Updated July 24, 2023

Difference Between Fundamental Analysis and Technical Analysis

Fundamental analysis can be defined as a study concerned with the factors that possibly impact the stock prices of an organization in the future. Fundamental Analysis vs Technical Analysis scrutinizes the factors in the fundamental analysis: financial statements, industry, management processes, etc. This type of analysis is relevant for investments that are for a longer duration of time. It is concerned with the previous as well as current data. Therefore, the fundamental analysis aims to identify an organization’s intrinsic value to determine if a particular stock is overpriced or underpriced.

Fundamental analysis is useful for investing functions only. Technical analysis studies previous patterns, charts, and trends to make predictions concerning an organization’s future price movements. In other words, technical analysis can be defined as a method used to determine the upcoming price of securities based on charts to identify trends and patterns. Technical analysis is relevant for investments that are held for a shorter time. Technical analysis only considers the previous data and is useful solely for trading functions. Thus, the technical analysis aims to identify the perfect time for entering or exiting the market.

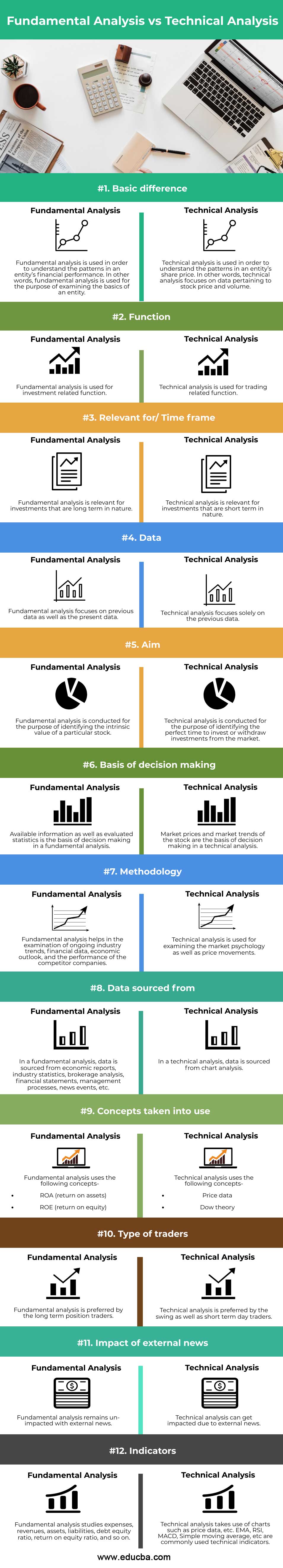

Head To Head Comparison Between Fundamental Analysis vs Technical Analysis(Infographics)

Below are the Top 12 comparisons between Fundamental Analysis vs Technical Analysis:

Key Differences Between Fundamental Analysis vs Technical Analysis

The key differences between Fundamental Analysis vs Technical Analysis are as follows:

- Fundamental analysis is helpful for the purpose of evaluating the intrinsic value of a particular stock. In contrast, technical analysis is for the purpose of predicting upcoming price trends.

- Fundamental analysis is useful for the investment function, whereas technical analysis is useful for the trading function.

- Fundamental analysis takes place by analyzing multiple economic factors. In contrast, technical analysis analyzes price movements and patterns provided on charts.

- Long-term traders participate in the case of fundamental analysis, whereas swing and short-term traders participate in technical analysis.

- Fundamental analysis is not impacted by external news, whereas technical analysis gets impacted by external news.

- The data for fundamental analysis is sourced from economic reports, industry statistics, brokerage analysis, financial statements, management processes, news events, etc. In contrast, the data for technical analysis is from chart analysis.

- Fundamental analysis takes the return on assets and returns on equity concepts into its use. In contrast, technical analysis uses price data and dow theory.

- Fundamental analysis is useful for long-term investments, whereas technical analysis is for short-term investments.

- Fundamental analysis focuses on both qualitative as well as quantitative factors. In contrast, technical analysis focuses on price and volume (charts, moving averages, etc.).

- Fundamental analysis looks at previous and present data, whereas technical analysis looks only at previous data.

- Fundamental analysis is useful for the calculation of stock value, making use of economic factors. In contrast, technical analysis is useful for the calculation of the price movement of a stock to forecast upcoming price movements.

Comparison of Table Between Fundamental Analysis vs Technical Analysis

Given below are the major difference between Fundamental Analysis vs Technical Analysis:

| Basis of Comparison | Fundamental Analysis | Technical Analysis |

| Basic difference | Fundamental analysis is useful for understanding an entity’s financial performance patterns. In other words, fundamental analysis is useful for the purpose of examining the basics of an entity. | Technical analysis is useful for understanding the patterns in an entity’s share price. In other words, technical analysis focuses on stock price and volume data. |

| Function | Fundamental analysis is useful for investment-related functions. | Technical analysis is useful for a trading-related function. |

| Relevant for/ Time frame | Fundamental analysis is relevant for investments that are long-term in nature. | Technical analysis is relevant for investments that are short-term in nature. |

| Data | Fundamental analysis focuses on previous data as well as the present data. | Technical analysis focuses solely on the previous data. |

| Aim | Fundamental analysis is for the purpose of identifying the intrinsic value of a particular stock. | Technical analysis aims to identify the perfect time to invest or withdraw investments from the market. |

| Basis of decision making | Available information, as well as evaluated statistics, is the basis of decision-making in fundamental analysis. | Market prices and market trends of the stock are the basis of decision-making in technical analysis. |

| Methodology | Fundamental analysis helps examine ongoing industry trends, financial data, economic outlook, and the performance of competitor companies. | Technical analysis is useful for examining market psychology as well as price movements. |

| Data sourced from | In fundamental analysis, data is sourced from economic reports, industry statistics, brokerage analysis, financial statements, management processes, news events, etc. | In technical analysis, data is sourced from chart analysis. |

| Concepts have been taken into use | Fundamental analysis uses the following concepts:

|

Technical analysis uses the following concepts:

|

| Type of traders | Long-term position traders prefer fundamental analysis. | Technical analysis is preferred by the swing as well as short-term day traders. |

| Impact of external news | Fundamental analysis remains unimpacted by external news. | Technical analysis can get impacted due to external news. |

| Indicators | Fundamental analysis studies expenses, revenues, assets, liabilities, debt-equity ratio, return on equity ratio, etc. | Technical analysis makes use of charts such as price data, etc. EMA, RSI, MACD, Simple moving average, etc., are common technical indicators. |

Conclusion

Fundamental analysis is useful for long-term investments, while technical analysis is for short-term investments. The fundamental analysis enables analysts to forecast future performance by using an organization’s financial reports. In contrast, technical analysis enables analysts to ascertain whether previous patterns in stock prices will repeat in the coming time. Fundamental analysis considers both previous and current data, whereas technical analysis considers only past data.

Recommended Articles

This is a guide to Fundamental Analysis vs Technical Analysis. Here we discuss the difference between Fundamental Analysis vs Technical Analysis, key differences, infographics, & a comparison table. You can also go through our other related articles to learn more–