What to Do If You Receive an IRS Notice?

Getting a letter from the IRS can be unsettling. The moment you see that envelope, your mind starts racing. Did I make a mistake? Am I in trouble? What do they want? Take a deep breath. An IRS notice does not always mean bad news, but it does require your immediate attention. Responding appropriately can prevent bigger issues from arising. This guide outlines the essential steps for handling an IRS notice effectively.

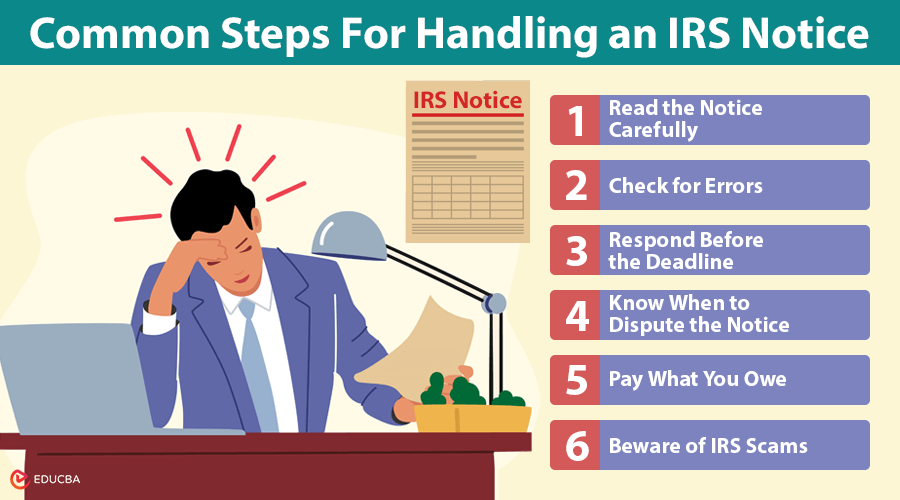

Common Steps For Handling an IRS Notice

Following these essential steps will help you address the issue quickly and effectively:

#1. Read the Notice Carefully

Before assuming the worst, read the IRS notice thoroughly. It will clearly state:

- The reason for the notice

- Any action you need to take

- The deadline for response

- Contact information for questions

Some notices are about minor corrections, while others might request additional documents or notify you of an audit. Understanding what the IRS wants is the first step in handling the situation properly.

#2. Check for Errors

With millions of tax returns processed by the IRS, errors can occur. If the notice says you owe money, do not assume it is correct. Compare it with your tax return and records. If you find a discrepancy, you may need to dispute the notice. A Houston Tax Attorney can help you review the details and challenge any errors that could save you money.

#3. Respond Before the Deadline

Ignoring an IRS notice can make things worse. If you miss the deadline, penalties, interest, or even wage garnishments may follow. If you need more time to gather documents, you may be able to request an extension. The most important thing is to act before the deadline passes.

#4. Know When to Dispute the Notice

If you believe the IRS made a mistake, you can challenge it. Some common ways to dispute an IRS notice include:

- Sending a written response with supporting documents

- Requesting an appeal

- Filing a petition in Tax Court

The IRS enforces strict dispute procedures, and a tax attorney can ensure proper handling of your response.

#5. Pay What You Owe (Even if You Cannot Afford It)

If the IRS notice is correct and you owe money, you have options:

- Installment Agreement: Make monthly payments over time.

- Offer in Compromise: Settle for less than what you owe if you qualify.

- Currently Not Collectible Status: Delay payments if you are facing financial hardship.

Each option has pros and cons, and a tax attorney can help determine the best choice for your situation.

#6. Beware of IRS Scams

The IRS will always send a letter before reaching out via phone, email, or text. If someone calls demanding immediate payment or threatens legal action, it is a scam. Scammers often:

- Use aggressive language and threats

- Demand payments through gift cards or wire transfers

- Pretend to be IRS agents over the phone

Contact the IRS directly or consult a tax professional if you are unsure about a notice.

How to Handle an IRS Audit?

An audit does not always mean trouble; sometimes, the IRS needs additional information. If you receive an audit notice:

- Stay Calm: Not all audits result in more taxes owed.

- Gather Your Records: Submit only the requested documents, including receipts, bank statements, and tax forms.

- Do Not Overshare: Provide precise answers to minimize follow-up questions.

- Seek Professional Help: A tax attorney can advocate for you and handle negotiations with the IRS.

Handling an audit alone can be risky, especially if you are unfamiliar with tax laws. The IRS has trained professionals working for them.

How can a Houston Tax Attorney Help?

Tax laws are complicated, and small mistakes can be costly. If your IRS notice involves a large amount, penalties, or legal risks, a tax attorney can:

- Analyze your notice and tax records

- Identify errors and dispute incorrect claims

- Negotiate with the IRS to reduce penalties

- Represent you in audits and appeals

A tax attorney may even help lower or eliminate tax debt through legal strategies that most people are unaware of.

Final Thoughts

Handling an IRS notice properly can prevent unnecessary stress, penalties, and legal trouble. Whether you need to dispute an error, negotiate a payment plan, or respond to an audit, acting quickly is key. If your situation is complex, a tax attorney can guide you through the process and safeguard your financial interests. By staying informed and responding correctly, you can resolve your IRS notice efficiently and avoid bigger problems in the future.

Recommended Articles

We hope this guide on handling an IRS notice helps you confidently navigate the process. Check out these recommended articles for more tips and strategies to manage your tax-related concerns.