What is Funds from Operations?

In real estate investment trusts (REITs), the term “funds from operations” refers to a very critical non-GAAP performance measure that is similar to the cash flow from operations in other businesses.

In other words, it indicates the cash flow generated purely from the real estate business of a company.

Formula

The formula is defined by the National Association of Real Estate Investment Trusts (NAREIT), is expressed as net income plus depreciation & amortization expense minus gains / (losses) from sales of property. Mathematically, it is represented as below,

Example of Funds from Operations (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

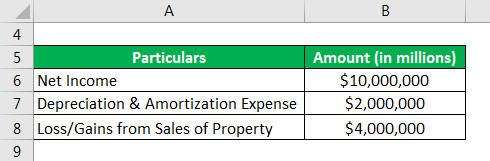

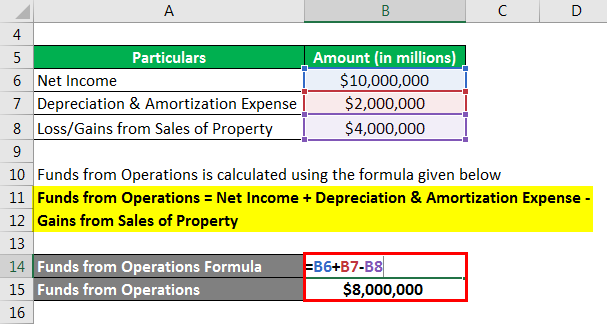

Let us take the example of a REIT to illustrate the calculation of funds from operations. During 2019, the REIT reported a net income of $10 million and recognized gains from sales of property to the tune of $4 million. Calculate the funds from operation for the REIT if the depreciation & amortization expense for the year was $2 million.

Solution:

Funds from Operations is calculated using the formula given below

Funds from Operations = Net Income + Depreciation & Amortization Expense – Gains from Sales of Property

- Funds from Operations = $10.0 million + $2.0 million – $4.0 million =$8.0 million

Therefore, the REIT generated $8.0 million during the year 2019.

Example #2

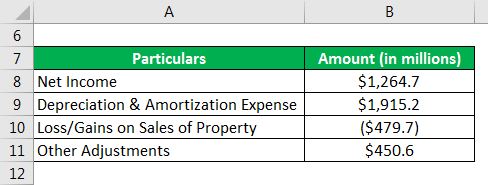

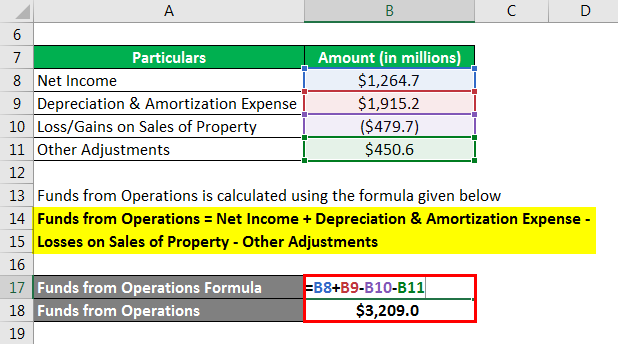

Let us now take the example of American Tower Corporation and calculate its funds from operations based on its annual report for the year 2018. According to the latest annual report, the company generated a net income of $1,264.7 million during the year while it recognized losses on sales of property worth $479.7 million. Further, the depreciation & amortization expense pertaining to real estate was $1,915.2 million and another adjustment was $450.6 million (includes dividend payment and adjustments for unconsolidated affiliates and non-controlling interests). Calculate the funds from operation for American Tower Corporation for the year based on the given information.

Solution:

Funds is calculated using the formula given below

Funds from Operations = Net Income + Depreciation & Amortization Expense – Losses on Sales of Property – Other Adjustments

- Funds from Operations = $1,264.7 million + $1,915.2 million – $479.7 million – $450.6 million

- Funds from Operations = $3,209.0 million

Therefore, American Tower Corporation’s funds for the year 2018 was $3,209.0 million.

Source Link: Washington D.C. Balance Sheet

Example #3

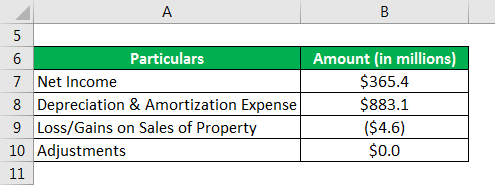

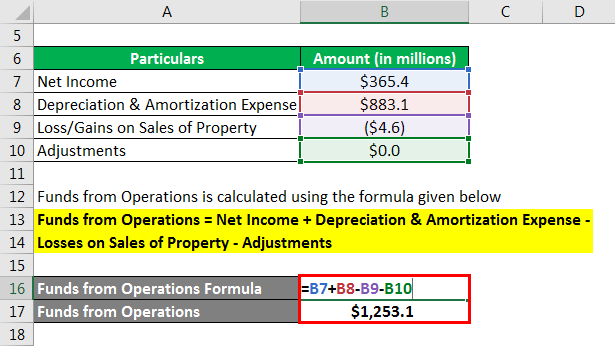

Let us take the example of Equinix Inc. and illustrate the calculation of funds from operations. According to its annual report for the year 2018, the company booked net income of $365.4 million and recognized losses on sales of property worth $4.6 million. The real estate depreciation & amortization expense during the year was $883.1 million while adjustment for unconsolidated joint ventures was nil. Calculate the funds from operation for Equinix Inc. for the year based on the given information.

Solution:

Funds is calculated using the formula given below

Funds from Operations = Net Income + Depreciation & Amortization Expense – Losses on Sales of Property – Adjustments

- Funds from Operations = $365.4 million + $883.1 million – $4.6 million – 0

- Funds from Operations = $1,253.1 million

Therefore, Equinix Inc.’s funds for the year 2018 was $1,253.1 million.

Source Link: Equinix Inc.’s funds

Explanation

The formula can be calculated by using the following steps:

Step 1: Firstly, determine the net income booked by the subject company during the given period.

Step 2: Next, determine the depreciation & amortization expense recognized purely against the real estate business of the company during the period.

Step 3: Next, determine the value of gains received or losses incurred by the company from sales of real estate property during the period.

Step 4: Finally, the formula for this can be derived by adding back depreciation & amortization expense (step 2) to the net income (step 1) and deducting (adding) the gains (losses) from sales of property (step 3) as shown below.

Funds from Operations = Net Income + Depreciation & Amortization Expense – Gains / (Losses) on sales of property

Importance

The concept is very important for analysts and investors dealing in real estate because it helps in measuring the operational efficiency or performance of REIT companies. We know that the value of real estate properties tends to rise or fall in accordance with macroeconomic conditions. As such, measuring the operating results of REITs by using the cost accounting techniques might not present the true picture of its performance. Consequently, this is predominantly used by real estate companies, investors, and analysts. They use it to benchmark operating performance or assess the financial performance of the REITs.

Funds from Operations vs Cashflow

The major differences between both are as follows:

- This indicates the cash generated purely by real estates related business. On the other hand, cash flow is a measure of the amount of cash coming in and going out of a business, which includes cash flow generated from the operation, invested in the business, and raised from external sources.

- This is a non-GAAP measure while cash flow is a GAAP measure.

Recommended Articles

This is a guide to the Funds from Operations. Here we discuss how to calculate along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –