Updated July 6, 2023

What is Forward Premium?

A forward premium occurs when the predicted future price for a currency is higher than the current rate. For instance, if the forward price of EUR/USD is 1.10 and the spot price is 1.00, then the premium is 10. Additionally, the annualized premium will be 40.

Forward Premium is usually in terms of annual amounts by economists and scholars. It indicates that the present local exchange rate would rise above the other currency. It is when a currency’s demand is greater than the supply.

Key Highlights

- It exists when the quoted forward exchange rate is higher than the quoted spot exchange rate.

- When the market anticipates that the value of the local currency will decline compared to the foreign currency in the future, a forward contract will attract a premium.

- It uses the current spot rate and the forward rate for the calculation.

Formula

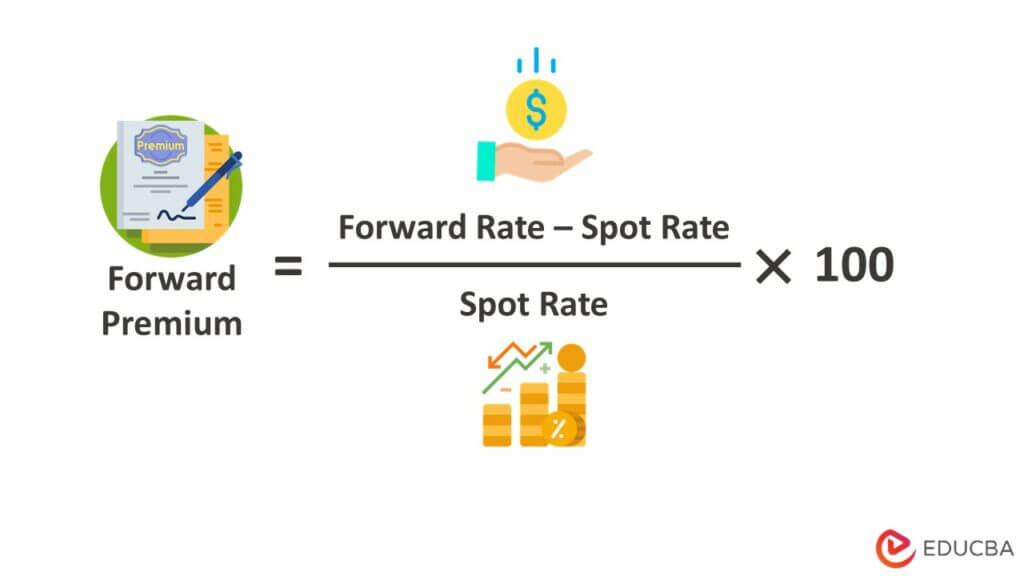

The formulas are,

Here,

- A forward rate is a future transaction’s maturity rate.

- The spot rate is the current rate for a particular commodity.

Excel Examples

Example #1: Forward Premium

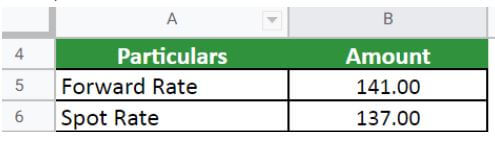

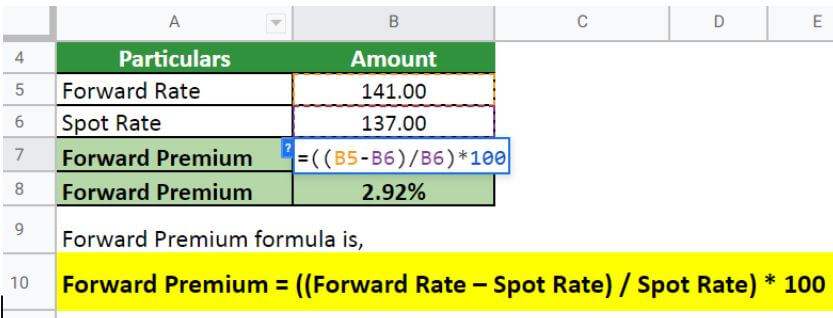

Assume a currency pair USD/CAD has the following data,

- Forward rate = 141

- Spot rate = 137

Calculate the forward premium.

Given,

Solution:

So, Forward Premium = 2.92%.

It indicates that if the trader exchanges the currency USD for CAD at a future date, they will receive almost 2.92% in profit. In contrast, if they sell USD for CAD today, they will not make a substantial profit.

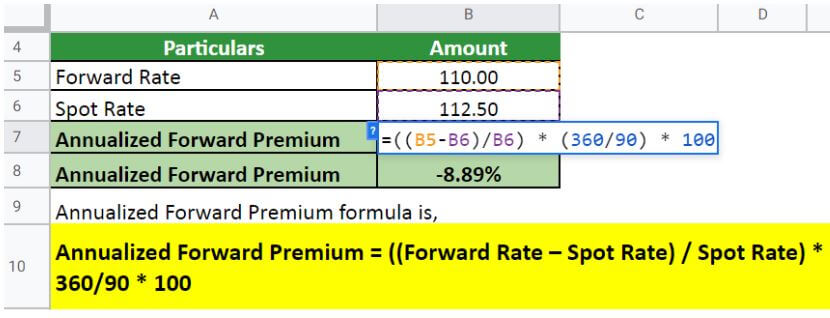

Example #2: Annualized Forward Premium

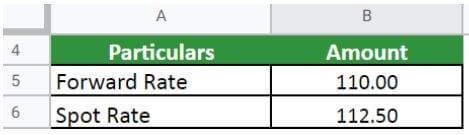

Let’s say you are looking at a 3-month GBP/USD forward contract with a forward rate of 110. The current spot rate is 112.50. Calculate the AFP.

Given,

Solution:

AFP is -8.89%. It signifies that if you trade GBP today, you’ll receive a profitable USD value, rather than if you sell it after three months. After the 90-day period, the currency will depreciate, leaving you with an 8.89% loss.

Forward Discount vs. Premium

|

Forward Premium |

Forward Discount |

| It exists when the interest rate in the country with the stronger currency is higher than in the country with the weaker currency. | A forward discount exists when the interest rate in the country with the weaker currency is higher than that in the country with the stronger currency. |

| It increases the value of the stronger currency and a corresponding decrease in the value of the weaker currency. | It decreases the value of the stronger currency and increases the value of the weaker currency. |

| If there is more demand for a currency than it is available, the price will go up (resulting in a premium). | Similarly, if there is less demand for a currency than is available, the price will go down (resulting in a discount). |

Advantages & Disadvantages

|

Advantages |

Disadvantages |

| It provides the ability to lock in an exchange rate for a future transaction. | One has to pay a fee for the service. |

| It reduces exposure to currency fluctuations. | Requires a large amount of money upfront. |

| It helps hedge against potential losses. | Risking loss if the market moves against you. |

Calculator

You can use the following forward premium calculator.

| Forward Rate | |

| Spot rate | |

| Forward premium = | |

| Forward premium = | ((Forward Rate - Spot rate) / Spot rate) * 100 |

| = | ((0 - 0) /0) * 100 = 0 |

Final Thoughts

It is a sign of currency depreciation that establishes the direction in which a particular currency moves. For instance, due to continuous increases in interest rates by the US and India, the forward rate for USD/INR fell to 300 basis points, almost 1.70%. As per economists, it can weaken the INR and even impact the carry trades.

Checking whether currencies trade at a premium or discount is therefore crucial. Investors will pay a premium now to determine a price to buy a currency in the future if they anticipate it will increase in value.

Frequently Asked Questions (FAQs)

Q1. Define forward premium.

Answer: The forward premium is the amount by which the forward cost exceeds the spot price, expressed as a percentage. Suppose for the currency pair USD/INR, the forward rate and spot rate are 2.5 and 2.0, respectively. Thus, the forward premium will be 20.

Q2. What is the difference between forward premium and forward discount?

Answer: If one currency is worth more than another currency in the future, it is said to be at a forward premium. Conversely, if one money is worth less than another currency in the future, it is said to be at a forward discount. The premium is the amount by which the forward price of a currency exceeds the spot price, while the discount is the amount by which the spot price exceeds the forward price.

Q3. How Does a Forward Premium in Forex Trading Work?

Answer: When the future price of a currency is more than the current spot price, this is known as a forward premium. When the forward price of the currency is less than the spot price, there is a forward discount. The difference between the forward and spot prices must be found and divided by the spot price to determine a premium or value.

For instance, it may signify that the interest rate on the home currency is lower. On the other hand, when a forward discount is present, it can mean that interest rates for the native currency are going up.

Q4. Who benefits from low forward premiums?

Answer: Importers, who receive funds out of India and demand dollars, profit from declining forward premiums. As a result, importers could cover their futures exposures cheaper when premiums are low. Lower premiums allow these investors to hedge their positions because unhedged directions can experience considerable losses due to exchange rate movements.

But the possibility of such a dollar shortage may put even more intense force on the spot market, which is still a worry for importers.

Recommended Articles

This article has explained different aspects of forward premium. It includes concept formulas, examples, and their importance, especially for investors. Read these articles for more details-