Updated July 7, 2023

Gross Income Meaning

Gross income is the total money a person earns before considering any tax deductions. It includes salary, bonuses, returns, and any other form of income. For example, employee A receives wages of $20,000 and $5,000 from investments. Their total income is $25,000.

On the other hand, it is also called gross profit, which refers to a company’s profit obtained after deducting direct and manufacturing costs from total sales. Suppose, in the first quarter, a firm spends $35,000 on product manufacturing and earns $50,000 on sales. Its income will be $15,000 in that quarter.

Not all companies report it as a separate item on their income statement; only some do. Apart from salary, it can include income from various sources, like self-employment, Autonomous Side Jobs, Bonuses, Rental Property Earnings, Alimony & Royalties, and more.

Key Highlights

- Gross income is the total amount a person makes before considering any deductions. It is the sum of all incomes, such as wages, dividends, capital gains, etc. It also signifies total sales less cost of sales for businesses

- One can report it differently. Either by listing each source of income on the tax return individually or listing all income sources in one line

- It is not dynamically accurate as it does not account for deductions such as taxes and other expenses

- Further adjustments are made to the measure to derive adjusted and modified adjusted gross income, which helps determine the taxation amount.

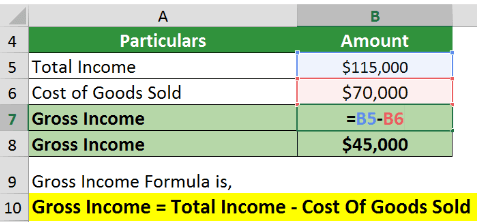

Gross Income Formula

The formula is,

OR

- Totaling up sources of income, namely, salary, rent, investment returns, and more can provide the gross income for an individual

- Total income is the company’s total amount of sales in the period

- Cost Of Goods Sold (COGS) is the costs incurred for producing goods, like raw materials, direct labor, manufacturing overhead, etc.

Calculation – Excel Examples

Example 1

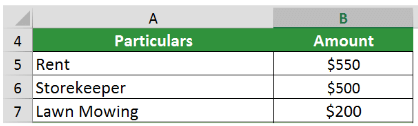

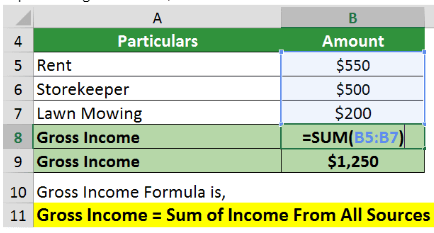

Alicia’s primary income source is the rent she collects from her tenants, which is $550 per month. On the side, she earns $500 per month as a storekeeper and $200 per month by mowing grass for a friend’s business. Calculate her gross income per month as well as annually.

Given,

Implementing the formula,

The annual value will be,

Therefore, Gross income is $1,250, and Gross annual income is $15,000.

Example 2

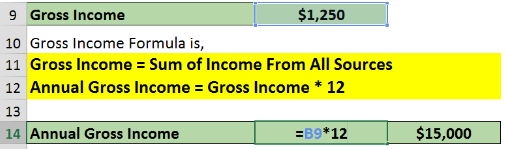

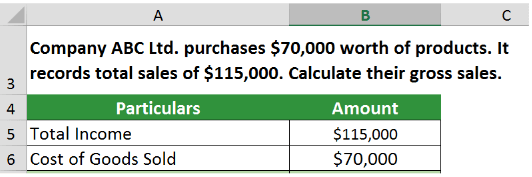

Company ABC Ltd. purchases $70,000 worth of products from the manufacturers. The company records total sales of $115,000. Calculate their gross sales.

Given,

As per the formula,

Hence, the company’s gross income is $45,000.

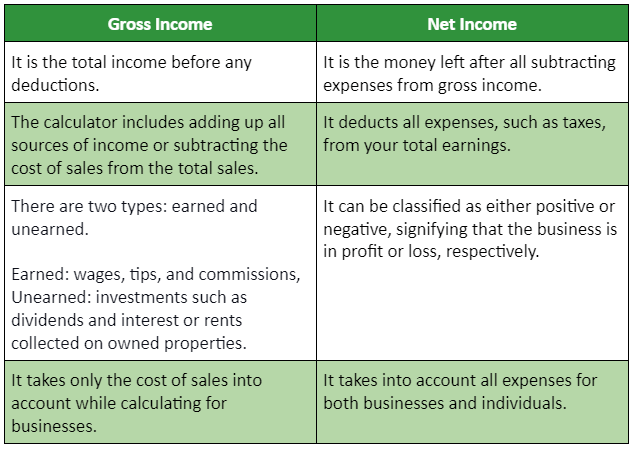

Gross Income vs. Net Income

Adjusted Gross Income (AGI)

- AGI is how the IRS calculates a citizen’s tax income. It serves as the basis for an individual’s income taxes

- AGI is the income after subtracting above-the-line deductions or income adjustments from gross income

- It can help lower the tax burden by reducing education costs, interest on student loans, contributions to retirement plans, payments regarding alimony, etc.

Modified Adjusted Gross Income

- It describes the total gross income of an individual or family, minus certain deductions

- For most people, it is very similar to AGI value

- The deductions can include income from an offshore business, Social Security benefits, and tax-exempt interests.

Importance

- It can be useful while calculating other critical metrics and an important measure for the service industry

- In comparison to gross revenue, it is a more accurate representation of how a product-selling company is doing

- Analysts calculate the company’s value as a multiple of its gross profit. It is primarily for start-ups, new businesses, and even some established businesses

- Businesses use this value to determine where their firm stands financially. It helps them estimate if they can repay debts, provide dividends, and clear other necessary payments.

- They can also help analyze and compare the data to see if sales are increasing or decreasing

- Lenders can use this information to decide if they want to lend money to borrowers. For approval, citizens should meet a certain threshold.

Calculator

Use the following calculator for business calculations.

| Total Income | |

| Cost of Goods Sold | |

| Gross Income = | |

| Gross Income = | Total Income – Cost of Goods Sold |

| = | 0 - 0 = 0 |

| Salary | |

| Rent | |

| Investment Returns/Dividends | |

| Other Earnings | |

| Gross Income = | |

| Gross Income = | Sum of Income From All Sources |

| = | 0 + 0 + 0 + 0 = 0 |

Frequently Asked Questions(FAQs)

Q1. What is the gross income multiplier (GIM)?

Answer: The GIM is a measure that values an investment property. It tells the investor if the property is worth purchasing. To calculate it, they divide the selling price of the property by the potential income it can secure.

Q2. What are gross income exclusions?

Answer: Exclusions reduce the amount of taxable income. Some standard deductions are health insurance premiums, alimony & child support payments, income from federal bonds, insurance benefits, and more.

Q3. Where is the adjusted gross income on the 1040 form?

Answer: The amounts from the W-2 forms are taken under consideration to compute adjusted gross income. It is available on the first page of the 1040 form.

Q4. Does it include bonuses?

Answer: Yes, as bonuses are usually an addition to an employee’s salary, they are also considered income. Therefore, the calculation includes a bonus as well.

Recommended Articles

This was a guide to Gross Income. To learn more, please read the following articles,