What is a Goldilocks Economy?

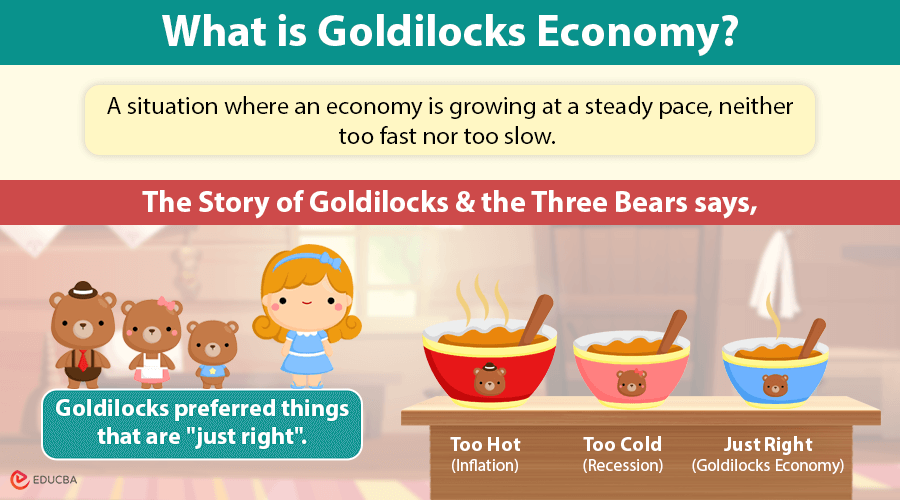

A Goldilocks Economy is a situation where an economy is growing at a steady pace, neither too fast nor too slow.

A Goldilocks economy stays in an optimal state, just like Goldilocks in the famous story, choosing things that are “just right.” In economic terms, it means that growth is strong enough to create jobs and improve incomes but not so rapid that it causes inflation or market instability.

Consider a country experiencing steady GDP growth of around 2.5%, an inflation rate close to 2%, and an unemployment rate below 5%. In such a scenario, businesses thrive due to consistent consumer demand, workers enjoy job stability, and the cost of living remains manageable. This balance fosters confidence among investors and policymakers, contributing to overall economic prosperity.

Factors Contributing to a Goldilocks Economy

Achieving and maintaining a Goldilocks Economy involves a delicate balance of various factors:

- Monetary policy management: Central banks, like the Federal Reserve, play a crucial role by adjusting interest rates to control inflation and stimulate growth. Lowering rates can encourage borrowing and investment, while raising them can prevent an overheating economy.

- Fiscal policy and government spending: Governments can influence economic activity through spending on infrastructure projects and adjusting tax policies to encourage business investment and consumer spending. However, excessive spending or tax cuts can lead to budget deficits and long-term economic challenges.

- Technological innovation: Advancements in technology can boost productivity, leading to economic growth without corresponding inflation increases. For instance, the rise of the internet in the 1990s contributed significantly to economic expansion.

- Global trade dynamics: Engaging in international trade allows countries to specialize based on comparative advantages, promoting efficiency and growth. However, trade tensions or protectionist policies can disrupt this balance.

Real-World Examples of a Goldilocks Economy

Here are some real-world examples of the Goldilocks economy:

1. The United States in the 1990s (Clinton Era)

One of the best-known examples of a Goldilocks Economy occurred in the U.S. during the mid-to-late 1990s under President Bill Clinton. This period saw strong economic growth, low inflation, and declining unemployment, creating an ideal economic balance.

Key Indicators:

- GDP Growth: Around 4% per year from 1995 to 2000.

- Unemployment: Dropped from 5.6% in 1995 to 4.0% in 2000.

- Inflation: Remained controlled at around 2-3% despite rapid growth.

Why It Happened:

- The dot-com boom led to massive technological innovation and increased productivity.

- Globalization helped keep inflation low by reducing production costs.

- The Federal Reserve maintained balanced interest rates, neither too high nor too low.

2. Germany in the Mid-2010s

Between 2014 and 2019, Germany experienced a Goldilocks Economy with steady growth, low unemployment, and controlled inflation.

Key Indicators:

- GDP Growth: Around 2-3% annually.

- Unemployment: Dropped to a record low of 3.1% in 2019.

- Inflation: Remained between 1-2%, ensuring price stability.

Why It Happened:

- Strong manufacturing and export-driven economy (especially in automobiles and machinery).

- Labor market reforms made hiring more flexible, reducing unemployment.

- The European Central Bank (ECB) sets low interest rates, making it easier for businesses to invest.

3. Australia in the 2000s and 2010s

Australia experienced nearly three decades of uninterrupted economic growth (1991-2019), making it a prime example of a long-term Goldilocks Economy.

Key Indicators:

- GDP Growth: Averaged around 2.5-3% per year.

- Unemployment: Stayed low, hovering around 5%.

- Inflation: Remained stable at 1-3%.

Why It Happened:

- Mining boom fueled exports, especially to China.

- Strong immigration and population growth supported demand.

- Sound fiscal and monetary policies helped prevent recessions.

Challenges and Risks

Maintaining a Goldilocks Economy is fraught with challenges:

- Monetary policy missteps: Incorrectly calibrated interest rates can either stifle growth or fuel inflation. For example, raising rates too quickly can increase borrowing costs, reducing consumer spending and business investment.

- Fiscal imbalances: Excessive government debt can lead to higher interest payments, limiting funds available for essential services and potentially destabilizing the economy.

- Global supply chain vulnerabilities: Disruptions, such as those from geopolitical tensions or pandemics, can hinder production and distribution, impacting economic stability.

- Income inequality: When wealth is not shared fairly, it can cause social unrest and lower consumer spending, which weakens the economy.

- Environmental concerns: Neglecting environmental sustainability can result in resource depletion and climate-related disasters, posing long-term economic risks.

Impact on Innovation and Global Economy

A Goldilocks Economy fosters an environment conducive to innovation:

- Entrepreneurship flourishes: Stable economic conditions encourage individuals to pursue entrepreneurial ventures, leading to job creation and technological advancements.

- Attracting global talent: Countries experiencing balanced growth become hubs for skilled professionals seeking opportunities, enhancing the talent pool and driving further innovation.

- Research and development investments: Businesses are more likely to invest in R&D during stable economic periods, leading to new products and services that fuel future growth.

Can a Goldilocks Economy Last Forever?

A Goldilocks Economy is difficult to sustain indefinitely due to changing economic cycles. Central banks and governments must continuously monitor key indicators and adjust policies accordingly. While temporary periods of stable growth can be achieved, external factors such as global economic downturns, political instability, or natural crises can disrupt the balance.

Final Thoughts

A Goldilocks Economy represents an ideal economic state with balanced growth, low unemployment, and controlled inflation. It creates a stable and predictable environment for businesses, investors, and consumers. However, maintaining such an economy requires careful management of fiscal and monetary policies. While it may not last forever, understanding its principles helps governments and policymakers aim for sustainable economic growth.

Recommended Articles

We hope this guide on the Goldilocks Economy has been helpful. Check out these recommended articles for more insights on economic trends, market stability, and financial strategies.