Updated July 25, 2023

Introduction to Form 10 K

Under the Securities Exchange Act of 1934, corporations must file a comprehensive annual report, Form 10-K, with the U.S. Securities and Exchange Commission (SEC), all the companies listed on various stock exchanges registered with SEC under Section 6(a) of the Exchange Act. This report provides detailed information about the company’s financial and current business conditions and contains annual audited Financial Statements and schedules. Each shareholder receives a distinct document called Form 10-K before the annual meeting to elect directors, which is separate from the annual report to shareholders.

Timelines for Submission of Form 10 K

Three different timelines are given by SEC based on the category of Filers:

- Large Accelerated Filers: Large Accelerated Filers are publicly listed companies with a public float of $ 700 Million or more. As per SEC, such companies must file Form 10 K within 60 days after completing the fiscal year covered in the report.

- Accelerated Filers: Accelerated Filers are publicly listed companies with a public float of more than $ 75 Million and less than $ 700 Million. As per SEC, such companies must file Form 10 K within 75 days after completing the fiscal year covered in the report.

- Non-Accelerated Filers: Non-Accelerated Filers are publicly listed companies with a public float of less than $ 75. As per SEC, such companies must file Form 10 K within 90 days after completing the fiscal year covered in the report.

Components of Form 10 K

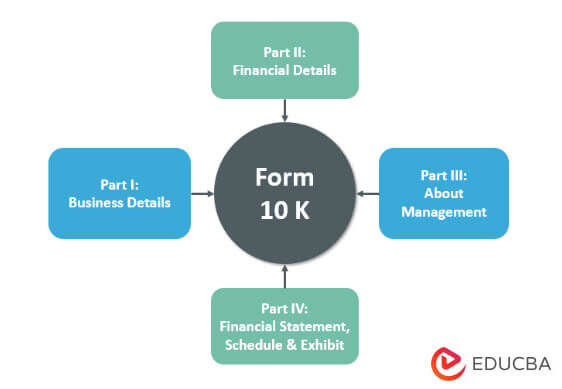

As above mentioned figure exhibits, Form 10 K consists of 4 main sections:

Part I: Business Details

Part I of Form 10 K gives a complete introduction to the Business. This has many sub-sections that are listed below:

1. Business

This section captures the complete Introductory detail of the Business, the various segments of the business, the Details of Competition available in the Market, and the Regulations associated with this business.

- Risk Factor: Details of all the risks involved in the business. This section also explains the factors that can impact the Business.

- Unresolved Staff Comments: If the filer received a written comment from SEC staff regarding any periodic report not less than 180 days before the end of fiscal relating, such comments remained unresolved. This section will disclose the details of any such unresolved comments and the position of filers on such comments.

2. Properties

It contains details of all the offices and assets held by the Business.

3. Legal Proceedings

Details of all the judicial, regulatory, and arbitration proceedings concerning matters arising in connection with the conduct of businesses.

4. Mine Safety Disclosures

Companies provide information in health and safety reports submitted to the SEC, which includes details such as mining-related fatalities, orders to identify imminent danger, and pending legal action before regulatory bodies.

Part II: Financial Details

5. Details of Sell and Purchase of Equity Securities

This subsection also covers details of all the equity securities of the registrant sold during the fiscal year covered in form 10 K; in the report, they furnish the information of any buyback made in a month within the fourth quarter of the fiscal year covered by the report.

6. Company’s Financial Data

Provide financial information about the company for the last 5 years.

7. Management’s Discussion and Analysis of Financial Condition and Result of Operations

In this section, the company gives its viewpoint on the past year’s financial and Business performances, Management Discussions on the various business risks, and Details of critical accounting estimates and Judgements.

- Disclosures of Market Risk: All companies in this section give information about business exposure to Market Risk. This section also mentions all the strategies taken or to be taken by management.

8. Financial Statements and Other Supporting Data

This section includes the Audited Financial Statement, Financial Schedule, and Exhibit of the last 3 Years.

9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

It is a disclosure from the company in case of a change of Accountants, with all details of any disagreement between the management and accountants.

Part III: Management Details

10. Details of Board Members and Higher Management

This section contains information related to the experience and qualification of the company’s director and Executive officers and complete professional details related to a member of the Board of the company.

11. Details of Compensation paid to Executives

The company here discloses the details of Compensation paid to the CEO, CFO, and other highly compensated Executive officers. A also must highlight the process followed in decision-making on executives’ compensation.

12. Information on Security Holding Pattern

Disclose the shareholding pattern with the details of shares held by the Promoters, FPIs, FIIs, and shares covered by an equity compensation plan.

13. Details of Relationships and Related Transactions, Director Independence

Disclose information about the professional and personal relationship between the company, its directors, officers, and their family members.

14. Fees paid to the Accountant and Details of the Services Taken

The company disclosed their compensation to their accounting firm in the last two fiscal years in this Section.

Part IV: Financial Statement, Schedule, and Exhibit

15. The exhibit, Financial Statements, and Schedule

The following Documents were filed as part of the Report under this part:

- Financial Statements

- Financial Schedules

- Separate financial statements of an associated entity whose securities are pledged as collateral

Benefits of Form 10 K

- Form 10 K explains the Company’s Finances and Risks and gives an idea about the future prospect of Management.

- It is a prospectus for potential investors to make investment decisions.

- It is an important document introduced by the SEC to ensure investors’ transparency and true information flow.

Conclusion

Form 10 K is an annual report which consists of information like background, Organization Structure, financial details, Management details, and any other relevant information and is the most detailed and important document available in the public domain that acts as a prospectus for investors. Every publicly listed company must submit This annual report to the US Security and Exchange Commission (SEC).

Recommended Articles

This is a guide to Form 10 K. Here we discuss the introduction and components of Form 10 K which includes business and financial details, etc., along with the benefits of Form 10 K. You may also look at the following articles to learn more –