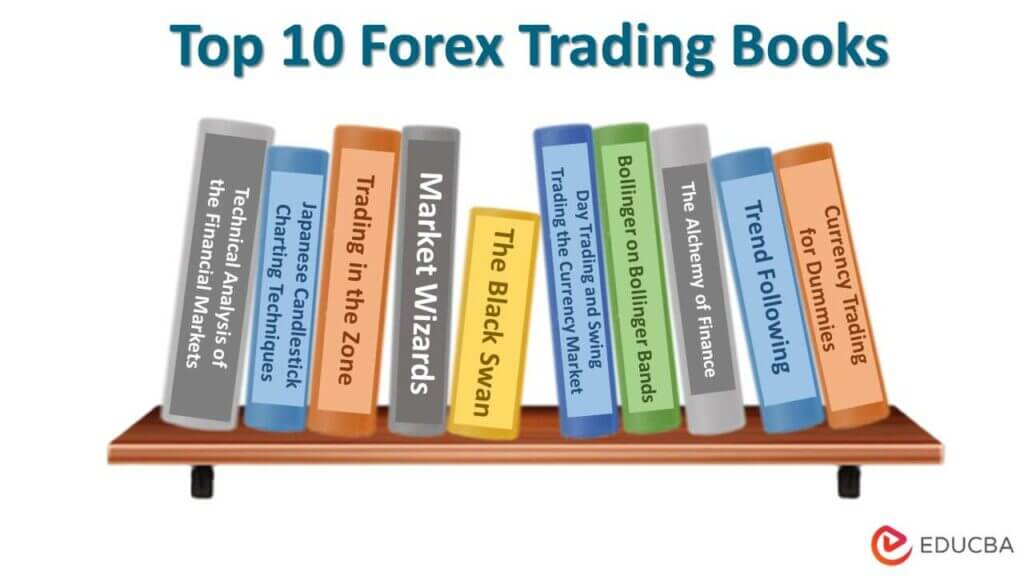

We have the list of the top 10 books on FX trading below:

|

# |

Book | Author | Published |

Rating |

| 1 | Technical Analysis of the Financial Markets | John J. Murphy | 1999 | Amazon: 4.7

Goodreads: 4.19 |

| 2 | Japanese Candlestick Charting Techniques | Steve Nison | 2001 | Amazon: 4.7

Goodreads: 4.31 |

| 3 | Trading in the Zone | Mark Douglas | 2018 | Amazon: 4.7

Goodreads: 4.28 |

| 4 | Market Wizards | Jack D. Schwager | 2012 | Amazon: 4.7

Goodreads: 4.25 |

| 5 | Day Trading and Swing Trading the Currency Market | Kathy Lien | 2008 | Amazon: 4.3

Goodreads: 3.70 |

| 6 | Bollinger on Bollinger Bands | John Bollinger | 2001 | Amazon: 4.6

Goodreads: 3.84 |

| 7 | The Alchemy of Finance | George Soros | 2015 | Amazon: 4.3

Goodreads: 3.74 |

| 8 | Currency Trading for Dummies | Kathleen Brooks | 2021 | Amazon: 4.6

Goodreads: 3.74 |

| 9 | The Black Swan | Nicholas Taleb | 2010 | Amazon: 4.5

Goodreads: 3.95 |

| 10 | Trend Following | Michael Covel | 2017 | Amazon: 4.4

Goodreads: 3.74 |

Let us discuss each book in detail, outlining their key points and review.

#1 Technical Analysis of the Financial Markets

Author: John J. Murphy

Buy this book here.

Review:

This book was updated and enhanced to understand the needs of the modern financial environment. It talks about the most recent advancements in technical tools and computer technology. It includes new content on Intermarket relationships, candlestick charting, stocks, and stock rotation. In addition, it has cutting-edge figures and examples. Readers get an understandable overview of the area of technical analysis. Many traders have already learned the fundamentals of technical analysis and applied them to the futures and stock markets.

Key Points:

- The book is beneficial for understanding the fundamentals of technical analysis.

- It is an excellent resource for newcomers that covers all the essentials.

- This book only serves as a basic introduction to technical analysis and trading. You can seek additional reading on each topic covered in this book.

- Readers also learn how to read charts, comprehend indicators, and the vital role technical analysis plays in investing.

#2 Japanese Candlestick Charting Techniques

Author: Steve Nison

Buy this book here.

Review:

The Western world first saw this flexible technical analysis method through Steve Nison’s Japanese Candlestick charting techniques, now frequently employed by forex traders. The book extensively covers candlestick charting, which applies to futures, speculation, hedging, and equities. Nison’s work is appropriate for traders looking to improve their trading tactics.

Key Points:

- It presents a complete explanation of the fundamental candlestick patterns. Many patterns use the difference between opening and closing prices.

- This historical charting, renowned for its adaptability, can be combined with any other analytical instrument available, including conventional Western technical analysis.

#3 Trading in the Zone

Author: Mark Douglas

Buy this book here.

Review:

In this book, the authors argue that a small amount of psychological research is necessary to learn psychological skills to trade well. In addition, the book discusses the psychological aspects of forex trading and provides strategies to assist novice traders in developing them. This book is unmatched in what it says about one of the most crucial trading abilities: your mentality. Through this, Mark imparts a lesson on objectively viewing the market and how clashing opinions might prevent this.

Key Points:

- The book supports readers in creating and putting into practice techniques devoid of emotional disturbance.

- Reading this book on forex psychology has helped many traders who felt trapped find fresh inspiration and improve their performance.

#4 Market Wizards

Author: Jack D. Schwager

Buy this book here.

Review:

As the title suggests, this book contains interviews with some of the best and most successful traders in the trading world. The book discusses the viewpoints and techniques of successful stock traders; it provides nearly perfect detail about their backgrounds, personalities, and the circumstances that forced them to make the trading judgments they did at the beginning of their careers.

Key Points:

- This book covers various trading strategies and markets (treasuries, futures, commodities, etc.).

- The book also discusses the attributes and personality features of effective traders.

- A trader can learn about the interview’s similarities and differences by reading them.

- This book is brimming with knowledge for both beginning and experienced traders. For the serious investor, this is a must-read. Any profession can benefit from the lessons in this wisdom.

#5 Day Trading and Swing Trading the Currency Market

Author: Kathy Lien

Buy this book here.

Review:

As managing director of BK Asset Management and a renowned currency analyst, Kathy Lien frequently appears on Reuter’s, Bloomberg, and CNBC programs. Her book uses a two-pronged strategy. It blends theory and practical knowledge with a balanced understanding of the fundamental and technical forex trading tactics. This book also includes methods that use news, forex basics, Intermarket linkages, and interest rate differences. It contains the long- and short-term causes affecting currency pairs. They are explained step-by-step. She also discusses standard trading methods based on the technical analysis used by experienced forex traders.

Key Points:

- This book provides day and swing traders with an in-depth peek at the philosophy and practice of forex trading.

- The work’s emphasis on using various tried-and-true methods and fundamental trading strategies that one might effectively implement by analyzing a trading environment adds value.

- Day and swing forex traders looking to increase their knowledge and abilities may improve outcomes. This book comes highly recommended.

#6 Bollinger on Bollinger Bands

Author: John Bollinger

Review:

Anyone interested in learning more about technical analysis and who has at least a basic understanding of trading or investing should read this book. Bollinger bands are precisely what the author describes, along with what they can and cannot achieve. Especially the interaction of Bollinger Bands with other indicators is focused on in the book. Bollinger can offer technical guidance while also dipping a little into trading etiquette. A part of the book explains that everyone should develop their trading strategy using the tools and avoid copying other people.

Key Points:

- The book covers the market factors that influenced the development of the indicator and three techniques that can assist traders in utilizing it to its maximum potential.

- The author explains the complementary fundamental analysis approaches that can help confirm how markets will move.

- It also shows how to use the tool properly and avoid typical pitfalls.

#7 The Alchemy of Finance

Author: George Soros

Review:

For those with an open mind and a healthy dose of skepticism, “The Alchemy of Finance” is challenging but immensely gratifying. George Soros published this book in 1986 outlining his investment management strategy, which produced exceptional returns for investors in his Quantum Fund over the previous 18 years. Soros claims that despite going against traditional economic thinking, this has given him a competitive advantage over other traders throughout his career.

Key Points:

- Market facts shape their expectations by market facts, which are then shaped by participants’ expectations.

- According to the “theory of reflexivity,” people’s perceptions of a situation can alter it.

- According to the theory of efficient markets and rational expectations, markets allot resources most efficiently. But people are illogical and biased, and markets are inefficient as the outcome.

#8 Currency Trading for Dummies

Author: Kathleen Brooks

Buy this book here.

Review:

This forex trading book covers the fundamentals of trading. It also improves the mechanics of trading, including currency exchange, their pairing, how to interpret price quotes, how the global trading day progresses, and other topics. Before investing money in the market, one can test their knowledge by starting a practice trading account with an international online brokerage.

Key Points:

- This accessible manual describes how the forex market operates and how one might profit from it.

- The book provides a clear overview of the global FOREX market, explaining its size, scope, and key participants.

- It explains other important economic factors affecting currency values and how to analyze the data and events logically.

- In addition, one will investigate numerous trading approaches to develop a clear strategy and an action plan.

#9 The Black Swan

Author: Nicholas Taleb

Buy this book here.

Review:

Black swans are highly unlikely events. They have three main characteristics. They have a significant impact, they are unpredictable, and we invent an explanation after the fact that makes them appear less random and more predictable. Taleb has researched for years how we deceive ourselves into believing we know more than we do. While significant events continue to surprise us and influence our environment, we limit our thinking to the unimportant. Taleb explains ways to deal with and take advantage of black swans, which are surprisingly easy.

Key Points:

- It explains unprecedented, significant black swan events.

- We increasingly reside in Extremistan, a realm of inequality and unanticipated extreme outliers.

- We place too much significance on our knowledge and are unaware of our ignorance.

- People make up explanations for why Black Swan events occurred, which disguises how unexpected they were.

#10 Trend Following

Author: Michael Covel

Buy this book here.

Review:

This forex reference book demonstrates how traders can benefit even in volatile market conditions by observing standard market moves. Following the 2008 market crisis, Covel developed a technical framework that teaches traders to speculate on various markets. The Trend Following book also offers practical advice to alter readers’ perspectives and behaviors to increase their chances of implementing an effective trend-following system.

Key Points:

- The book exposes the reality of a trading method that generates profits in up, down and surprise markets.

- Anyone can learn to profit from the markets, whether they are bull, bear, or black swans, by applying simple, repeatable rules and by adhering to the trend until it ends.

- The trend philosophy will be explained, along with how it has fared during booms, bubbles, panics, and collapses.

Recommended Books

This article reviews the top 10 forex trading books for a better understanding of the economy. To know more, read the following books,