Updated July 25, 2023

Gross Income Formula (Table of Contents)

What is Gross Income Formula?

For companies, the term “gross income” means the profit obtained from total revenue. The costs that can be directly assigned to the production process are deducted. Such costs are collectively called the cost of goods sold or sales.

Although not all, some companies report gross income as a separate line item in their income statement. Gross income is popularly known as gross profit. The formula for gross income can be derived by deducting the cost of goods sold (COGS) from the company’s total sales. The mathematical representation of the formula is as below:

Examples of Gross Income Formula (With Excel Template)

Let’s take an example to understand the calculation of Gross Income in a better manner.

Example #1

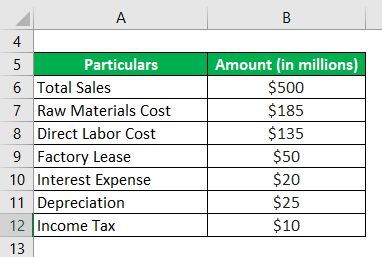

Let us take the example of SDF Inc. to illustrate the computation of gross income. The company manufactures rigid and flexible packaging products and has its manufacturing facility in Illinois, US. According to the company’s recently published annual report for 2018, the following information is available: Calculate the gross income of SDF Inc. for 2018 based on the given information.

Solution:

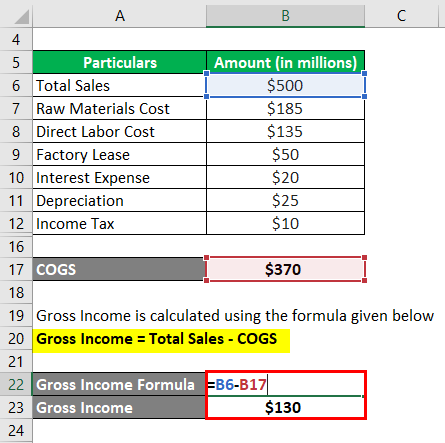

The formula to calculate COGS is as below:

COGS = Raw Materials Cost + Direct Labor Cost + Factory Lease

- COGS = $185 million + $135 million + $50 million

- COGS = $370 million

The formula to calculate Gross Income is as below:

Gross Income = Total Sales – COGS

- Gross Income = $500 million – $370 million

- Gross Income = $130 million

Therefore, SDF Inc. booked a gross income of $130 million during the year 2018.

Example #2

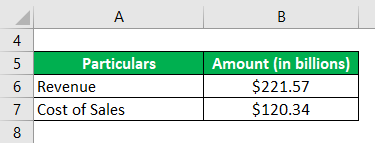

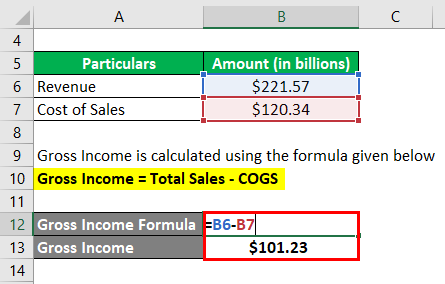

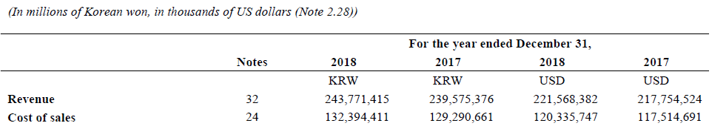

Let us take the example of Samsung to illustrate the computation of gross income. According to the annual report for 2018, the company registered a revenue of $221.57 billion, with the corresponding cost of sales of $120.34 billion. Calculate the gross income of the company for the year 2018.

Solution:

The formula to calculate Gross Income is as below:

Gross Income = Revenue – Cost of Sales

- Gross Income = $221.57 billion – $120.34 billion

- Gross Income = $101.23 billion

Therefore, Samsung managed a gross income of $101.23 billion during the year 2018.

Source Link: Samsung Balance Sheet

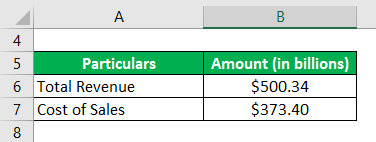

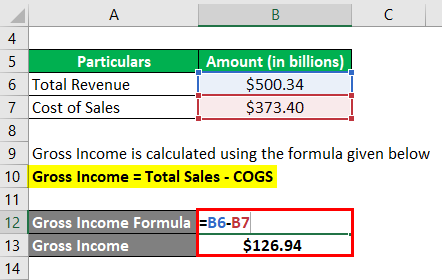

Example #3

Let us now take the example of Walmart Inc. to illustrate the computation of gross income. During 2018, the company recorded total revenue and cost of sales of $500.34 billion and $373.40 billion, respectively. Calculate the gross income of the company for the year 2018.

Solution:

The formula to calculate Gross Income is as below:

Gross Income = Total Revenue – Cost of Sales

- Gross Income = $500.34 billion – $373.40 billion

- Gross Income = $126.94 billion

Therefore, Walmart Inc. secured a gross income of $126.94 billion during the year 2018.

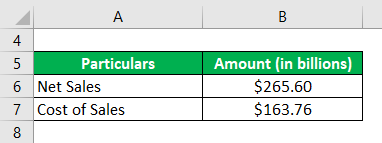

Example #4

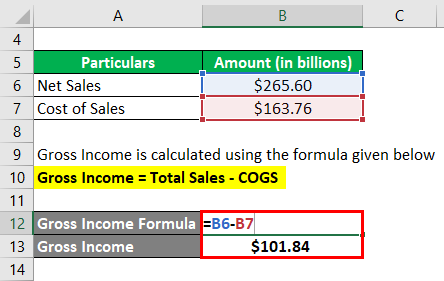

Let us now take the example of Apple Inc. to illustrate the computation of gross income. As per the latest annual report, the company booked net sales of $265.60 billion and a cost of sales of $163.76 billion during the year 2018. Calculate the gross income of the company for the year 2018.

Solution:

The formula to calculate Gross Income is as below:

Gross Income = Net Sales – Cost of Sales

- Gross Income = $265.60 billion – $163.76 billion

- Gross Income = $101.84 billion

Therefore, Apple Inc. booked a gross income of $101.84 billion during the year 2018.

Source Link: Apple Inc. Balance Sheet

Explanation

The formula for gross income can be derived by using the following steps:

Step 1: Firstly, figure out the company’s total sales, which is typically the first line item in any company’s income statement.

Step 2: Next, determine the directly assignable cost or COGS from the income statement. It is the aggregate of all the costs of production that can be directly assigned to the production process. COGS primarily comprises raw material cost, direct labor cost, and manufacturing overhead (factory rent, insurance, etc.).

COGS = Raw Material Cost + Direct Labor Cost + Manufacturing Overhead

Step 3: Finally, the formula for gross income can be derived by deducting COGS (step 2) from the company’s total sales (step 1), as shown below.

Gross Income = Total Sales – COGS

Relevance and Use

It is important to understand the concept of gross income because it indicates a company’s first line of profitability, which in turn indicates its operational efficiency. The metric captures how many dollars the company could generate in profit after deducting the directly assignable costs of production. Further, this metric is predominantly used for calculating the profitability ratio of gross profit margin, where gross income is the numerator and total sales are the denominator.

Although gross income computation includes the direct cost of production of goods and services, it fails to consider the other costs related to selling activities, such as administration, taxes, etc., which is one of the major limitations of this metric.

Gross Income Formula Calculator

You can use the following Gross Income Formula Calculator

| Total Sales | |

| COGS | |

| Gross Income | |

| Gross Income = | Total Sales – COGS |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This is a guide to Gross Income Formula. Here we discuss how to calculate Gross Income along with practical examples. We also provide a Gross Income calculator with a downloadable Excel template. You may also look at the following articles to learn more –