Future Value Formula

The value of the money doesn’t remain the same; it decreases or increases because of the interest rates, the state of inflation, and deflation, which makes the value of the money less valuable or more valuable in the future. But for financial planning of what we expect for our future goals, we calculate the future value of the money by using an appropriate rate in a future formula.

The Future Value formula gives us the future value of the money for the principal or cash flow at the given period.

![]()

FV is the Future Value of the sum, PV is the Present Value of the sum,

r is the rate taken for calculation by factoring everything in it, n is the number of years

Example of Future Value Formula

To better understand the concept, we will calculate the future value using the abovementioned formula.

Calculate the future value of 15,000 rupees loaned 12 percent per annum for 10 years.

To calculate the future value,

PV =15,000

R = 12 %

N= 10

- FV = PV (1+R) n

- FV = 15000 (1 + 0.12) 10

- FV = 46587.72

Here, we have put in the Present Value as 15000

A rate of the period which is in years as 0.12

The number of periods, which is year 10 years

Here 1.12 rate is raised to power 10, which is in years multiplied by principle 15000.

Explanation

It is used in every aspect of finance, whether it’s investments, corporate finance, personal finance, accounting, etc.

The Future Value of an investment depends on its purchasing power and the return of investments on the capital.

This cumulative inflation and investment return is now factorized in one term as the rate of return for the period.

Therefore,

FUTURE VALUE = PRESENT VALUE + INCURRED RETURN ON INVESTMENT

To calculate this future value, we need to understand that we will use the value with a compounded rate of return over the years on the present value of the capital.

With the help of an example.

Let’s present an example

10 percent interest

And capital is 1000, so the Future Value will be equal to 1000 + 100 = 1100

Now, to calculate for 2 years, we can calculate by using 1100 + 110 = 1210

Which can also be written as 1000 (1.1) ^2 which will make the calculation to 1.21 * 1000 = 1210

This way, we can calculate the future values of any amount when an interest rate is given.

Significance and Use of Future Value Formula

The uses of the Future Value Formula are immense and help us to be very informative and have a view ahead:

- The best use of the future value formula is determining the value of investments after a period.

- Corporate Finance uses the Future Value formula to make effective decisions for valuing capital expenses.

- You can calculate the number of installments on a loan amount

- You can calculate the savings needed to reach a financial goal when years of compounded returns work for you.

- Calculation of annuity, income by investments over time.

Future Value Calculator

You can use the following Future Value Calculator

| PV | |

| r | |

| n | |

| Future Value Formula | |

| Future Value Formula | = | PV x (1 + r)n |

| = | 0 x (1 + 0)0 = 0 |

Future Value Formula in Excel (With Excel Template)

Calculating Future Value in Excel is easy and can take many variables, which can be difficult to calculate otherwise without a spreadsheet.

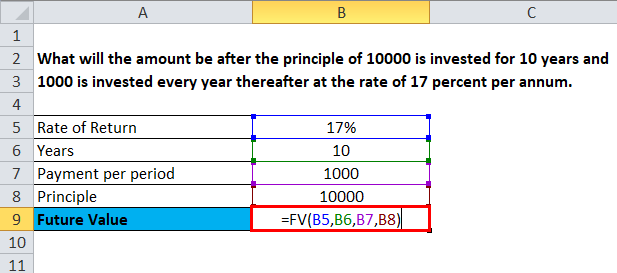

Here we will take an example, and I will solve it in the spreadsheet:

What will the amount be after the principle of 10000 is invested for 10 years and 1000 is invested every year thereafter at 17 percent per annum?

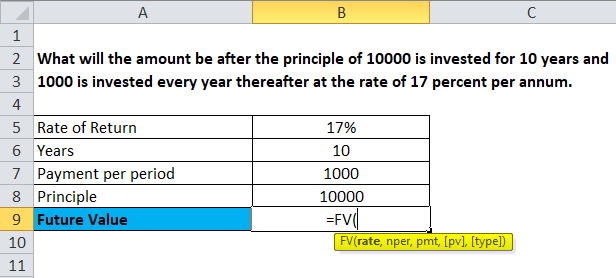

Now, using a specific function to calculate the future value, which FV denotes, is essential.

Now, as soon as you put in the FV function and start a bracket, excel asks you to open the bracket and give rate (rate), the number of periods (nper), payment per term (pmt), Present Value (PV) close brackets.

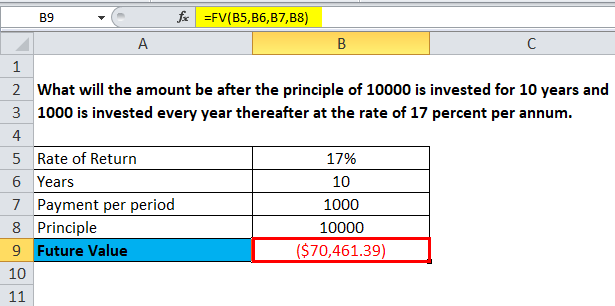

Now, following the problem above:

- Rate = B5 = 17%

- Nper = B6 = 10

- PMT = B7 = 1000

- PV = B8 = 10000

- Future Value = FV (B5, B6, B7, B8)

As we press enter in B6, we will get our Future Value.

Use this Excel illustration in Google Sheets as well. We just need to be clear about the functions and the input.

Recommended Articles

Although, this has been a guide to a Future Value formula. Here, we discuss its uses along with practical examples. We also provide a Future Value Calculator with a downloadable Excel template. You may also look at the following articles to learn more –