Updated July 27, 2023

Growth Rate Formula (Table of Contents)

What is the Growth Rate Formula?

The term “growth rate” refers to the rate of increase or change in the value of any metric over a certain period of time. Some common usages of growth rate include revenue growth, dividend growth, profit growth, etc., where the change in value is usually assessed for a year, quarter, etc.

The formula for growth rate can be calculated by deducting the initial value of the metric under consideration from its final value and then dividing the result by the initial value. Mathematically, the growth rate is represented as,

Examples of Growth Rate Formula (With Excel Template)

Let’s take an example to understand the calculation of Growth Rate in a better manner.

Example #1

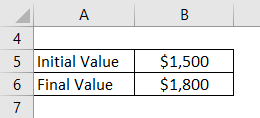

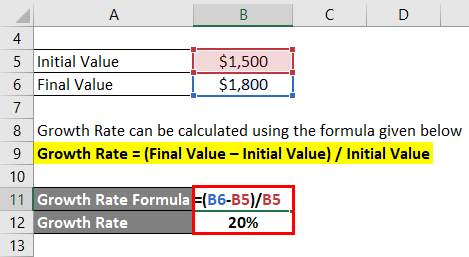

Let us take the example of a stock investment purchased exactly one year back for $1,500. According to the market, the investment is currently trading at $1,800. Calculate the growth of the rate based on the given information.

Solution:

Growth Rate can be calculated using the formula given below

Growth Rate = (Final Value – Initial Value) / Initial Value

- Growth Rate = ($1,800 – $1,500) / $1,500

- Growth Rate = 20%

Therefore, the value of the investment grew by 20% during the last year.

Example #2

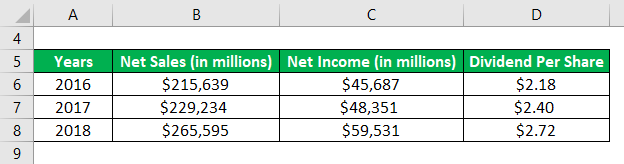

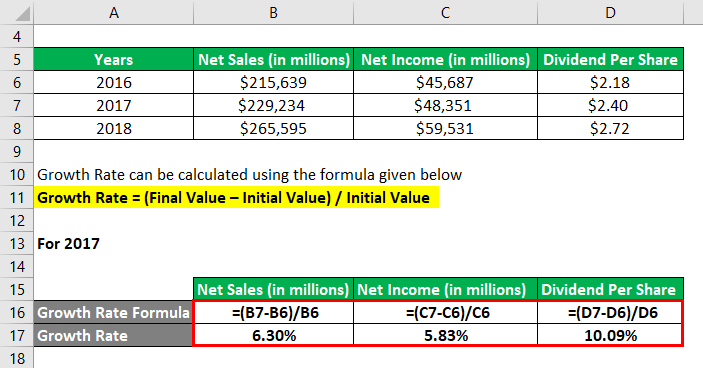

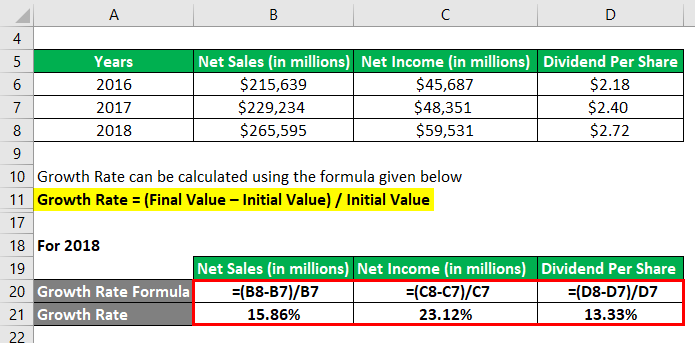

Let us take the real-life example of Apple Inc. to explain the growth rate witnessed in net sales, net income, and dividend per share during the last two financial years i.e. growth rate in 2017 and 2018. Please whether the same growth rate trickles down from the net sales to the dividend per share.

Solution:

Growth Rate can be calculated using the formula given below

Growth Rate = (Final Value – Initial Value) / Initial Value

For 2017

Net Sales

- Growth Rate in Net Sales = ($229,234 – $215,639) / $215,639

- Growth Rate in Net Sales = 6.30%

Net Income

- Growth Rate in Net Income = ($48,351- $45,687) / $45,687

- Growth Rate in Net Income = 5.83%

Dividend Per Share

- Growth Rate in Dividend Per Share = ($2.40 – $2.18) / $2.18

- Growth Rate in Dividend Per Share = 10.09%

For 2018

Net Sales

- Growth Rate in Net Sales = ($265,595 – $229,234) / $229,234

- Growth Rate in Net Sales = 15.86%

Net Income

- Growth Rate in Net Income = ($59,531- $48,351) / $48,351

- Growth Rate in Net Income = 23.12%

Dividend Per Share

- Growth Rate in Dividend Per Share = ($2.72 – $2.40) / $2.40

- Growth Rate in Dividend Per Share = 13.33%

Therefore, it can be seen that the growth trajectory for net sales, net income, and dividend share is slightly different but moving in the same direction. Dividends witnessed higher growth than net sales in 2017, while revenue growth remained slightly higher than the dividend growth rate in 2018.

Explanation

The formula for the growth rate can be calculated by using the following steps:

Step 1: First, determine the metric’s initial value under consideration. In this case, revenue from the previous year’s income statement can be an example.

Step 2: Next, determine the final value of the same metric. In this case, revenue from the current year’s income statement will serve the purpose.

Step 3: Next, calculate the change in the metric’s value by deducting the initial value (step 1) from the final value (step 2), as shown below.

Change in Value = Final Value – Initial Value

Step 4: Finally, the growth rate formula can be obtained by dividing the change in value (step 3) by the initial value (step 1) of the metric and then expressing the result in percentage by multiplying by 100%, as shown below.

Growth Rate = (Final Value – Initial Value) / Initial Value

Relevance and Use

It is one of the simplest but most important concepts because analysts and investors usually use the growth rate formula to assess a company’s growth during a certain period and forecast future performance based on those growth rates. Typically, companies use growth rates to assess their performance in terms of sales, earnings, profits, etc. On the other hand, investors use these ratios to assess their investment performance, such as growth in book value, price-to-earnings, etc. Analysts predominantly use the growth rates to assess the performance of publicly listed companies when they report their quarterly or annual earnings, metrics such as quarter-over-quarter (Q-o-Q) growth rates, or year-over-year (Y-o-Y).

Growth Rate Formula Calculator

You can use the following Growth Rate Calculator

| Final Value | |

| Initial Value | |

| Growth Rate | |

| Growth Rate = |

|

|

Recommended Articles

This is a guide to Growth Rate Formula. Here we discuss How to Calculate Growth Rate along with practical examples. We also provide a Growth Rate Calculator with a downloadable Excel template. You may also look at the following articles to learn more –