Updated July 19, 2023

Definition of Goodwill Valuation

Goodwill is an intangible asset representing the reputation and brand value a business has built over time. When one firm buys another for more than the fair worth of the acquired company’s net assets, the extra amount is allocated to goodwill. This excess amount represents the value of the acquired company’s reputation and other intangible assets.

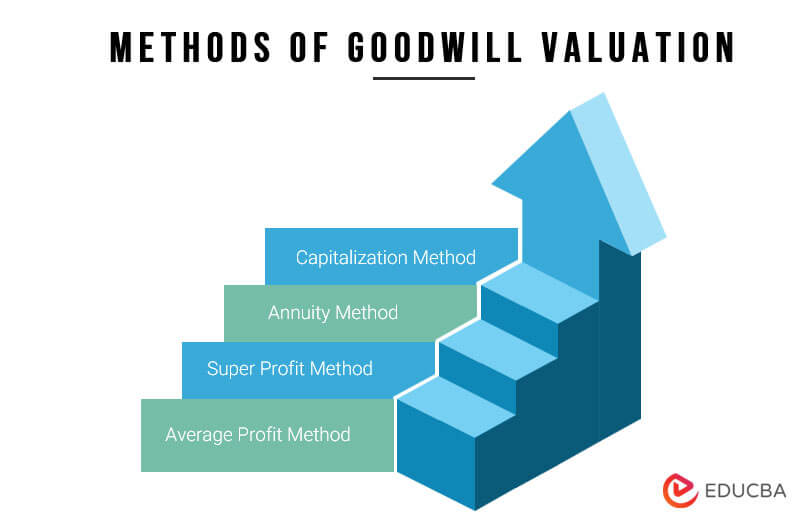

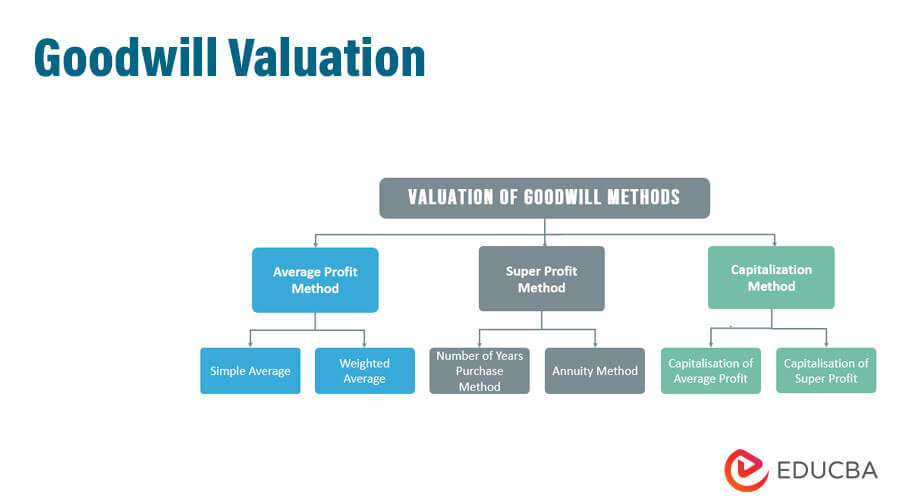

Methods of Goodwill Valuation

1. Average Profit Method

The average profit approach calculates a modest profit over the last 3-4 years, ignoring any abnormal profit or loss. The computed average profit will be multiplied by the agreed-upon number of years, say 4 or 5. The resultant figure gives the value of the goodwill.

2. Super Profit Method

Under the super profit method, the valuation of goodwill involves multiplying the net profit by a specified number of years. Net profit is calculated by taking the excess profit over the average profit. Deducting the typical return from the projected sustainable profit yields the average profit. By multiplying the capital utilized by the usual rate of return, the future sustainable profit is computed. To calculate the amount of goodwill, multiply the super profit by the agreed-upon number of years from purchase.

3. Annuity Method

This method calculates goodwill as the company’s present value of future super-profits. As a result, multiplying super profits by the annuity factor yields the current value of goodwill.

4. Capitalization Method

This method calculates goodwill by subtracting the actual capital used from the capitalized average profit based on a normal rate of return or by dividing super profit by the agreed capitalization rate. Thus, the following are the two options for calculating goodwill under this method.

- Average Profit Capitalization Method: Goodwill = [Average profit/ normal rate of return* 100]- capital employed.

- Super Profit Capitalization Method: Goodwill – Super profit/ capitalization rate* 100.

Factors Affecting Goodwill Valuation

Below are the factors that affect goodwill valuation at the time of business combination:

- The nature of business and its location affect the value of goodwill. If the business is located in a favorable location, goodwill will increase.

- Longevity, i.e., the time period since the business exists, also affects how much goodwill will be valued. Older the company, the stronger the market existence and brand name, and the higher the goodwill valuation.

- Quality of products and services, customer trust, and customer base also evaluate goodwill.

- License, technical know-how, customer services, after-sales services, and business risks also affect goodwill valuation.

- Profitability, capital employed, market competitors, management strategies for meeting the investors’ expectations, etc., are other factors affecting goodwill.

Need for Goodwill Valuation

There can be many circumstances in the business wherein the need for the valuation of goodwill arises. Some of them in respect of the company are as follows:

- When an existing company amalgamates with another current company.

- If a firm wishes to acquire a controlling position in another company, it may record the value of goodwill in its books. This usually occurs when the purchasing business pays more than the acquired company’s net assets.

- If a company wants to merge with another company, i.e., a business combination.

- When the value of shares is necessary for tax purposes, the stock quote may not always be available.

Advantages of Goodwill Valuation

- It helps to establish the value of the business in the eyes of stakeholders, customers, and investors.

- It helps set the business image above its competitors in customers’ minds when they need clarification on choosing two companies.

- Goodwill based on brand name built over helps improve the business’s current value.

- It helps encourage brand loyalty and serves as a test for the business’s solvency.

Conclusion

Valuation of goodwill is essential during business combination, amalgamation, etc. When a business is sold or transferred, goodwill is recognized as an intangible asset, regardless of the time and work required to build it.

Recommended Articles

We hope that this EDUCBA information on “Goodwill Valuation” was beneficial to you. You can view EDUCBA’s recommended articles for more information.