Why Group Health Insurance for Companies is a Smart Move?

In the competitive job market, health insurance is more than just a benefit—it is a strategic tool for businesses to boost productivity, attract top talent, and foster a positive work culture.

Offering Group Health Insurance for Companies gives employers a significant advantage in hiring and retaining skilled employees. It also enhances workplace morale and reduces absenteeism. This guide explores the importance of group health insurance, how it works, and how businesses can maximize its benefits.

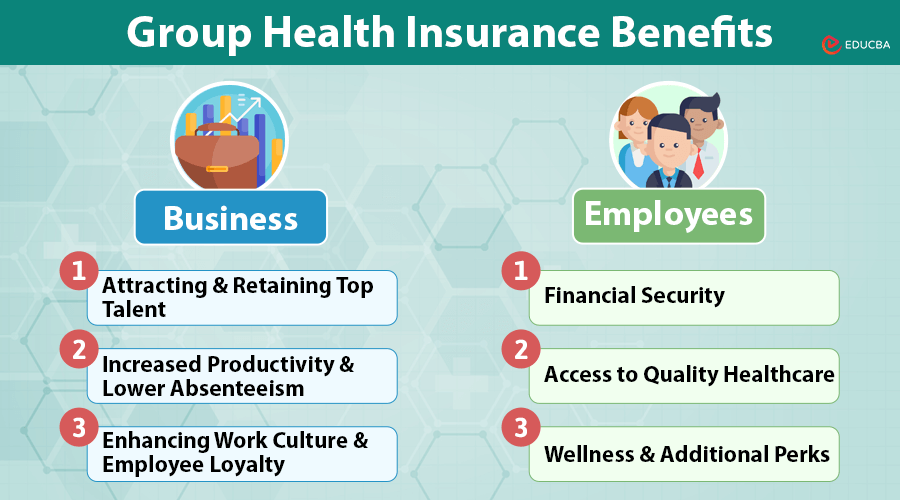

Business Benefits of Group Health Insurance

1. Attracting and Retaining Top Talent

- Companies offering Group Health Insurance for Companies gain distinct benefits in attracting and retaining talent.

- Employees prioritize health security, making it a crucial factor when selecting a job.

- A survey found that 60% of employees consider health benefits essential for job satisfaction and retention.

2. Increased Productivity & Lower Absenteeism

- Healthy employees contribute more effectively to workplace success.

- Regular check-ups, preventive care, and timely treatment reduce sick days and prevent chronic health issues from escalating.

- A robust health insurance plan leads to fewer absences and higher workplace efficiency.

3. Enhancing Work Culture & Employee Loyalty

- Providing group health insurance for companies fosters trust and long-term employee engagement.

- Employees who feel valued by their employer exhibit greater job satisfaction, collaboration, and loyalty.

- A positive work environment translates to lower turnover rates and a stronger workforce.

How does Group Health Insurance Work for Businesses?

1. Understanding Group Health Insurance

- Group health insurance for companies covers employees under a shared policy where employers usually contribute a portion of the premium.

- Group plans generally offer lower premiums than individual policies because they pool risks.

- Many plans also cover dependents, increasing their value to employees.

2. Customization & Flexibility

- Businesses can tailor their insurance plans based on workforce needs.

- Coverage options range from basic hospitalization to expanded benefits like maternity, dental, vision, and mental health services.

- Customization ensures all employees—from entry-level to executives—receive appropriate benefits.

3. Compliance & Legal Considerations

- Companies must adhere to local regulations regarding health benefits and insurance coverage.

- Employers should know tax exemptions, government incentives, and legal obligations to optimize costs.

Employee Benefits of Group Health Insurance

1. Financial Security

- Medical emergencies can be expensive. Group health insurance for companies shields employees from high out-of-pocket costs.

- Coverage includes surgeries, hospitalizations, chronic illness management, and more.

2. Access to Quality Healthcare

- Private healthcare offers better service and shorter wait times compared to public facilities.

- Employees benefit from quicker appointments, specialist care, and advanced treatment options.

3. Wellness & Additional Perks

- Many companies provide extra benefits such as gym memberships, mental health support, and routine health screenings.

- Wellness programs promote a healthier lifestyle, reducing long-term medical expenses.

How to Design an Effective Group Health Insurance Plan?

1. Assessing Workforce Needs

- Conduct employee surveys to understand their healthcare priorities.

- Consider maternity coverage, chronic disease support, and mental health services.

2. Comparing Coverage Plans

- Providers offer different tiers of coverage—basic, mid-tier, and premium.

- Employers should balance costs and benefits to align with business goals.

3. Partnering with Reliable Insurance Providers

- Choose from the best health insurance providers with strong financial stability, a wide hospital network, and excellent customer service.

- Working with an insurance broker can simplify plan selection and customization.

Integrating Health Insurance into the Employee Benefits Strategy

1. Complementary Benefits

- Pair group health insurance for companies with wellness programs, stress management workshops, and mental health initiatives.

2. Clear Communication

- Employees should fully understand their health insurance plan, including coverage details and the claims process.

- Regular communication and educational sessions ensure maximum plan utilization.

3. Leveraging Technology

- Digital tools such as mobile apps make booking medical appointments and tracking claims easier.

- AI-driven systems can send preventive care reminders and personalized health insights.

Cost Management Strategies

1. Cost-Control Measures

- Implement preventive care programs to reduce claim frequency.

- Negotiate group discounts and co-payment options with insurers to lower expenses.

2. Shared Contributions

- Employers can split premium costs with employees, ensuring affordability for both parties.

- Offering incentives for healthy behaviors can further optimize costs.

Measuring Success & Continuous Improvement

1. Tracking Employee Participation & Satisfaction

- Conduct regular surveys to assess employee feedback on insurance benefits.

- Analyze coverage utilization to identify any gaps or areas for improvement.

2. Evaluating ROI

- Monitor absenteeism rates, productivity levels, and employee retention.

- Data-driven insights help refine health insurance offerings over time.

Final Thoughts

Investing in group health insurance for companies is not just a financial decision but a strategic move that strengthens the organization and its workforce.

With a well-planned approach, businesses can build a healthier, happier, and more engaged team. Ready to take the next step? Partner with experienced health insurance brokers to find a plan tailored to your company’s needs.

Recommended Articles

We hope this guide on group health insurance for companies helps you understand its benefits for businesses and employees. Check out these recommended articles for more insights on optimizing workplace well-being and employee benefits.