Gross Wages Definition

The total money an employee earns before their employer reduces all the necessary and optional deductions is known as gross wages.

For example, suppose Stella’s monthly fixed salary is $4,500. From this amount, her employer deducts $900 for taxes and $1,000 for other essential items, such as health insurance and retirement savings. In this scenario, Stella’s gross wages, before subtracting the $1,900 in deductions, would be $4,500.

Table of Contents

- Definition

- What Does It Include?

- How to Calculate?

- Case Study

- Deductions

- Importance

- Gross Vs. Net Wages

- Gross Wages Vs. W2 Form Wages Vs. FICA Wages

What is Included in Gross Wages?

Some common compensation included in gross wages are:

- Base salary: This is the fixed amount of money that an employee earns per pay period.

- Overtime pay: This is pay that an employee earns for working more than the standard number of hours per week.

- Bonuses: These are extra payments that an employer may pay employees as a reward for good performance or meeting certain goals.

- Commissions: These are payments that an employee earns based on the amount of sales they generate.

- Tips: These are payments that customers might offer employees for good service.

- Benefits: These are non-monetary compensation that an employer may provide to employees, such as health insurance, retirement plans, and paid time off.

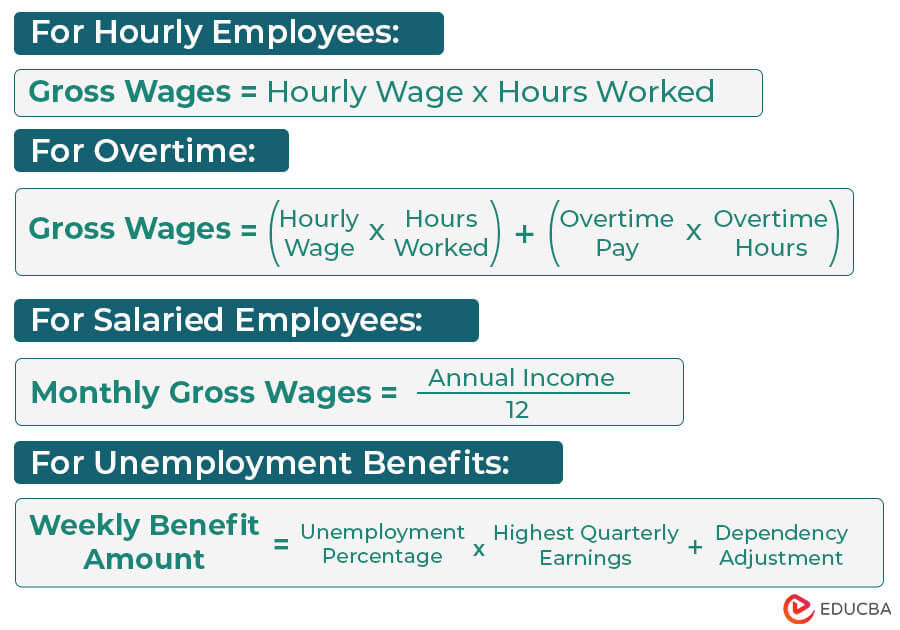

How to Calculate Gross Wages? – Formula

1. For Hourly Employees

The formula for calculating gross pay for hourly-paid employees is,

If an employee works overtime, the formula would be,

Example:

Consider Nick, who is an hourly-waged employee at a cafe. He works for 30 hours every week and receives an hourly wage of $15. Let us calculate his gross pay.

- Weekly Gross Wages = 30 x $15 = $450

- Monthly Gross Wages = $450 x 4 = $1,800

2. For Salaried Employees

To calculate the gross monthly income for salaried workers, use the following formula,

Example:

Suppose Jenny makes $60,000 per year; then her monthly gross wage would be:

Monthly Gross Wages = $60,000 / 12 = $5,000

3. For Unemployment Benefits

Unemployment benefits are like a financial safety net for individuals dealing with job loss. These benefits are not tax-free, and the taxation process varies from state to state. To calculate gross wages for unemployment benefits, we can use the below formula,

Example:

John, a Maryland resident, earned $30,000 last year, with his highest earning being $7,500 for the fourth quarter. Unfortunately, he lost his job and is eligible for 20 weeks of unemployment benefits. Let us calculate John’s weekly unemployment benefits using the given data,

Given:

- Unemployment Percentage = 4%

- Dependency Adjustment = $50 per week

- Highest Quarterly Earnings = $7,500

Applying the formula,

Weekly Benefit Amount = (4% × $7,500) + $50 = $300 + $50 = $350

Therefore, John’s weekly unemployment benefit amount is $350 per week. So, he will receive a total of $7,000 ($350 per week x 20 weeks).

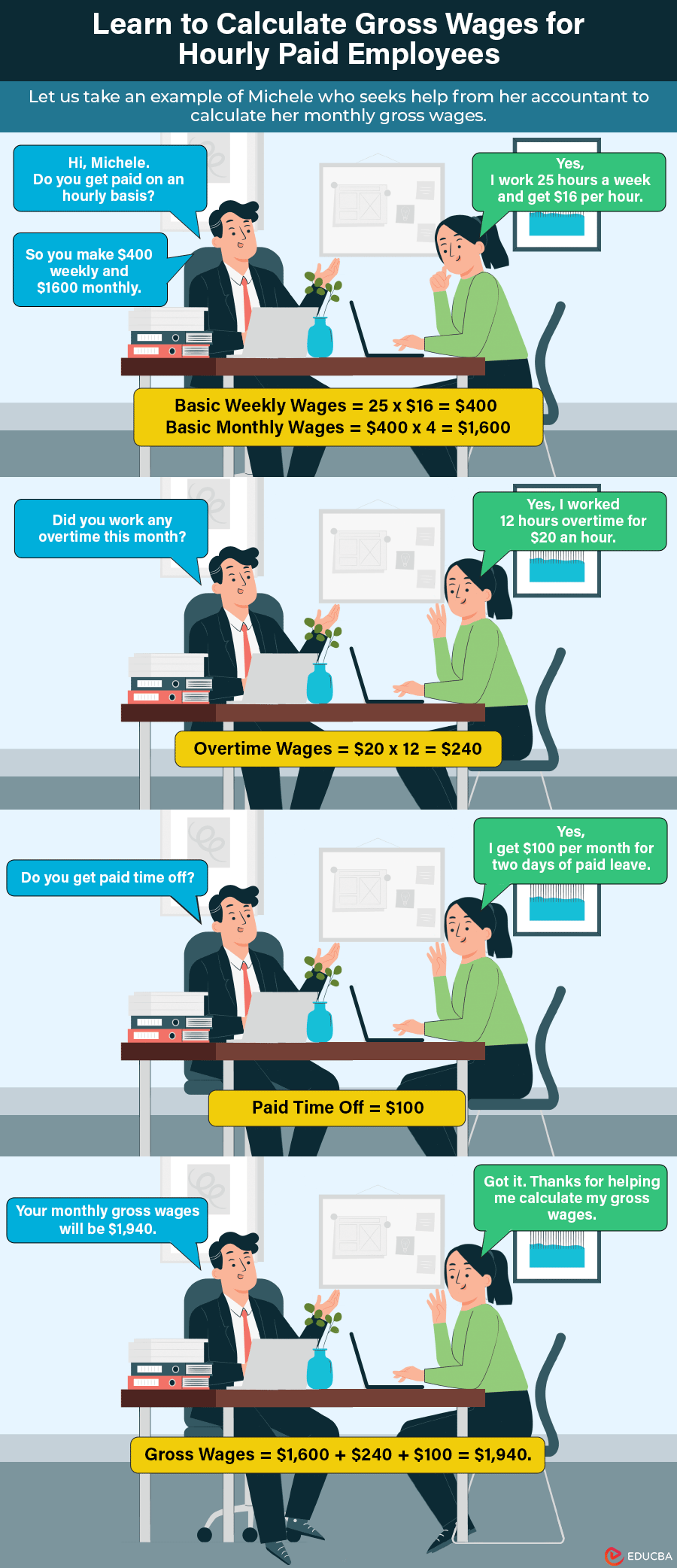

Case Study

Let us look at a detailed case study to understand how easy it is to calculate gross wages.

1. Let’s say Michele works at a restaurant as a waitress on hourly pay of $16.

- Currently in college, she works 25 hours a week at the shop.

- She received paid time off for 2 days every month when she got $100.

- Moreover, she worked 12 hours overtime for $20 per hour for a week.

Let us calculate her gross wages for the month (4 weeks).

- Basic Weekly Wages = 25 x $16 = $400

- Basic Monthly Wages = $400 x 4 = $1,600

- Overtime Wages = $20 x 12 = $240

- Paid Time Off = $100

So, if we add her basic monthly pay and other compensation together, Michele’s gross wages would be: = $1,600 + $240 + $100 = $1,940.

2. Soon after graduating, she started working full-time at the same restaurant.

- Her annual salary is $42,000.

- Typically, she makes a minimum of $120 in tips every week.

- Moreover, she earned a bonus of $500 for her excellent work.

She finds her gross wages for the month as follows:

- Monthly Gross Wages = $42,000 / 12 = $3,500

- Tips = $120 x 4 = $480

- Bonus = $500

By adding her basic monthly pay, tips, and bonus, Michele’s gross wages would be: = $3,500 + $480 + $500 = $4,480.

3. Now, let’s say after working at the restaurant for two years, the company had to lay off Michele because of financial issues.

- As per the state regulations, the unemployment benefit percentage was 3%, and her dependency adjustment was $30 weekly.

- In the last year, she earned her highest income of $5,000 in July.

In this scenario, the weekly compensation Michele would receive as her unemployment benefit would be: = (3% x $5000) + $30 = $1,530

Deduction From Gross Wages

The costs that are applicable to be deducted from gross wages to find net wages are:

1. Taxes: This category covers federal, state, and local income taxes. Tax rules vary by jurisdiction, which impacts the taxable income and overall deduction amount.

2. Health-Related Deductions: This is the amount you pay for health insurance coverage, which supports your healthcare benefits.

3. Social Security and Medicare: These taxes fund the Social Security and Medicare programs, respectively. While social security tax applies only to people who earn about the mentioned limit, medicare tax is for all wages.

4. Retirement Contributions: This money goes to retirement funds, such as 401(k) plans or pension schemes. These contributions not only provide a financial safety net for retirement but may also reduce taxable income.

5. Other Voluntary Deductions: Employees may choose to make additional deductions, such as contributions to a flexible spending account or a charitable organization. These voluntary deductions allow employees to customize their financial allocations, supporting personal preferences.

Why are Gross Wages Important?

The following are several reasons why calculating and understanding gross wages is important.

1. Tax Calculations

These wages serve as the basis for calculating income taxes. Knowing the gross salary helps individuals and employers estimate tax liabilities accurately. This ensures compliance with tax regulations and simplifies tax filing.

2. Benefit Calculations

Businesses often calculate many employee benefits, such as insurance premiums and retirement contributions, based on the gross salary. Therefore, understanding these wages aids in assessing the overall value of the compensation package, including both monetary and non-monetary benefits.

3. Negotiation and Career Planning

Employees can use knowledge of gross pay during salary negotiations and career planning. It helps individuals understand their earning potential, negotiate better terms, and make informed decisions about career moves.

4. Budgeting and Financial Planning

Knowing the gross salary is crucial for employees in budgeting and financial planning. It is a starting point for managing personal finances and deciding on voluntary deductions. It simply lets them organize their finances and allocate their money as per their needs.

Gross Wages Vs. Net Wages

| Aspect | Gross Wages | Net Wages |

| Definition | It is an employee’s total earnings before any deductions. | It is the amount an employee receives after all the deductions. |

| Appearance on Pay Stub | It typically appears at the top of the pay stub, providing a comprehensive overview of the total earnings before deductions. | It is usually present at the bottom of the pay stub, helping employees know the actual amount they will receive. |

| Formula | Gross Salary = Basic Salary + House Rent Allowances + Other Allowances. | Net Salary = Gross Salary – Applicable Deductions. |

Gross Wages Vs. W2 Form Wages Vs. FICA Wages

- Gross Wages refer to the total earnings an employee receives before any deductions. For example, if Sarah earns a salary of $60,000 per year, receives a $5,000 bonus, and earns $2,000 in overtime, her gross wages would be $60,000 + $5,000 + $2,000 = $67,000.

- W2 Form Wages is the total taxable income an employee earns over the course of a year. For example, if, in addition to her salary, bonus, and overtime pay, Sarah also receives $3,000 in taxable health insurance benefits, her W2 form wages would be $67,000 (gross wages) + $3,000 (taxable health insurance) = $70,000.

- FICA Wages focus on the income subject to Social Security and Medicare taxes. For example, let’s say according to tax regulations, only the first $65,000 of Sarah’s income is subject to Social Security and Medicare taxes. In this case, her FICA wages would be $65,000.

Recommended Articles

We hope you found this article on Gross wages informative and easy to understand. For more such articles, refer to the following recommendations.