Updated June 27, 2023

Difference Between Hard Money vs Soft Money

Hard and soft money is assumed to be liquid cash or cash on hand, while soft money is money on paper. These definitions are not true. These terms refer to money loaned and the purpose behind these loans.

Apart from the differences stated below, there are some common types between Hard money vs soft money –

- Both these loans are used to purchase real estate.

- Both these loans can be used to purchase an investment property.

- Even though it’s not the only factor considered in Hard money, both these loans consider borrower’s history.

- Both these types of loans require a down payment and or collateral.

- Interest payments are mandatory throughout the loan term.

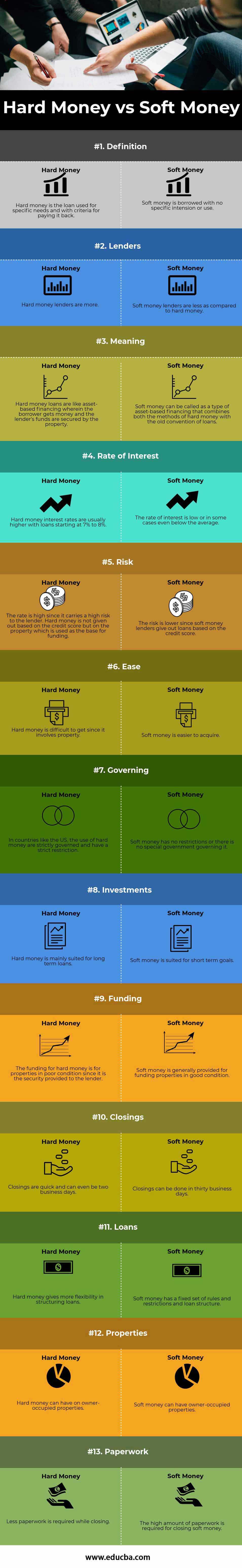

Head To Head Comparison Between Hard Money vs Soft Money (Infographics)

Below is the top 13 difference between Hard Money vs Soft Money

Key Differences Between Hard Money vs Soft Money

Both Hard Money vs Soft Money are popular choices in the market; let us discuss some of the major Difference Between Hard Money vs Soft Money:

- Hard money is a loan used for specific needs and with criteria for paying it back. Soft money is borrowed with no specific intention or use.

- Hard money has more lenders compared to soft money.

- Closings in hard money are quick and can be even two business days, while closings in soft money can be thirty days. The paperwork required for hard money is comparatively less than for soft money.

- Hard money gives more flexibility in structuring loans, while soft money has rules and restrictions.

- Hard money can have on owner-occupied properties, while soft money can have owner-occupied properties.

- Hard money loans are like asset-based financing wherein the borrower gets money, and the property secures the lender’s funds. Soft money can be called a type of asset-based financing that combines hard money methods with the old convention of loans.

- The interest rate in hard money is high since it carries a high risk to the lender. Hard money is not given out based on the credit score but the property used as the funding base. The rate of interest falls between 7% to 8%. The risk is lower since soft money lenders give out loans based on the credit score; hence, the interest rate is low and sometimes even below the average rate.

- Hard money is difficult to get since it involves property, while Soft money is easier to acquire

- In countries like the US, hard money is strictly governed, and has strict Soft money has no restrictions or no special government governs it.

- The funding for hard money is for properties in poor condition since it is the security provided to the lender. Soft money is generally provided for funding properties in good condition.

- Hard money is mainly suited for long-term loans. Soft money is suited for short-term goals.

- Pros of Soft Money – These loans become a part of the credit history and can be used to repair credit

- Pros of Hard Money – It is easier to get a hard money loan in comparison to soft money since they don’t consider credit history or take credit score into account

- Cons of Soft Money – The closing time for soft money are longer and have a time of ten to fourteen days

- Cons of Hard Money – The interest rates are higher since the amount is high and the period is short. However, if the investor pays the loan on time, the interest rate is not affected much.

Hard Money vs Soft Money Comparison Table

Below is the 13 topmost comparison between Hard Money vs Soft Money

| The Basis Of Comparison |

Hard Money |

Soft Money |

| Definition | Hard money is a loan used for specific needs and with criteria for paying it back. | Soft money is borrowed with no specific intention or use. |

| Lenders | Hard money lenders are more. | Soft money lenders are fewer as compared to hard money. |

| Meaning | Hard money loans are like asset-based financing wherein the borrower gets money, and the property secures the lender’s funds. | Soft money can be called a type of asset-based financing that combines hard money methods with the old convention of loans. |

| Rate of Interest | Hard money interest rates are usually higher, with loans starting at 7% to 8% | The interest rate is low or, in some cases, even below the average. |

| Risk | The rate is high since it carries a high risk to the lender. Hard money is not given out based on the credit score but the property used as the funding base. | The risk is lower since soft money lenders give out loans based on credit scores. |

| Ease | Hard money is difficult to get since it involves property. | Soft money is easier to acquire |

| Governing | In countries like the US, hard money is strictly governed and has strict restrictions. | Soft money has no restrictions, or no special government governs it. |

| Investments | Hard money is mainly suited for long-term loans. | Soft money is suited for short-term goals. |

| Funding | The lender is provided with the security of properties in poor condition, as it funds hard money. | Soft money is generally provided for funding properties in good condition. |

| Closings | Closings are quick and can even be two business days. | Closings can be done in thirty business days. |

| Loans | Hard money gives more flexibility in structuring loans. | Soft money has a fixed set of rules and restrictions and a loan structure. |

| Properties | Hard money can have on owner-occupied properties. | Soft money can have owner-occupied properties. |

| Paperwork | Less paperwork is required while closing. | A high amount of paperwork is required for closing soft money. |

Conclusion

The type of loan can be decided based on the requirement. Soft money would be appropriate if an investor is looking at a long-term investment and buys and holds one. Hard money can be considered if the investor is looking for a short-term investment and can pay high-interest rates. The way hard money loans are structured, it is a definitive way of investing in real estate. They are suitable for constructing properties like bridges that require a large amount of money for a small period.

Recommended Articles

This has guided the top difference between Hard Money and Soft Money. Here we also discuss Hard Money vs Soft Money key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.