Difference Between General Journal vs General Ledger

The key to running a successful business is finance, and how that finance will succeed depends upon how it is utilized optimally, which can be achieved through accounting. So, when it comes to tracking an enterprise’s financial transactions, a double-entry system is widely used. The same incorporates a “general journal” and a “general ledger” concept, which are the best methods for tracking the overall numbers and the statistics and keeping the operations running profitably and smoothly. But to understand how the double-entry accounting record systems function, one must first understand the key different functions associated with the 2 key components: general journals and general ledgers. Journal will be the first form of the financial transaction. In the journal, the qualified accountant will debit and credit the correct account and record the transaction in the books of accounts of the firms for the very 1st time using the double-entry accounting system.

Coming to the ledger, the qualified accountant will create a “T” format type and then insert the journal in the correct order. In other words, a ledger can be an extension of a general journal. All the important financial statements, such as trial balances, income statements, and balance sheets, are created by looking at the ledger; the ledger becomes very important.

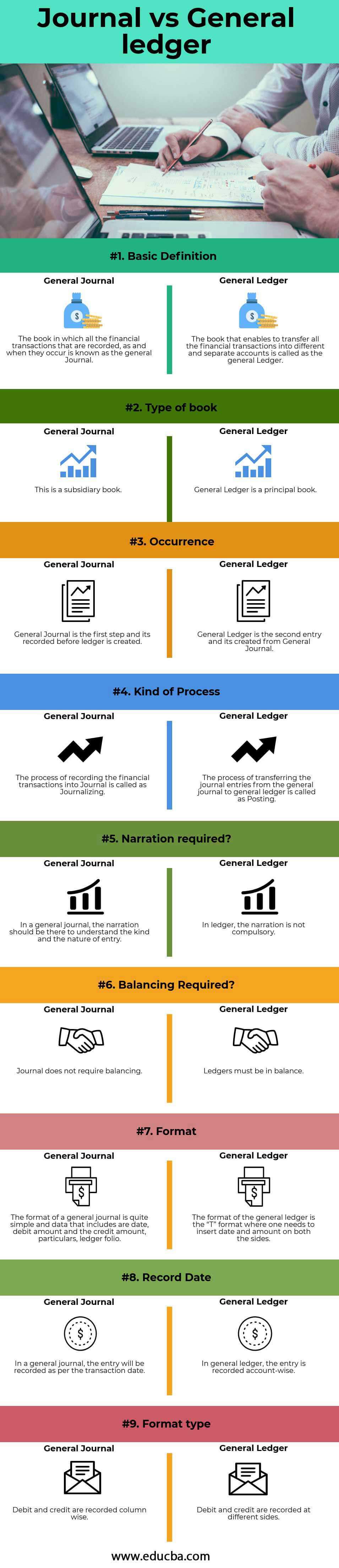

Head To Head Comparison Between General Journal vs General Ledger (Infographics)

Below is the top 9 difference between General Journal vs General Ledger

Key Differences Between General Journal vs General Ledger

Both General Journal vs General Ledger are popular choices in the market; let us discuss some of the major differences between General Journal vs General Ledger:

- The General Journal records all the financial transactions for the very first time. When these financial transactions are recorded or entered in the general journal, they will be posted into individual accounts, which we call General Ledger.

- In the general journal, narration should be written to support that journal entry and provide its justification for posting it. On the other hand, in the general ledger, there is no specific requirement for writing any narration.

- The General Journal is called the book of an original journal entry, but to the contrary, the Ledger is a book of subsequent or, say, the second entry.

- The General Journal, as stated earlier, is a subsidiary book, whereas the General Ledger, on the other hand, is a principal book.

- In the general journal, financial transactions must be recorded sequentially. On the contrary, in the general ledger, the financial transactions will be recorded based on those accounts.

- Credit and Debit are the columns in the general journal, but on the flip side, in the general ledger are two opposite sides.

- In the general journal, financial transactions must be recorded chronologically, whereas, in the general ledger, these financial transactions must be recorded in an analytical order.

- Balancing general ledger accounts is a requirement while balancing the general journal is not necessary.

Journal vs General Ledger Comparison Table

Below is the 9 topmost comparison between General Journal vs General Ledger

| Basis of comparison |

General Journal |

General Ledger |

| Basic Definition | The General Journal records all financial transactions as and when they occur. | The book that enables transferring all financial transactions into different and separate accounts is the General Ledger. |

| Type of book | This is a subsidiary book | General Ledger is a principal book |

| Occurrence | The first step is recording the General Journal before creating the ledger. | General Ledger is the second entry, and General Journal created it. |

| Kind of Process | Journalizing is the process of actively recording financial transactions in a Journal. | Posting transfers the journal entries from the general journal to the general ledger. |

| Narration required? | In a general journal, the narration should be there to understand the kind and nature of the entry. | In the ledger, the narration is not compulsory. |

| Balancing Required? | The journal does not require balancing. | Ledgers must be in balance. |

| Format | The format of a general journal is quite simple, and data includes a date, debit amount, credit amount, particulars, and ledger folio. | The general ledger format is the “T” format, where one needs to insert the date and amount on both sides. |

| Record Date | Record the entry in the general journal according to the transaction date. | Record entries in the general ledger account-wise. |

| Format type | Record debit and credit column-wise. | Differentiate the recording of debit and credit on distinct sides. |

Conclusion

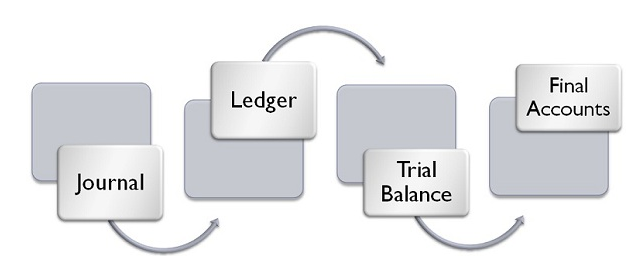

Recording the financial transactions involves a series of actions; for example, they are 1st recorded in the general journal, and then from there, they will be grouped and classified into different and separate accounts and will then finally be posted into the general ledger, which will then be transferred to the trial balance and finally the final accounts will be prepared. These steps are a base for preparing an organization’s financial accounts. If one misses any of the above steps, preparing those final accounts won’t be easy.

From 2015 onwards, most organizations or firms used the software available in the market to record these financial transactions in general journals and general ledgers. Most accounting software maintains a central repository where one can also log the journal entries and the general ledger. Advances in technology, however, will make it less tedious and easier to record those financial transactions, and further, one doesn’t need to maintain every book of accounts differently or separately. The person entering data in any of the modules of one’s firm or the company’s bookkeeping or accounting will not even be aware of such repositories.

In all these software applications, the person who enters the data must only click a drop-down menu to enter a financial transaction into a general ledger or the general journal. Both General Journal vs General Ledger are important from the perspective of a financial statement.

Recommended Articles

This has guided the top difference between General Journal and General Ledger. Here, we discuss the General Journal vs General Ledger key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.