Definition of Forward Rate Agreement

Forward rate agreement is the type of OTC contract that is cash-settled and is contracted between the two parties where the buyer borrows, and the seller lends a notional sum which is having a fixed interest rate and the period of time also specifies that starts at an agreed date in future, or in simple words, it is a forward starting loan where there is no exchange of principal.

Explanation

The forward rate agreement has no principal exchange, but it is the type of forward starting loan. The interest payment calculates by simply using the notional amount. The interest rates that will be effective at some point in the future, the forward rate agreement allows the market participants to trade today and also allow them to hedge their interest rate exposure on future agreements.

There will be protection for both buyer and the seller. The buyer locks in the borrowing rate and gets protected against the rise in an interest rate, and the seller gets protected against a fall in interest rate because he obtains a fixed lending rate.

The Formula for Forward Rate Agreement

The formula for forward rate agreement (fra) is as follows:

Where,

- FRAP= Forward Rate Payment

- FRA= Forward Rate Agreement

- R= Floating Interest rate, which uses in the contract

- NP= Notional principal amount on which interest calculates

- Y= Number of days in the year-based contract used in day count generally is 365 days or 360 days depending on case to case.

- P= Period of the contract calculated as the number of days.

Examples of Forward Rate Agreements

Let’s consider Company ABC Ltd, which is planning to borrow $5,000,000 in 6 months. The interest rate for borrowing the required funds is 6 months LIBOR plus 40 basis points. Let’s assume that the 6-month LIBOR is currently at 0.92, but there is the possibility that it will rise further by 1.5% in the upcoming months.

The company chooses to buy the 6*12 FRA for six months starting now. He receives an interest rate quotation of 0.97% from his bank for $5,000,000 on May 15th. Suppose on the fixing date, the 6-month LIBOR rate is 1.28; the settlement rate is also applicable for the company’s FRA. Suppose the number of days from the fixing date= is 182 days. In this case, the company will consider the seller and will receive the settlement amount, which will calculate as follows:

- Interest Differential = (1.28 – 0.97) * (182/360) * 5,000,000

- Interest Differential = $783,611.11

On the settlement date, the company will receive,

- = 783,611.11/ (1+1.28)*(182/360)

- = $475,749.106

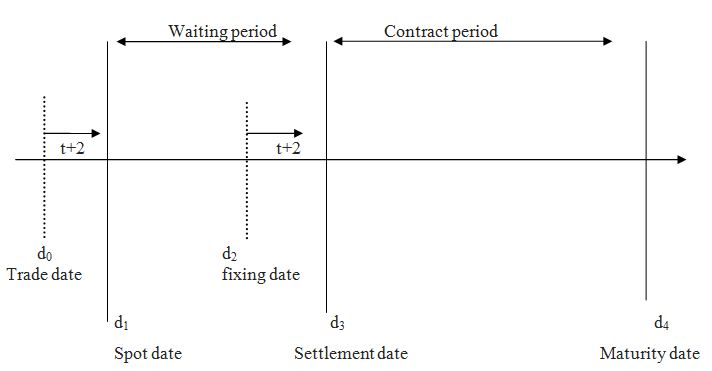

Forward Rate Agreement Diagram

The above diagram represents the forward rate agreement. It can be seen from the above diagram that an FRA life is composed of two periods, i.e., a waiting period (d1 to d3) and a contract period (d3 to d4). The date d0 is the date of trading when FRA is negotiated among the two counterparties. The date d1 is the spot date, generally two working days after the trade date. The date d2 is the fixing date on which the reference rate is being determined. And The date d3 is the settlement date which is generally two working days after the fixing date, and it is the date on which the notional loan period begins and which settlement amount is paid. The date d4 is the maturity date on which the notional loan expires.

Applications of Forward Rate Agreement

More frequently, FRAs are used by banks for the applications like hedging interest rate exposures that arise from the mismatches in money market books. Also, FRAs are used for speculative activities.

Valuation of Forward Rate Agreement

The valuation of the forward rate agreement is done based on the sale perspective and the cash difference arising from an exchange of FRA between the two parties.

Uses of Forward Rate Agreement

The following are the uses of forward rate agreement:

Many banks and large corporations use it to hedge exchange rate exposure and future interest. Both buyers and sellers hedge against the risks, like the seller hedges against the risk of a falling interest rate, while the buyer hedges against the risk of a rising interest rate. Other than buyers and sellers, other parties act like speculators, use the forward rate agreement, and make bets based on future directional changes in the interest rate.

It is a customized contract based on the requirement of the parties as it offers various options including over counter financial options on short term deposits.

Advantages

- It protects the buyer against the rise in interest rate as the buyer locks in the borrowing rate.

- This protects the seller against a fall in interest rate because he obtains a fixed lending rate.

- It provides guaranteed interest rates.

- FRAs are fully customizable, and thus they are flexible.

- There is no requirement for the principal amount

Disadvantages

- There is no possibility of benefits from favorable fluctuation in the interest rate between the date of determination and the date of settlement.

- Hedging remains effective even if underlying does not exist.

- There is an exchange rate risk when the unhedged agreement is in foreign currency.

Conclusion

Thus, a forward rate agreement (FRA) is a contract entered to set the interest rate for a future transaction. In this, there is an over-the-counter (OTC) agreement between the parties with a fixed interest rate guaranteed to the borrower and lender for a specified period and amount. With the forward rate agreement, there will be protection for both parties of the agreement, i.e., the buyer and the seller.

Recommended Articles

This is a guide to Forward Rate Agreement. Here we also discuss the definition, example of forward rate agreement, and advantages and disadvantages. You may also have a look at the following articles to learn more –