Updated July 24, 2023

Gearing Formula (Table of Contents)

What is the Gearing Formula?

The term “gearing” refers to the group of financial ratios that demonstrate to what degree a company’s operations are funded by debt financing vs equity capital.

In other words, the metrics signify the mix of funding from lenders and shareholders. There are three major gearing ratios –

- Debt-to-Equity Ratio

- Equity Ratio

- Debt Ratio

The formula for the debt-to-equity ratio is expressed as the company’s total debt divided by its total equity. Mathematically, it represents as,

The formula for equity ratio is expressed as the company’s total equity divided by its total assets. Mathematically, it represents as,

The formula for debt ratio is expressed as the company’s total debt divided by its total assets. Mathematically, it represents as,

Examples of Gearing Formula (With Excel Template)

Let’s take an example to understand the calculation of Gearing in a better manner.

Gearing Formula – Example #1

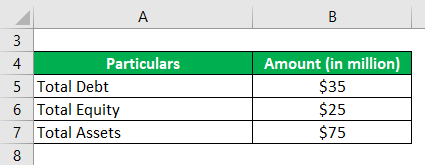

Let us take the example of a company with the following information retrieved from its annual report: Calculate its gearing ratio based on the given information.

Solution:

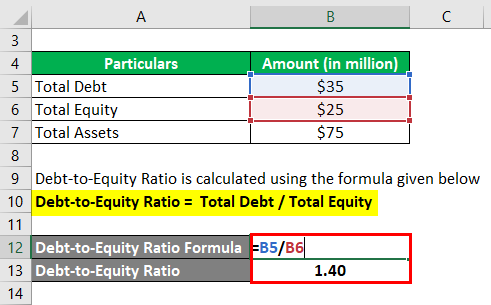

Debt-to-Equity Ratio calculates by using the formula given below

Debt-to-Equity Ratio = Total Debt / Total Equity

- Debt-to-Equity Ratio = $35 million / $25 million

- Debt-to-Equity Ratio = 1.40x

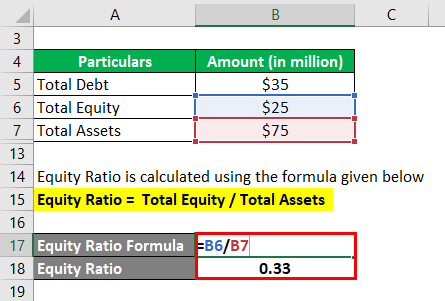

Equity Ratio calculates by using the formula given below

Equity Ratio = Total Equity / Total Assets

- Equity Ratio = $25 million / $75 million

- Equity Ratio = 0.33x

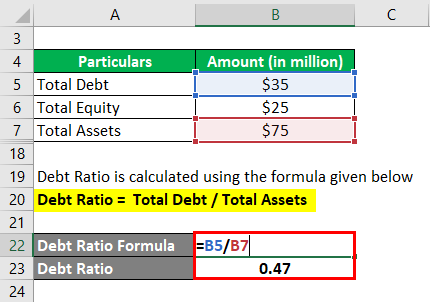

Debt Ratio calculates by using the formula given below

Debt Ratio = Total Debt / Total Assets

- Debt Ratio = $35 million / $75 million

- Debt Ratio = 0.47x

Therefore, the company’s debt-to-equity, equity, and debt ratios are 1.40x, 0.33x, and 0.47x, respectively.

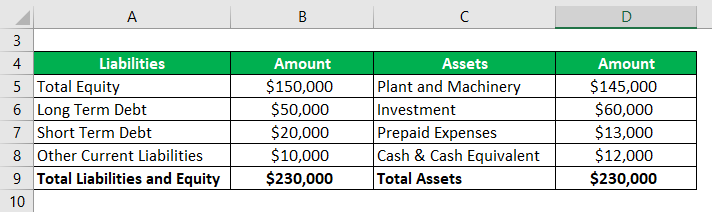

Gearing Formula – Example #2

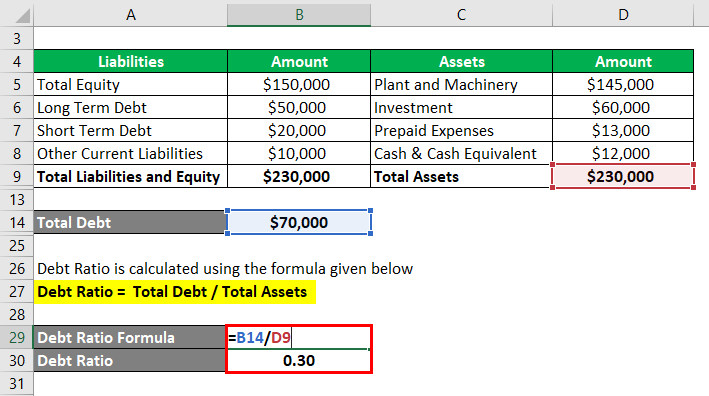

Let us take an example of more detailed financial information to illustrate the computation of gearing ratios. Use the following information to compute the gearing ratios:

Solution:

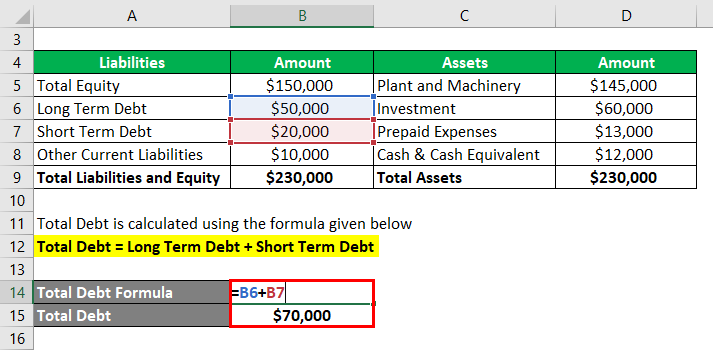

Total Debt calculates by using the formula given below

Total Debt = Long-Term Debt + Short-Term Debt

- Total Debt = $50,000 + $20,000

- Total Debt = $70,000

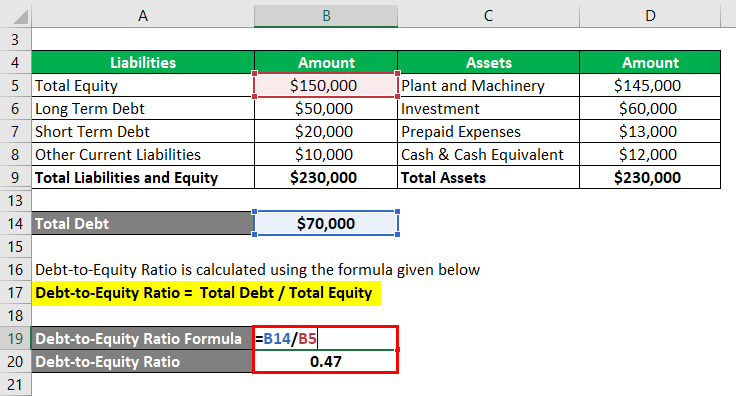

Debt-to-Equity Ratio calculates by using the formula given below

Debt-to-Equity Ratio = Total Debt / Total Equity

- Debt-to-Equity Ratio = $70,000 / $150,000

- Debt-to-Equity Ratio = 0.47x

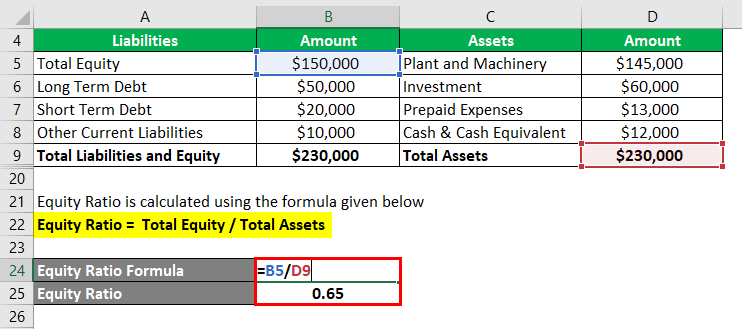

The Equity Ratio calculates by using the formula given below

Equity Ratio = Total Equity / Total Assets

- Equity Ratio = $150,000 / $230,000

- Equity Ratio = 0.65x

Debt Ratio calculates by using the formula given below

Debt Ratio = Total Debt / Total Assets

- Debt Ratio = $70,000 / $230,000

- Debt Ratio = 0.30x

Therefore, the company’s debt-to-equity, equity, and debt ratios are 0.47x, 0.65x, and 0.30x, respectively.

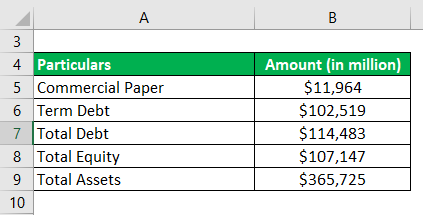

Gearing Formula – Example #3

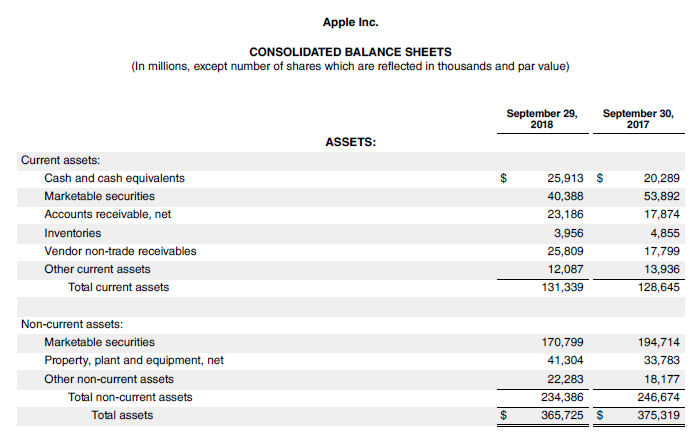

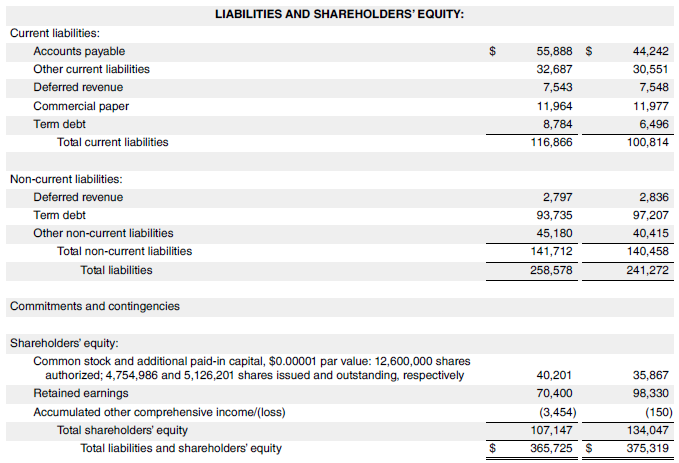

Let us take the example of Apple Inc. and calculate the gearing ratios according to the annual report’s financial report for 2018. The following is available:

Solution:

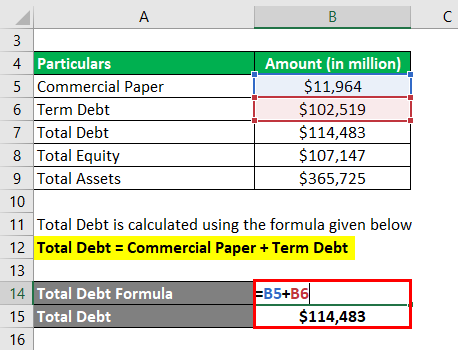

Total Debt calculates by using the formula given below

Total Debt = Commercial Paper + Term Debt

- Total Debt = $11,964 million + $102,519 million

- Total Debt = $114,483 million

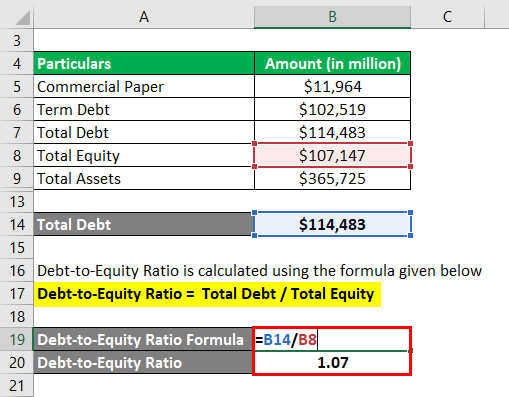

Debt-to-Equity Ratio calculates by using the formula given below

Debt-to-Equity Ratio = Total Debt / Total Equity

- Debt-to-Equity Ratio = $114,483 million / $107,147 million

- Debt-to-Equity Ratio = 1.07x

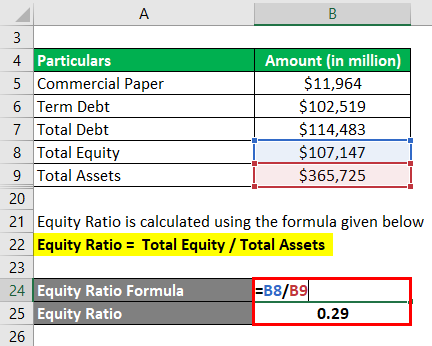

The Equity Ratio calculates by using the formula given below

Equity Ratio = Total Equity / Total Assets

- Equity Ratio = $107,147 million / $365,725 million

- Equity Ratio = 0.29x

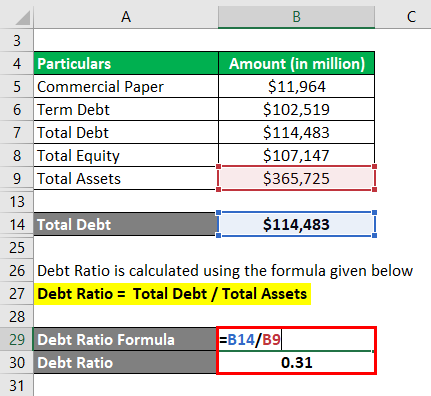

Debt Ratio calculates by using the formula given below

Debt Ratio = Total Debt / Total Assets

- Debt Ratio = $114,483 million / $365,725 million

- Debt Ratio = 0.31x

Therefore, Apple Inc.’s debt-to-equity ratio, equity ratio, and debt ratio for the year 2018 were 1.07x, 0.29x, and 0.31x, respectively.

Screenshot of balance sheet used for calculation

Source Link: Apple Inc. Balance Sheet

Explanation

The formula for different gearing ratios can be derived by using the following steps:

Step 1: Firstly, determine the total debt of the company, which is the aggregate of all long-term and short-term interest-bearing liabilities such as term loans, working capital loans, capital leases, etc.

Step 2: Next, determine the company’s total equity, also known as shareholder’s equity.

Step 3: Next, determine the company’s total assets, the sum of all capitalized resources employed in the business.

Step 4: The formula for a debt-to-equity ratio can be derived by dividing total debt (step 1) by total equity (step 2), as shown below.

Debt-to-Equity Ratio = Total Debt / Total Equity

The formula for the equity ratio can be derived by dividing total equity (step 2) by total assets (step 3), as shown below.

Equity Ratio = Total Equity / Total Assets

The formula for debt ratio can be derived by dividing total debt (step 1) by total assets (step 3). Mathematically, it represents as,

Debt Ratio = Total Debt / Total Assets

Relevance and Use of Gearing Formula

It is important to understand the concept of gearing ratios because most lenders and analysts use these financial ratios to assess an entity’s degree of leverage. Typically, a higher value of equity ratio and lower value of debt-to-equity ratio and debt ratio indicates sound financial health. However, please note that the gearing ratios should be compared among companies operating in the same industry, as these ratios are very industry-specific.

Recommended Articles

This is a guide to Gearing Formula. Here we discuss how to calculate Gearing along with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more –