Updated July 24, 2023

Definition of GAAP

GAAP is the short form used for Generally Accepted Accounting Principles. GAAP can be defined as a set of accounting rules and formats used solely for financial reporting purposes. Non-GAAP can be defined as a set of measures that do not follow a standard calculation. With Non – GAAP, statements are issued on a quarterly basis in addition to generally accepted accounting principles.

Difference Between GAAP vs Non-GAAP

GAAP vs Non-GAAP in this article, GAAP is the short form used for Generally Accepted Accounting Principles. GAAP can be defined as a set of accounting rules and formats used solely for financial reporting purposes. GAAP ensures that an organization’s financial statements are prepared with full authenticity and in such a manner that it reflects the utmost fairness and transparency to the readers of the same. GAAP ensures that an organization’s financial statements reflect the true and fair picture of its financial wellness and do not contain any misleading information.

With GAAP, readers of the financial statements find it really easy for them to understand the same and arrive at an appropriate decision pertaining to investment making. The financial reports that are constructed under the Generally Accepted Accounting Principles are most likely to depict the economic wellness of an organization. On the other hand, Non-GAAP can be defined as a set of measures that do not follow a standard calculation. With Non – GAAP, statements are issued on a quarterly basis in addition to generally accepted accounting principles. Non-GAAP even offers information pertaining to positive and negative cash flows and enables a better understanding of stakeholders.

Non-GAAP excludes specific financial transactions, but includes free cash inflows and outflows, earnings before interest and taxes (EBIT), earnings before interest, taxes, depreciation, and amortization (EBITDA), adjusted earnings before interest, tax, depreciation, and amortization, operating earnings per share (EPS) and operating earnings. Non-GAAP measures are issued under guidance and compliance with Securities and Exchange Commission (SEC) rules and regulations.

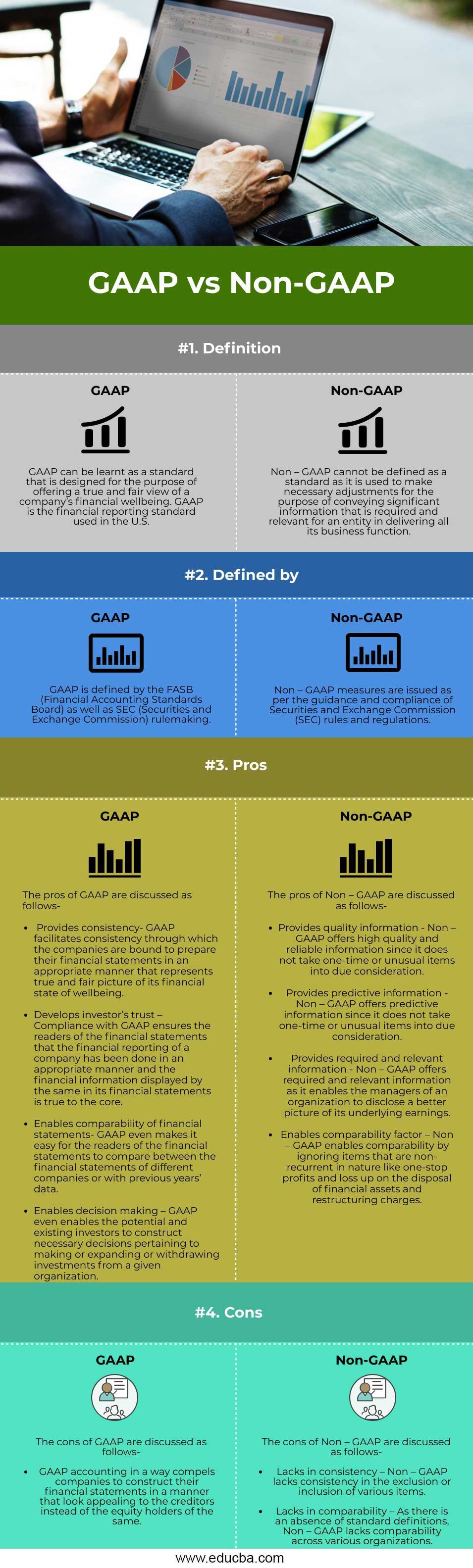

Head To Head Comparison Between GAAP vs Non-GAAP (Infographics)

Below are the Top 4 difference between GAAP vs Non-GAAP:

Key Differences Between GAAP vs Non-GAAP

The key differences between GAAP and Non- GAAP are provided and discussed below-

1. The purpose of GAAP is to offer a true and fair picture or in other words, an actual picture of an entity’s financial performance to the readers of the financial statements. On the other hand, Non – GAAP is used for the purpose of making required adjustments in order to convey legitimate business information of an entity concerning its business operations. In other words, Non – GAAP is used to offer better and accurate information on an entity’s business operations.

2. Generally Accepted Accounting Principles or GAAP is defined by the Financial Accounting Standards Board (FASB) and the Securities and Exchange Commission (SEC) rulemaking. On the other hand, Non – GAAP is defined by SEC frameworks.

3. GAAP is a standard whereas Non – GAAP is not a standard.

4. GAAP comprises of all the financial transactions whereas Non – GAAP excludes certain types of financial transactions.

Comparison Table Between GAAP vs Non-GAAP

Let’s discuss the top comparison between GAAP vs Non-GAAP:

| Basis of Comparison | GAAP | Non-GAAP |

| Definition | GAAP can be learned as a standard that is designed for the purpose of offering a true and fair view of a company’s financial wellbeing. GAAP is the financial reporting standard used in the U.S. | Non – GAAP cannot be defined as a standard as it is used to make necessary adjustments for the purpose of conveying significant information that is required and relevant for an entity in delivering all its business functions. |

| Defined by | GAAP is defined by the FASB (Financial Accounting Standards Board) as well as SEC (Securities and Exchange Commission) rulemaking. | Non-GAAP measures are issued as per the guidance and compliance of the Securities and Exchange Commission (SEC) rules and regulations. |

| Pros | The pros of GAAP are discussed as follows:

|

The pros of Non-GAAP are discussed as follows:

|

| Cons | The cons of GAAP are discussed as follows:

|

The cons of Non-GAAP are discussed as follows:

|

Conclusion

The first and foremost difference probable between the generally accepted accounting principles or GAAP and Non-GAAP is the fact that the former is a standard while the latter isn’t actually a standard. The purpose of generally accepted accounting principles is to offer a clear picture of a company’s financial state of wellbeing. On the other hand, Non-GAAP is used for the purpose of initiating necessary financial adjustments to offer substantial financial information of a company with respect to all its business operations. Unlike GAAP, Non-GAAP does not record all sorts of financial transactions.

Recommended Articles

This is a guide to GAAP vs Non-GAAP. Here we discuss the difference between GAAP vs Non-GAAP, along with key differences, infographics, & a comparison table. You can also go through our other suggested articles to learn more–