What is Goodwill in Accounting?

Goodwill, in accounting, is an intangible asset created when one firm acquires another at a cost more than the total fair value of the acquired firm’s identifiable net assets.

We can classify it as purchased and inherent. Goodwill is a significant part of the purchase cost value of an acquisition. It is also generally higher than the net fair value of all the other assets and liabilities. It is an asset with unlimited life under US GAAP and IFRS Standards, so its depreciation is unnecessary. Private corporations can amortize it over ten years but must assess it annually.

Key Takeaways

- It is an intangible asset that accounts for the surplus in purchase value when an enterprise acquires another. It is of two types: Purchased and inherent.

- We can calculate purchased goodwill by subtracting the fair market value of the liabilities and the assets from the purchasing price of the company.

- Inherent includes the company’s intangible assets, such as its brand name, and is immeasurable.

- Various factors affect it, including customer base, quality of the product, the risk and stability of the business, etc.

- It is essential during the acquisition phase. However, it does not consider abnormal profits or losses during its analysis.

Explanation

- It comprises the company’s intangible assets, such as brand name, healthy customer base, good customer relationships, technology strength, etc.

- It generally includes assets that don’t quantify easily.

- We can calculate it by using the company’s purchase value and subtracting the fair value of the assets & liabilities from it.

- Companies must review their goodwill and record it in their financial statement at least once a year. It is per the International Financial Reporting Standards (IFRS) and generally accepted accounting principles (GAAP).

- Similarly, they must also record any impairments.

- Its calculation is relatively simple but can get quite complex during implementation. Acquirers closely observe this value during phases of acquisition.

- The acquiring company will be keen to acquire target companies with positive goodwill.

Types of Goodwill

- Purchased: It is the difference between the sum paid for a business as a going concern less the total value of its assets and liabilities. This type only occurs when there is an acquisition. As companies are fixed assets, this type can be known as fixed assets goodwill. Companies can either write them off or amortize them.

- Inherent: It is the firm’s value over each net asset’s fair price. Companies build this type of goodwill internally. It comes into place because of the company’s excellent reputation. It is pretty valuable; one such thing is brand value. It can have a positive or a negative value. When the firm’s worth exceeds the fair market value of the acquired net assets, it creates positive value and vice versa.

How to Calculate Goodwill?

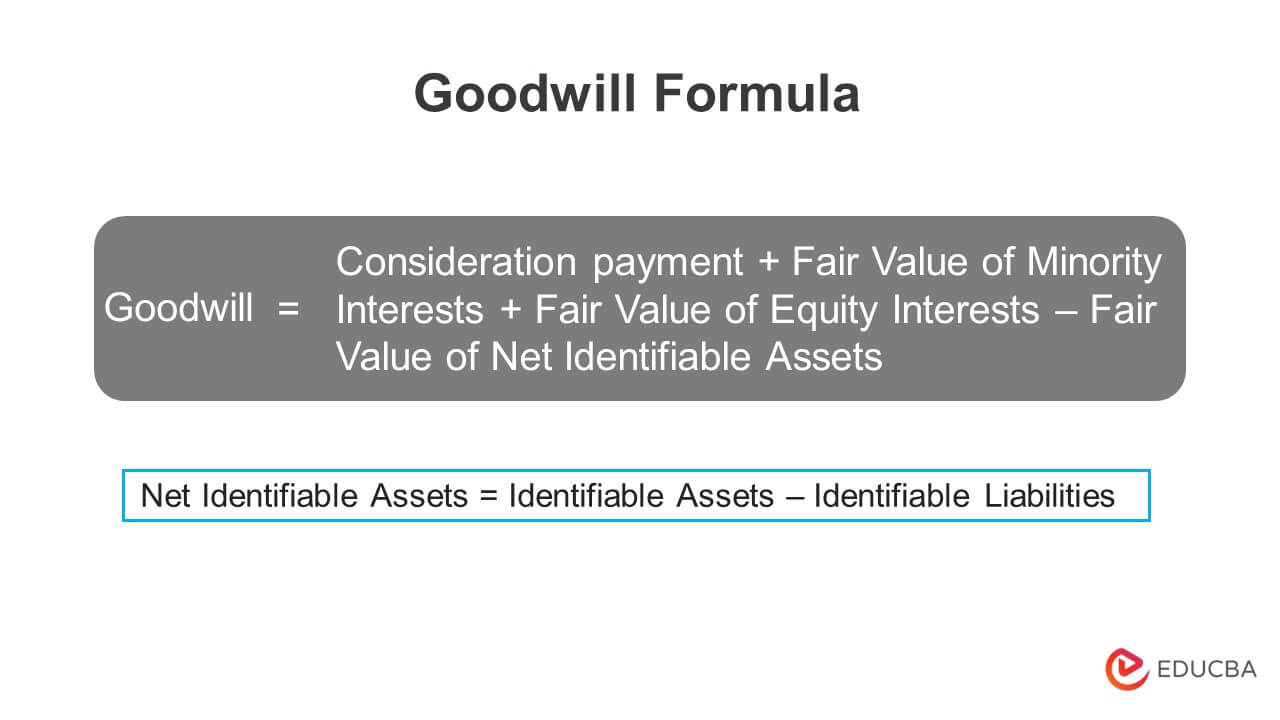

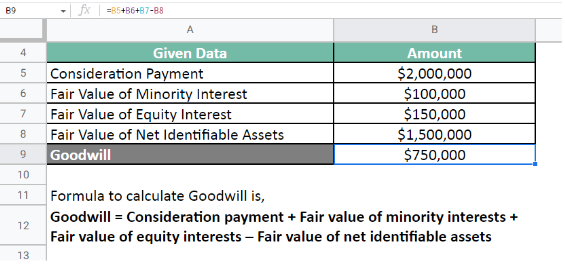

To calculate purchased goodwill, one can use the following formula,

Here,

First, as stated in the transaction contract, ascertain the consideration paid by the purchaser to the seller. The purchaser can use shares, cash, or payment-in-kind to pay the consideration. Then, compute the acquisition firm’s minority interest’s fair market value. Minority interest is otherwise known as non-controlling interest. Afterward, establish the fair value of equity interests.

We subtract all identifiable liabilities from assets to calculate net identifiable assets. One can find the value of assets and liabilities on the company’s balance sheet. Finally, we calculate the goodwill equation.

Examples

Download the Excel template here – Goodwill Excel Template

Example 1

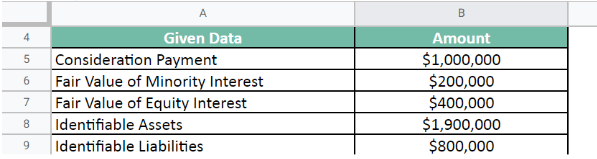

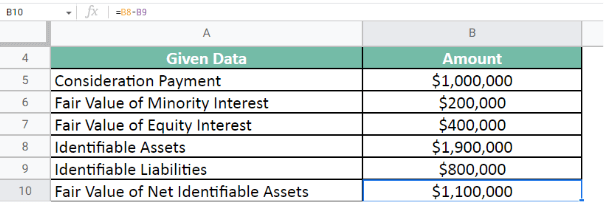

Company ABC wants to acquire Company XYZ and thus wants to know its goodwill value. The consideration is $1,000,000, and the fair value of minority interest is $200,000. The company has previous equity interests of $400,000. Its identifiable assets and liabilities are $1,900,000 and $800,000, respectively. Calculate the goodwill for Company XYZ.

Given,

First, we calculate the Net identifiable assets.

Net identifiable assets = Identifiable assets – Identifiable liabilities

Finally, we calculate the goodwill value.

Therefore the goodwill value for Company XYZ is $500,000.

Example 2

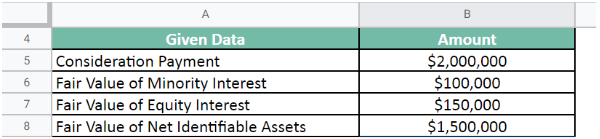

Company A wants to acquire Company B. The agreed consideration payment is $2,000,000. The fair value of minority and equity interest is $100,000 and $150,000, respectively. The value for net identifiable assets is $1,500,000. Calculate the goodwill for Company XYZ.

Given,

Calculate the goodwill value.

Therefore the goodwill value for Company B is $750,000.

Journal Entries of Goodwill

Goodwill assets exist in all kinds of enterprises. Although it is immaterial, it has value when we trade or acquire another business. In such a situation, conveying Goodwill in notebook entries is necessary.

The Goodwill journal entries for the acquirer and seller are different.

Acquirer: Suppose a corporation purchases a company for an amount higher than the market value. The difference between the market value and acquisition value is goodwill. Therefore, although it is an intangible asset, the company needs to make a journal entry to register it.

- It enters the business; it counts as an asset. Hence, any growth in a company’s assets will come under debt.

- As the buyer pays in cash, it loses money, which will come under credit.

- For instance, Company A acquires Company B. Company A pays $ 3,000,000 for Company B’s goodwill. Therefore, $3,000,000 will be added to debit (assets) and deducted from credit (cash).

Seller: When a company sells its goodwill for capital, it has to record the transaction on its balance sheet. Companies make journal entries accordingly, as the trade may result in profit or loss depending if the received amount is in surplus or undervalued.

- Either the cash assets increase in case of profit or decrease for loss. However, companies always debit all liabilities and costs.

- It decreases due to its sale; it comes under credit in both loss and gain.

Impairment & Testing

Companies must evaluate it annually for any impairments. Impairments occur when the paid value for the asset is higher than its fair market value.

For instance, Company A pays $10 million for a company, of which $4 million is goodwill. After operating for two years, they conducted an impairment test and realized the market value had fallen by $2 million. Therefore, the value of goodwill falls by $2 million too.

The goodwill impairment test has both qualitative and quantitative tests.

Preliminary Qualitative Assessment

- In this step, the company must identify if the goodwill on its financial statements is expected to be more than its actual market value.

- No more testing is necessary if the preliminary qualitative analysis demonstrates the opposite.

- However, the corporation must perform a quantitative evaluation if it determines that its reported goodwill will likely go beyond its fair market value.

Quantitative Assessment

- The first step is to determine the market value of the reporting unit of the derived goodwill.

- Then contrast it to the amount of goodwill already recorded on the company’s financial statements.

- This phase of the quantitative evaluation is essentially a refined version of the initial qualitative assessment.

- If this analysis shows that the value on the firm’s balance sheet does not surpass its fair value, no more testing is necessary.

- On the other hand, if the quantitative assessment finds a transcend in fair value, they must continue testing.

- Now, the corporation carefully examines the worth of different assets and liabilities of the reporting unit to establish its valuation.

- If the results show that the goodwill surpasses the reporting unit’s valuation, the excess amount is an impairment value of goodwill.

Treatment

It differs in various situations. Here are a few cases of treatment.

Partner’s Death/Retirement:

- As a company’s acquired goodwill is the product of all previous partners’ work, the retiring or departed partner must receive their percentage at the time of their retirement or death.

- However, future revenues will not be divided.

PSR Changes:

- Companies value goodwill whenever there is an alteration in the partners’ profit-sharing margin.

- Companies adjust the PSR using the capital ratios of the partners.

Partner’s Admission:

There are two techniques to handle it during a partner’s acceptance.

- The first is the Premium method, where the current partners divide it in a particular ratio, and the new partner contributes in cash.

- The second is the revaluation method. Here, the new partner opts not to make cash contributions. So, they credit old partners as per their old PSR. For the new partner, they debit the goodwill.

Need for Valuation

Companies may need to value it in case of any of these factors.

- When a company buys another company, it values the business to determine the purchase price.

- In the case of a partnership business, the addition of new partners, changes in the profit-sharing percentage, and when a partner passes away or retires.

- It is necessary for companies who have written off but still need to document records. It is also helpful while calculating taxes, consolidation processes, etc.

Conclusion

It plays a significant role in the acquisition phase for the companies. The worth of your company rises as it expands its customer base. We cannot value brand recognition and intellectual property, but both represent goodwill. It all together impacts the valuation of a company. The gathering takes a considerable period, and it can’t happen overnight. Thus, a company must stand apart in this competitive world and fulfill its customers’ expectations to gather goodwill.

FAQs of Goodwill

Q1. What is Goodwill? What are the types of goodwill?

Answer: A form of an intangible asset is known as goodwill. Businesses avail it when they buy another business. It is associated with either the acquisition of a company or its non-quantifiable value. Purchased and inherent are its two types.

Purchased goodwill is when a business is bought for a price greater than the fair market value of its net assets. In contrast, inherent type represents a company’s unquantifiable value, like customer & employee relationships, brand name, etc.

Q2. What distinguishes goodwill from other Intangible assets?

Answer: Other intangible assets, like licenses, have a finite life, but it has an infinite life. It is impossible to buy or sell goodwill on its own; it is a premium paid beyond fair value through a transaction. Other intangible assets, like licenses, can be purchased or sold separately.

Q3. What is negative goodwill?

Answer: A business term describes the bargain price when a firm buys a company or its assets for less than its fair market value. A negative value typically signifies that the selling party has financial difficulties or has filed for bankruptcy. Therefore has no choice but to sell its assets.

Q4. What is an alternative for goodwill?

Answer: Private companies and nonprofit organizations use the accounting alternative. It permits businesses to assess goodwill impairment-inducing occurrences solely as of the accounting quarter’s closure. It can be transitory or annual and identifies and records those impairments.

Recommended Articles

This is a guide to goodwill. We discuss its types, calculations, treatment, impairments, and more. To learn more, visit the following links.