What is Fund Accounting?

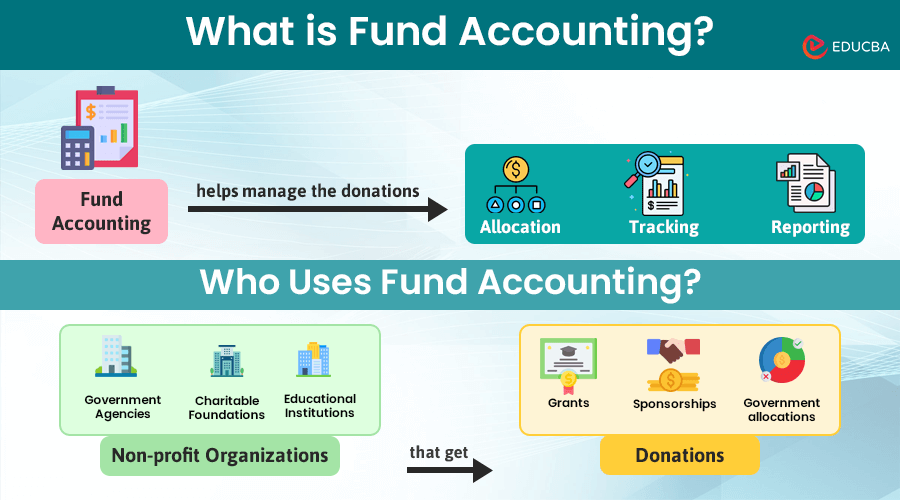

Unlike regular accounting, which for-profit businesses use, fund accounting is used only by organizations that receive and manage funds from donations and grants, such as nonprofit organizations and government agencies.

Fund accounting manages funds from:

- Grants

- Donations

- Government allocations

- Sponsorships

- Funds for research and community development, and more.

In this system, each fund is treated as its own entity, which means that each fund has its own accounting records and financial statements. Fund accounting’s main purpose is to ensure transparency and accountability by tracking the source and use of all funds. It ensures that these organizations use these donations, grants, and public funds appropriately according to strict guidelines.

Table of Contents

Basics of Fund Accounting: How are Funds Allocated?

The organization decides the allocation of funds based on the specific restrictions and purposes that the donors or funding sources set. It means that each fund has a designated use. Therefore, the organization must ensure that they spend the funds accordingly.

Example:

Let’s say a nonprofit organization receives a $25,000 grant from a foundation to support a community hit by an earthquake. The foundation has specified the following use for the funds:

- $10,000 for medical supplies

- $10,000 for emergency shelter supplies

- $5,000 for staff salaries and administrative costs.

Therefore, the nonprofit organization must allocate the funds like this:

- Record $10,000 in the medical supplies fund (which they can only use to purchase medical supplies).

- Record $10,500 in the emergency shelter supplies fund (which they can only use to provide shelter supplies).

- Record $5,000 in the staff salaries and administrative costs fund (which they can only use to pay the staff salaries and administrative costs).

Types of Funds in Fund Accounting

Here are the types of funds in fund accounting with simple examples:

1. Restricted Funds: Restricted funds are donations or funds that come with specific conditions. Donors or granting agencies impose restrictions on these funds, specifying how to use them.

2. Unrestricted Funds: Unrestricted funds are those that an organization can use for any purpose, as they have no specific restrictions on their use.

3. Temporarily Restricted Funds: Temporarily restricted funds are donations or resources that expire over time or when they meet certain conditions.

What Organizations Use Fund Accounting?

| Organization | Purpose | How is it implemented? |

| Government Agencies | Manage public funds transparently and responsibly. | There is a segregation of funds based on revenue sources and spending purposes. |

| Nonprofit Organizations | Proper usage of donations and grants. | There is the categorization of funds (unrestricted, restricted, temporarily restricted) to track expenditures. |

| Research Institutions | Manage research grants and funding sources efficiently. | There is an allocation of funds for research projects (equipment, salaries, and research expenses). |

| Healthcare Institutions | Manage revenues from patients and subsidies efficiently. | There is an allocation of funds to departments (e.g., surgery, emergency). |

| Educational Institutions | Manage tuition, grants, and donations effectively. | There is an allocation of funds to departments (e.g., academic programs, student services). |

| Charitable Foundations | Track and report donations and grants for compliance. | Funds are categorized by purpose (e.g., scholarships, community grants). |

How Fund Accounting Works? ( Step-by-Step Process)

Step #1: Fund Establishment

An organization receives and creates funds for specific purposes, like research or community projects. These funds can be general (for overall use) or restricted (for specific projects).

Step #2: Recording Transactions

Each fund needs separate financial records like general ledger and financial statements. It helps track how each fund spends its money.

Step #3: Budgeting

A separate fund leads to a separate budget for each fund, which sets the organization’s expenditure narrative. Budgeting works as a guideline for the organization, depending on which financial decisions are made, further ensuring the appropriate use of funds.

Step #4: Allocating Funds

When the organization gets money, it puts it in the right fund and uses it for what the donor wants. It keeps the money used correctly.

Step #5: Reporting

The organization can show what each fund does with its money through financial statements like balance sheets, cash flow, and income statements. These reports help stakeholders understand how the organization uses its funds.

Step #6: Monitoring

The organization regularly checks to ensure funds are used correctly for their intended purpose. It involves conducting regular audits, implementing internal controls, and meeting reporting requirements.

Fund Accounting Examples

1. Hospital Donations

Suppose a local hospital receives donations from fundraising events. These donations are for specific needs like purchasing new medical equipment and patient care. Therefore, the hospital can spend these funds exclusively for that purpose and cannot use them for daily expenses such as staff salaries.

2.University Research Funding

Suppose, a research department of a university receives grants from the government to study diseases. These funds allocated for disease research can only be useful for that specific purpose, and the university cannot use it to support other academic areas or administrative costs.

3. Government Agency Expenditures

Suppose a city government gets money from local taxes, state funding, and federal grants. It can use these funds only for road repairs and public transportation improvements. Funds for road repairs cannot go to other projects like park renovations.

Final Thoughts

Fund Accounting is complex and requires a thorough understanding of accounting principles. Therefore, organizations should prioritize regular training on accounting standards and regulatory updates to uphold compliance. Additionally, organizations must focus on using accounting, budgeting, and grant management tools for real-time monitoring and reporting.

Frequently Asked Questions (FAQs)

Q.1 How is fund accounting different from financial accounting?

Answer: Fund accounting tracks and monitors how government agencies, nonprofits, and other organizations use funds (grants or donations) for specific purposes. It adheres to the rules set by regulatory authorities, such as the government. Financial statements in fund accounting focus on specific funds, such as donations or grants.

Financial accounting oversees the financial activities of for-profit organizations, offering an overview of the company’s financial performance and market position. This type of accounting adheres to GAAP and IFRS. Financial statements in this field include income statements, balance sheets, and cash flow statements.

Q.2 Is fund accounting a good career?

Answer: Fund accounting offers a rewarding career path for individuals interested in financial management and regulatory adherence. In this role, you prepare detailed financial reports for designated funds, monitor spending to meet regulatory standards, and ensure transparency in operations. You can work as a financial manager, budget analyst, or controller.

Q.3 What are some top fund accounting software?

Here are the top 5 fund accounting software:

- Aplos

- AccuFund

- Certent Equity Management

- Sage Intacct

- QuickBooks

Q.3 What are the features of fund accounting?

A few features are:

- Segregation of Funds: Funds are separated based on their sources (e.g., donations, grants) and purposes (e.g., research projects, operational expenses).

- Restricted Use: Funds may have restrictions on how one spends them.

- Specific Financial Statements: Each fund must have its own financial statements.

- Compliance: Adherence to accounting standards (e.g., GAAP for nonprofits) and regulatory guidelines are important.

- Monitoring and Control: They closely monitor expenses to ensure organizations are using the funds within the guidelines.

- Reporting: How funds are managed and utilized is clearly reported to stakeholders and regulatory bodies.

Recommended Articles

We hope you learned all about fund accounting through this blog. For more informative accounting articles, here are some resources you can check.